A Church Donation Form is essential for managing contributions, ensuring transparency, and keeping accurate financial records. Whether you’re donating online or in person, this Donation Form and Church Form simplifies the process. It provides a structured way for churches to track tithes, one-time gifts, and recurring donations, ensuring every contribution is accounted for. Proper documentation also allows donors to receive tax deductions. This guide offers templates, best practices, and essential information to streamline church donations while fostering generosity within the congregation.

Download Church Donation Form Bundle

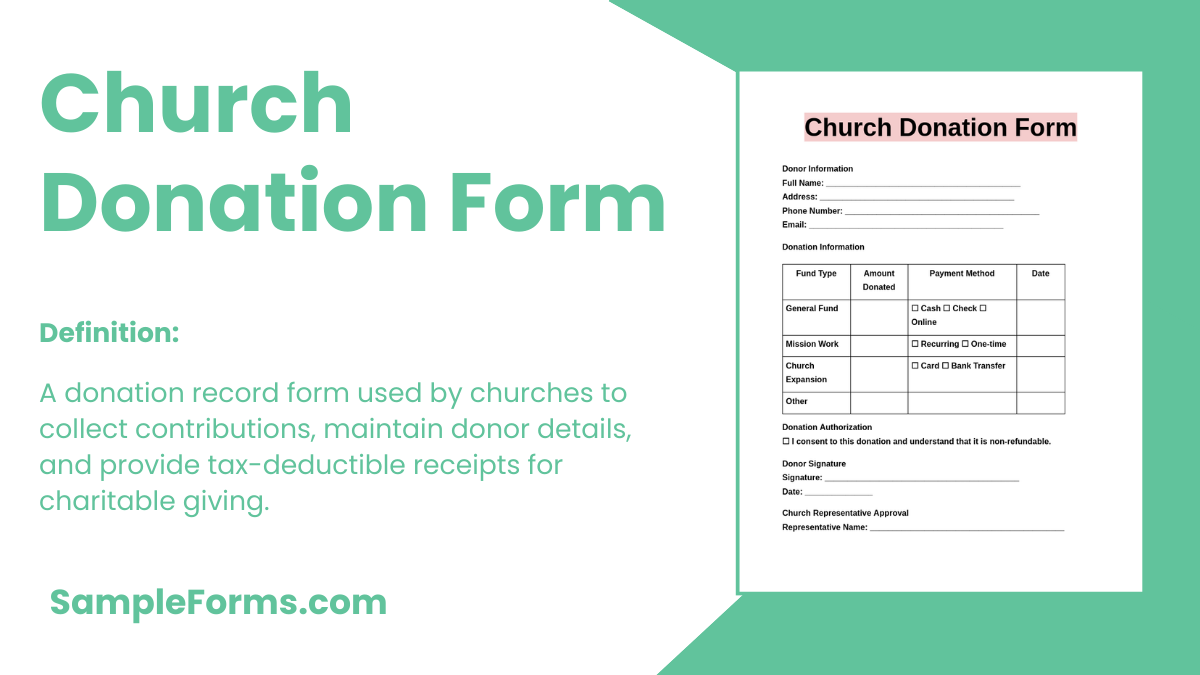

What is Church Donation Form?

A Church Donation Form is a structured document used by churches to record and process financial contributions from members and donors. It helps track donations for tax reporting, ensures proper allocation of funds, and provides a transparent way for churches to manage financial records. This form may include donor details, donation amount, payment method, and purpose of the contribution. It allows churches to maintain financial integrity while offering donors a convenient way to give, whether for tithes, community programs, or mission work.

Church Donation Format

Donor Information

Full Name: _______________________________

Mailing Address: _______________________________

Phone Number: _______________________________

Email: _______________________________

Donation Details

Date of Donation: _______________________________

Amount Donated: $_______________________________

Payment Method: ☐ Cash ☐ Check ☐ Credit/Debit Card ☐ Online Transfer

Donation Purpose: ☐ General Fund ☐ Church Renovation ☐ Missionary Support ☐ Charity & Outreach

Acknowledgment & Consent

☐ I authorize this donation for the stated purpose

☐ I request a donation receipt for tax purposes

Church Representative Approval

Name: _______________________________

Position: _______________________________

Signature: _______________________________

Date: _______________________________

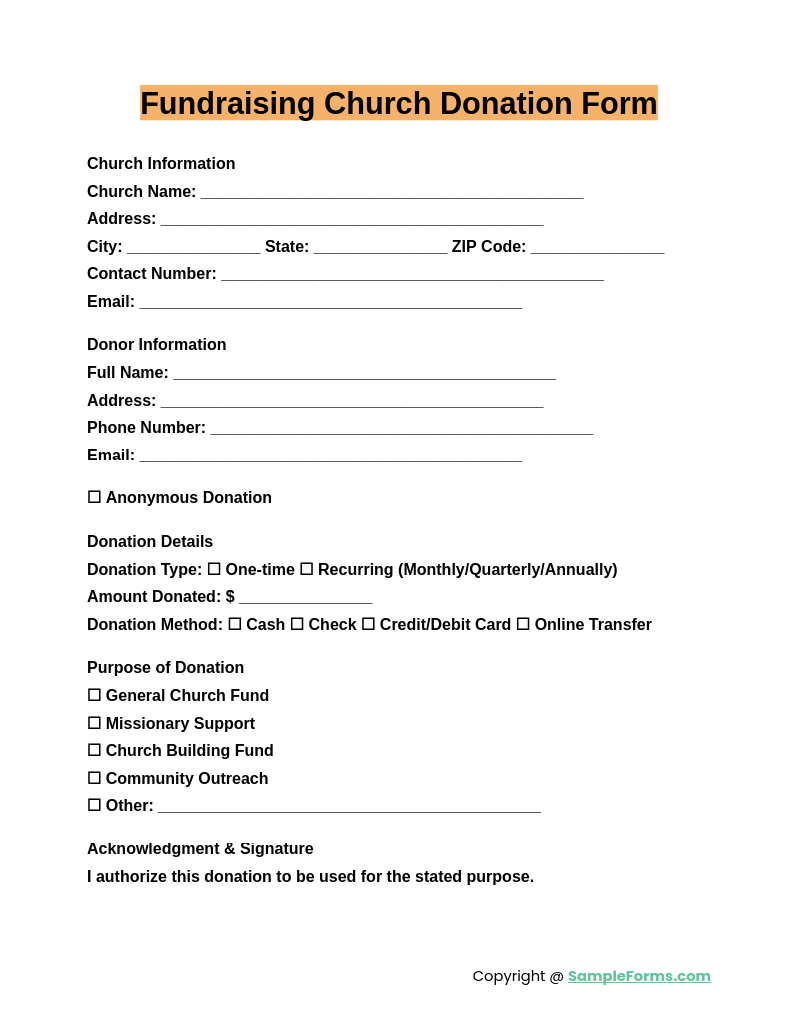

Fundraising Church Donation Form

A Fundraising Church Donation Form is essential for organizing church fundraising efforts. Similar to a Donation Receipt Form, it records contributions, donor details, and the purpose of funds, ensuring financial transparency and accountability while encouraging generous giving for church projects.

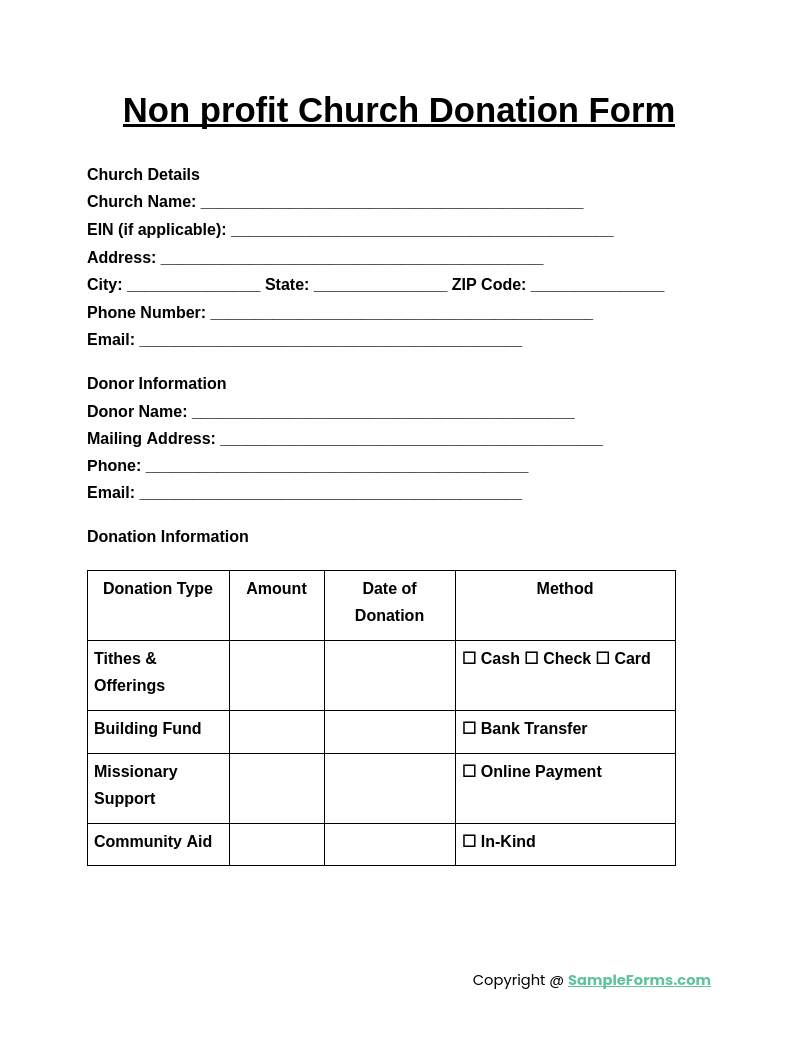

Nonprofit Church Donation Form

A Nonprofit Church Donation Form helps churches operate as tax-exempt entities. Like a Donation Request Form, it ensures compliance, organizes donations, and provides official records for donors, allowing them to claim tax deductions while supporting church activities.

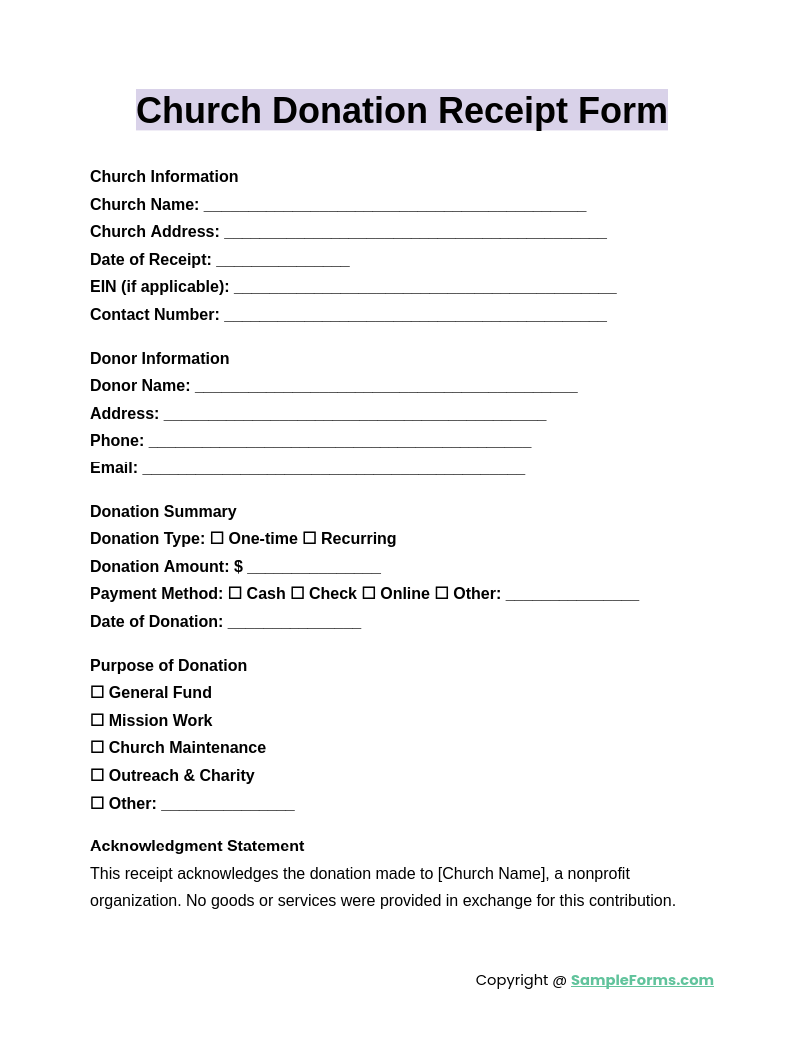

Church Donation Receipt Form

A Church Donation Receipt Form acknowledges donor contributions. Similar to a Blood Donation Form, it verifies the donation amount, donor name, and church details, providing official proof of contribution for tax purposes or financial records.

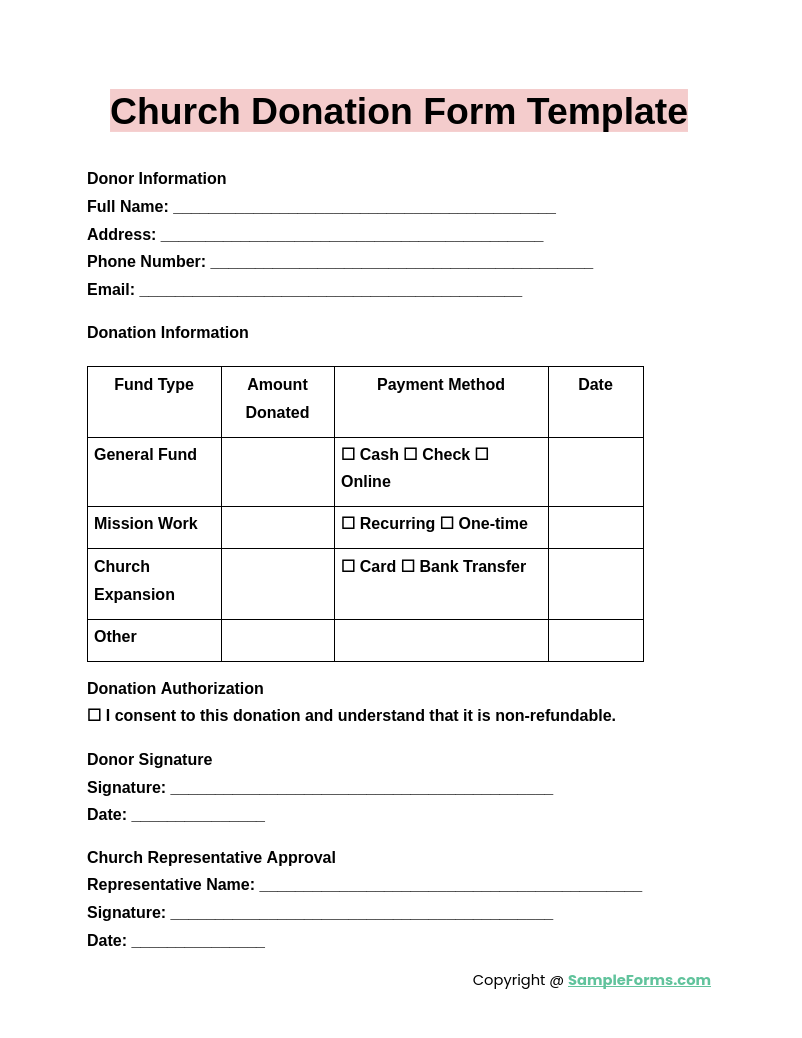

Church Donation Form Template

A Church Donation Form Template simplifies collecting and tracking contributions. Like a Nonprofit Donation Form, it provides a structured format for managing tithes, special offerings, and charitable donations, ensuring accurate records and donor recognition.

Browse More Church Donation Forms

Church Donation Form Sample

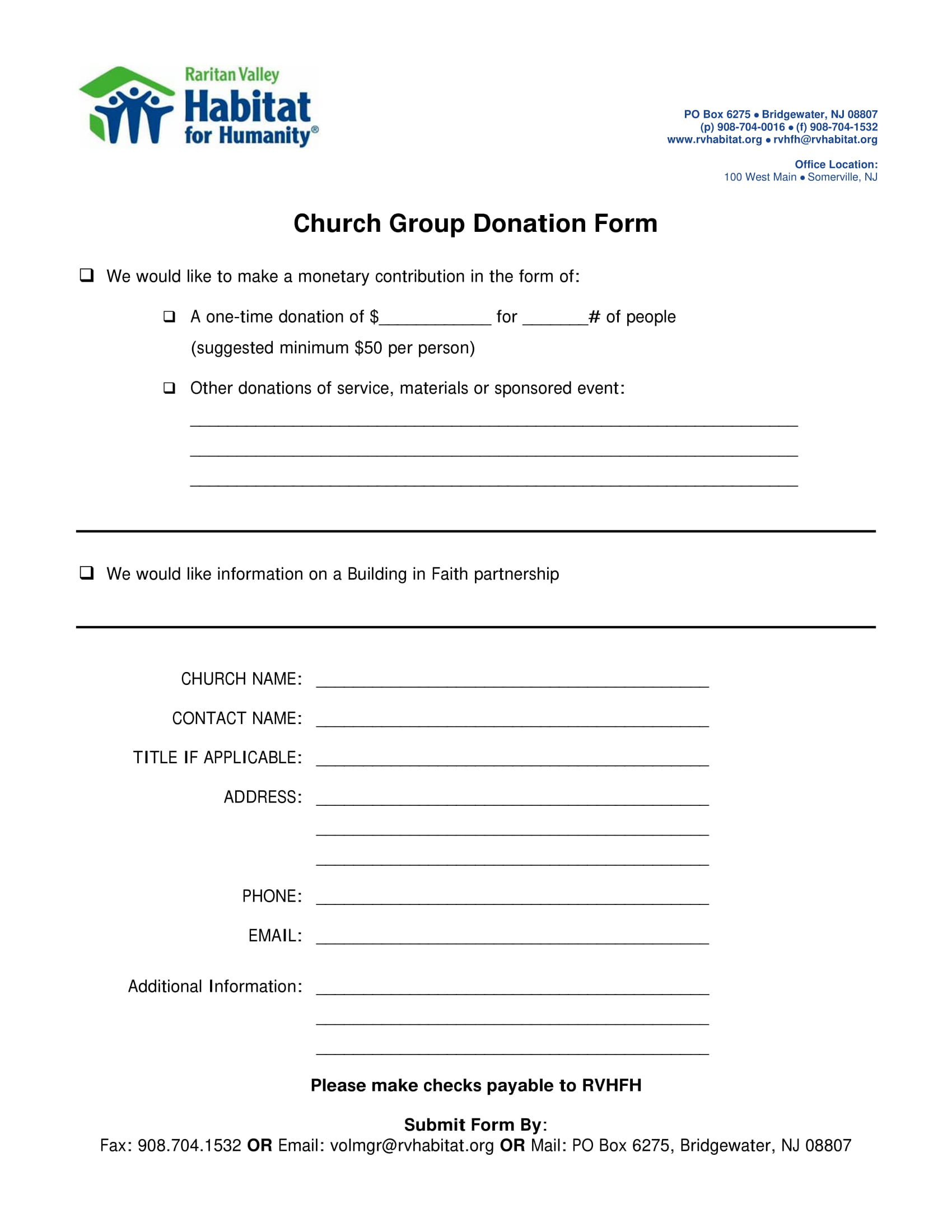

Church Group Donation Form

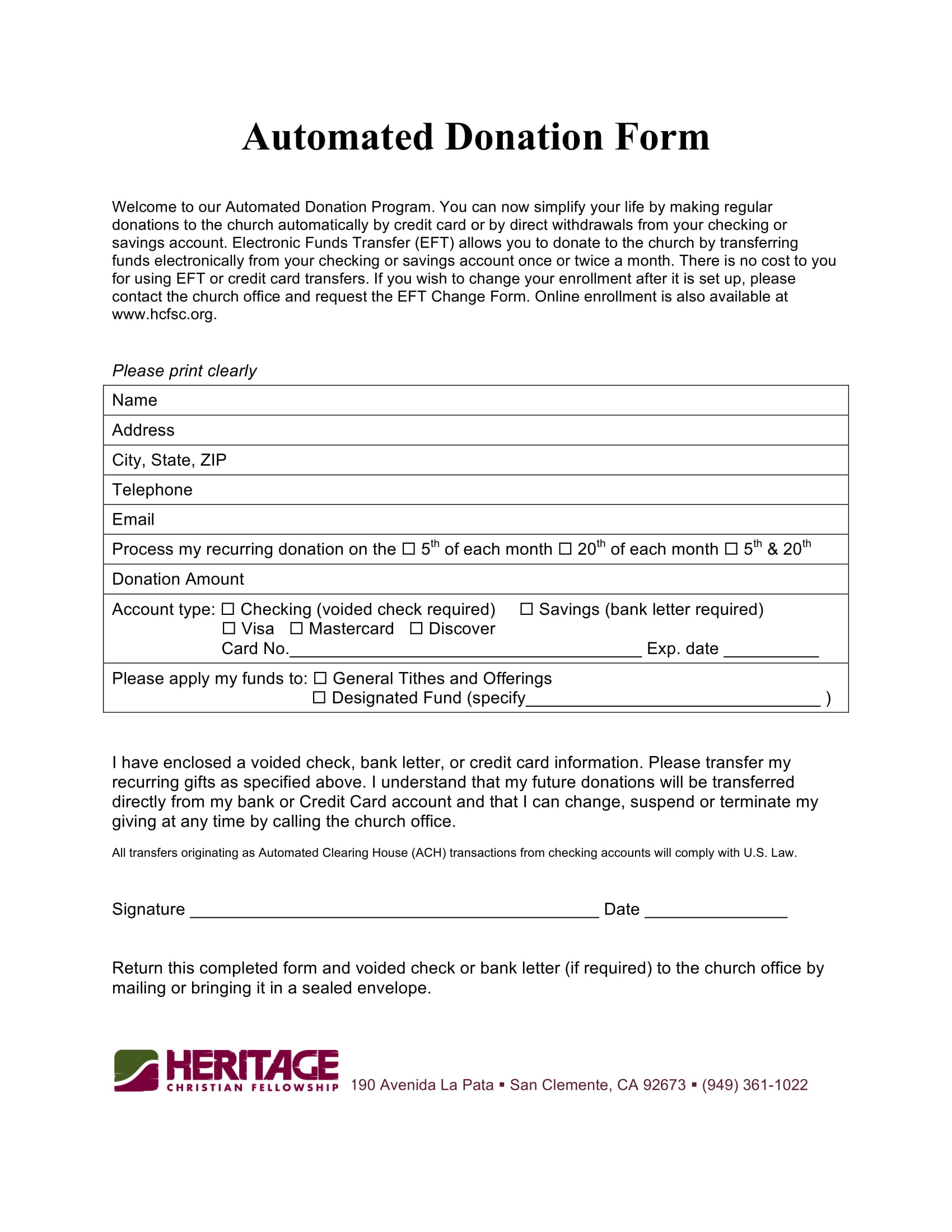

Fellowship Automated Donation Form

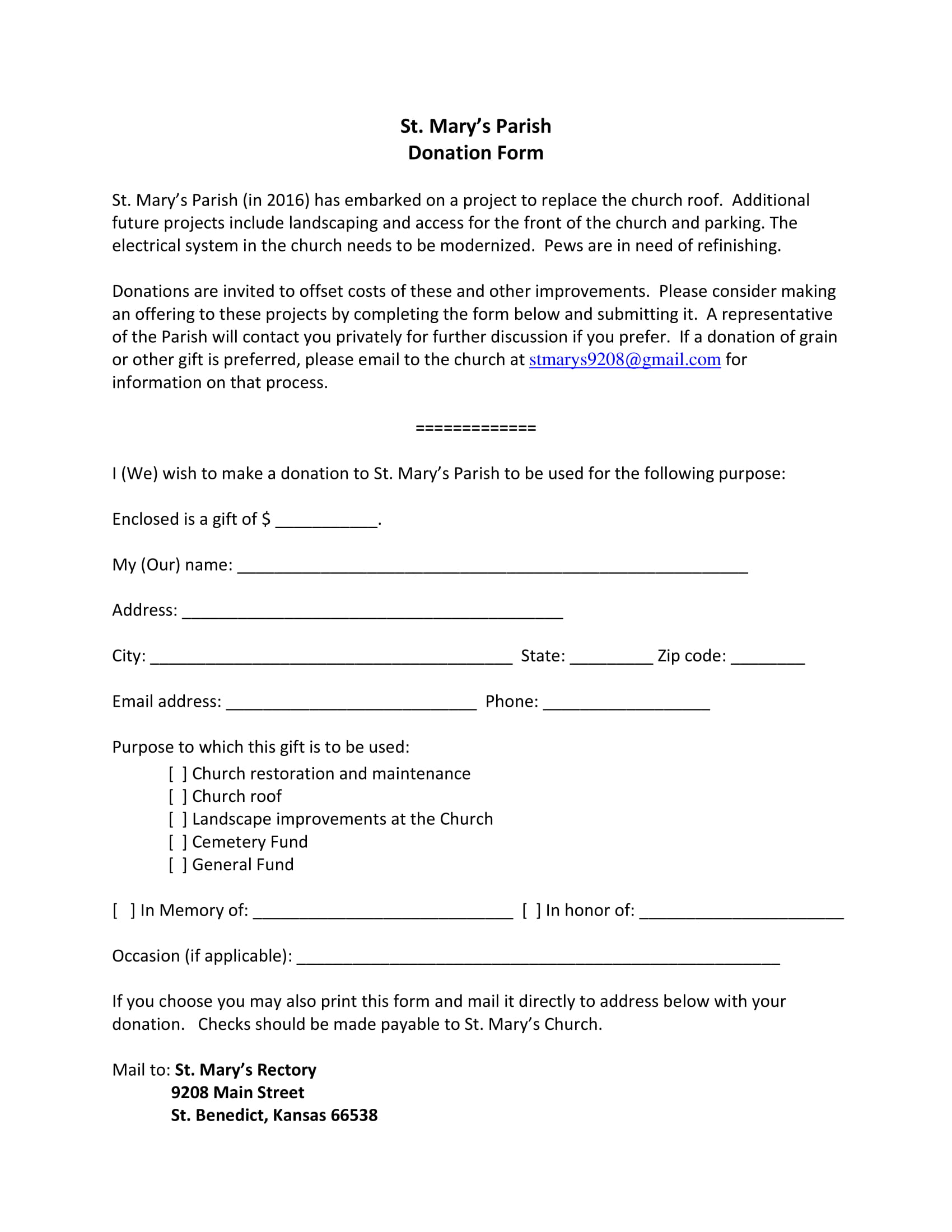

Parish Donation Form

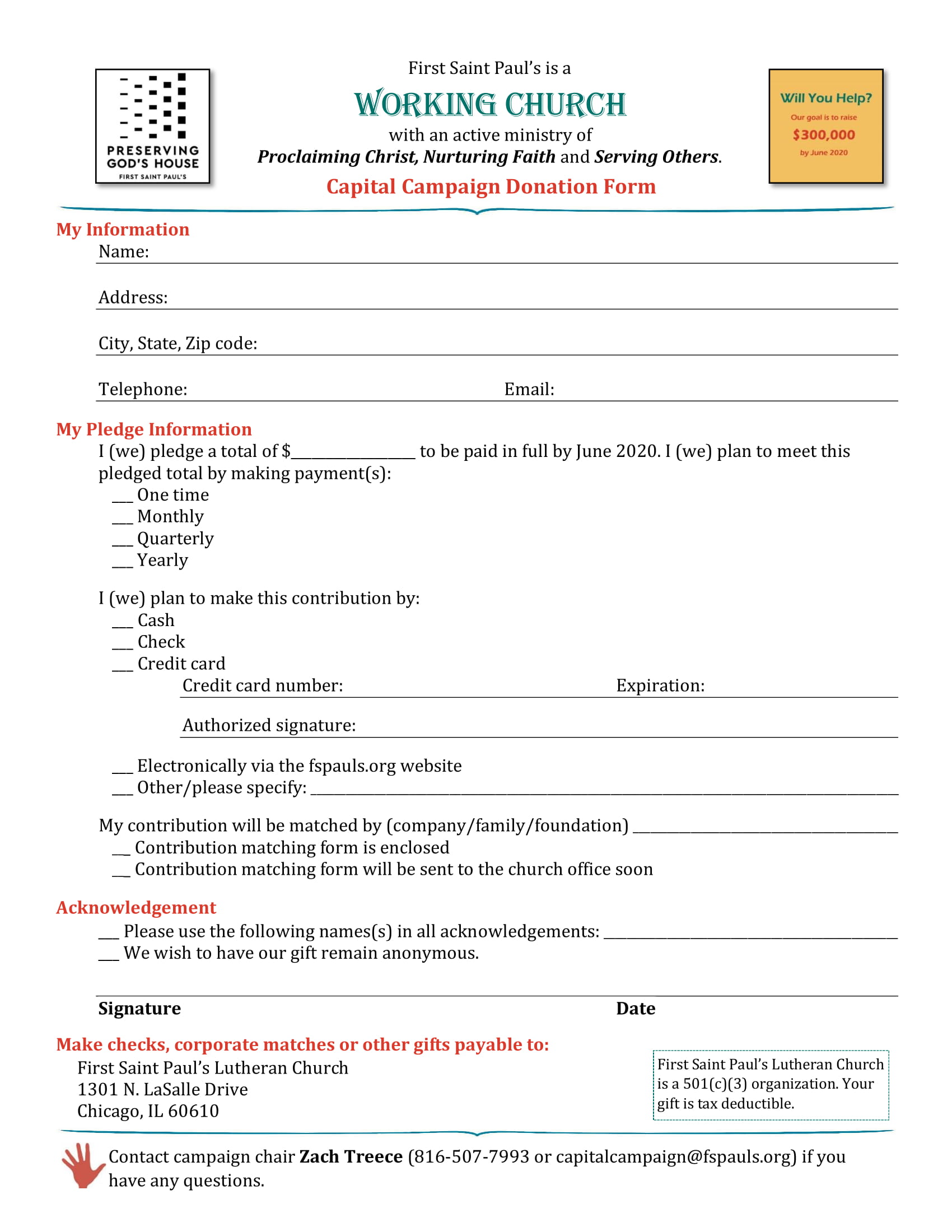

Church Capital Campaign Donation Form

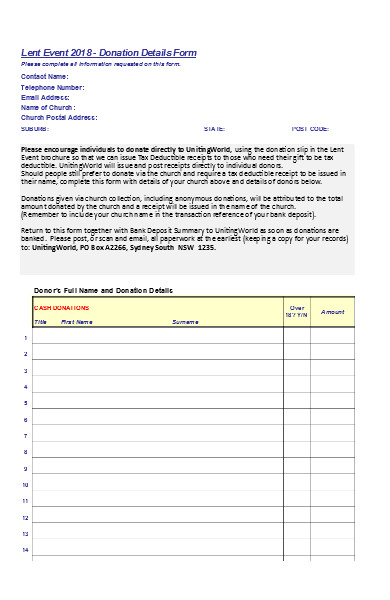

Church Donation Details Form

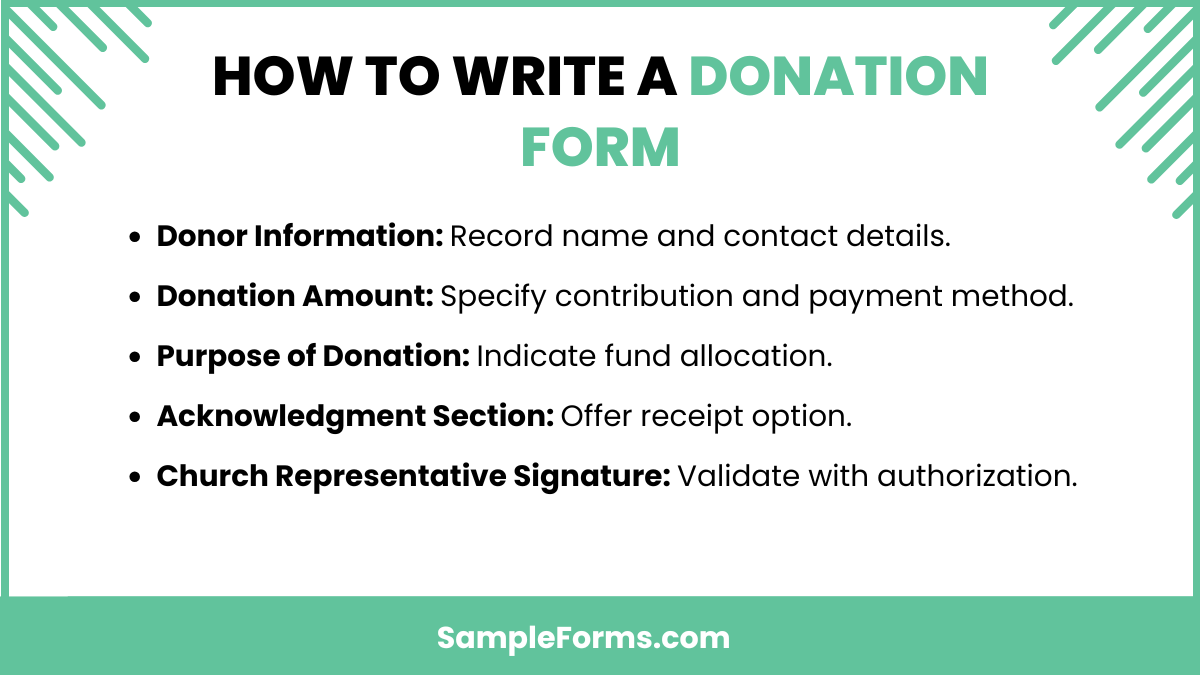

How to write a donation form?

A donation form ensures proper documentation of contributions. Similar to a Refuse Organ Donation Form, it must include essential donor details and transaction information for transparency.

- Donor Information: Collect the donor’s name, address, and contact details.

- Donation Amount: Clearly state the contribution amount and payment method.

- Purpose of Donation: Specify whether the donation is for general church funds, a specific project, or mission work.

- Acknowledgment Section: Provide an option for donors to request a receipt.

- Church Representative Signature: Ensure an authorized person signs to validate the donation.

What are the IRS rules for church donations?

The IRS requires proper documentation for tax-deductible donations. Like a Car Donation Form, church contributions must meet specific criteria to qualify for deductions.

- Qualified Organization: Donations must be given to a tax-exempt church.

- Record Keeping: Donors should keep receipts or bank records for donations.

- Written Acknowledgment: Churches must provide a formal receipt for contributions over $250.

- Fair Market Value: Non-cash donations must be assessed for their fair market value.

- IRS Reporting: Churches must comply with IRS filing requirements if donation records exceed a threshold.

How to claim church donation contributions?

To claim tax deductions, donors must provide valid proof of contributions. Similar to a Church Religious Resignation Form, official documentation is necessary to verify the donation.

- Official Receipt: Churches should issue donation receipts detailing the amount and date.

- Bank Statements: Electronic transfers or checks provide strong proof of donations.

- Written Pledge Agreement: Signed agreements between the donor and church confirm commitment.

- Donation Records: Churches should maintain records of all contributions for tax and legal purposes.

- Annual Contribution Statement: Churches should send annual giving statements to donors for tax reporting.

What proof do you need for donations?

Proper documentation is required to validate charitable contributions. Similar to a Church Registration Form, structured records help ensure compliance with tax laws and church policies.

- Receipt from Church: The receipt should state the amount and purpose of the donation.

- Canceled Checks: A bank-issued check or transaction record is acceptable proof.

- Donation Letter: A formal acknowledgment from the church verifies the contribution.

- Itemized Tax Deductions: Donors must include donation details when filing tax returns.

- Online Payment Records: Digital receipts from church websites or fundraising platforms serve as proof.

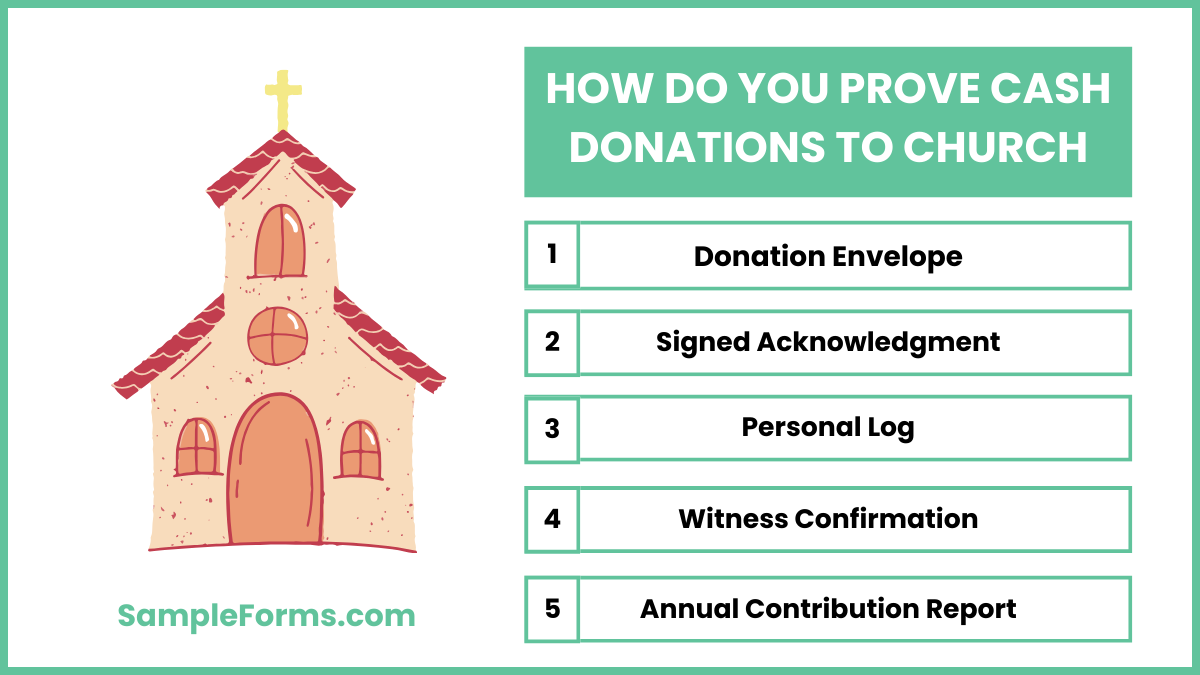

How do you prove cash donations to church?

Cash donations require additional verification for tax deductions. Like an Organ Donation Form, proper documentation ensures transparency and legal compliance.

- Donation Envelope: Churches often issue envelopes for cash donations, helping track contributions.

- Signed Acknowledgment: A written receipt signed by the church verifies the donation.

- Personal Log: Donors should keep a personal record of their cash contributions.

- Witness Confirmation: A church official can confirm large cash donations.

- Annual Contribution Report: Churches should issue yearly statements for donors’ tax filings.

What form do you use for church donations?

A Church Donation Form is used to track contributions. Similar to a Church Budget Form, it records donor details, amounts, and purpose for financial transparency.

Are church donations 100% tax deductible?

Yes, donations to tax-exempt churches are deductible. Like a Subscription Contract Form, they must follow IRS guidelines, including proper documentation and donation receipts, to qualify for tax benefits.

What is church donation called?

A church donation is often called tithes or offerings. Similar to a Subscription Form, it is a recurring or one-time contribution made by church members to support ministry and community services.

Can a church give money to an individual tax free?

Yes, but under IRS rules, it must qualify as charity. Like a Gift Affidavit Form, funds must be distributed for humanitarian aid, not personal gain, to remain tax-exempt.

What is an acceptable church donation?

Any voluntary monetary or non-monetary contribution is acceptable. Like a Charity Form, it must be given willingly, recorded properly, and used for church-related purposes, including mission work and outreach programs.

How do I donate money to church?

Donations can be made online, in person, or by mail. Similar to a Grant Proposal Form, proper documentation and payment methods should be followed to ensure transparency and tax compliance.

Do churches have to report donations to the IRS?

Churches must keep records but are exempt from filing certain tax forms. Like a Grant Application Form, they must comply with financial regulations if donations exceed reporting thresholds.

Do I need receipts for church donations?

Yes, IRS requires receipts for tax deductions. Similar to a Grant Deed Form, a detailed record, including the donor’s name and contribution amount, is necessary for financial tracking and audits.

Do paying tithes count as charitable donations?

Yes, tithes are considered charitable contributions. Like a Grant Review Form, they must be given to a tax-exempt organization and properly documented to qualify for tax deductions.

What is it called when you donate money to church?

Donating money to a church is called tithing or offering. Similar to a Grant Evaluation Form, it is a structured way to support church ministries, community aid, and spiritual activities.

A Church Donation Form plays a crucial role in maintaining financial transparency and accountability. By using this form, churches can efficiently manage contributions, issue receipts for tax deductions, and foster trust among members. Whether used for general tithing, special fundraising, or mission work, it ensures that every donation is properly recorded.

Related Posts Here

-

Contest Registration Form

-

Waiting List Form

-

Restaurant Schedule Form

-

Mobile Home Bill of Sale

-

Landlord Consent Form

-

60-Day Notice to Vacate Form

-

Financial Statement Form

-

Product Evaluation Form

-

Construction Contract

-

School Receipt Form

-

Restaurant Training Form

-

Daily Cash Log

-

Volleyball Evaluation Form

-

Holding Deposit Agreement Form

-

License Agreement Short Form