A Colorado Bill of Sale Form is essential for recording the transfer of ownership in sales transactions, from vehicles to personal property. This guide provides detailed instructions and examples to help you understand and complete the form correctly. Whether you’re a seller or a buyer, our comprehensive guide covers all aspects of the Bill of Sale Form and its importance in ensuring a legal and smooth transfer of ownership. Learn about the necessary components, how to fill out the form, and why having a Bill of Sale is crucial for protecting both parties in a transaction.

What is Colorado Bill of Sale Form?

A Colorado Bill of Sale Form is a legal document that verifies the sale and transfer of ownership of an item between a seller and a buyer. It includes essential details such as the item description, sale price, and the names of the parties involved. This form ensures that the transaction is documented and legally binding, providing protection for both the buyer and the seller.

Colorado Bill of Sale Format

Colorado Bill of Sale

1. Seller Information

- Name:

- Address:

- City, State, ZIP Code:

- Phone Number:

- Email:

2. Buyer Information

- Name:

- Address:

- City, State, ZIP Code:

- Phone Number:

- Email:

3. Item Description

- Item Sold:

- Make:

- Model:

- Year:

- VIN/Serial Number:

- Condition:

- Odometer Reading (if applicable):

4. Sale Information

- Sale Date:

- Sale Price:

- Payment Method:

5. Warranty Information

- The item is sold “as-is” without any warranties, unless otherwise noted.

6. Signatures

- Seller’s Signature:

- Date:

- Buyer’s Signature:

- Date:

7. Notary Acknowledgment (if applicable)

- Notary Public Signature:

- Date:

- Seal:

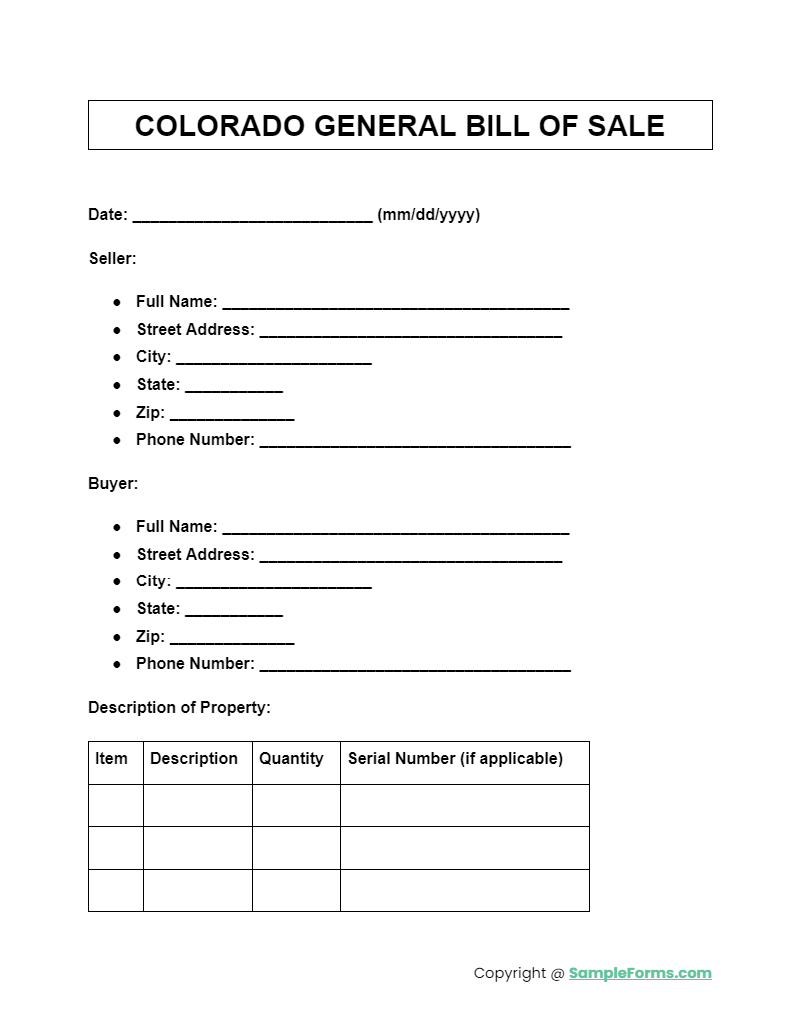

Colorado General Bill of Sale Form

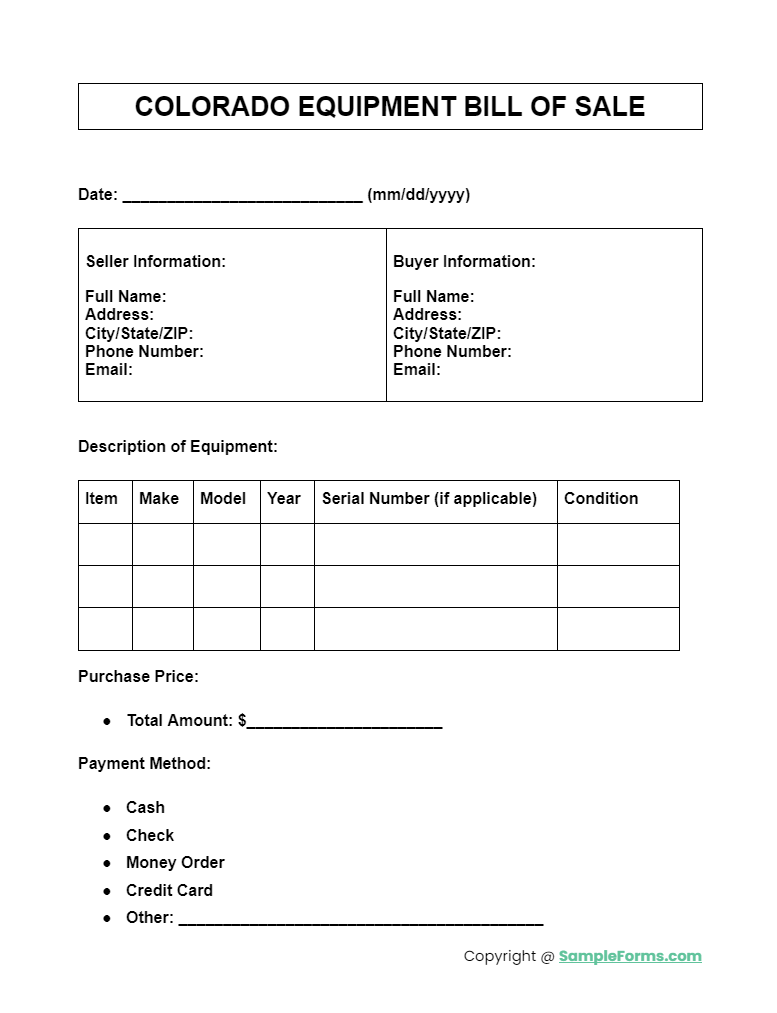

Colorado Equipment Bill of Sale Form

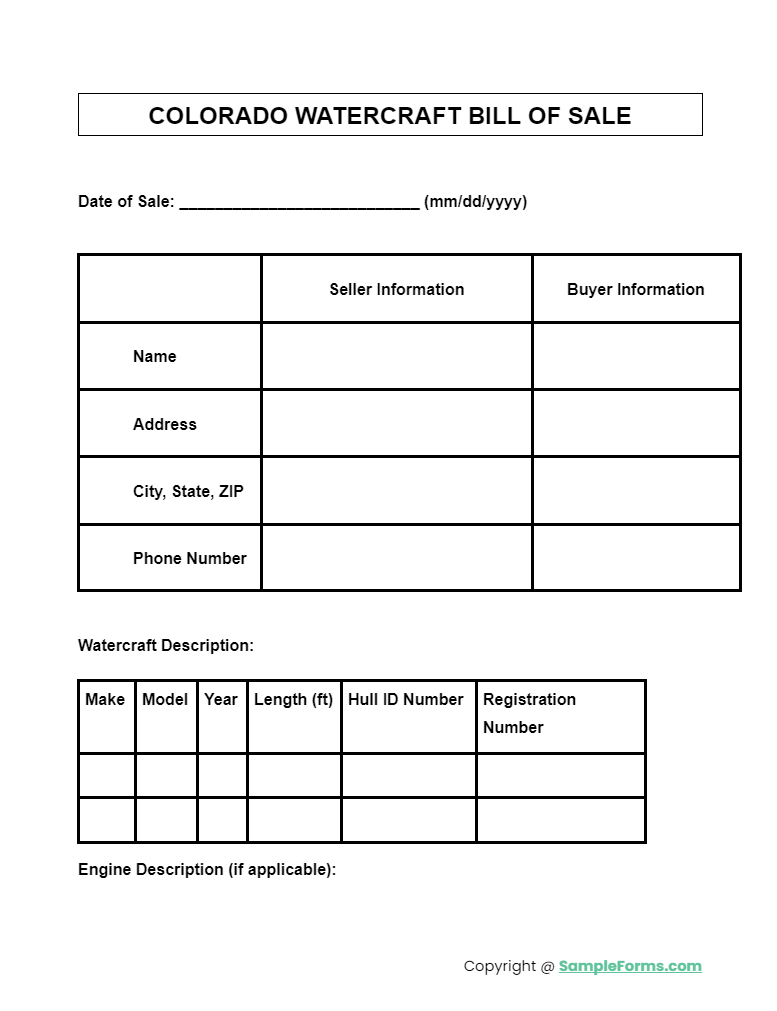

Colorado Watercraft Bill of Sale Form

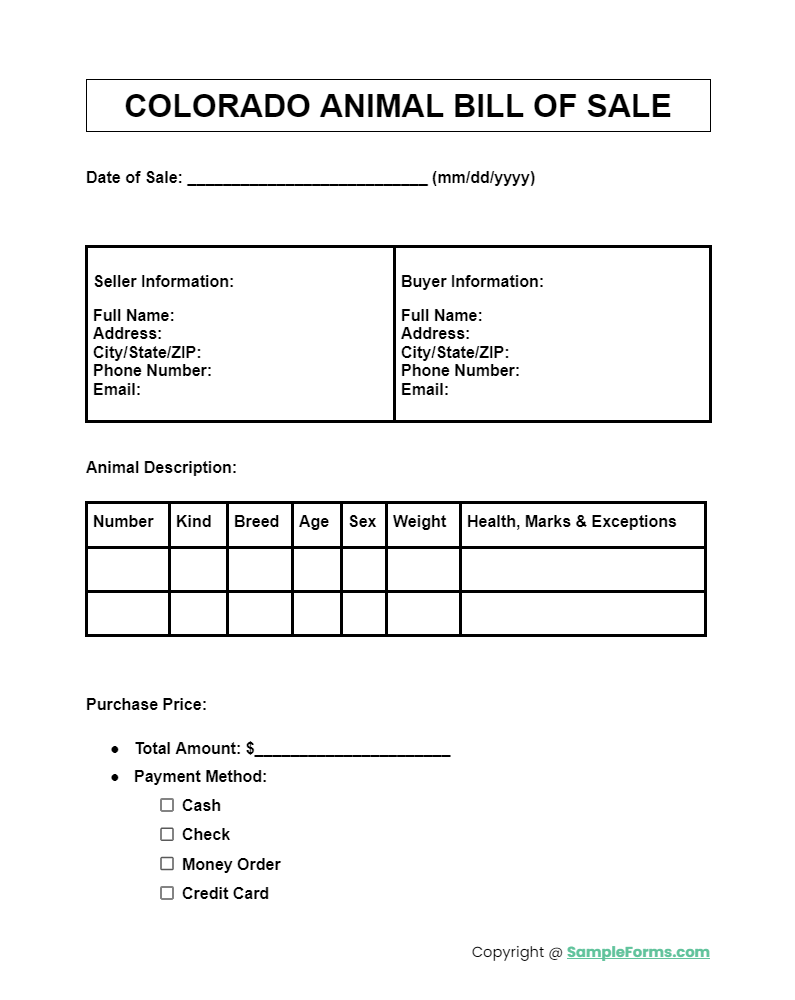

Colorado Animal Bill of Sale Form

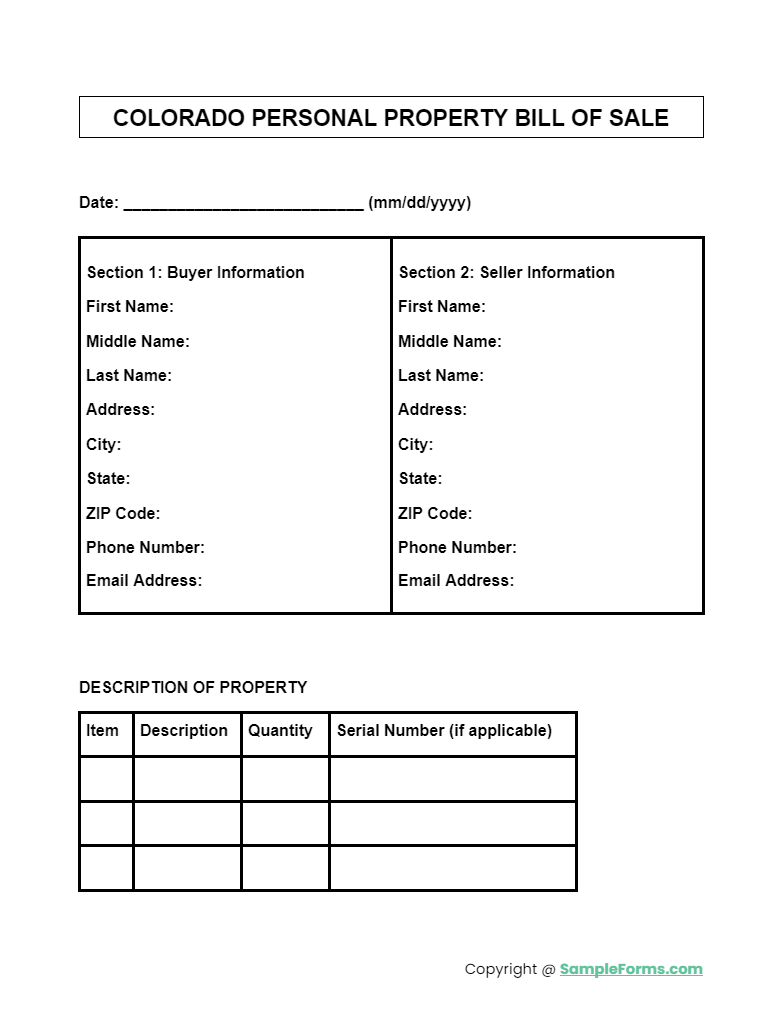

Colorado Personal Property Bill of Sale Form

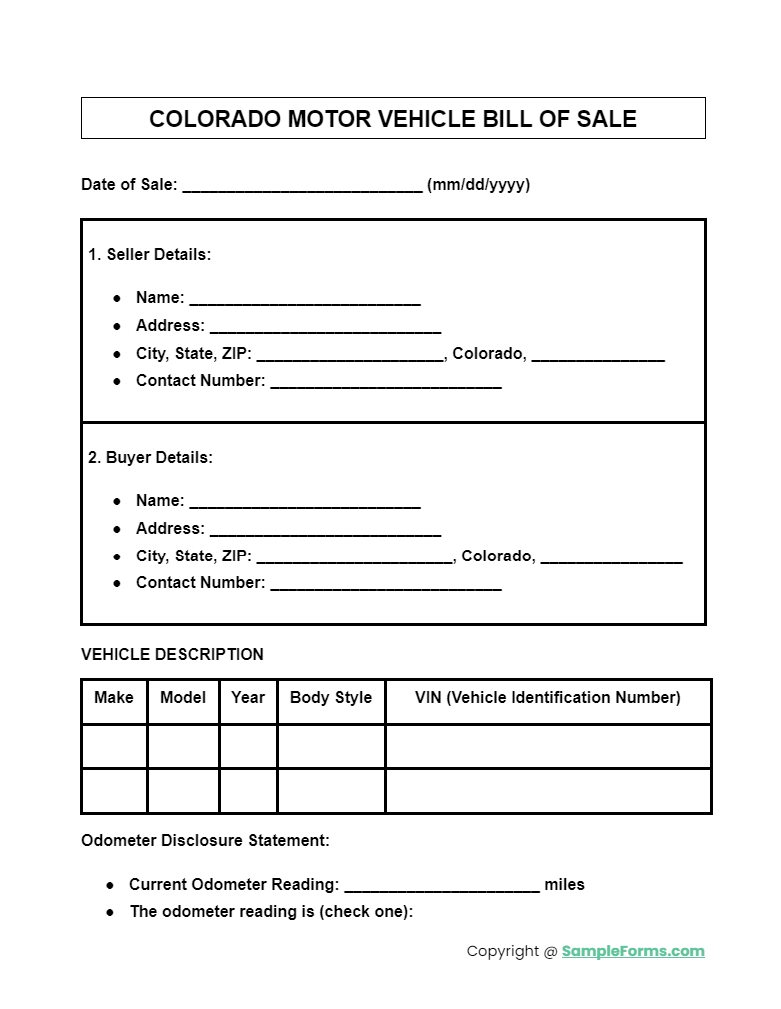

Colorado Motor Vehicle Bill of Sale Form

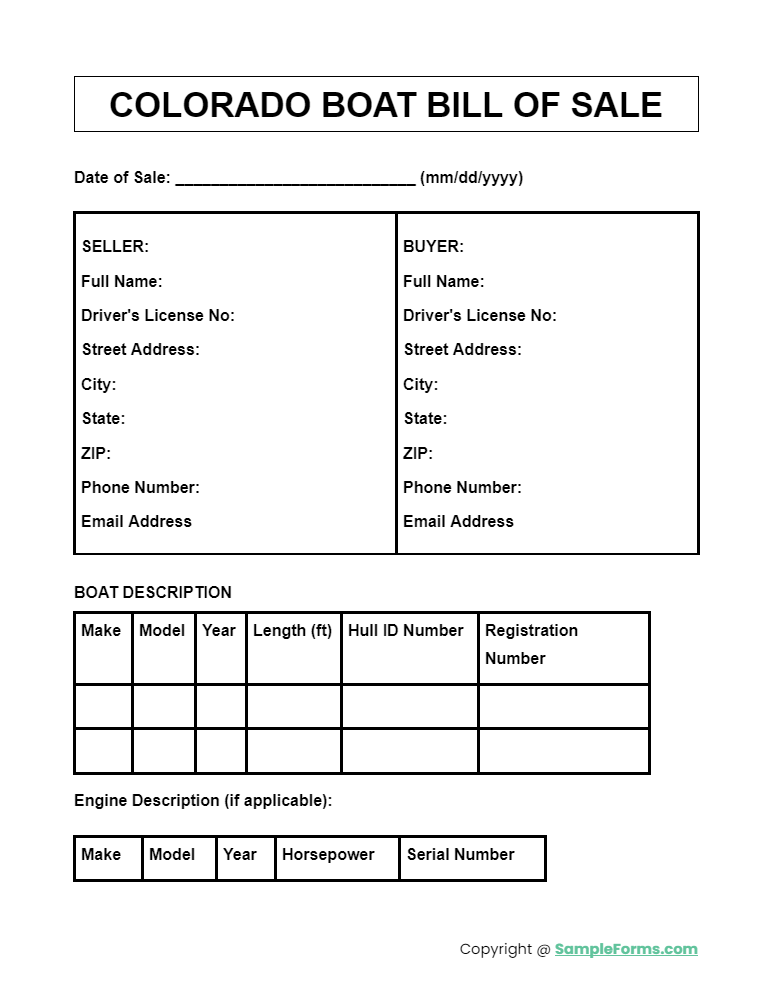

Colorado Boat Bill of Sale Form

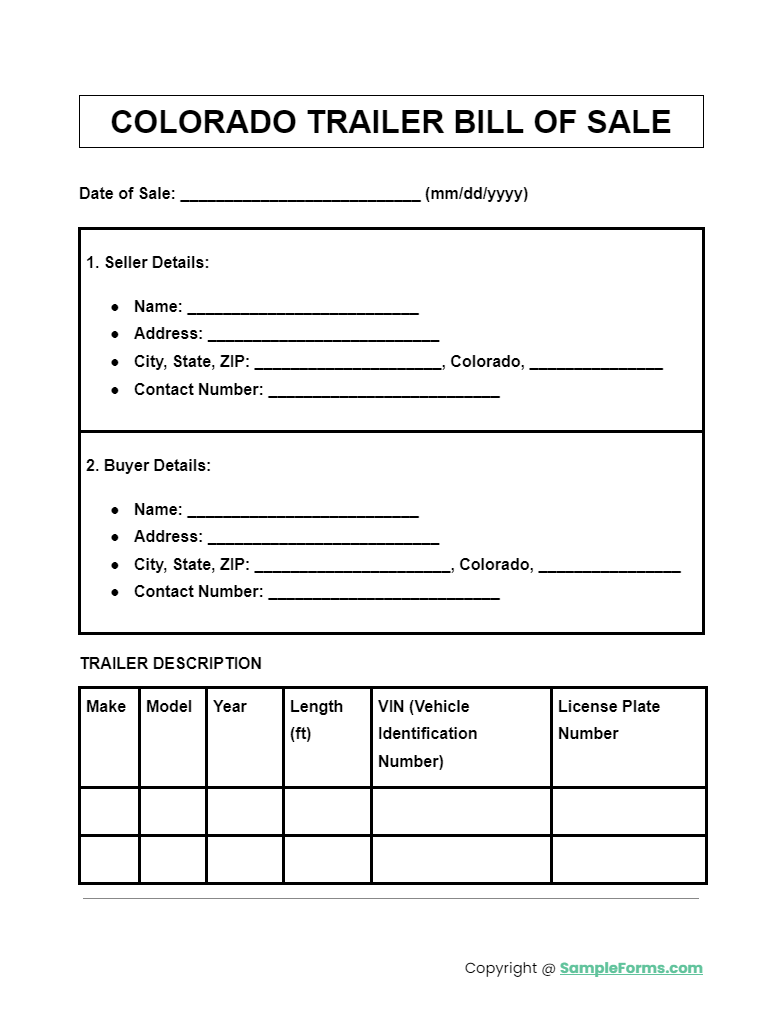

Colorado Trailer Bill of Sale Form

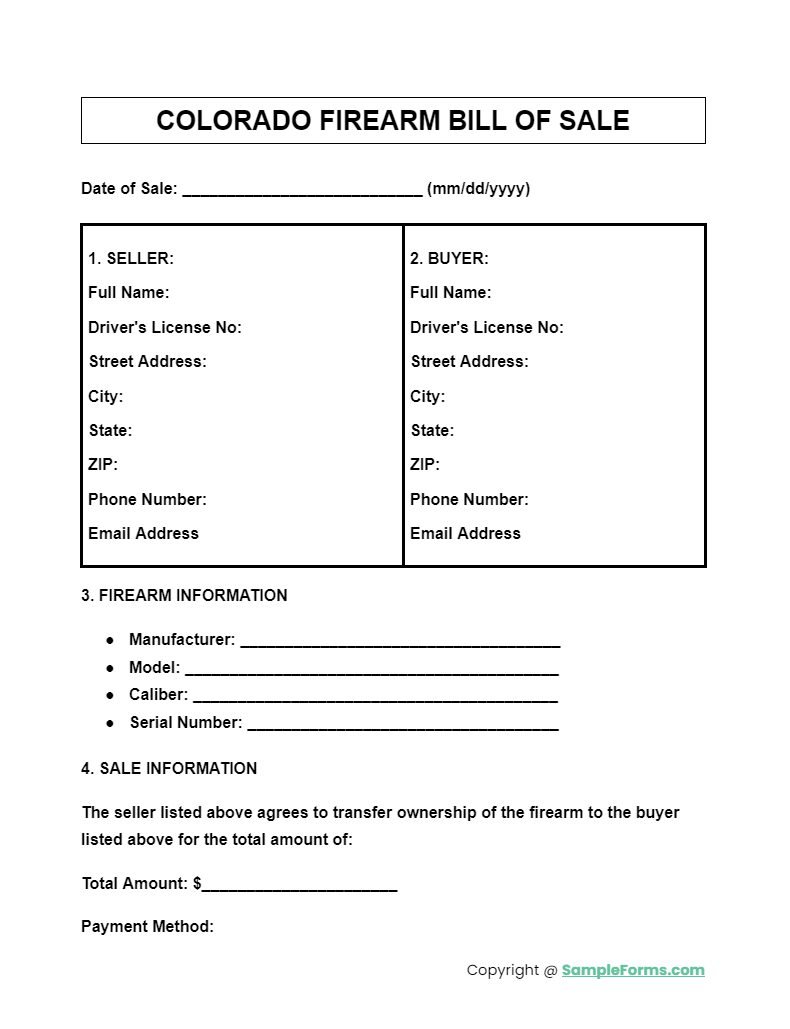

Colorado Firearm Bill of Sale Form

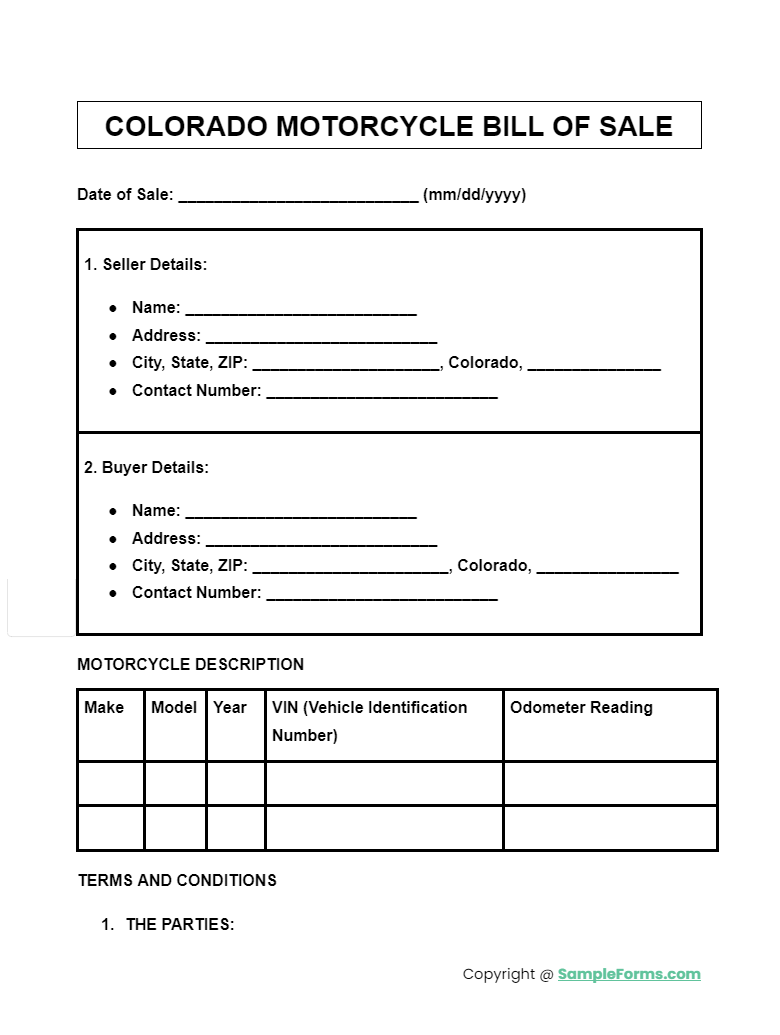

Colorado Motorcycle Bill of Sale Form

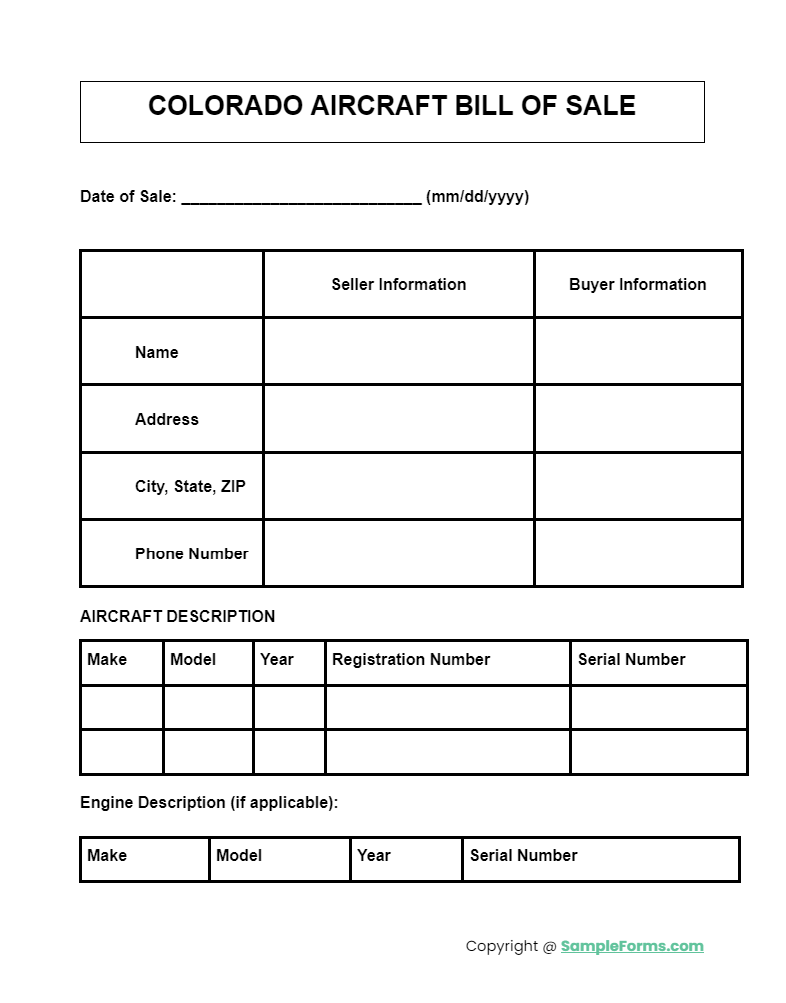

Colorado Aircraft Bill of Sale Form

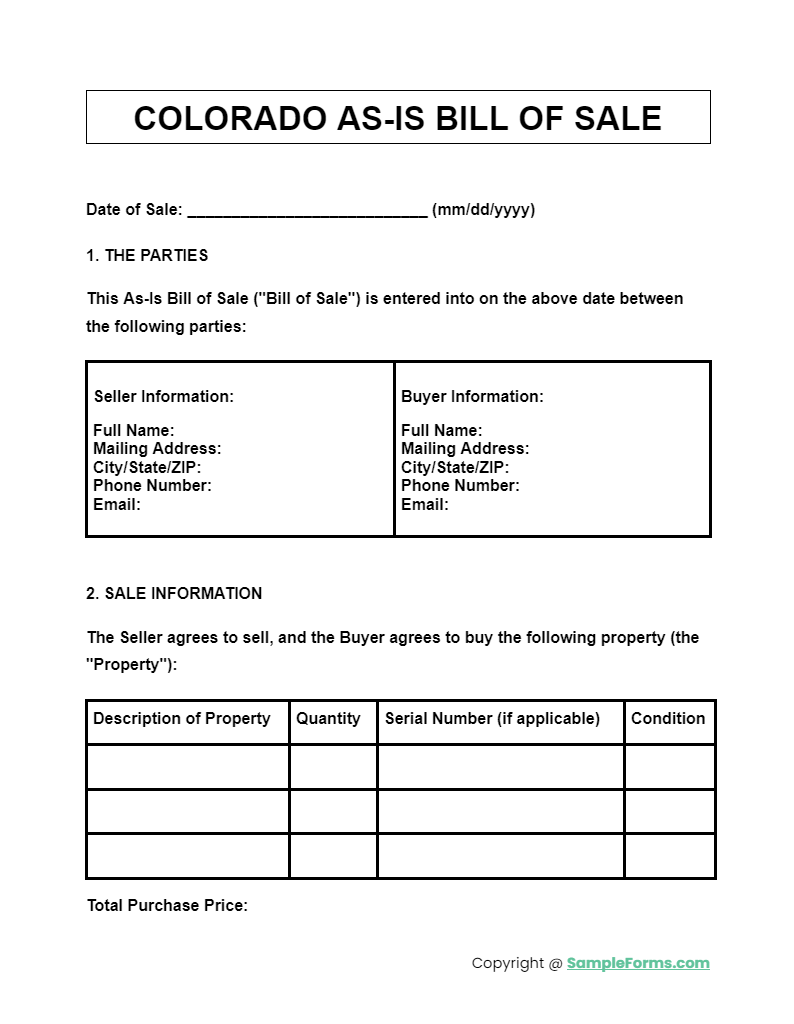

Colorado As-Is Bill of Sale Form

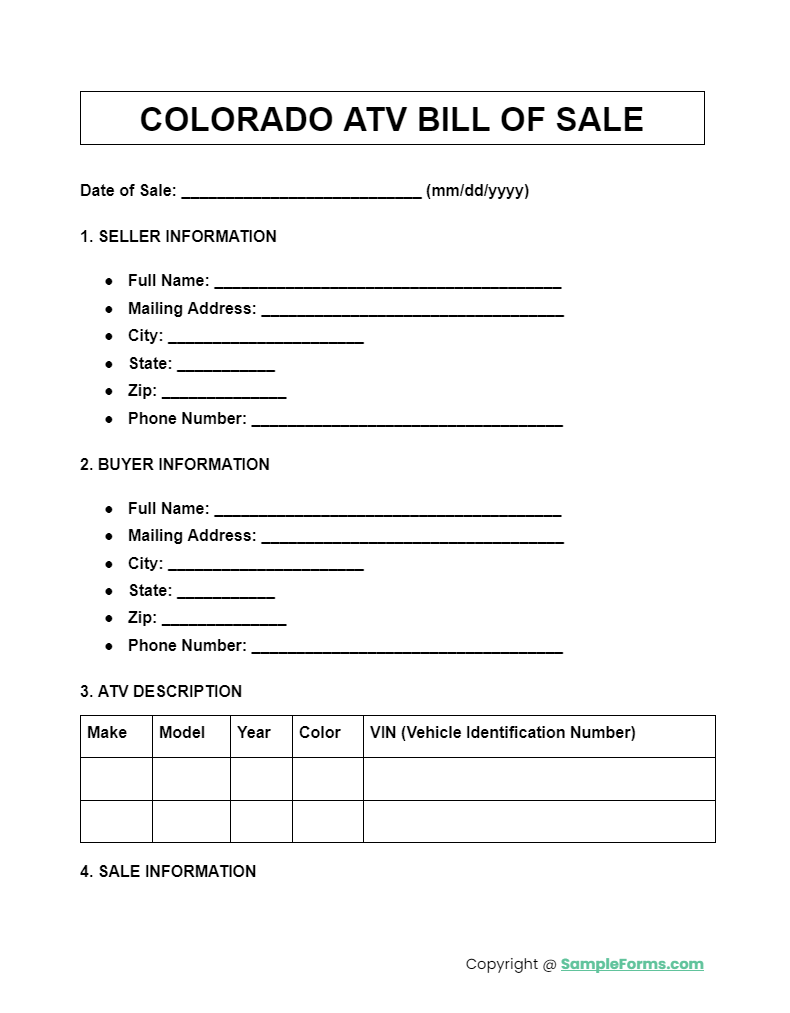

Colorado ATV Bill of Sale Form

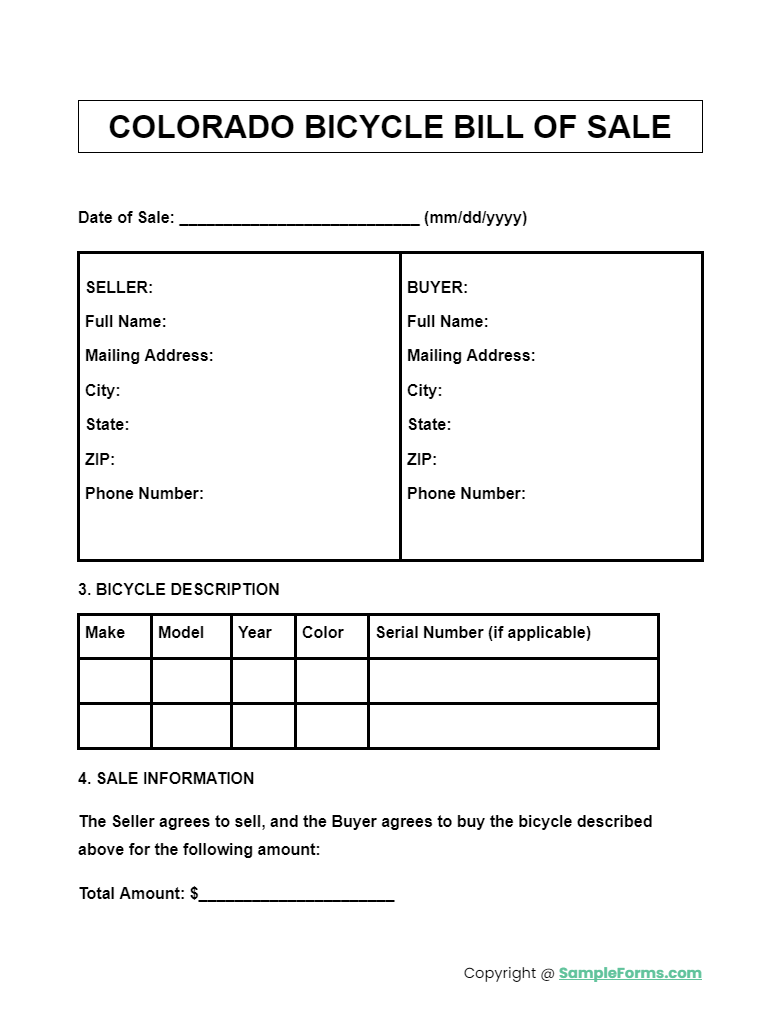

Colorado Bicycle Bill of Sale Form

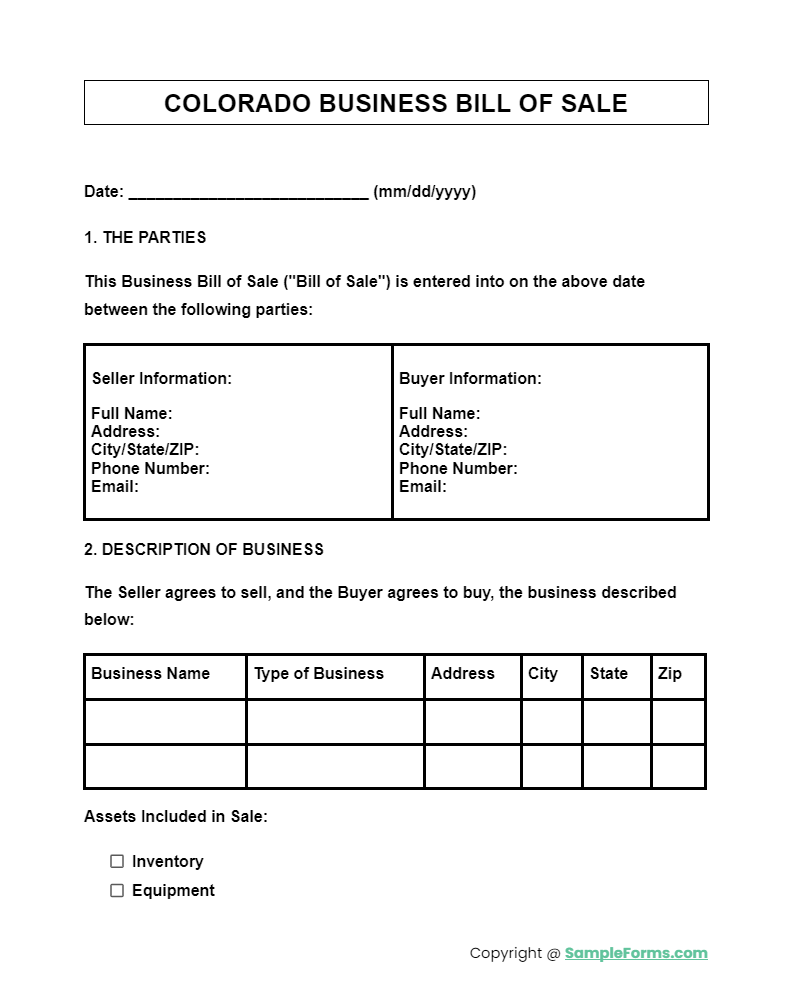

Colorado Business Bill of Sale Form

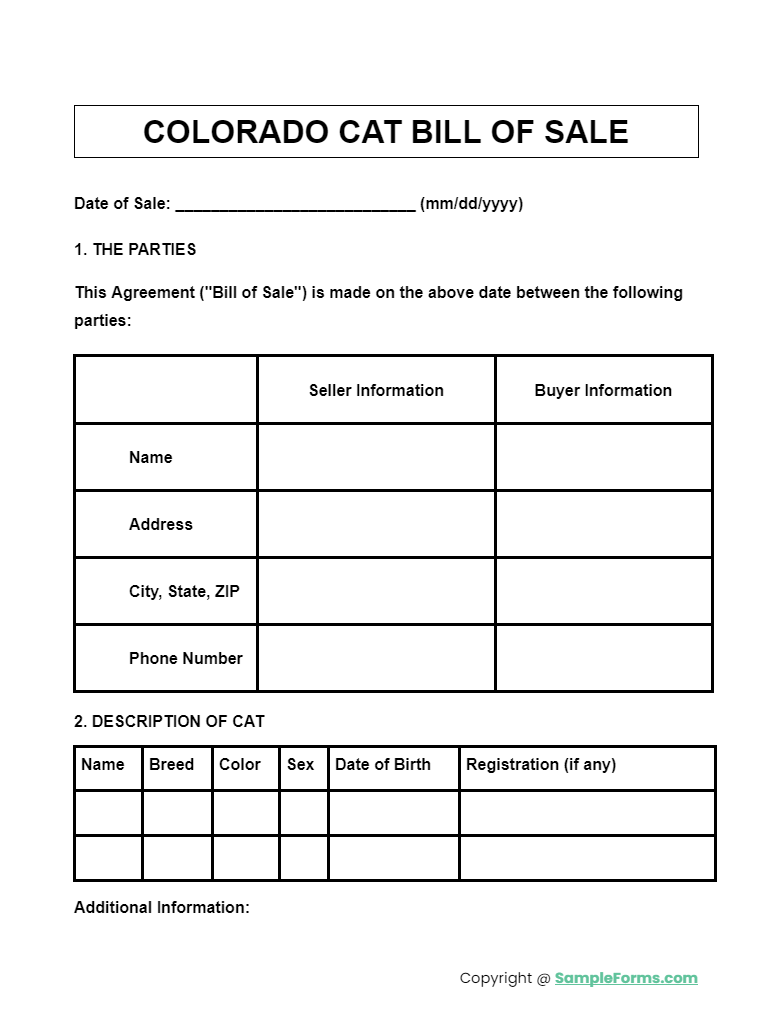

Colorado Cat Bill of Sale Form

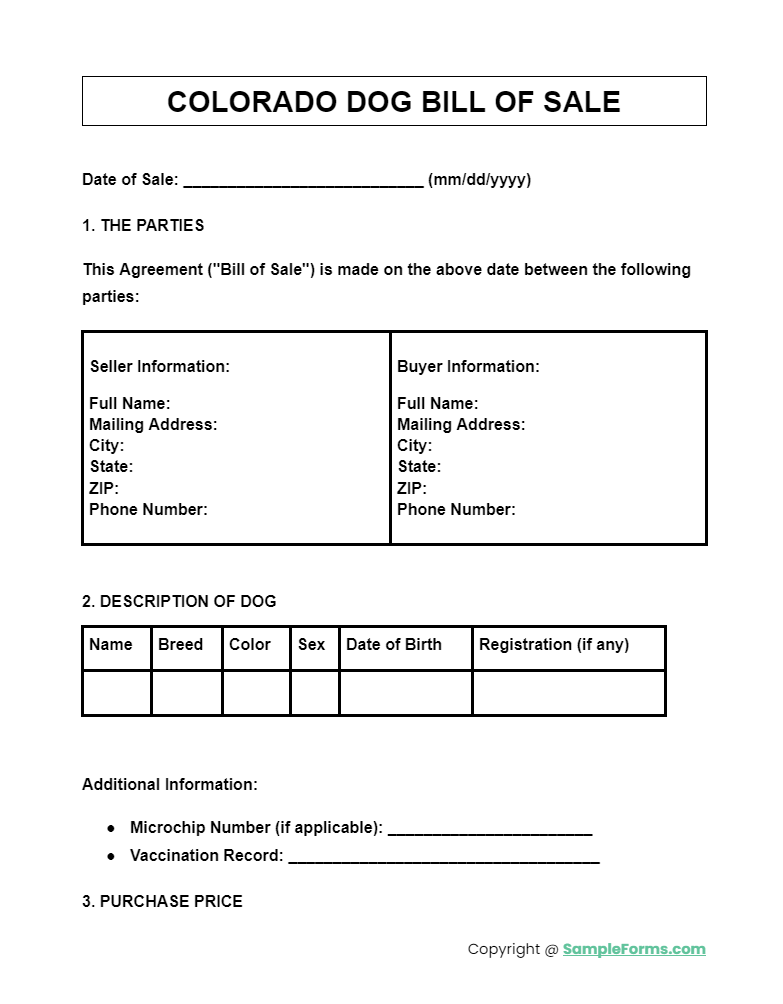

Colorado Dog Bill of Sale Form

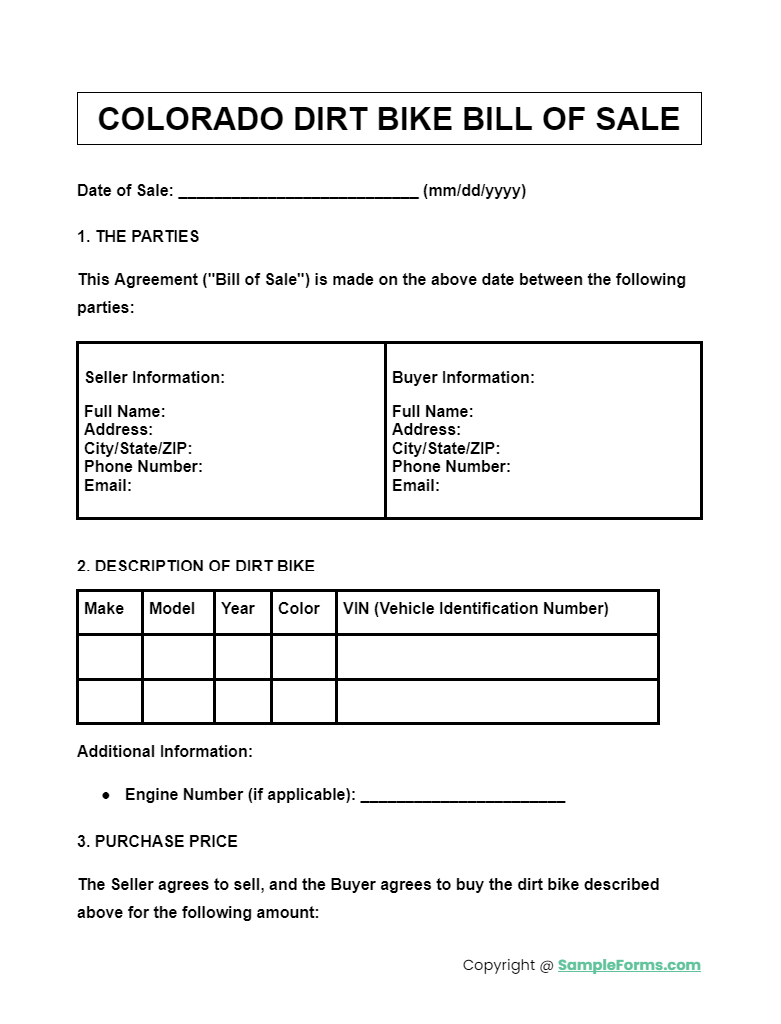

Colorado Dirt Bike Bill of Sale Form

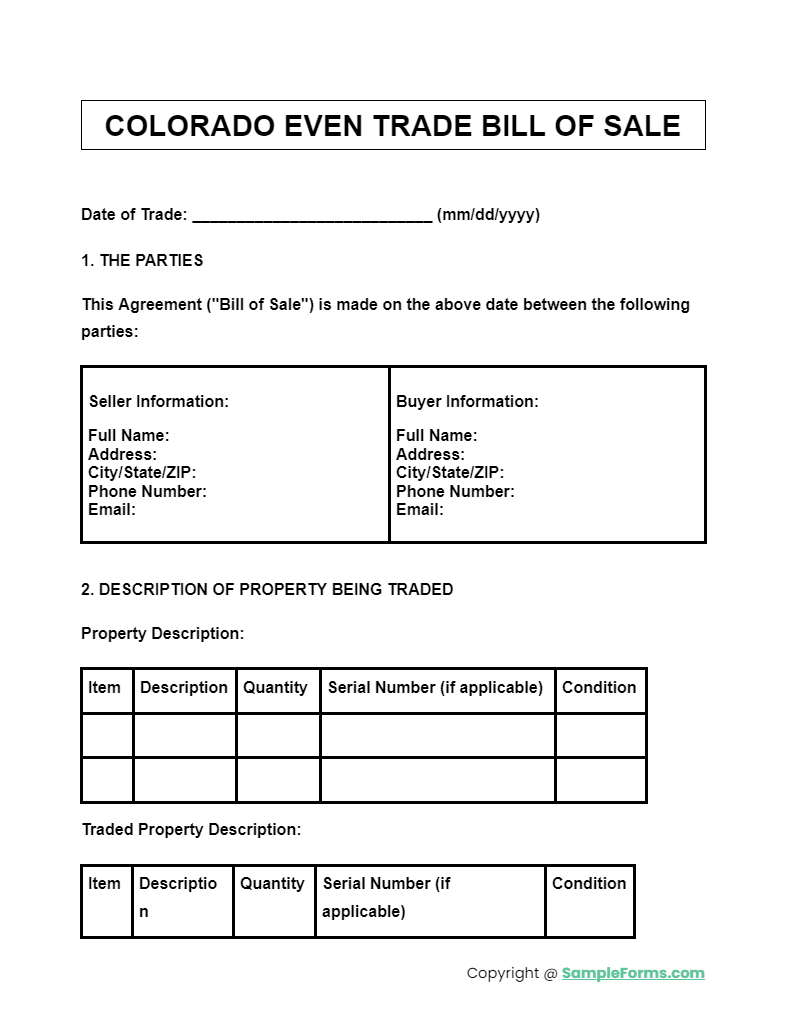

Colorado Even Trade Bill of Sale Form

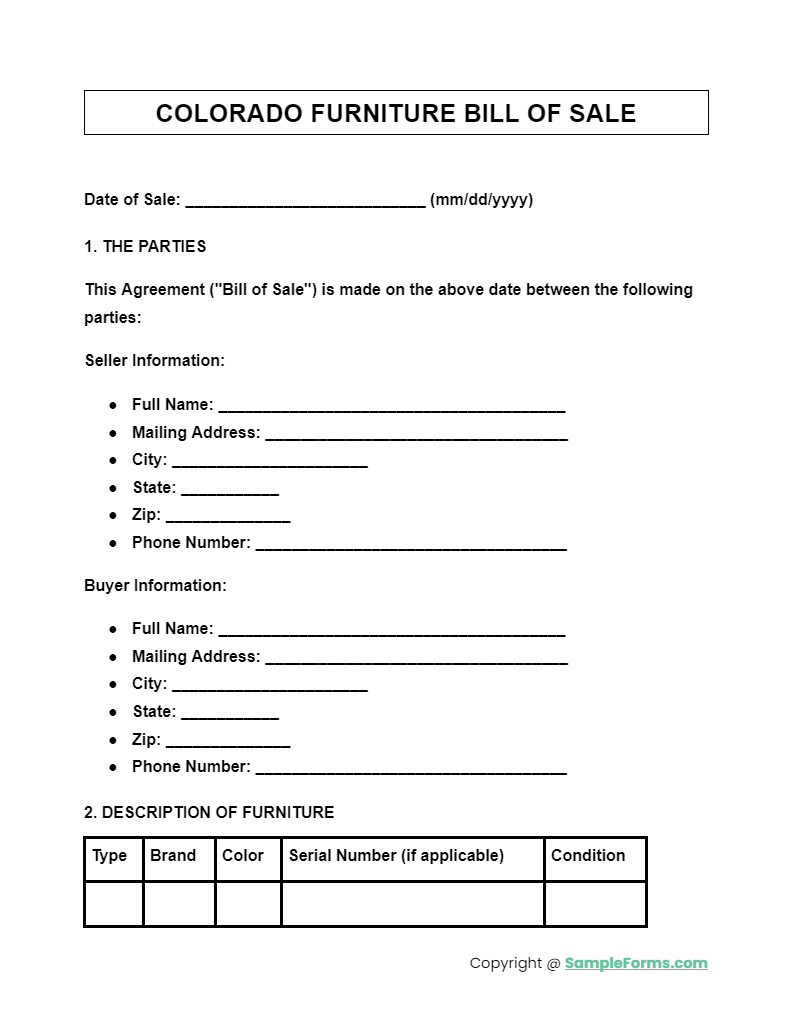

Colorado Furniture Bill of Sale Form

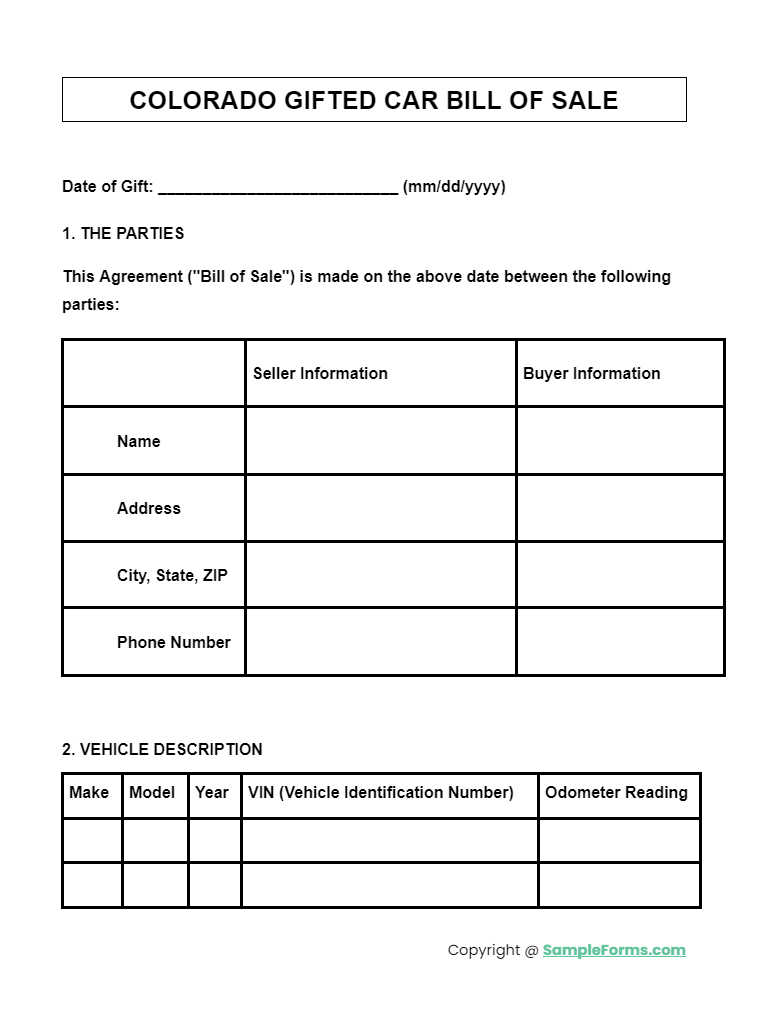

Colorado Gifted Car Bill of Sale Form

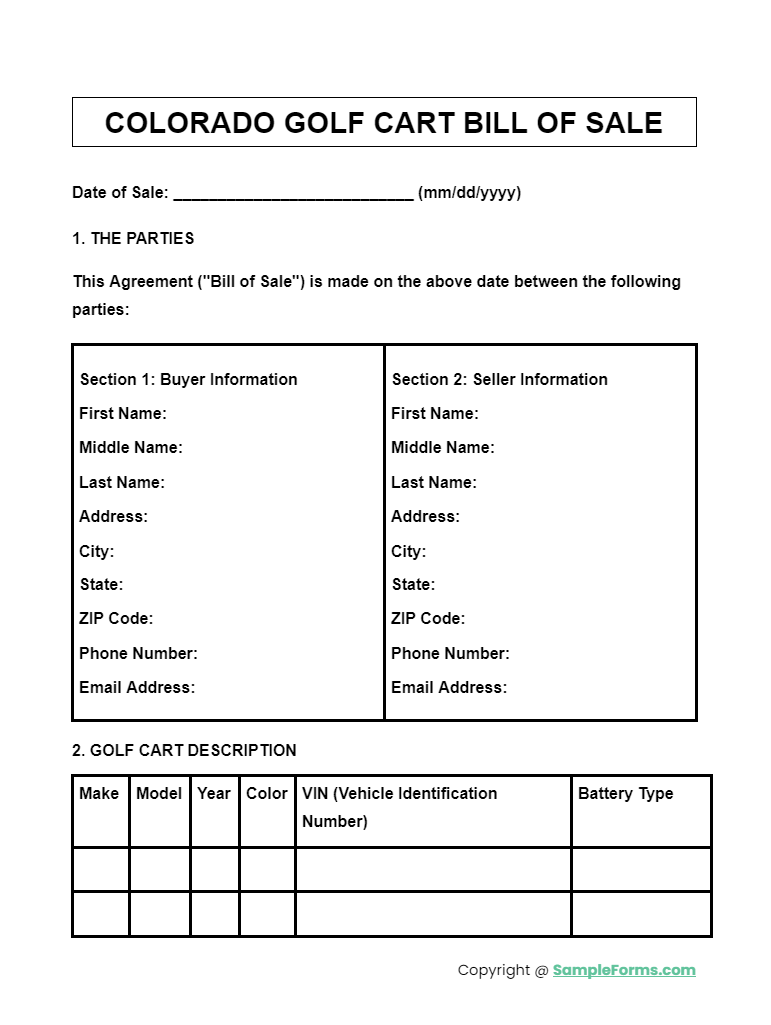

Colorado Golf Cart Bill of Sale Form

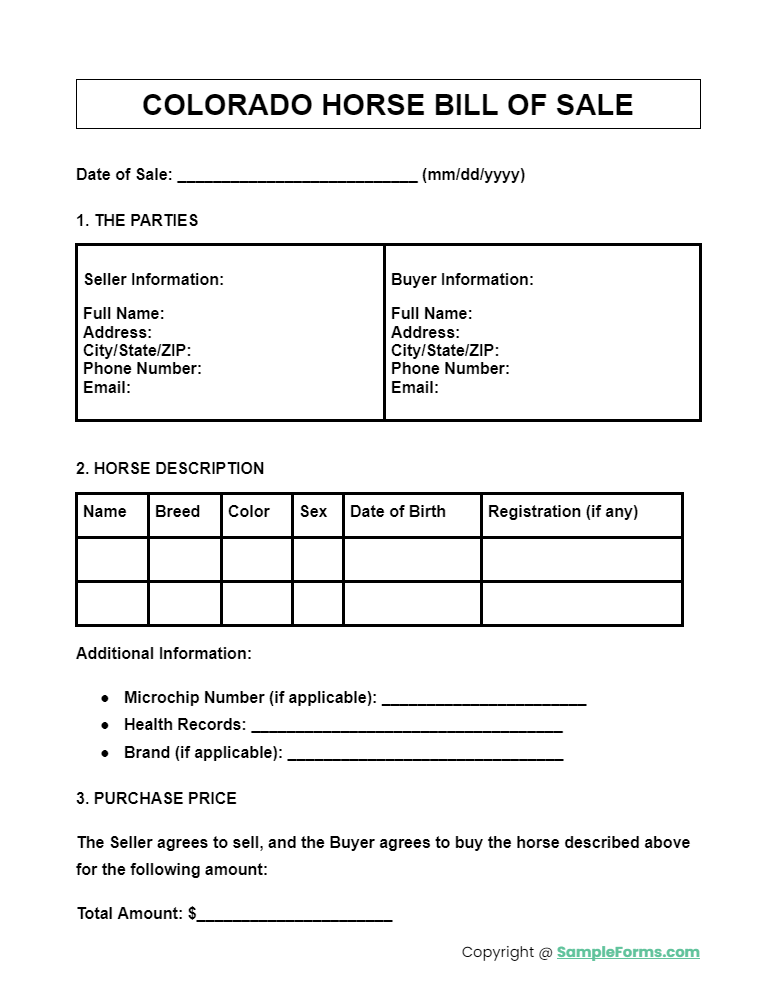

Colorado Horse Bill of Sale Form

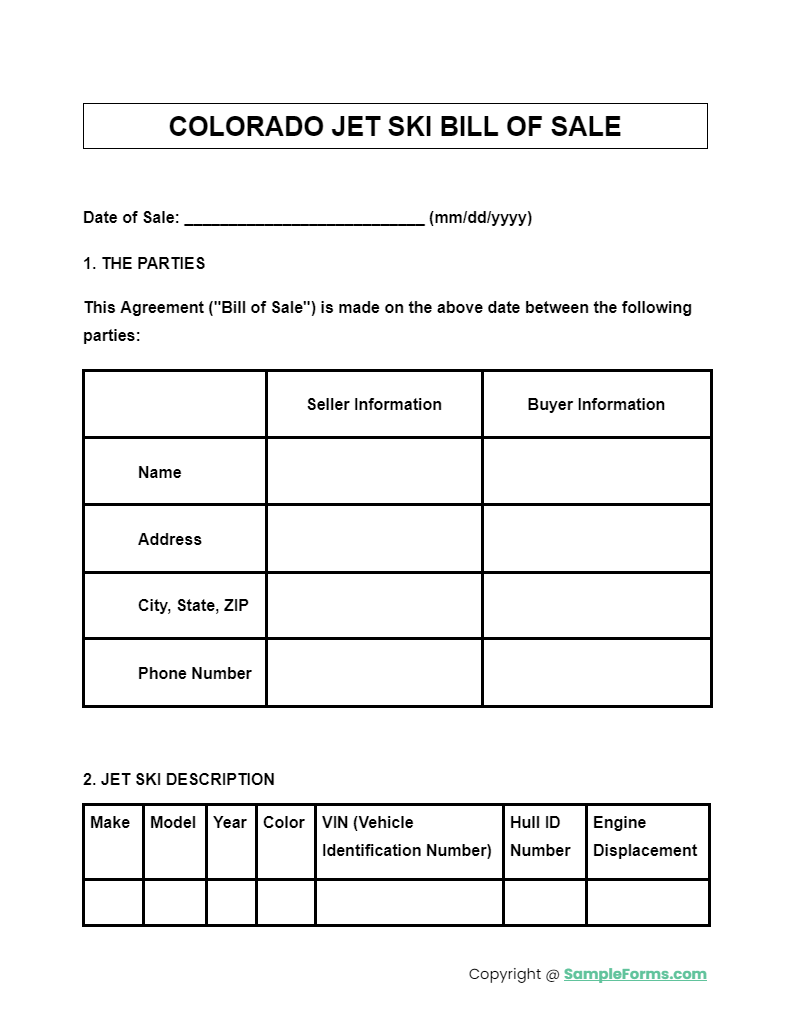

Colorado Jet Ski Bill of Sale Form

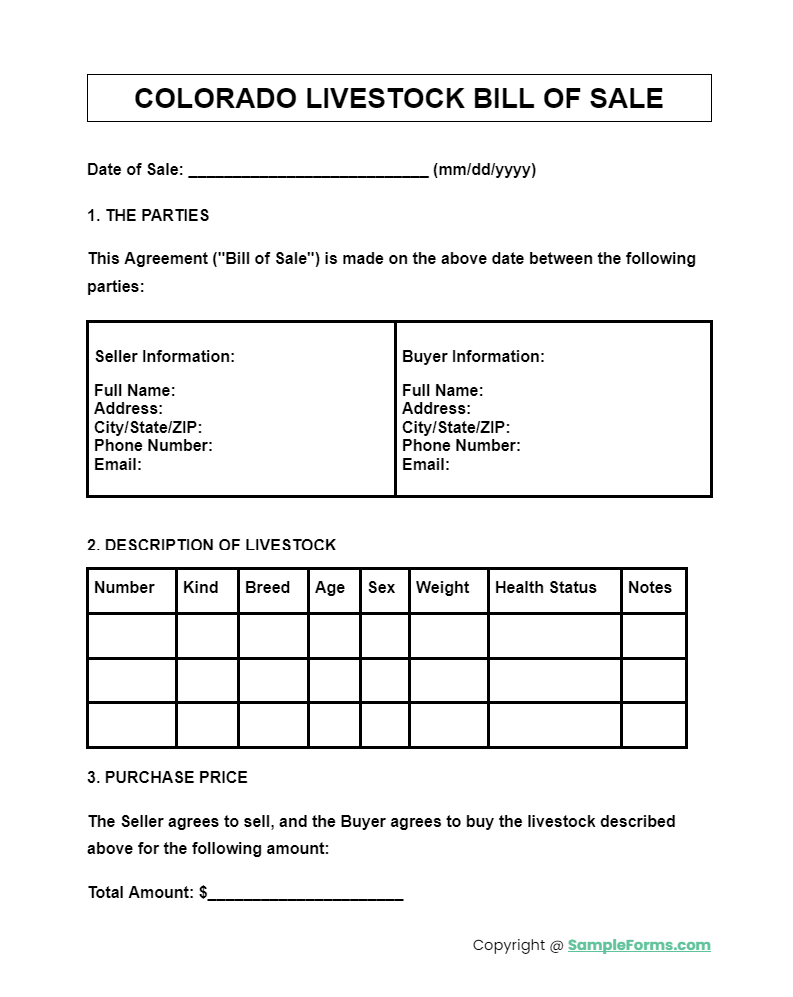

Colorado Livestock Bill of Sale Form

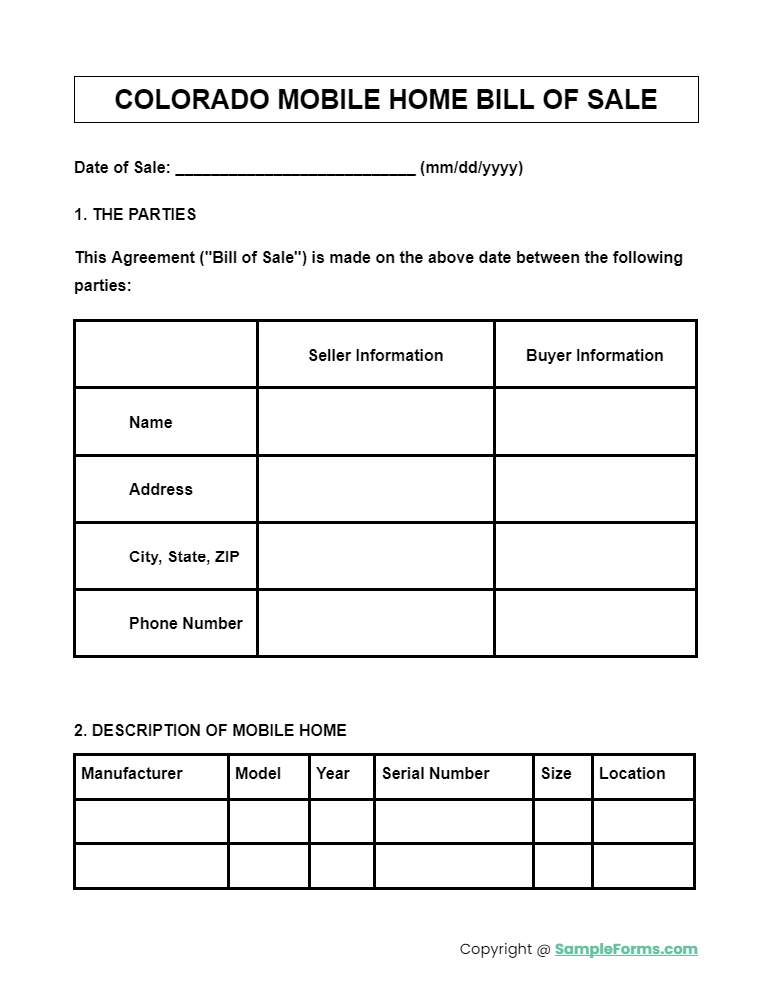

Colorado Mobile Home Bill of Sale Form

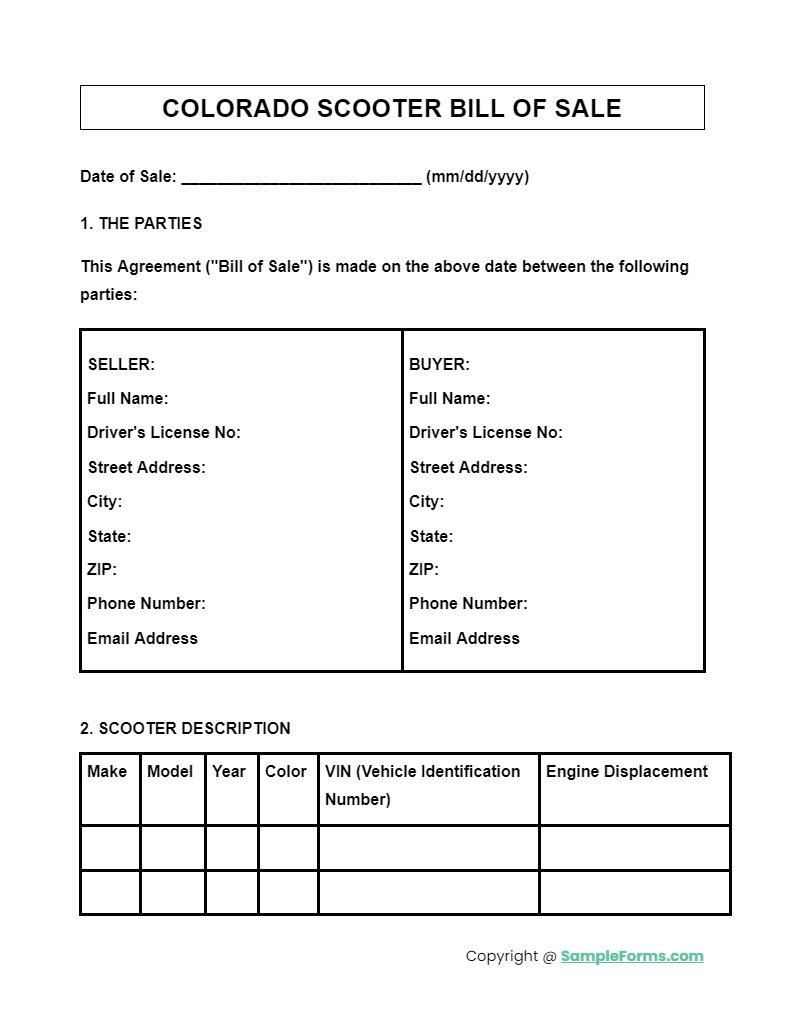

Colorado Scooter Bill of Sale Form

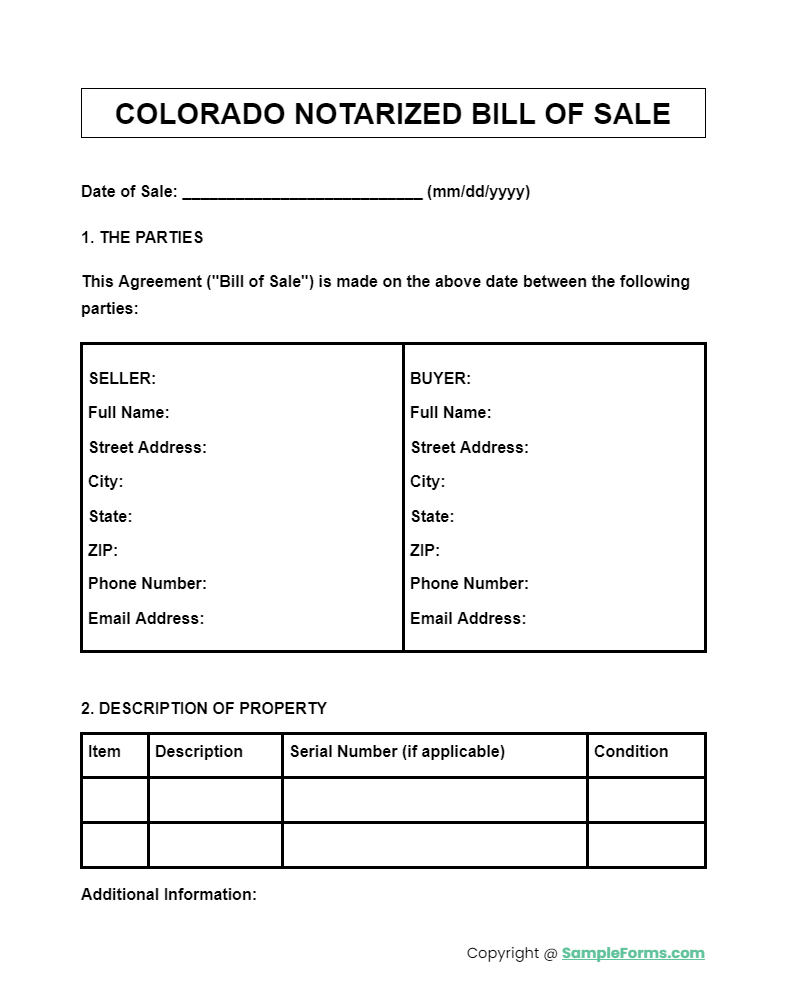

Colorado Notarized Bill of Sale Form

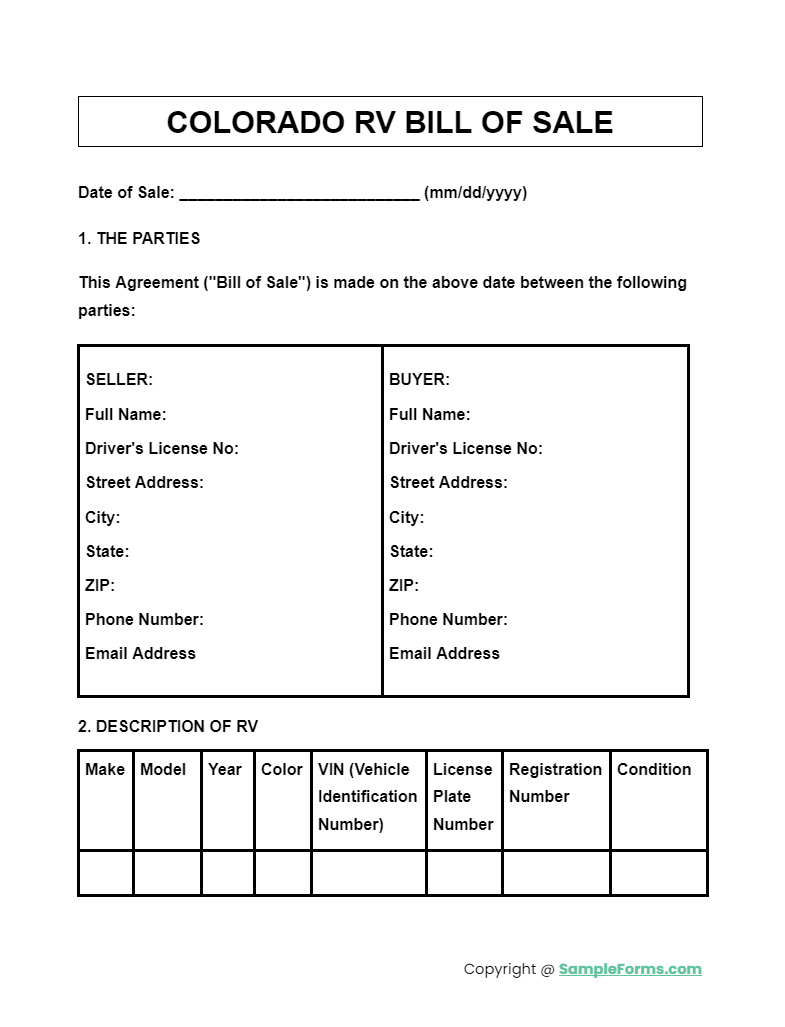

Colorado RV Bill of Sale Form

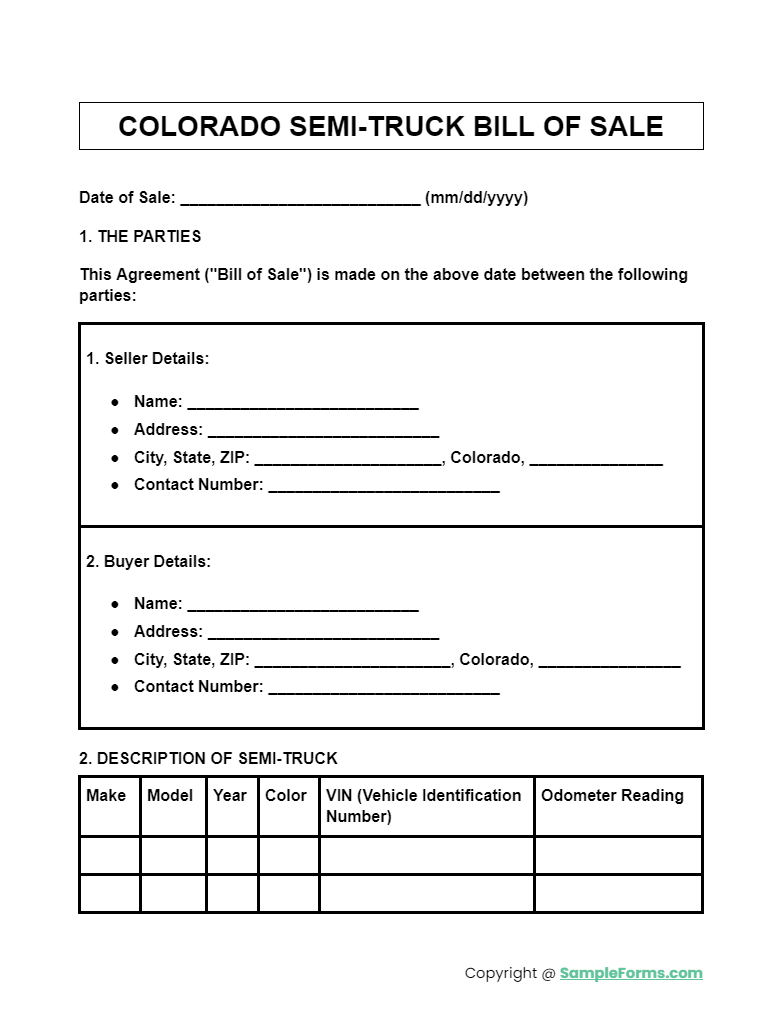

Colorado Semi-Truck Bill of Sale Form

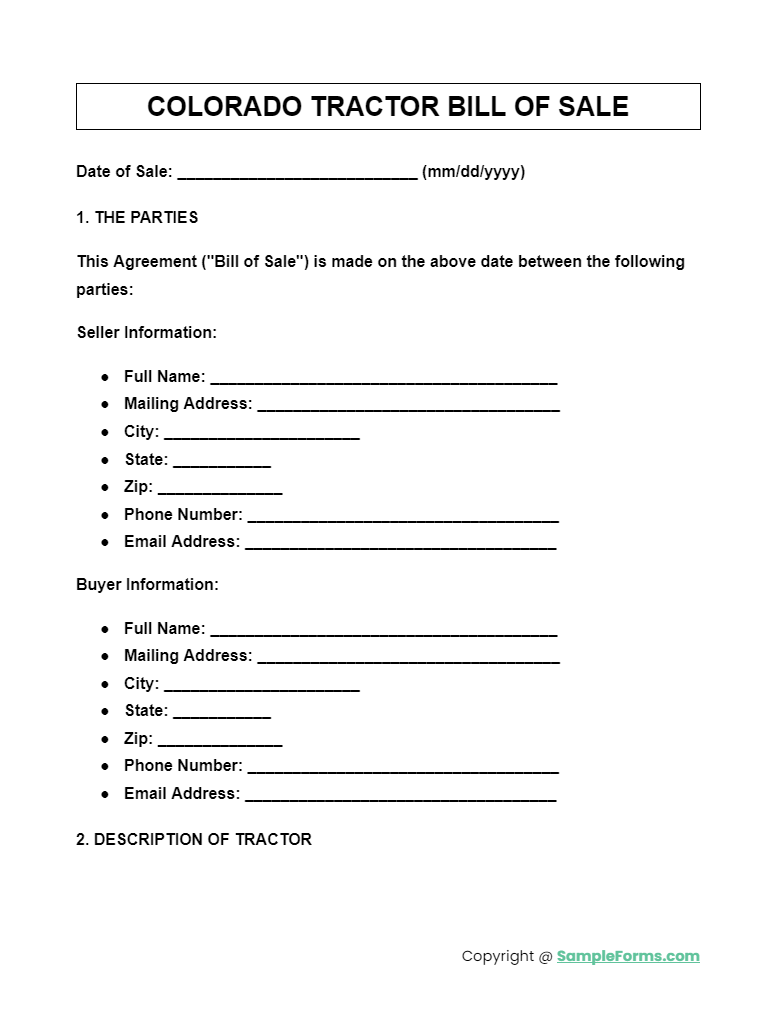

Colorado Tractor Bill of Sale Form

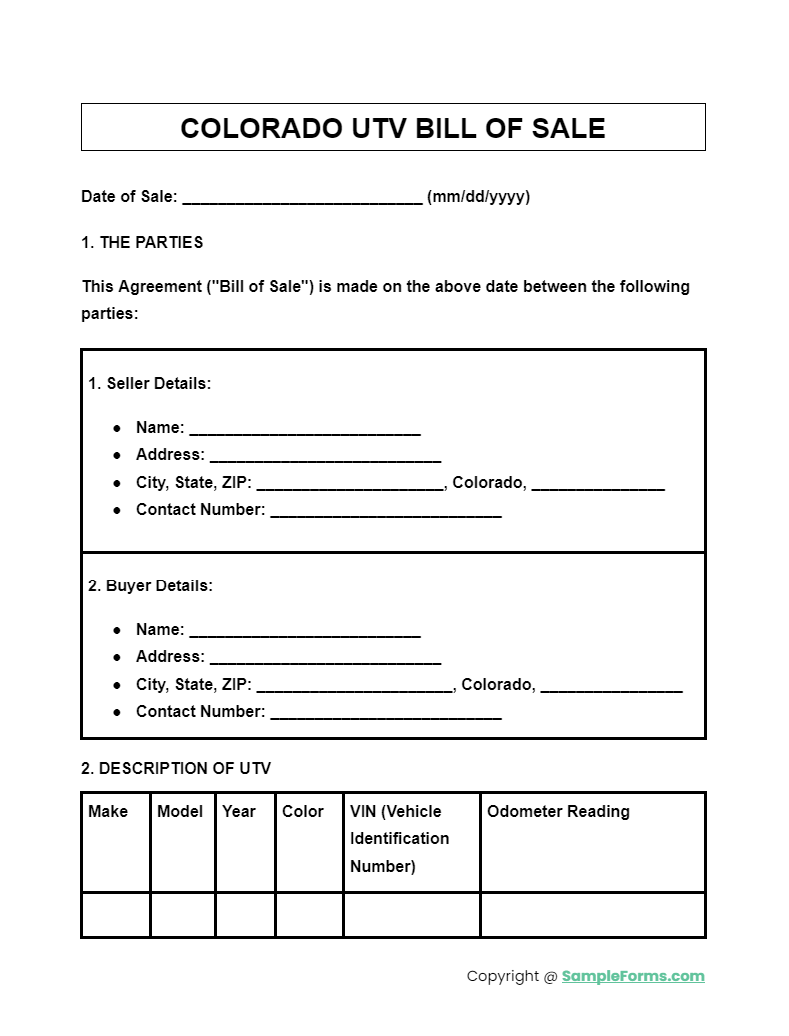

Colorado UTV Bill of Sale Form

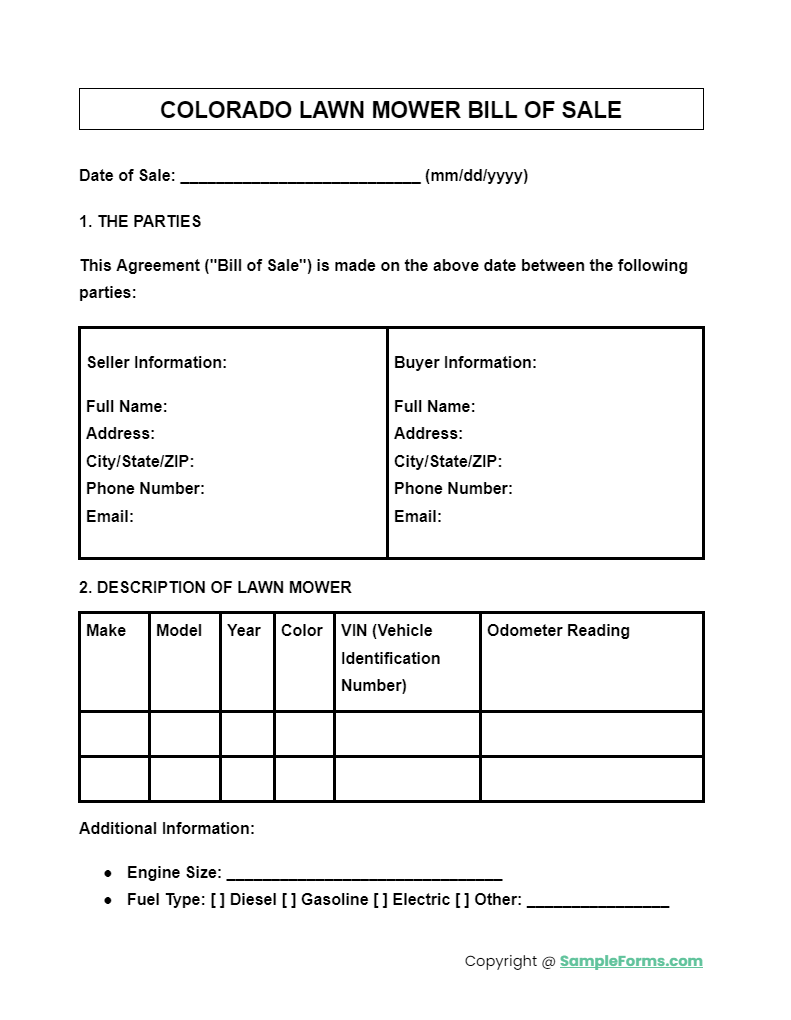

Colorado Lawn Mower Bill of Sale Form

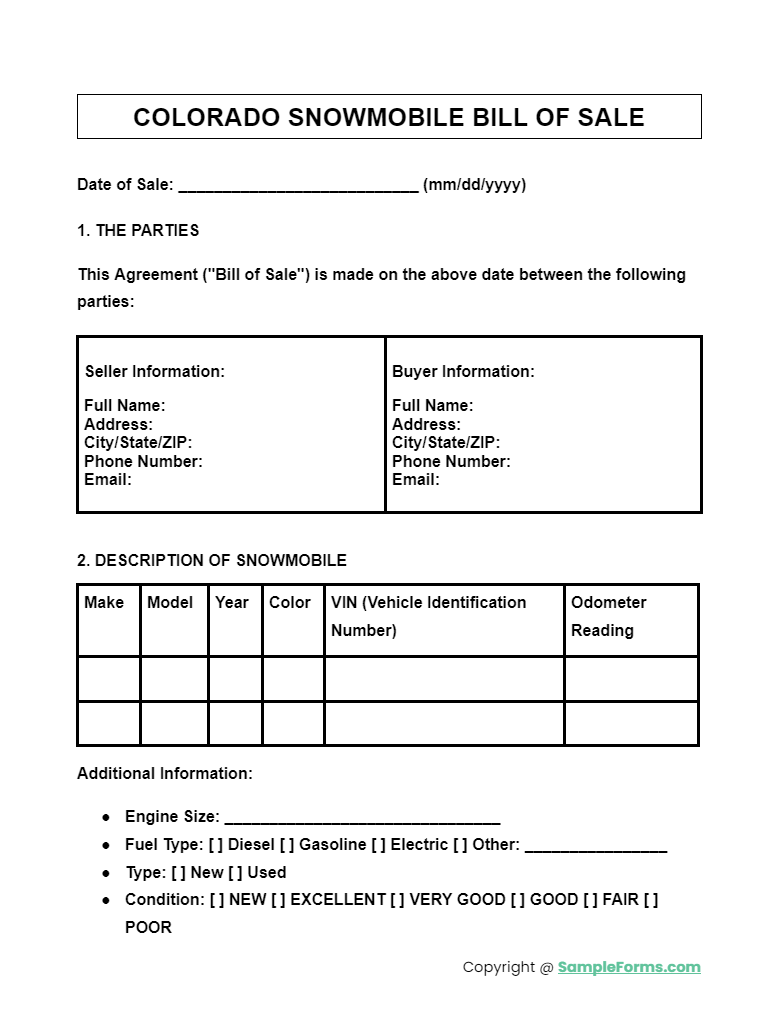

Colorado Snowmobile Bill of Sale Form

What is a bill of sale for personal property in Colorado?

A bill of sale for personal property in Colorado is a legal document that records the transfer of ownership from the seller to the buyer. It includes details such as the buyer’s and seller’s information, a description of the property, the sale price, and the date of the transaction. A Vehicle Bill of Sale Form is commonly used for vehicle transactions.

- Identification: Include full names and addresses of both parties.

- Description of Property: Provide detailed information about the item being sold.

- Sale Price: Clearly state the agreed sale price.

- Date of Sale: Include the date when the transaction took place.

- Signatures: Both parties should sign the document for it to be legally binding. You also browse our Mobile Home Bill of Sale

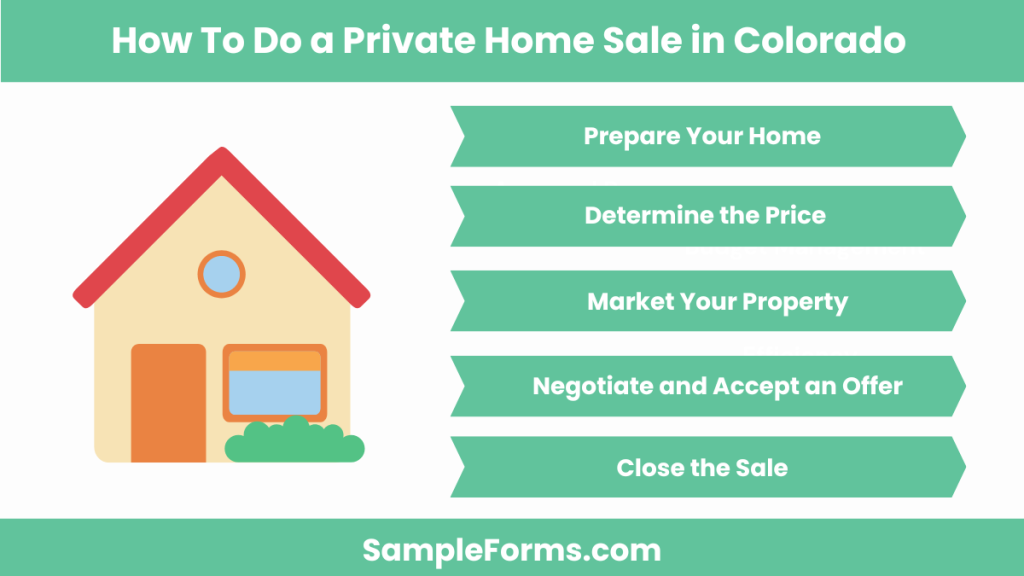

How to do a private home sale in Colorado?

Selling a home privately in Colorado involves several steps to ensure a legal and smooth transaction. A Notarized Bill of Sale Form can be useful for legal documentation.

- Prepare Your Home: Clean, repair, and stage your home to attract buyers.

- Determine the Price: Set a competitive price based on market research or a professional appraisal.

- Market Your Property: Use online listings, social media, and local advertisements to reach potential buyers.

- Negotiate and Accept an Offer: Communicate directly with buyers to negotiate and accept a fair offer.

- Close the Sale: Complete all necessary paperwork, including the transfer of the deed and finalizing payment. You also browse our Trailer Bill of Sale

How do I transfer ownership of a car in Colorado?

Transferring car ownership in Colorado requires completing specific forms and procedures to ensure the new owner is legally recognized. The Motorcycle Bill of Sale Form can also be adapted for car sales.

- Complete a Bill of Sale: Include all necessary information about the car and the sale.

- Sign the Title Over: The seller must sign the title to transfer ownership to the buyer.

- Odometer Disclosure: Provide the current mileage of the vehicle.

- Emission Test: Ensure the car passes the emission test if required.

- Visit the DMV: The buyer must take the completed forms to the DMV to finalize the transfer. You also browse our Boat Bill of Sale Form

How do I avoid capital gains tax on my house sale in Colorado?

Avoiding capital gains tax on a house sale in Colorado can be achieved through various legal strategies. Consulting with a tax professional is advised. The Bill of Sale for Vehicle form does not apply here but understanding the process is crucial.

- Primary Residence Exclusion: Ensure the home was your primary residence for at least 2 of the last 5 years.

- Calculate Gains Accurately: Subtract the cost basis (purchase price + improvements) from the sale price.

- Use Capital Gains Exemptions: Check if you qualify for exemptions based on IRS rules.

- Keep Detailed Records: Maintain records of all transactions and improvements.

- Consult a Tax Professional: Seek advice to utilize all possible deductions and exemptions. You also browse our DMV Bill of Sale Form

How to write a bill of sale in Colorado?

Writing a bill of sale in Colorado involves including all essential details to make it legally binding and clear. An Equipment Bill of Sale Form is a good reference for structuring the document.

- Seller and Buyer Information: Full names, addresses, and contact details.

- Description of the Item: Detailed information about the item being sold.

- Sale Price: Clearly state the amount for which the item is sold.

- Date of Sale: Include the exact date of the transaction.

- Signatures: Both parties must sign to validate the document. You also browse our Horse Bill of Sale Form

Can I write my own bill of sale in Colorado?

Yes, you can write your own bill of sale in Colorado. Ensure it includes essential details like buyer, seller, item description, sale price, and date. Use an Auto Bill of Sale Form as a reference.

Does a Colorado title need to be notarized?

No, a Colorado title does not need to be notarized for vehicle transfers. However, it’s recommended to use a Motor Vehicle Bill of Sale to document the transaction properly.

How much does it cost to register a car in Colorado?

The cost to register a car in Colorado varies by county and vehicle type. Generally, fees range from $50 to $150. For detailed costs, consult the DMV or use a Truck Bill of Sale Form for commercial vehicles.

How much does it cost to transfer title to Colorado?

Transferring a title in Colorado typically costs around $7, plus applicable county fees. Ensure all paperwork, including a Livestock Bill of Sale Form, is correctly filled if you’re transferring livestock titles.

Who pays for title in Colorado?

The buyer usually pays for the title transfer fee in Colorado. Ensure all details are correctly documented using a Personal Property Bill of Sale Form to avoid any disputes.

Do I need a bill of sale in Colorado?

Yes, a bill of sale is recommended in Colorado to document the sale and protect both parties. Utilize a Bill of Sale Vehicle Form for accuracy and legality.

Are 2 plates required in Colorado?

Yes, Colorado requires two license plates: one on the front and one on the back of the vehicle. Ensure all details are updated using the appropriate forms like a Dog Bill of Sale Form for pet transfers.

Can a non-resident register a car in Colorado?

Yes, a non-resident can register a car in Colorado if they have a valid Colorado address. Make sure all necessary forms, such as a Bill of Sale for Firearm, are completed correctly.

Why are license plates so expensive in Colorado?

License plates are expensive in Colorado due to high registration fees, taxes, and county-specific charges. Detailed documentation, like a Business Bill of Sale Form, helps in understanding and managing these costs.

In conclusion, the Colorado Bill of Sale Form is a vital document for anyone involved in a sale transaction. From vehicles to personal property, this form provides a legal record of the transfer of ownership, protecting both the buyer and the seller. Whether you need a sample form, guidance on how to fill it out, or information on its use, understanding the Bill of Sale process is crucial. Remember, a well-prepared Gun Bill of Sale Form can prevent future disputes and ensure a smooth, legal transaction. Make sure to use the correct format and include all necessary details to safeguard your sale.

Related Posts

-

Florida Bill of Sale Form

-

District of Columbia Bill of Sale Form

-

Delaware Bill of Sale Form

-

Connecticut Bill of Sale Form

-

California Bill of Sale Form

-

Arizona Bill of Sale Form

-

Arkansas Bill of Sale Form

-

Alaska Bill of Sale Form

-

Alabama Bill of Sale Form

-

FREE 6+ Recreational Vehicle Bill of Sale Forms in PDF | MS Word

-

FREE 5+ Kitten / Cat Bill of Sale Forms in PDF

-

FREE 6+ Notarized bill of sale Forms in PDF

-

FREE 6+ Boat (Vessel) Bill of Sale Forms in PDF | MS Word

-

FREE 6+ Motorcycle Bill of Sale Forms in PDF | MS Word

-

FREE 5+ Mobile Manufactured Homes Bill of Sale Forms in PDF