A well-structured Catering Invoice Form is essential for catering businesses to manage payments and maintain financial clarity. This document details services provided, pricing, taxes, and payment terms, ensuring seamless transactions between caterers and clients. It simplifies bookkeeping, prevents billing errors, and establishes transparency in financial dealings. Whether you run a small catering business or a large-scale event service, using a standardized Invoice Form can enhance efficiency. This guide provides comprehensive examples, templates, and best practices to help you create a professional invoice that meets industry standards. Learn how to format and customize invoices for different catering needs.

Download Catering Invoice Form Bundle

What is Catering Invoice Form?

A Catering Invoice Form is a document used by caterers to bill clients for food services provided. It includes details such as menu items, quantity, pricing, service fees, taxes, and payment terms. This form serves as an official record of transactions between the catering business and the client, ensuring accurate bookkeeping and financial accountability. A well-prepared invoice also helps in resolving disputes, tracking revenue, and streamlining the payment collection process. It is a crucial tool for maintaining organized financial records in the catering industry.

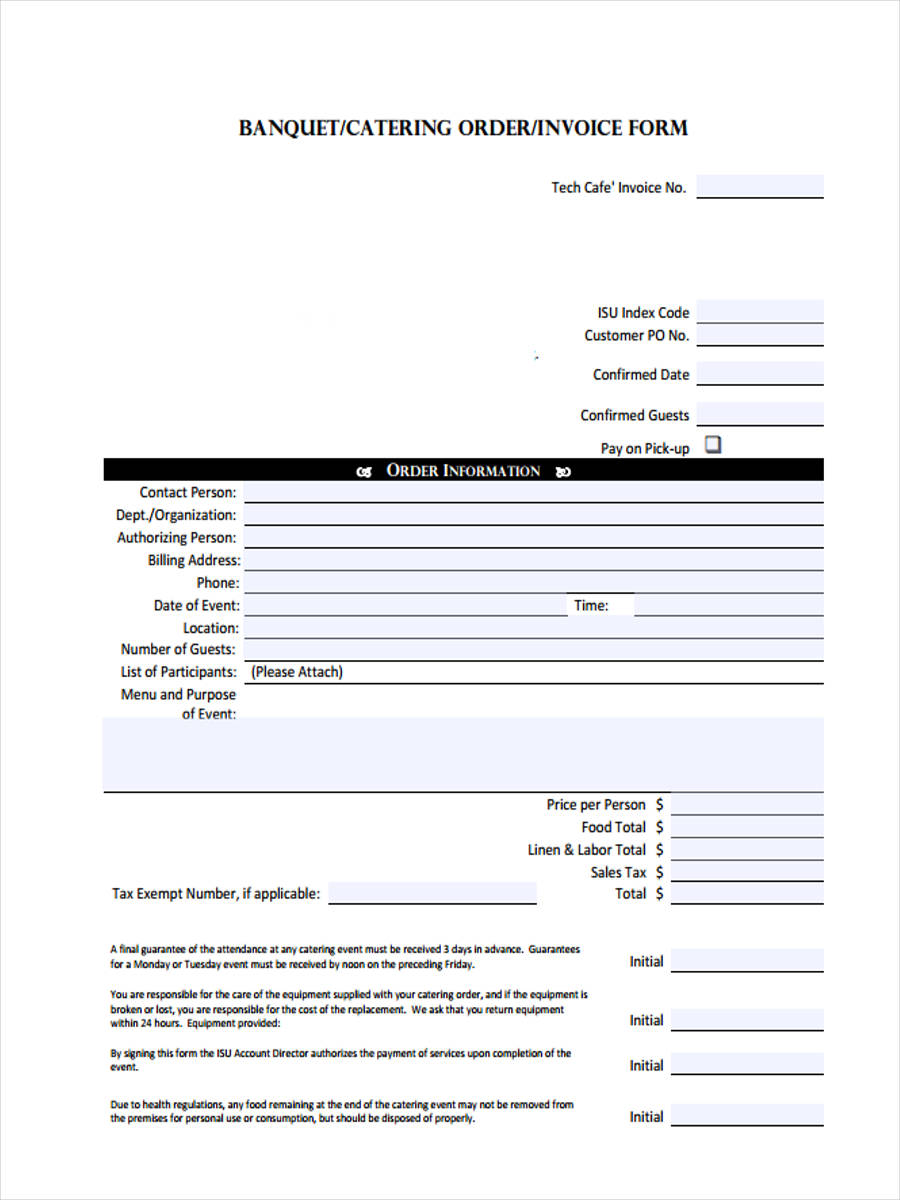

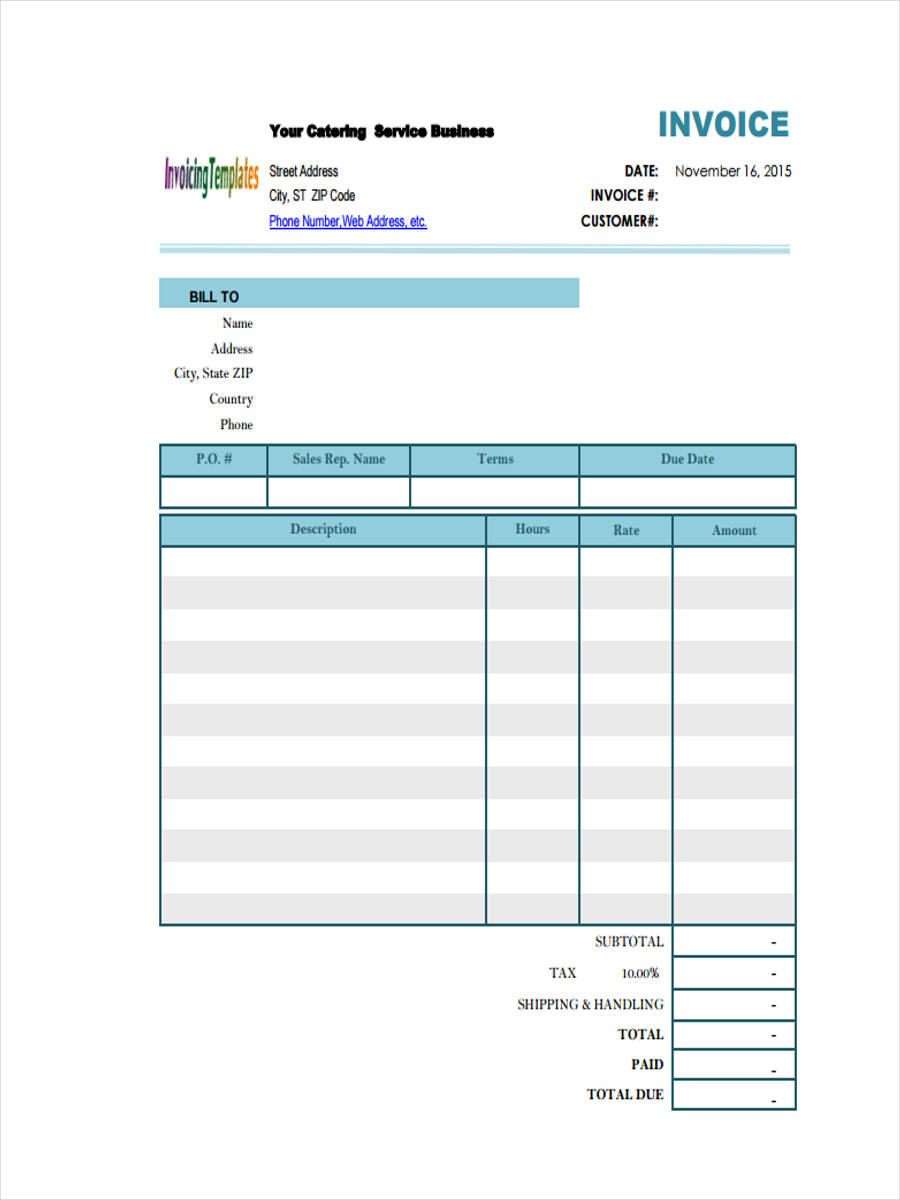

Catering Invoice Format

Business Details

- Catering Company Name – Official business name providing the service.

- Contact Information – Phone number, email, and website.

- Business Address – Physical or registered location.

Client Information

- Client’s Name – Name of the individual or company ordering the service.

- Event Address – Location where the catering service will be provided.

- Date of Event – Scheduled date for service delivery.

Order Details

- Menu Items – List of food and beverages provided.

- Quantity – Number of servings per item.

- Special Requests – Dietary preferences, allergies, or modifications.

Service Charges

- Food Costs – Total price based on selected items and quantity.

- Labor Charges – Fees for staff, chefs, and servers.

- Delivery and Setup – Costs for transport and venue arrangement.

Payment Terms

- Total Amount Due – Sum of all charges including taxes.

- Payment Methods Accepted – Cash, credit card, bank transfer, or check.

- Due Date – Deadline for payment submission.

Signatures and Acknowledgment

- Client’s Signature – Approval of invoice and agreement to terms.

- Catering Manager’s Signature – Confirmation of services and pricing.

- Date of Issue – Official issuance date of the invoice.

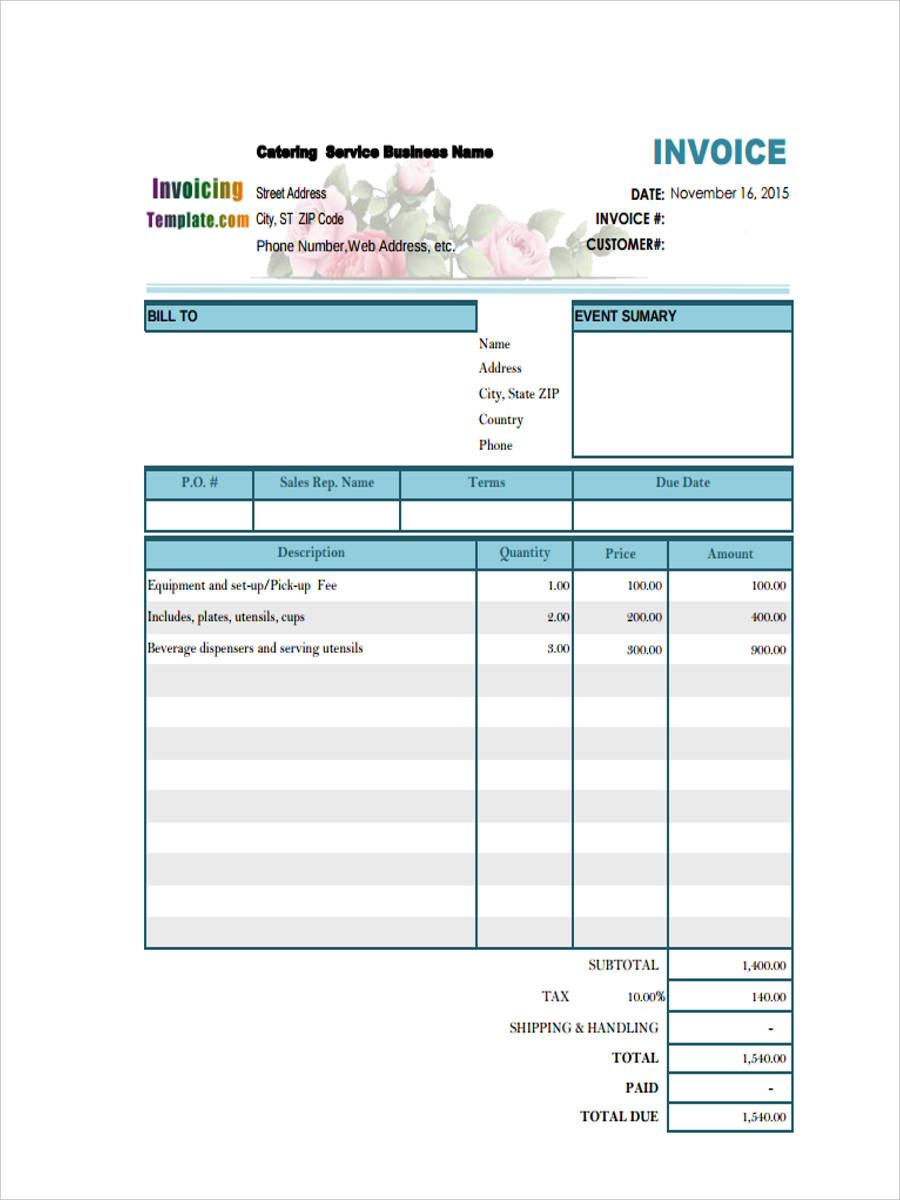

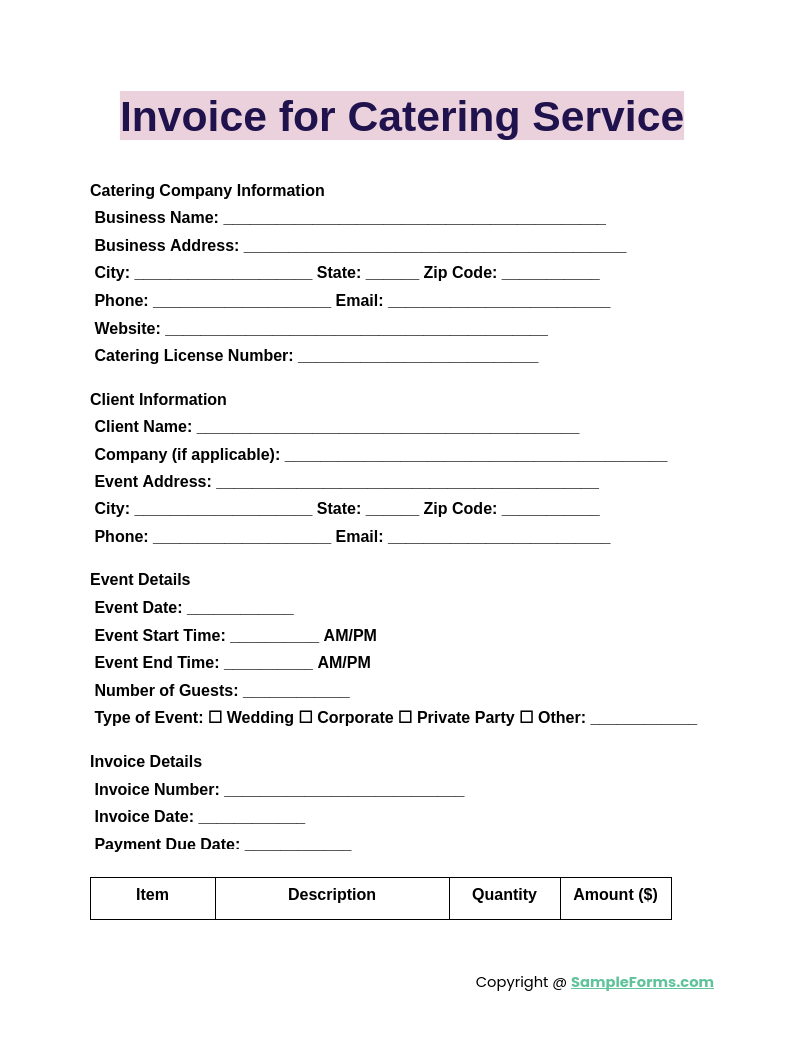

Invoice for Catering Service

An Invoice for Catering Service ensures accurate billing for food and event-related services. Similar to a Commercial Invoice Form, it includes service details, pricing, and payment terms, helping caterers maintain clear financial records while ensuring seamless transactions with clients.

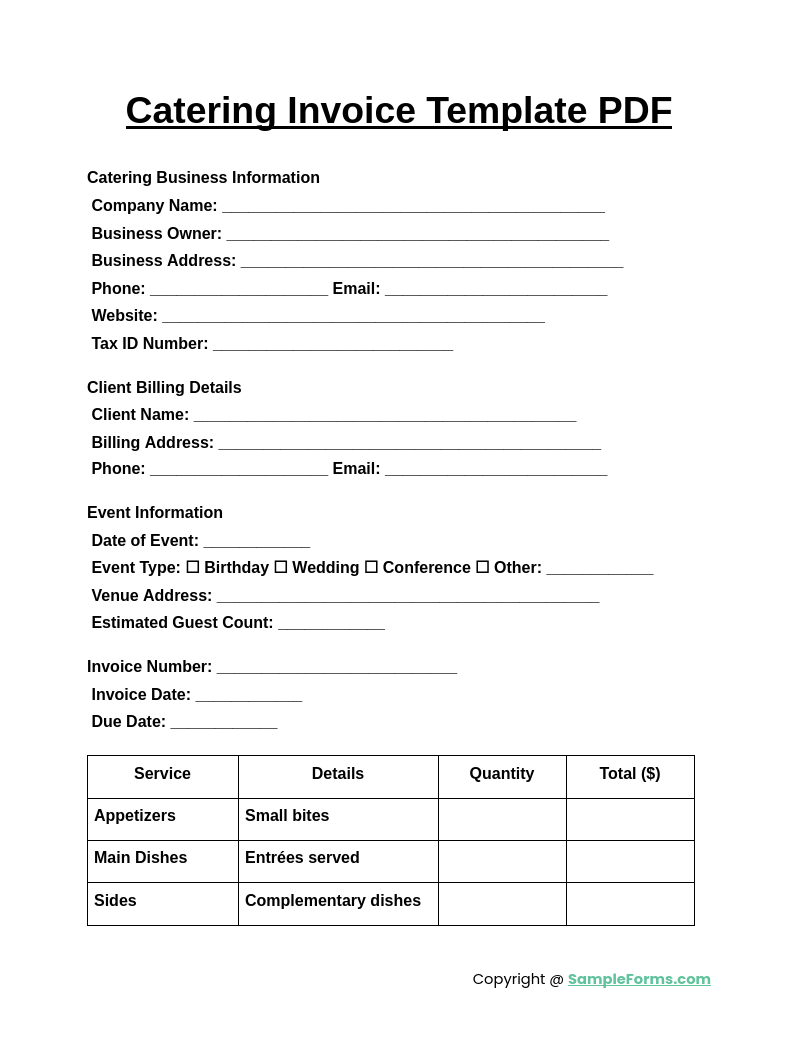

Catering Invoice Template PDF

A Catering Invoice Template PDF provides a structured format for billing catering services. Like a Medical Invoice Form, it includes essential details such as client information, service breakdown, taxes, and due dates, making invoicing more efficient and professional.

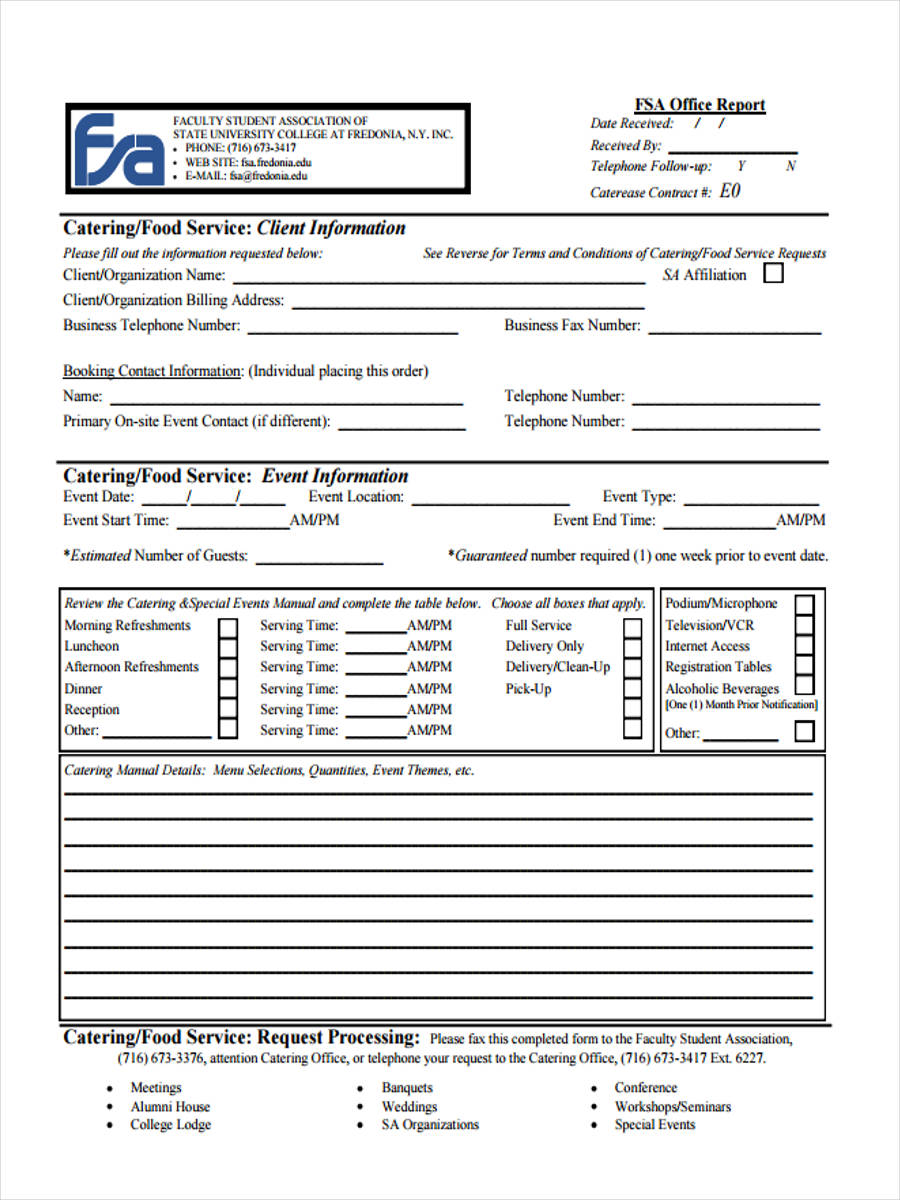

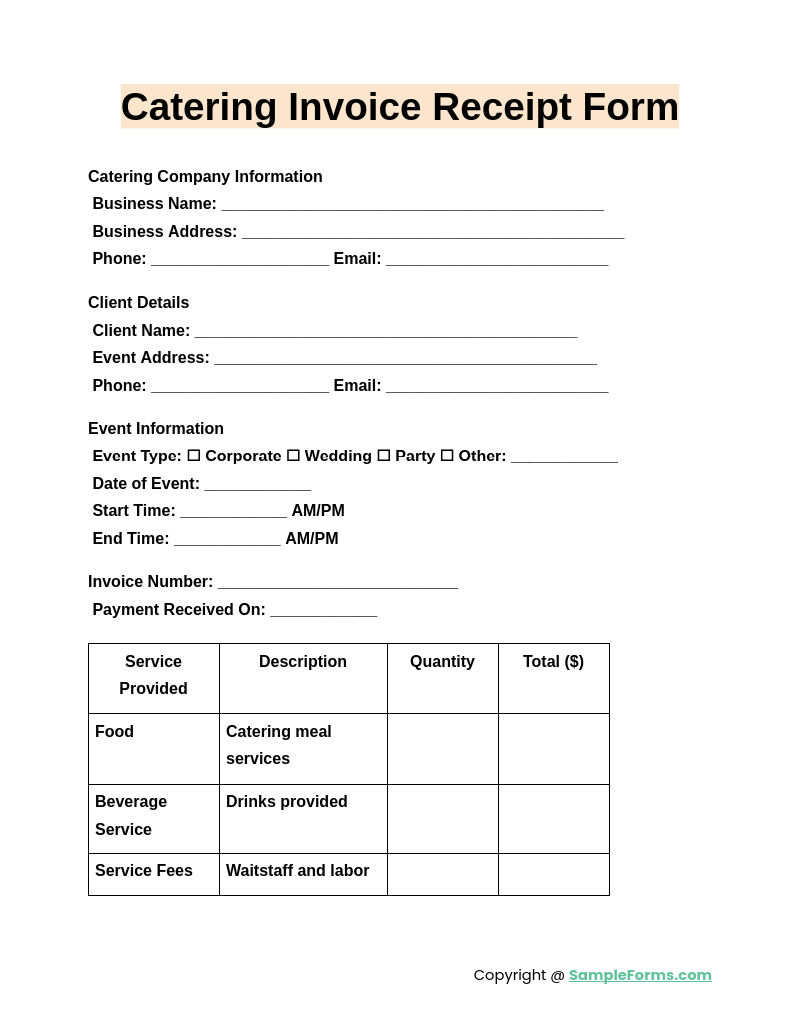

Catering Invoice Receipt Form

A Catering Invoice Receipt Form confirms payment for catering services. Similar to a Financial Audit Form, it documents transaction details, ensuring both parties have a clear record of payments received and services rendered for accountability.

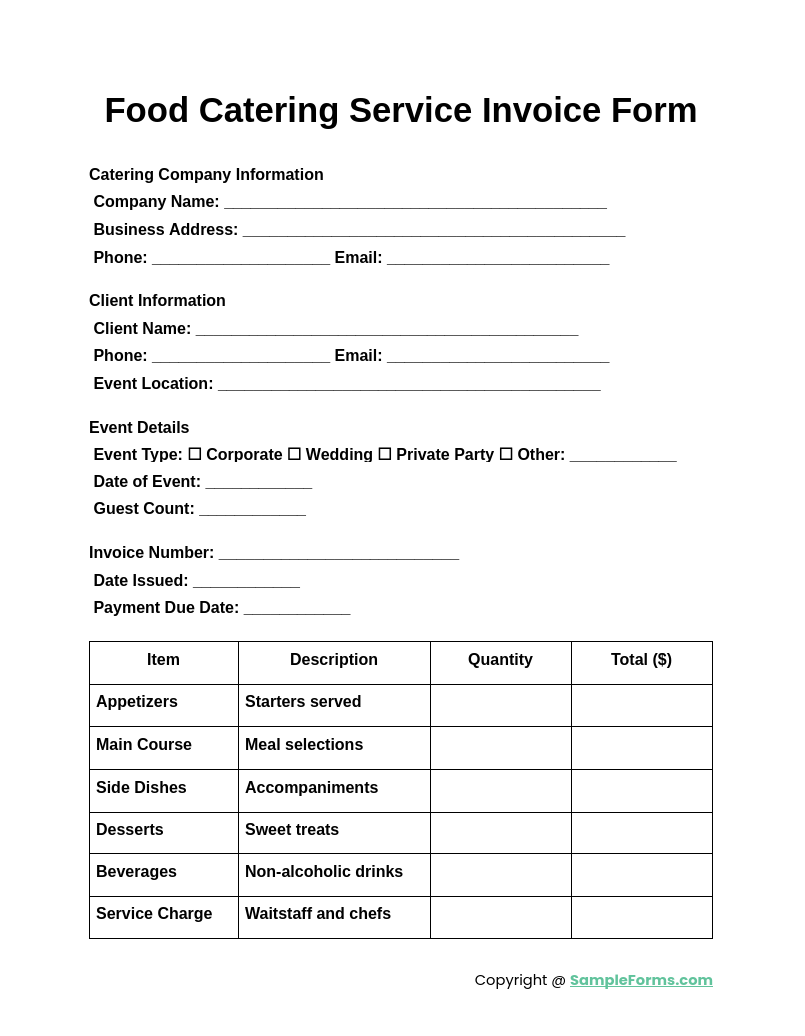

Food Catering Service Invoice Form

A Food Catering Service Invoice Form is essential for billing clients after an event. Like a Rent Invoice Form, it details charges, taxes, and payment deadlines, ensuring accurate financial tracking and preventing disputes in catering transactions.

Browse More Catering Invoice Forms

Catering Bill Invoice

Restaurant Catering Invoice

Catering Business Form

Wedding Catering Invoice

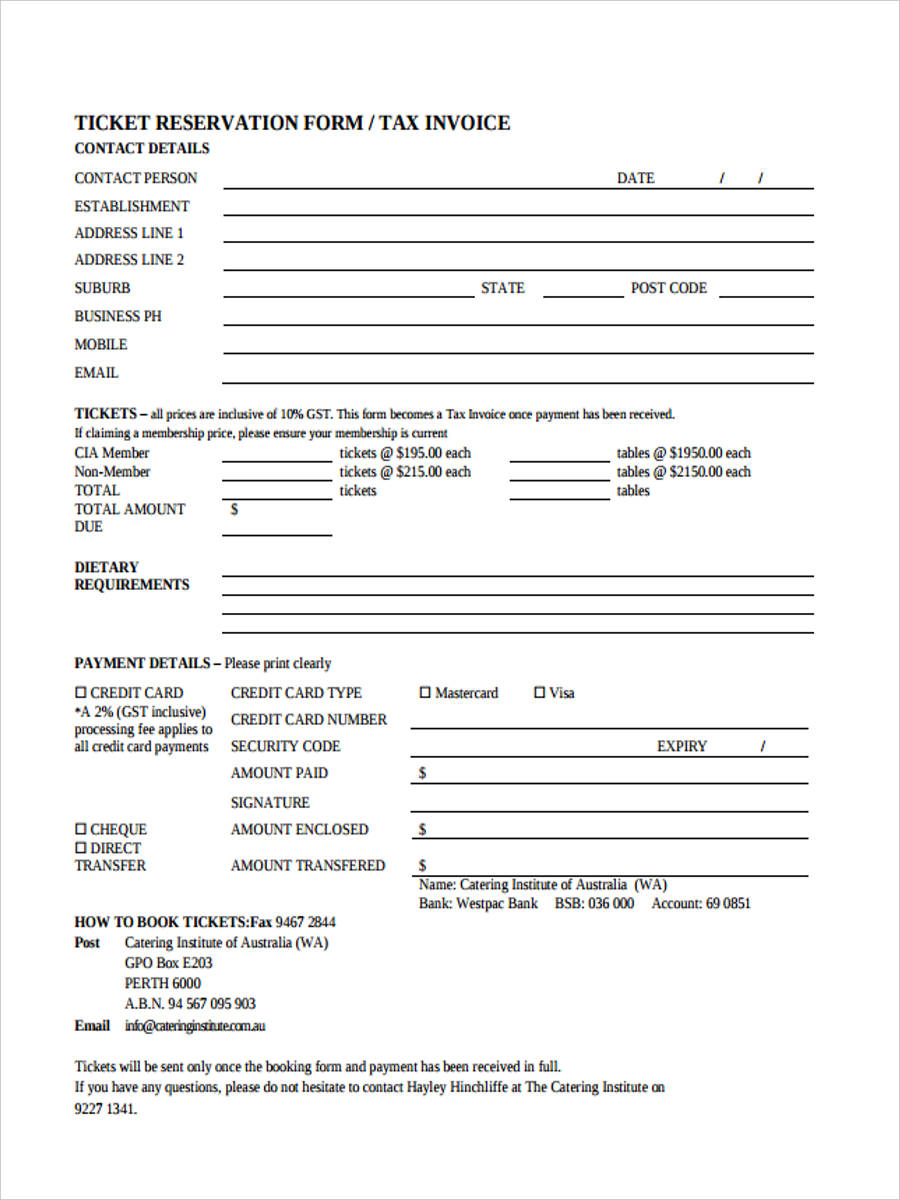

Catering Tax Invoice

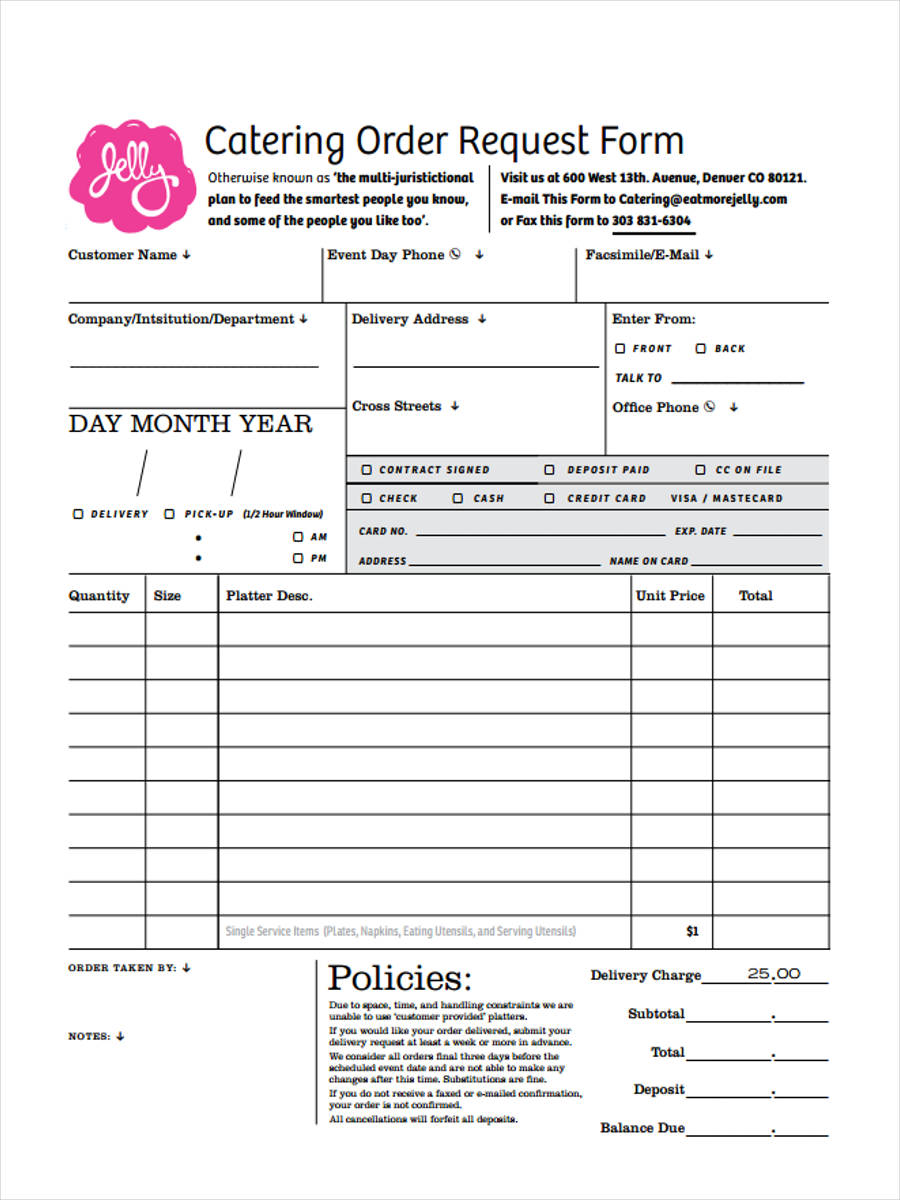

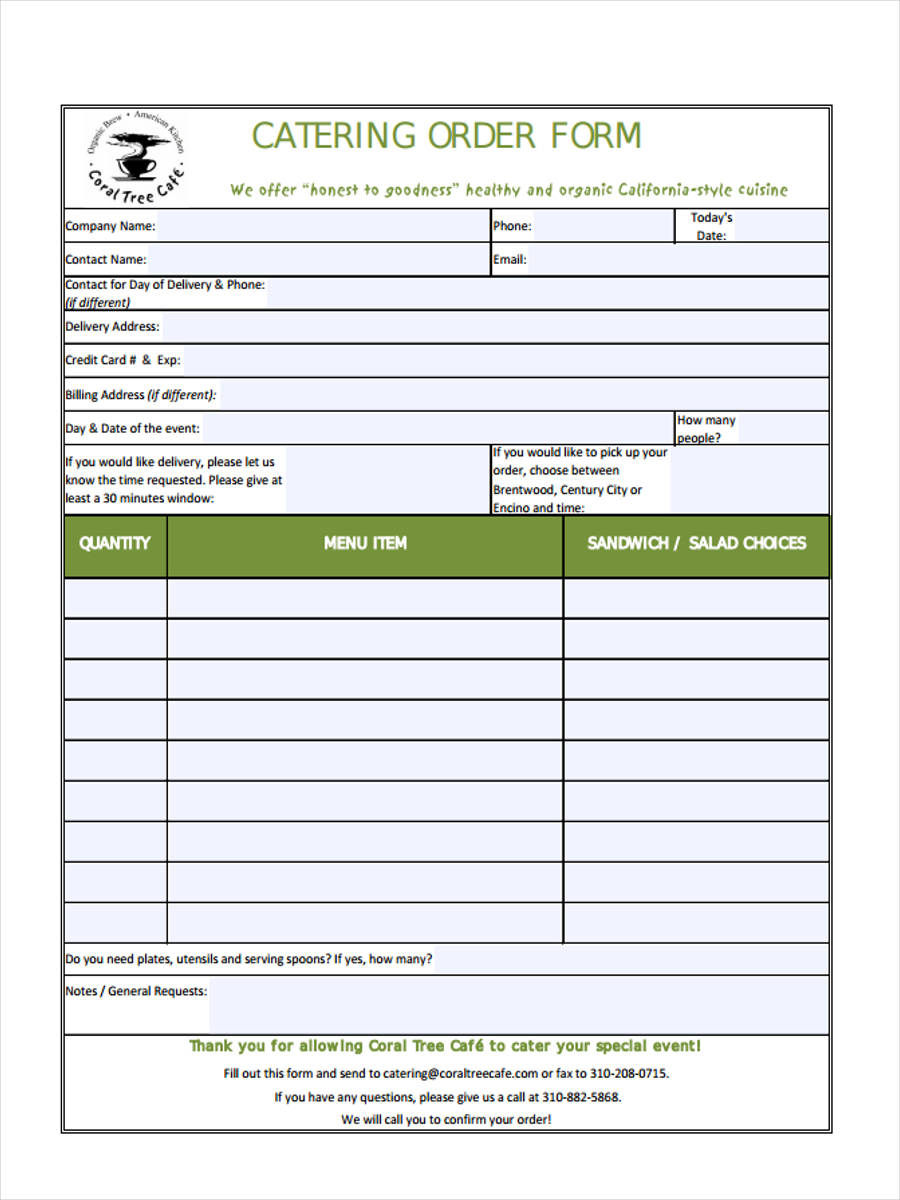

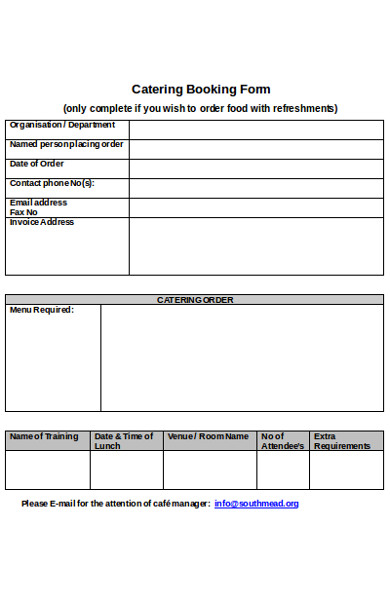

Catering Order Form

Food Catering Invoice

Catering Food Service Invoice

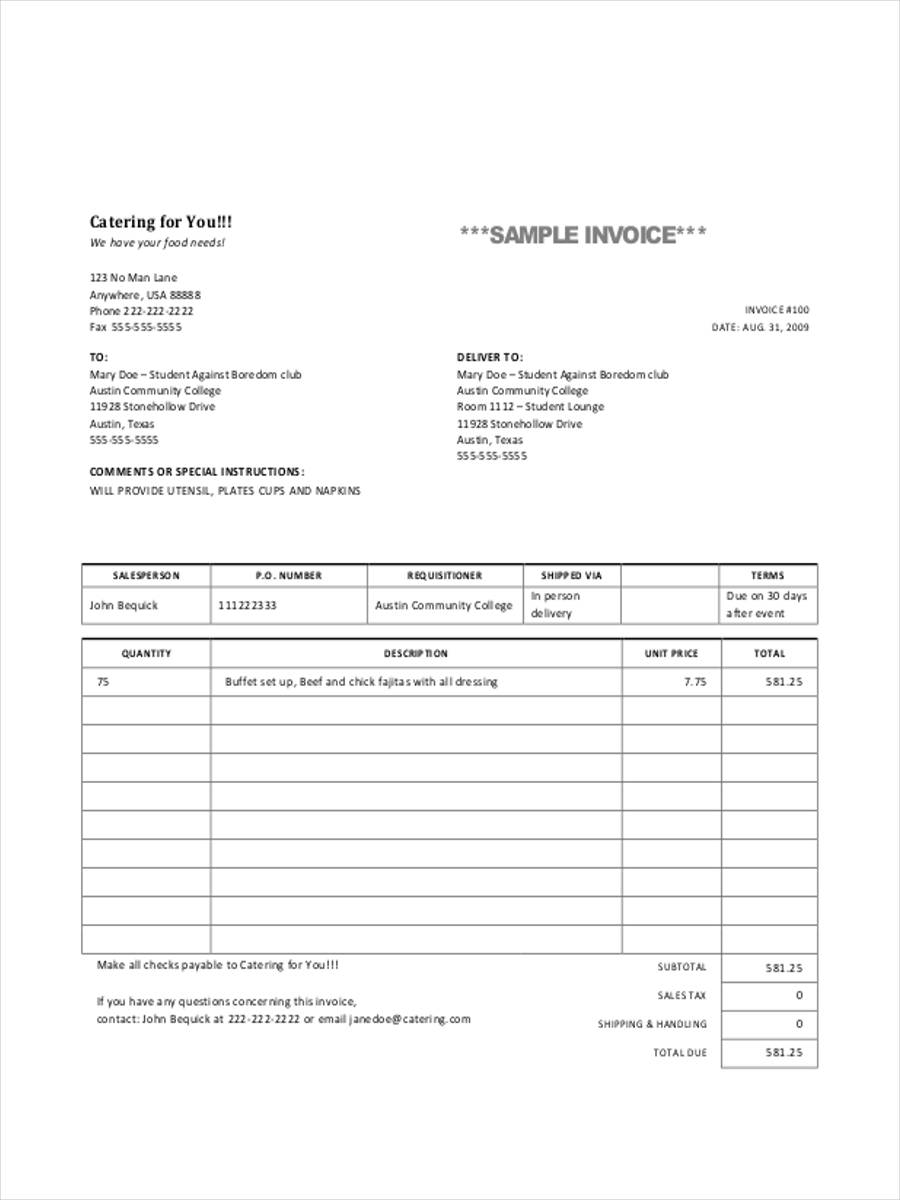

Sample Catering Invoice Form

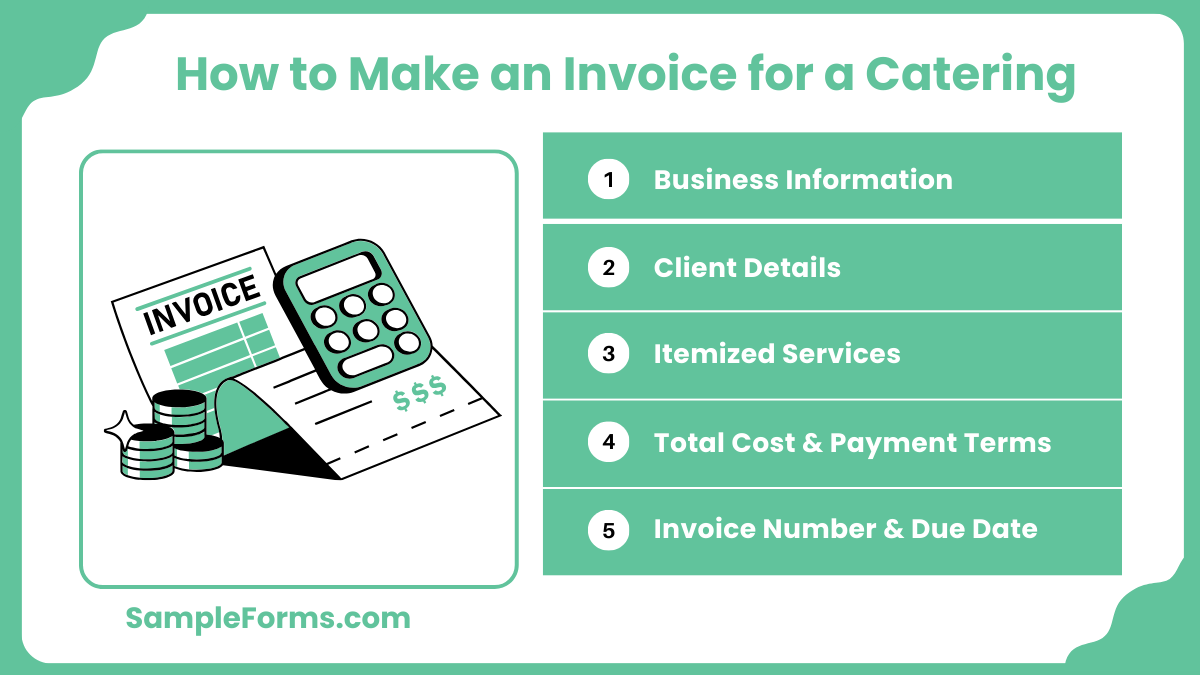

How to make an invoice for a catering?

Creating a Plumbing Invoice Form requires accurate service details, pricing, and payment terms. Follow these steps to ensure a professional and complete invoice.

- Business Information: Include your catering business name, address, contact details, and tax identification number.

- Client Details: Add the client’s name, billing address, and event details for clarity and record-keeping.

- Itemized Services: List menu items, quantities, service fees, and additional costs to provide a transparent breakdown.

- Total Cost & Payment Terms: Specify the subtotal, taxes, and final amount due, along with accepted payment methods.

- Invoice Number & Due Date: Assign a unique invoice number and deadline to track payments efficiently.

How do I fill out a catering invoice?

Filling out a Proforma Invoice Form for catering ensures precise financial documentation. Use the following steps to complete your invoice correctly.

- Header Section: Enter your business logo, name, and invoice title for a professional look.

- Client Information: Fill in the client’s details, including name, address, and contact information.

- Itemized Costs: List services such as food, staff, setup, and cleanup, including unit prices and quantities.

- Payment Instructions: Specify accepted payment methods, due dates, and applicable late fees for overdue payments.

- Final Review & Submission: Double-check all details for accuracy before sending the invoice to the client.

How do I make an invoice to receive payment?

A Vehicle Invoice Form for catering services should include necessary details to ensure timely payments from clients. Follow these steps to create an invoice:

- Invoice Identification: Assign a unique invoice number and date for record-keeping and tracking.

- Client & Event Details: Mention the event type, location, and customer contact details.

- Service Breakdown: Clearly outline charges for food, staff, rentals, and additional services.

- Payment Terms: Define the due date, accepted payment methods, and refund policies.

- Signature & Approval: If required, obtain a client signature or acknowledgment to confirm agreement on the charges.

What makes an invoice legal?

A Sales Invoice Form must meet legal requirements to be valid. Below are the key components that ensure invoice legality:

- Legal Business Information: Must include company name, registration details, and tax ID.

- Clear Service Description: An itemized list of products or services with associated costs ensures transparency.

- Tax Compliance: Clearly mention applicable sales tax, VAT, or any government-mandated charges.

- Payment Terms & Conditions: State due dates, penalties for late payments, and refund policies.

- Invoice Authorization: Some invoices may require a client or business signature for legal validity.

How do I start a small catering business from home?

Starting a catering business requires a structured plan, much like preparing a Catering Proposal Form to present services to clients. Follow these steps:

- Business Registration & Licensing: Obtain necessary food permits, tax registrations, and business licenses.

- Menu Planning & Pricing: Develop a menu based on market demand, costing, and customer preferences.

- Equipment & Supplies: Invest in essential kitchen tools, storage solutions, and serving materials.

- Marketing & Client Outreach: Use social media, referrals, and online platforms to attract potential customers.

- Billing & Invoicing System: Establish an efficient invoicing process to ensure smooth financial transactions.

Is it legal to make your own invoice?

Yes, businesses can create their own invoices as long as they include necessary details. A Catering Contract Form ensures proper documentation and legal compliance for transactions.

Can I send an invoice without a business?

Freelancers and individuals can send invoices without a registered business. Using a Catering Order Form helps maintain structured records for financial transactions and tax reporting.

What can I use instead of an invoice?

Alternatives include receipts, purchase orders, or agreements. A Financial Questionnaire Form can also help document financial details for informal business transactions.

How profitable is catering?

Catering can be highly profitable with good pricing and cost control. A Financial Affidavit Form helps track expenses, revenues, and net profits for business success.

Do people still use paper invoices?

Yes, though digital invoices dominate, some businesses prefer paper invoices. A Financial Evaluation Form can assist in tracking both digital and physical invoice records.

Can I send an invoice without tax?

Yes, if tax laws don’t require it. However, a Business Financial Statement Form ensures compliance with financial regulations and tracks taxable and non-taxable income.

What type of catering is most profitable?

Wedding and corporate catering are highly profitable. A Financial Statement Form helps businesses analyze profits, costs, and cash flow to optimize earnings.

Do I have to put my name on an invoice?

Yes, the issuer’s name is required for validity. A Financial Assistance Form helps businesses organize invoices while maintaining professional and legal records.

Is there a totally free invoice app?

Yes, several platforms offer free invoice creation. A Financial Contract Form helps keep track of invoices and payments for better financial management.

What is legally required on an invoice in the US?

Invoices must include business details, itemized charges, and payment terms. A Financial Agreement Form ensures compliance with U.S. invoicing regulations and financial documentation.

A professionally designed Catering Invoice Form simplifies financial transactions, maintains transparency, and ensures timely payments. Whether for small events or large-scale functions, a structured invoice minimizes errors and enhances business credibility. Like a Financial Waiver Form, it serves as an essential financial record, helping businesses manage cash flow and maintain compliance. Using templates or customized invoices streamlines the billing process, allowing caterers to focus on delivering exceptional service. Adopting an efficient invoicing system is key to running a successful catering business with clear financial documentation.

Related Posts

-

FREE 9+ Invoice Request Forms in MS Word | PDF | Excel

-

FREE 4+ Photography Invoice Forms in PDF

-

FREE 9+ Sample Service Invoice Forms in MS Word | PDF

-

FREE 6+ Vehicle Invoice Forms in MS Word | PDF

-

FREE 6+ Sample Tax invoice Forms in Excel | PDF

-

FREE 6+ Sample Rent Invoice Forms in PDF

-

Medical Invoice Form

-

FREE 24+ Invoice Forms in Excel

-

FREE 7+ Sample Plumbing Invoice Forms in PDF | MS Word

-

FREE 6+ Sample Payment Invoice Forms in MS Word | PDF

-

FREE 6+ Sample Work Invoice Forms in PDF | MS Word

-

FREE 6+ Sample Job Invoice Forms in PDF | MS Word

-

FREE 9+ Sample Business Invoice Forms in PDF | MS Word | Excel

-

FREE 9+ Sample Construction Invoice Forms in PDF | MS Word | Excel

-

FREE 8+ Photography Invoice Samples in PDF | Excel