A Church Budget Form is an essential tool for managing church finances. It ensures accurate tracking of donations, operational costs, and planned expenditures. By using a Church Form and Budget Form, churches can allocate funds efficiently, supporting their spiritual mission and community outreach programs. A well-prepared form simplifies financial discussions among leadership teams and fosters transparency.

Download Church Budget Form Bundle

What is Church Budget Form?

A Church Budget Form is a document designed to outline a church’s financial plan. It records income sources like donations or grants and expenses such as utilities, salaries, and community initiatives. By organizing this data, churches can maintain a balanced budget, making it easier to plan for events and growth opportunities. This Church Form ensures accountability and helps build trust within the congregation.

Church Budget Format

Budget Overview

Period: [Specify the budget time frame, e.g., fiscal year]

Prepared By: [Insert the name of the preparer]

Approved By: [Insert the name of the approver]

Income Sources

Tithes and Offerings: [Enter estimated or actual income]

Donations: [Provide pledged or received amounts]

Fundraising Events: [List expected revenue from events]

Other Income: [Specify any additional sources]

Expenses

Operational Costs: [Detail utility, maintenance, and office supply costs]

Staff Salaries: [Include clergy and support staff payments]

Ministries and Outreach: [Provide budgets for worship, education, and community programs]

Special Projects: [List amounts allocated for renovations or new initiatives]

Signatures

Preparer Signature: [Sign Here]

Date: [Insert Date]

Approver Signature: [Sign Here]

Date: [Insert Date]

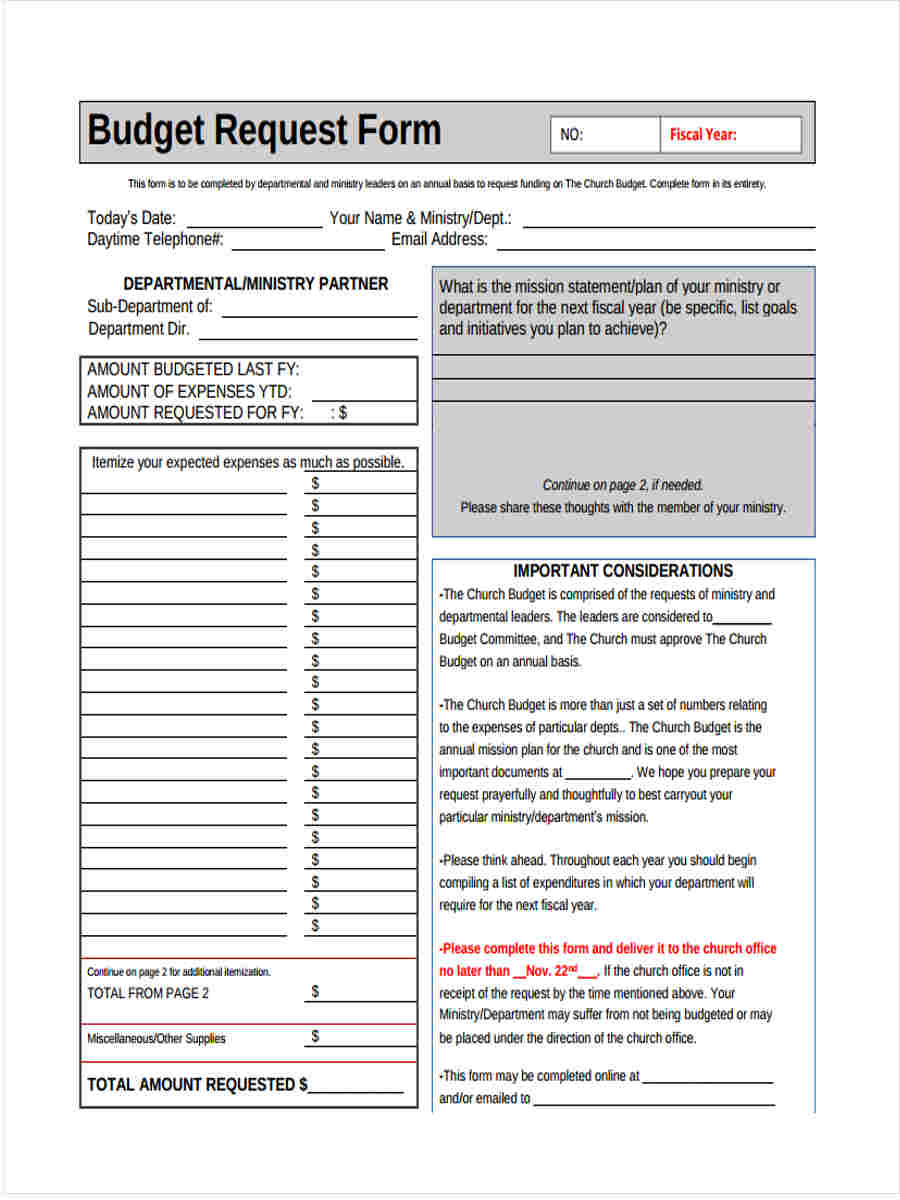

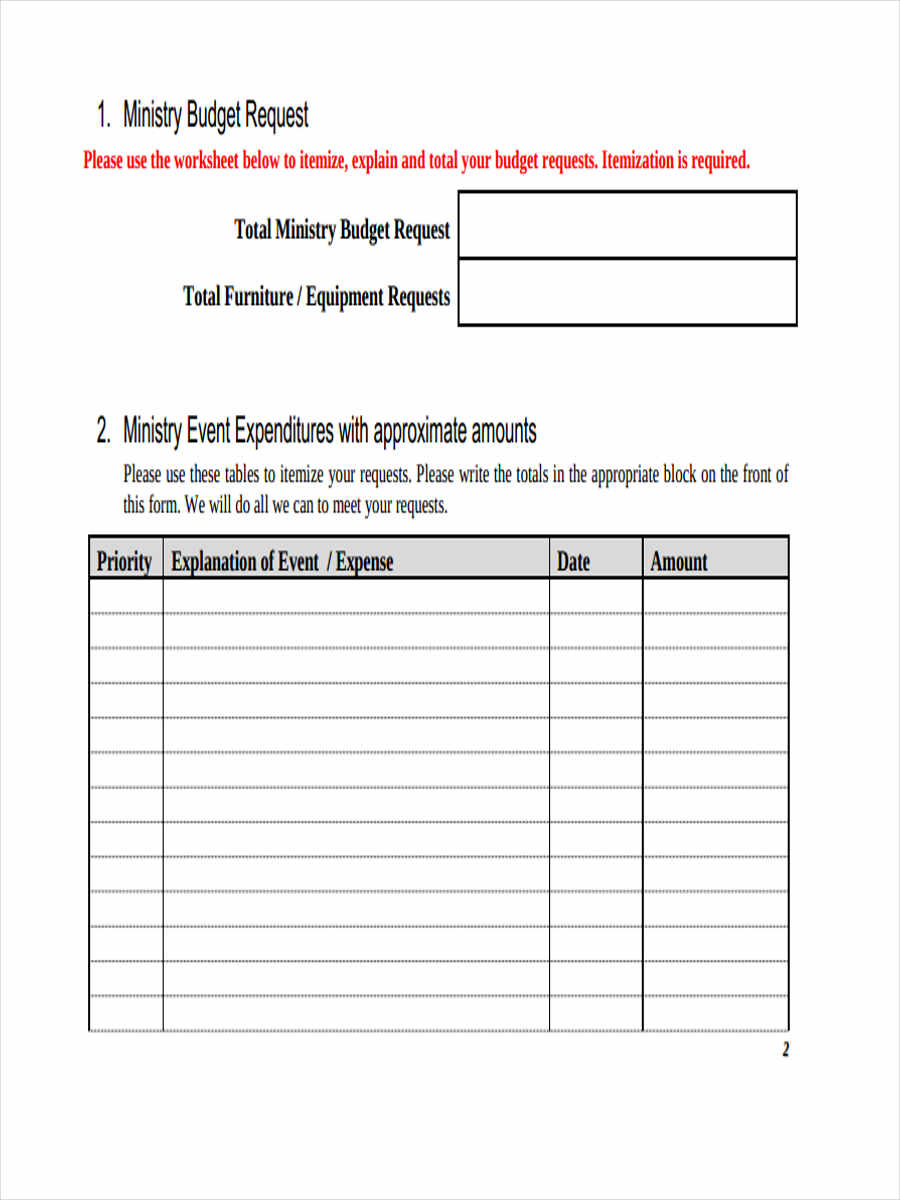

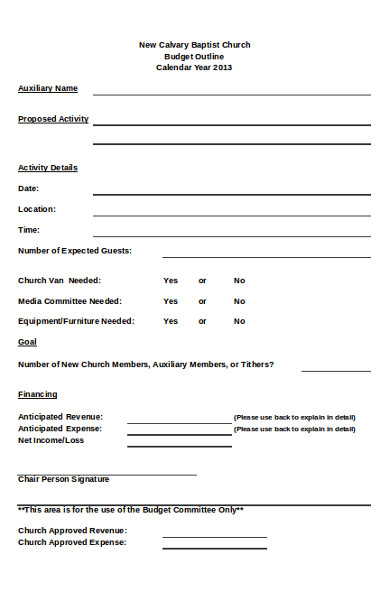

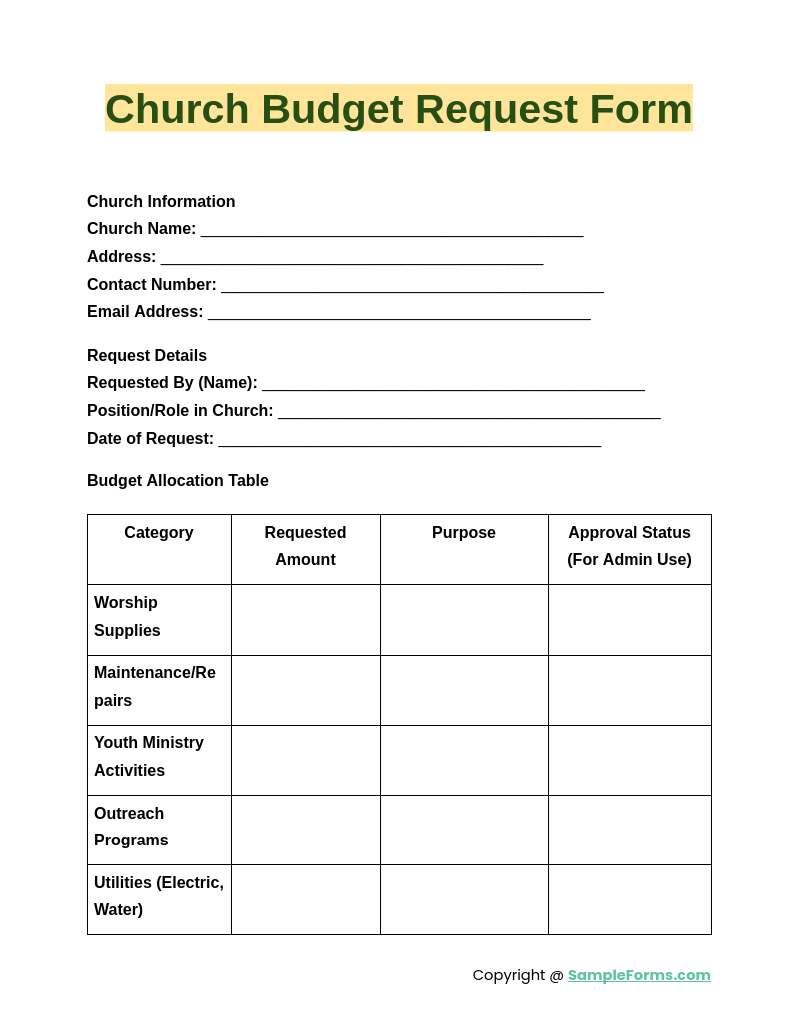

Church Budget Request Form

A Church Budget Request Form is essential for submitting financial requests for various church activities. Similar to a Church Donation Form, it specifies the amount, purpose, and timeframe of the required funds. It ensures proper allocation and accountability.

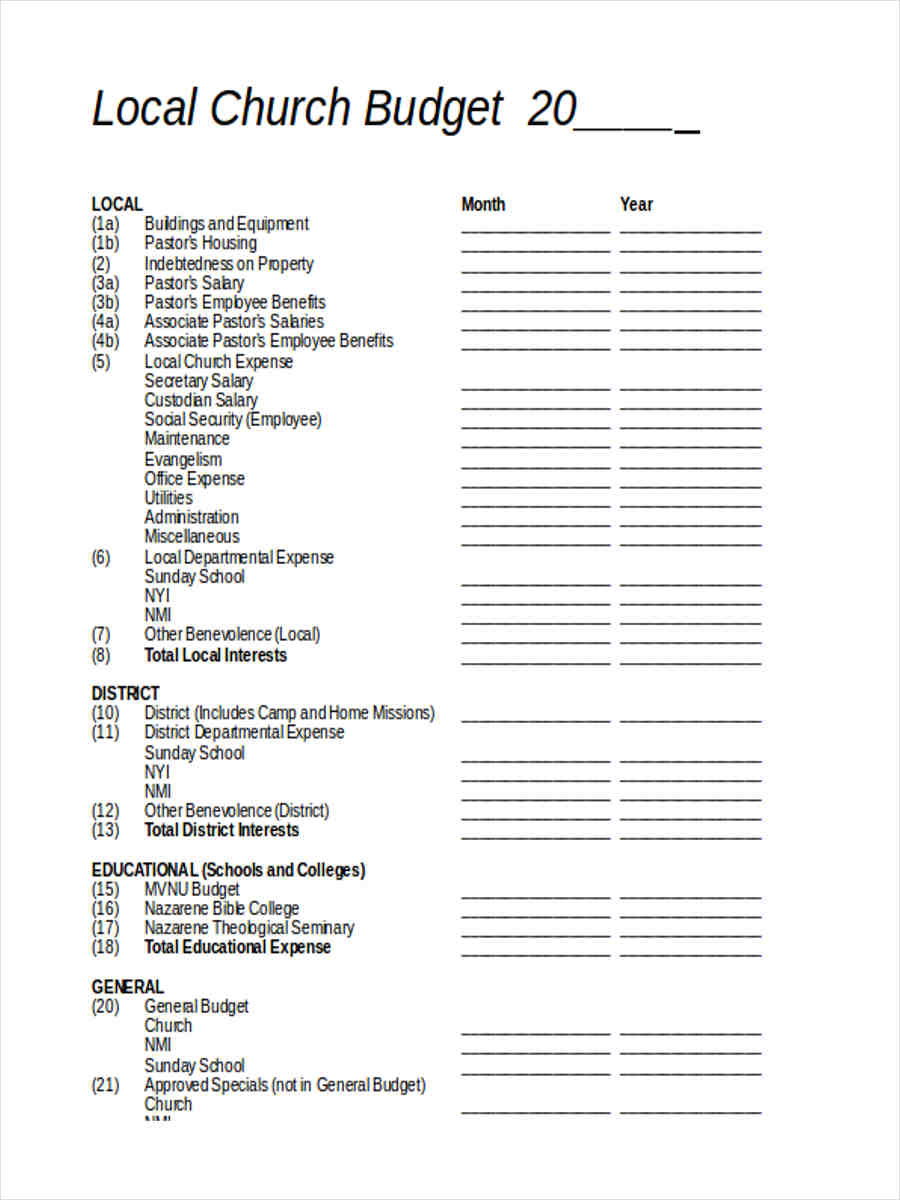

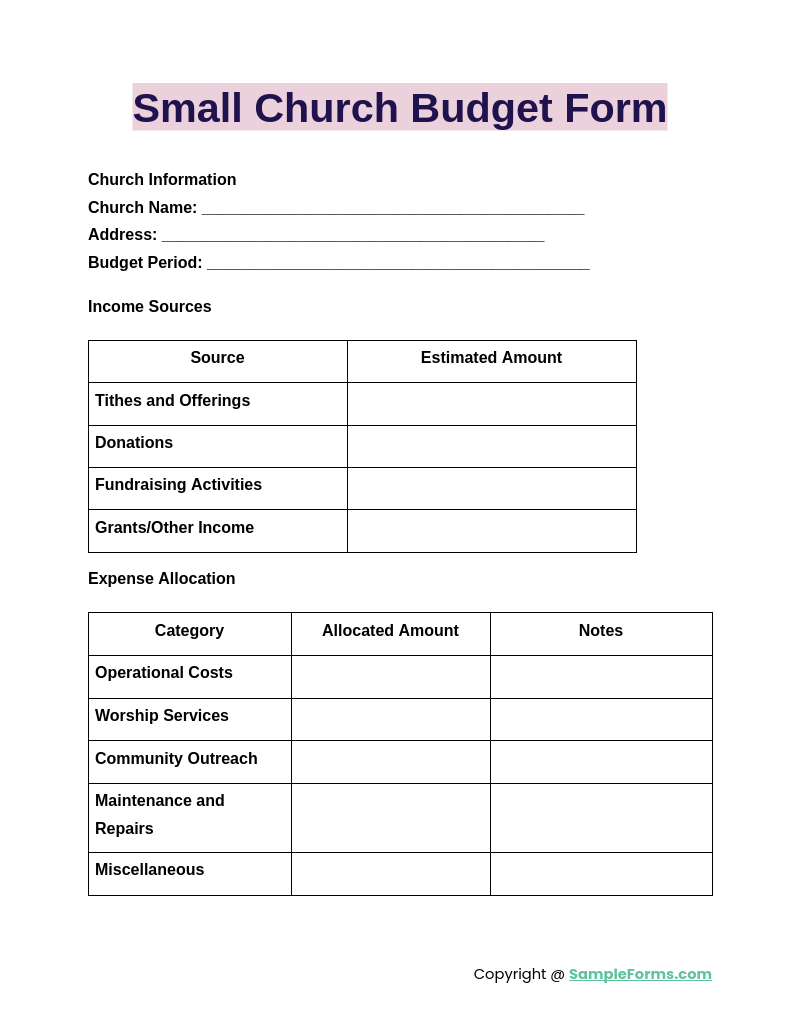

Small Church Budget Form

A Small Church Budget Form simplifies financial planning for small congregations. Like a Church Religious Resignation Form, it addresses specific needs and ensures transparent handling of limited resources, covering expenses like utilities, salaries, and community outreach.

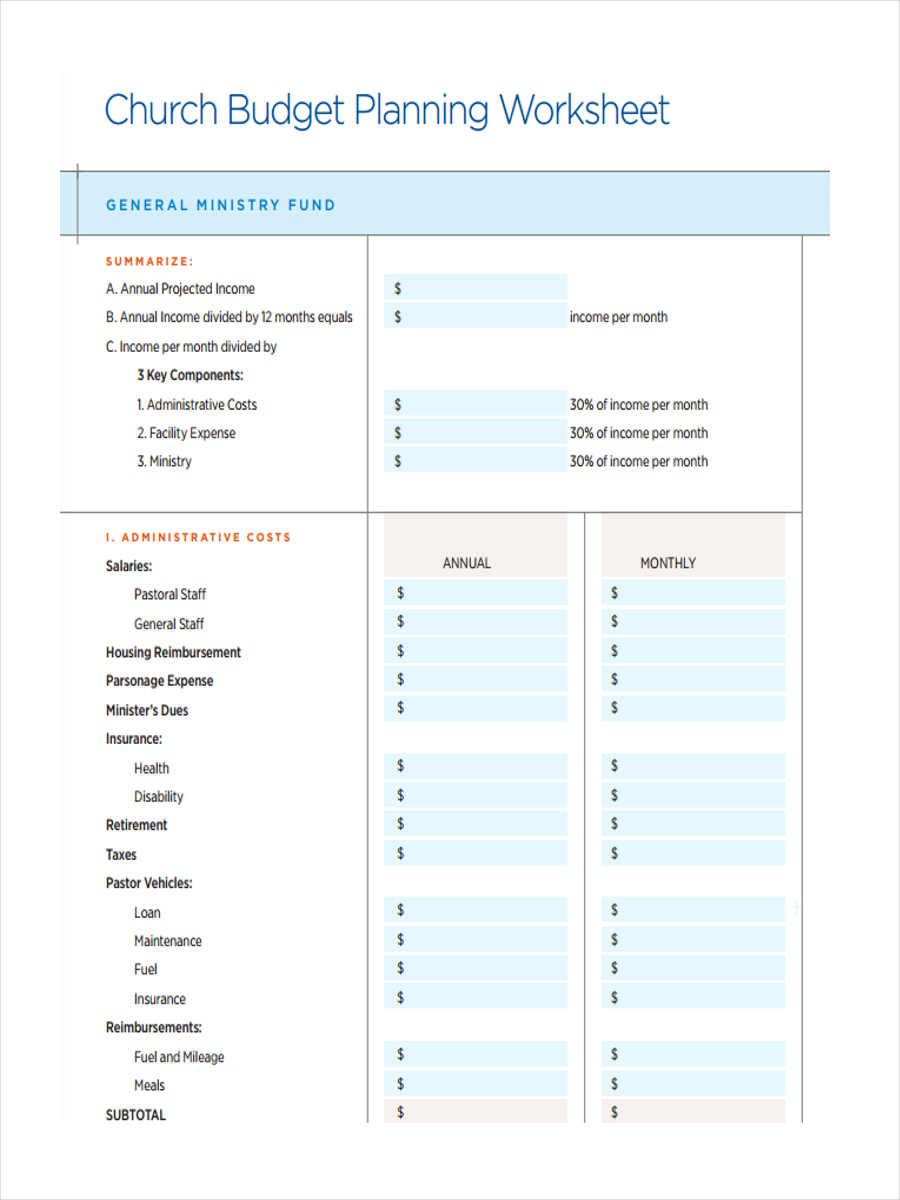

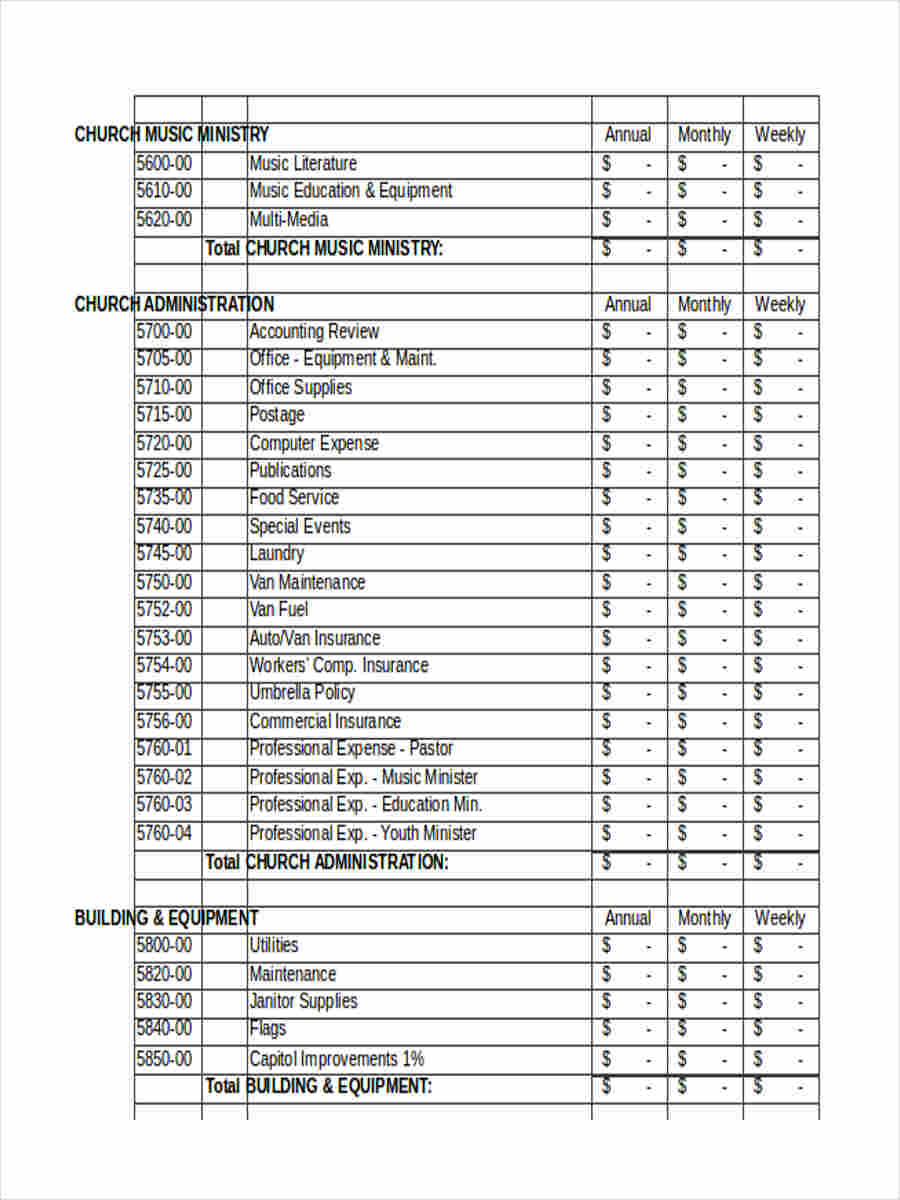

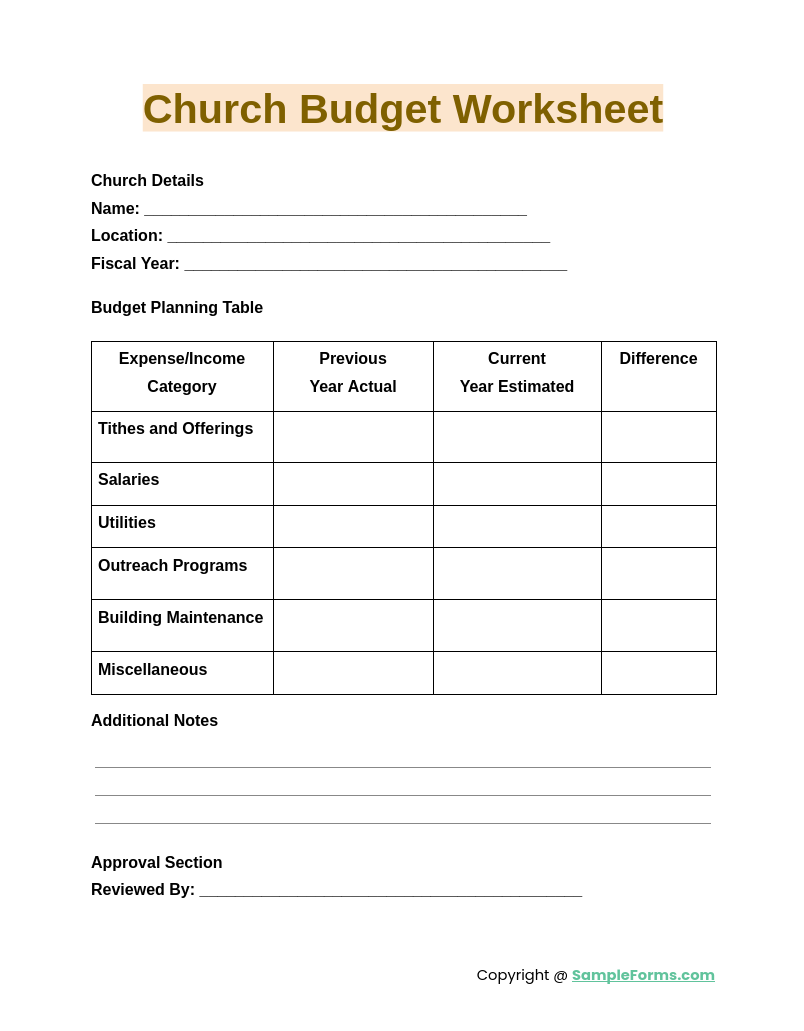

Church Budget Worksheet

A Church Budget Worksheet serves as a detailed tool for tracking income and expenses. Similar to a Church Registration Form, it organizes data systematically, helping church leaders visualize financial health and plan future initiatives effectively.

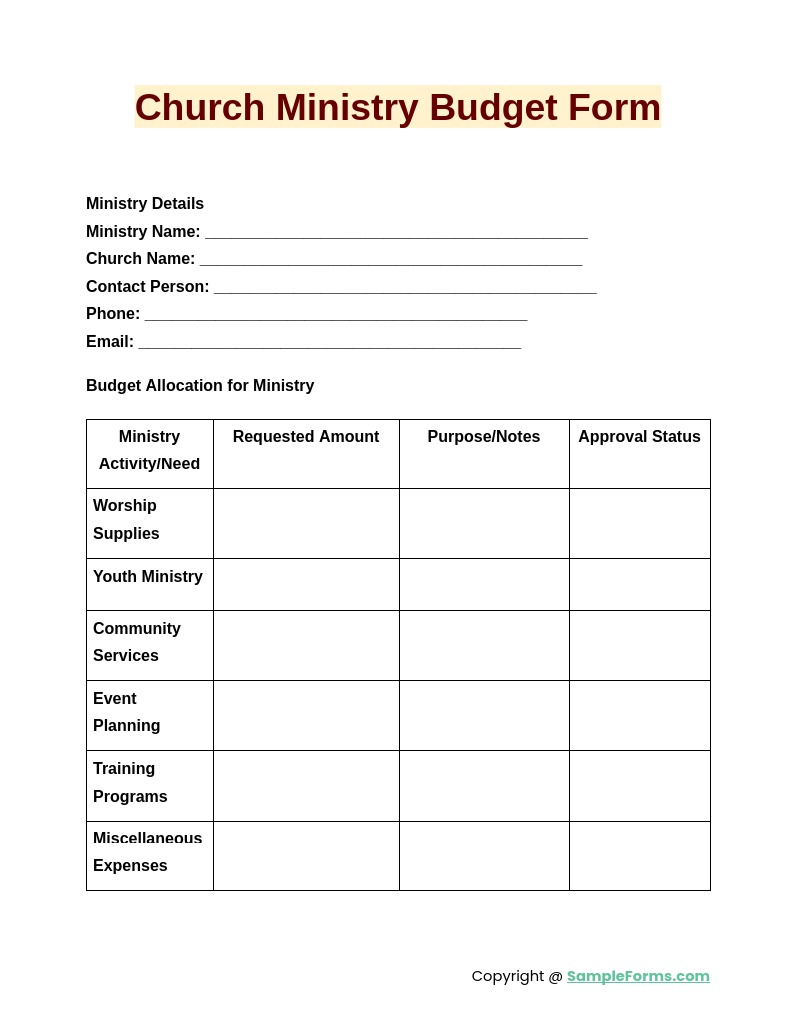

Church Ministry Budget Form

A Church Ministry Budget Form outlines financial needs for ministry programs. Like a Restaurant Budget Form, it breaks down costs into categories such as materials, salaries, and events, ensuring effective fund utilization for ministry goals.

Browse More Church Budget Forms

Church Budget Request

Church Budget Planning

Small Church Budget

Church Ministry Budget

Local Church Budget

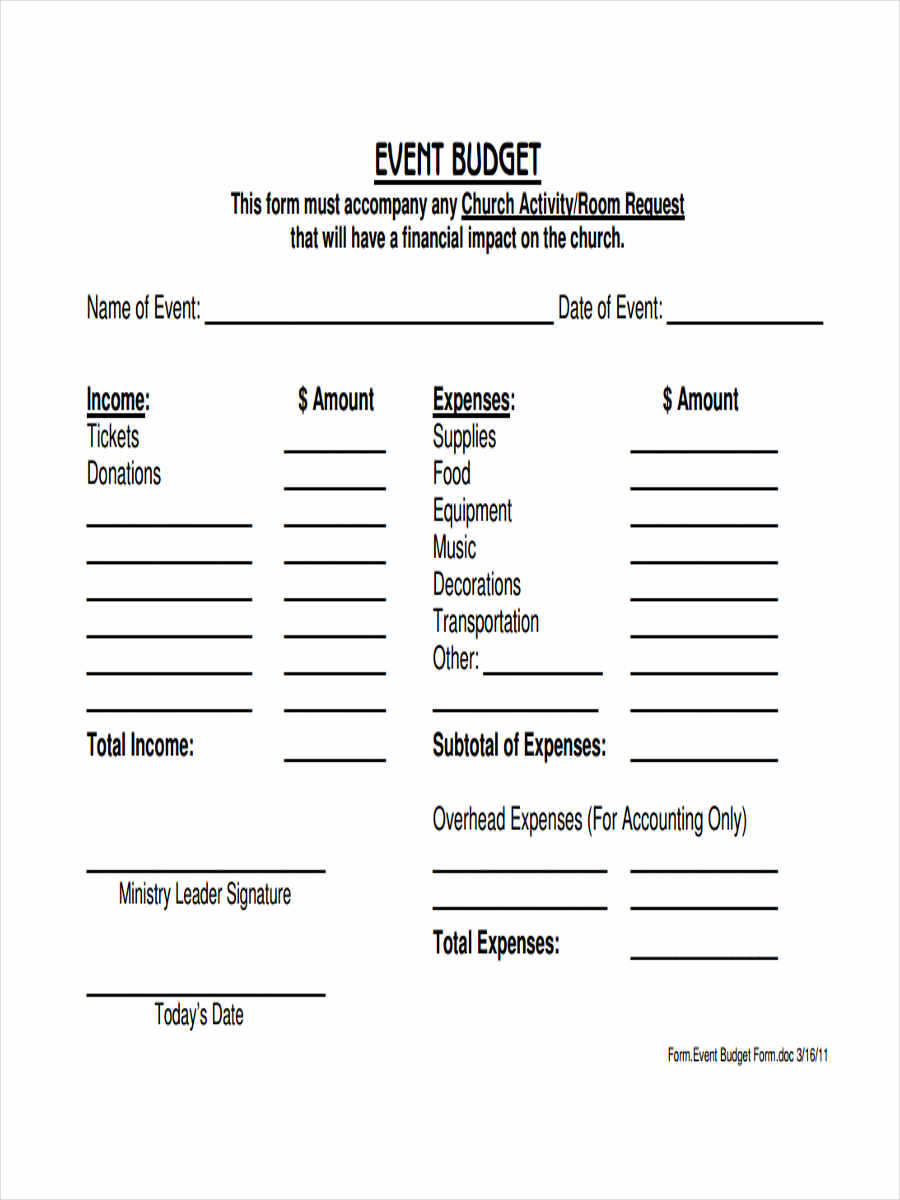

Event Church Budget

Sample Church Budget Form

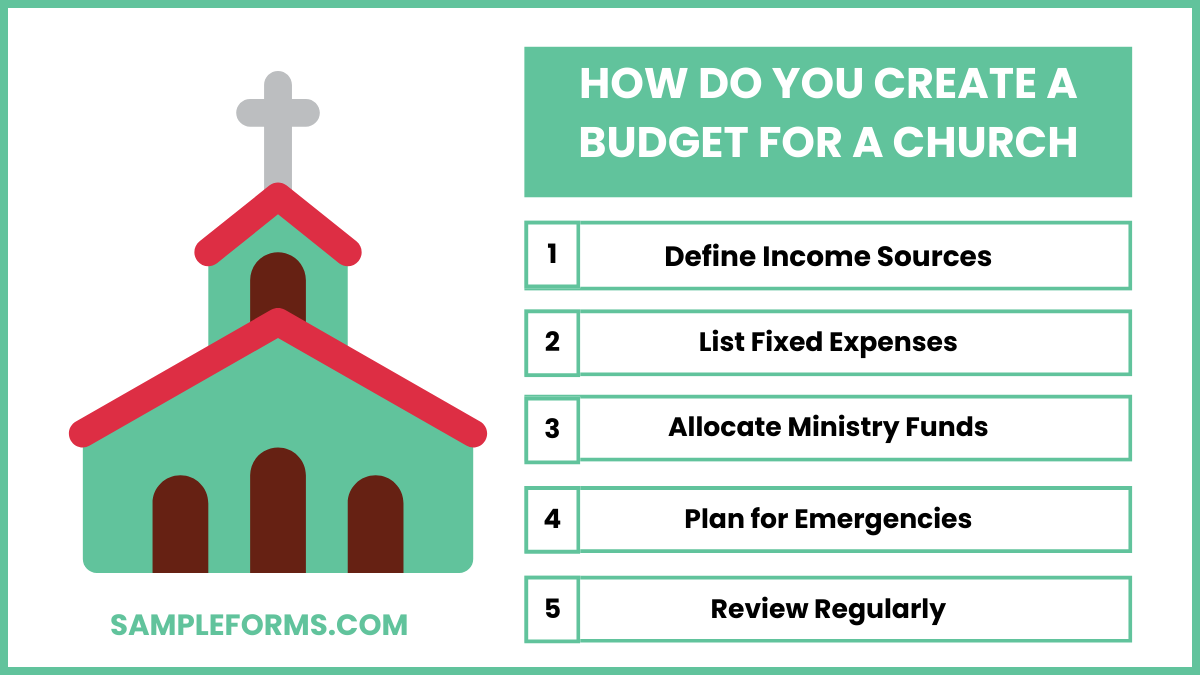

How Do You Create a Budget for a Church?

Creating a church budget involves tracking income and expenses while setting financial goals for ministries and operational costs. Use an Event Budget Form to simplify tracking.

- Define Income Sources: Identify revenue streams like tithes, donations, and event proceeds using tools like an Event Budget Form for clarity.

- List Fixed Expenses: Document consistent costs such as salaries, utilities, and maintenance in a Line Item Budget Form.

- Allocate Ministry Funds: Assign funds to specific ministries and outreach programs based on church goals.

- Plan for Emergencies: Reserve a portion of the budget for unexpected expenses, ensuring sustainability.

- Review Regularly: Evaluate budget performance quarterly and make adjustments as needed.

How Do You Categorize Church Expenses?

Categorizing church expenses ensures efficient resource allocation and transparency. Use a Family Budget Form for detailed categorization.

- Operational Costs: Include utilities, rent, and administrative expenses to track basic operational needs.

- Staff Salaries: Separate payroll and benefits for transparency in employee compensation.

- Ministry Programs: Allocate funds for education, worship, and outreach initiatives in the church community.

- Facility Maintenance: Account for building repairs, landscaping, and janitorial services.

- Miscellaneous Costs: Create a category for occasional expenses like retreats, conferences, and events.

How Much of a Church Budget Should Be Facilities?

Facilities typically account for 20-30% of a church’s budget, covering maintenance, utilities, and renovations. A Child Care Budget Form can aid in estimating facility-related costs.

- Assess Current Costs: Evaluate utility bills, repairs, and upkeep to establish a baseline.

- Include Long-Term Projects: Budget for renovations or expansions to ensure the church remains functional and welcoming.

- Prioritize Energy Efficiency: Invest in energy-saving measures to reduce long-term costs.

- Allocate Regular Maintenance Funds: Schedule periodic upkeep to avoid costly repairs later.

- Review Annually: Adjust facility budgets based on usage changes or congregation growth.

What Financial Records Should a Church Keep?

Maintaining accurate records ensures accountability and compliance with financial regulations. Use a Annual Budget Form to track all transactions.

- Income Records: Document all donations, tithes, and revenue from church activities.

- Expense Reports: Record all operational and ministry-related expenses for transparency.

- Bank Statements: Keep monthly bank reconciliations to match deposits and withdrawals.

- Payroll Records: Maintain employee payment details, including taxes and benefits.

- Audit Reports: Store past audit findings to improve financial practices.

How Much of a Church Budget Should Be Salaries?

Staff salaries often consume 40-60% of a church’s budget, depending on the size and priorities. Utilize a School Budget Form for detailed planning.

- Calculate Total Revenue: Determine annual income to set salary limits.

- Compare Industry Standards: Ensure compensation aligns with similar-sized organizations.

- Include Benefits: Account for health insurance, retirement plans, and paid leave.

- Allocate for Growth: Budget for future hires based on church expansion plans.

- Review Annually: Adjust salaries to reflect inflation and performance evaluations.

How Much of a Church Budget Should Be Salaries?

Salaries usually account for 40-60% of a church’s budget, depending on the size and operational priorities. Utilize a Monthly Budget Form for accurate planning.

What Is a Zero-Based Budget for a Church?

A zero-based budget allocates every dollar, ensuring no surplus. Each expense is justified from scratch, similar to a Project Budget Form for efficient resource distribution.

How Much Does the Average Church Make a Year?

The average church earns $100,000–$300,000 annually, depending on size and congregation contributions. Planning with a Household Budget Form can simplify financial management.

How Do You Make a Balance Sheet for a Church?

Track assets, liabilities, and equity. Include donations, expenses, and savings. A Capital Budget Form ensures detailed representation for clear financial health.

How Should a Beginner Start a Budget?

Define Income Sources: Identify revenue streams, such as donations and grants, to form the base of the budget using a Weekly Budget Form.

List Expenses: Categorize essential expenses, including salaries and utilities.

Set Goals: Allocate funds for upcoming projects and savings.

Track Spending: Monitor and review expenses regularly.

Adjust Regularly: Update the budget based on changes in income or expenses.

Should Pastors Be Involved in Church Finances?

Pastors can provide guidance but should delegate daily financial management to committees. Using tools like a Film Budget Form promotes accountability.

What Percentage of a Church Budget Should Go to Missions?

Allocate 10-15% of the budget to missions for effective outreach. A Travel Budget Form can streamline expense planning for missionary trips.

How Much Should a Pastor Be Paid in a Small Church?

Pastors in small churches typically earn $35,000–$50,000 annually. Planning with a Student Budget Form ensures balanced allocation for salaries and other expenses.

What Is an Average Church Budget?

The average church budget ranges from $100,000 to $500,000 annually. A Marketing Budget Form can aid in allocating resources for growth.

Who Pays for Church Missions?

Church missions are funded by donations, special offerings, and allocated budgets. A Construction Budget Form can help organize funds for mission-related projects.

A well-structured Church Budget Form is essential for effective financial management in churches. It provides clarity on income, expenditures, and future planning. Whether you’re managing a small or large congregation, the form ensures transparency and financial discipline. Explore how this tool supports spiritual and community goals effectively with the comprehensive Church Budget Form.

Related Posts

-

Check Register Form

-

FREE 5+ Income Statement Spreadsheet Forms in PDF

-

FREE 46+ Budget Forms in PDF | MS Word | Excel

-

FREE 9+ Project Budget Form Samples in PDF | MS Word | Excel

-

FREE 9+ Sample Proposal Budget Forms in PDF | MS Word | Excel

-

FREE 9+ Sample Construction Budget Forms in PDF | MS Word | Excel

-

FREE 7+ Sample Wedding Budget Forms in PDF | MS Word

-

FREE 7+ Sample Child Care Budget Forms in PDF | MS Word

-

FREE 8+ Sample College Budget Forms in PDF | MS Word | Excel

-

FREE 9+ Sample Annual Budget Forms in PDF | MS Word | Excel

-

FREE 6+ Sample Marketing Budget Forms in MS Word | PDF

-

FREE 7+ Sample Travel Budget Forms in PDF | MS Word

-

Daily Cash Log

-

FREE 9+ Sample School Budget Forms in MS Word | PDF | Excel

-

FREE 8+ Sample Personal Budget Forms in MS Word | PDF | MS Excel