A Cash Receipt Form is an essential document used in financial transactions to confirm the receipt of cash payments. This comprehensive guide explores the importance of maintaining precise records through such forms. Featuring practical examples and easy-to-understand templates, this guide ensures you can effortlessly create both Receipt Form and Cash Payment Receipt Form. Whether you’re a business owner, financial manager, or just starting out, understanding how to effectively use cash receipt forms can streamline your accounting processes, enhance transparency, and ensure accurate tracking of all cash inflows.

Download Cash Receipt Form Bundle

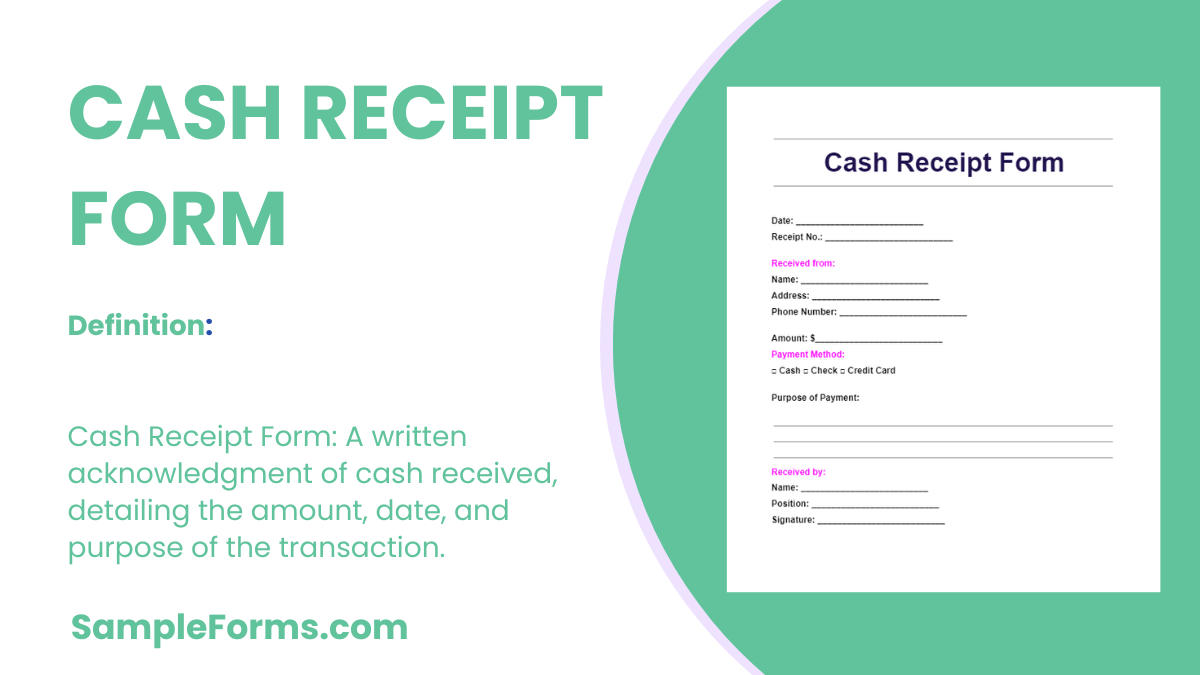

What is a Cash Receipt Form?

A Cash Receipt Form is a written acknowledgment that confirms the receipt of cash from a transaction. It typically includes details such as the amount received, the date of the transaction, the payer’s and receiver’s information, and the purpose of the payment. This form serves as proof of payment for both parties and is crucial for accurate bookkeeping and financial management. It’s particularly important in business exchanges where cash transactions still play a significant role.

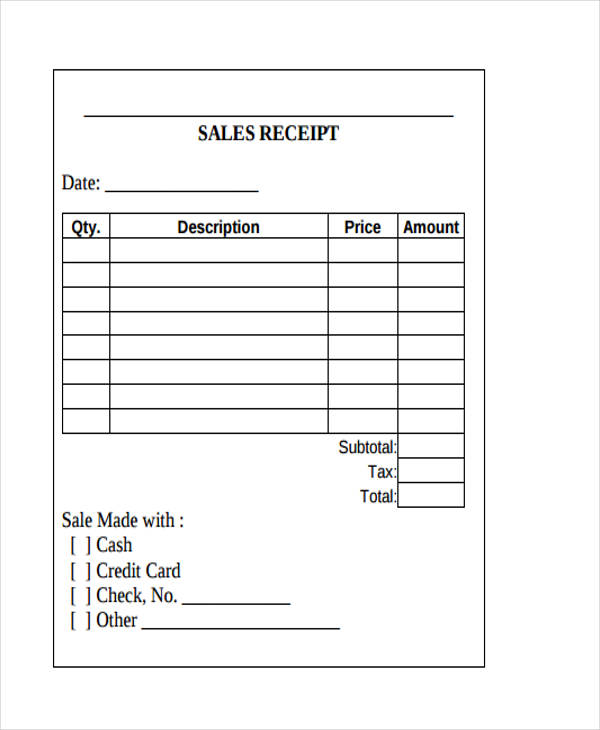

Cash Receipt Format

I. Header

- Business Name

- Business Address

- Contact Information

II. Receipt Information

- Receipt Number

- Date of Transaction

III. Payment Details

- Description of Goods or Services

- Quantity

- Price per Unit

- Total Amount Paid

- Method of Payment

IV. Footer

- Additional Notes

- Return Policy

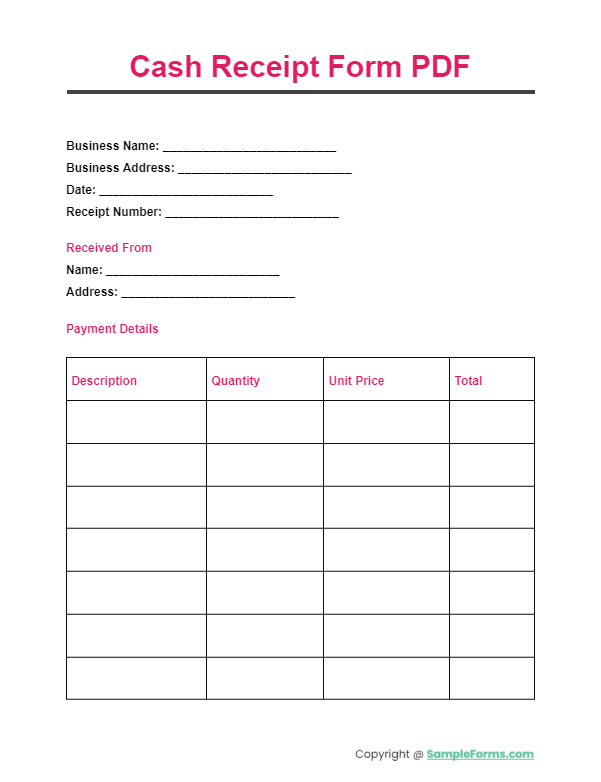

Cash Receipt Form PDF

Download a Petty Cash Log-compatible Cash Receipt Form in PDF format for secure and straightforward financial documentation. Perfect for recording transactions quickly and efficiently.

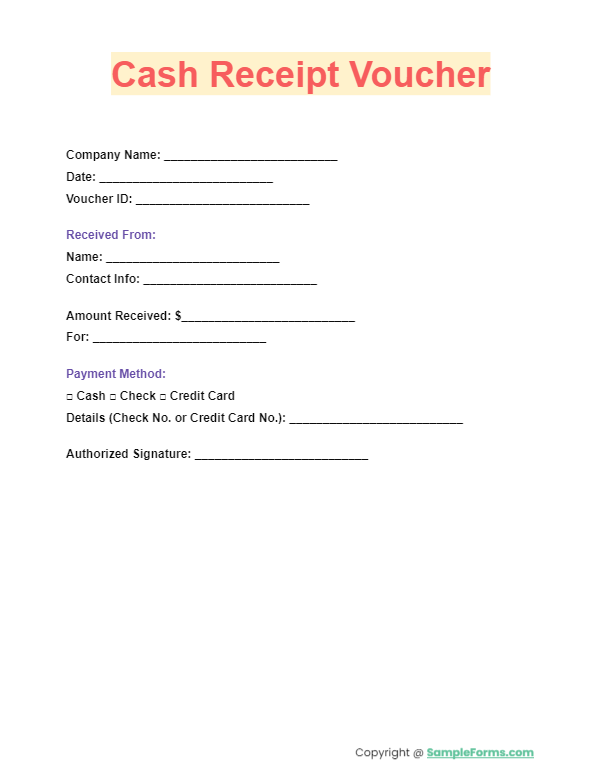

Cash Receipt Voucher

A Cash Receipt Voucher serves as an official record of cash transactions, aligning seamlessly with a Petty Cash Reimbursement Form to manage small, everyday expenses.

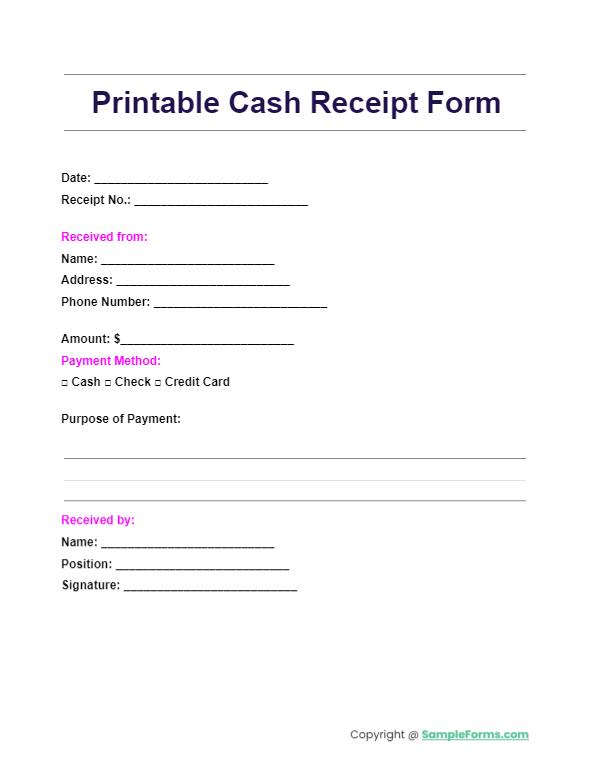

Printable Cash Receipt Form

Access a printable version of the Cash Receipt Form, designed to help maintain your Petty Cash Register with ease. Ensure accurate and immediate transaction recording with this user-friendly template.

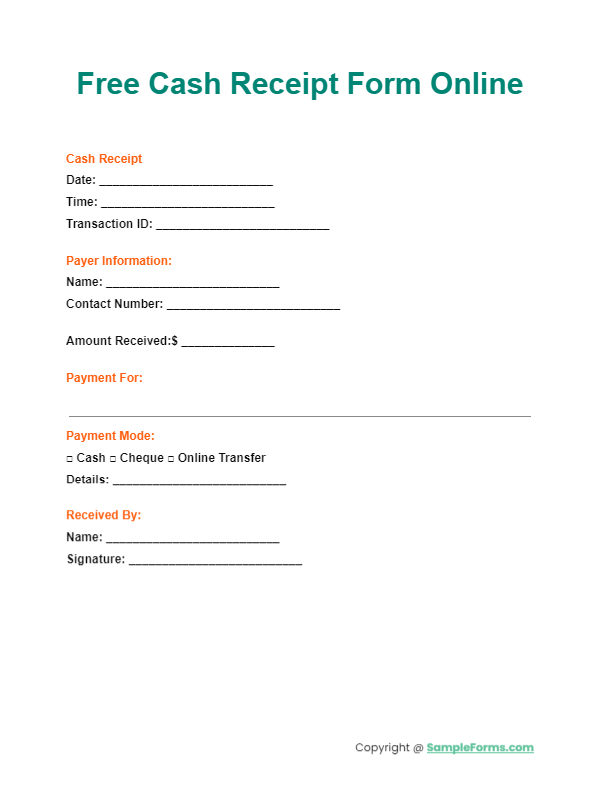

Free Cash Receipt Form Online

More Cash Receipt Form Samples

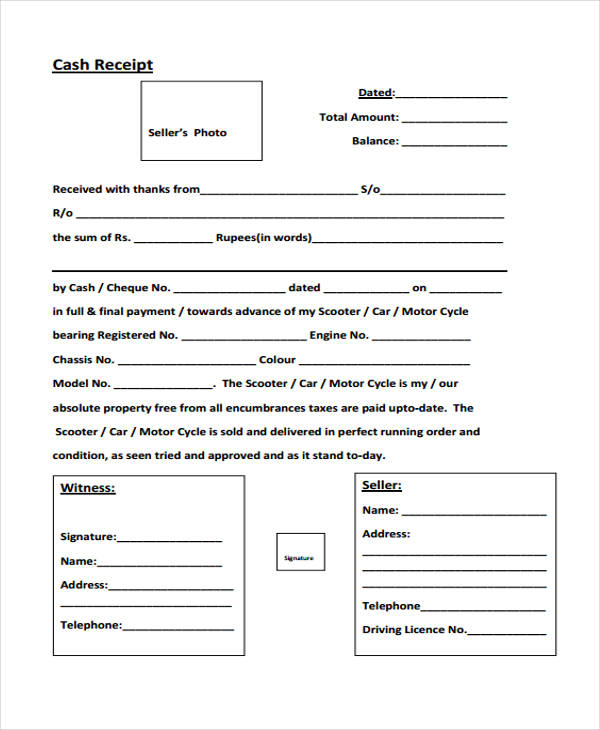

Cash Payment Receipt Form

Sample Cash Sales Receipt Form

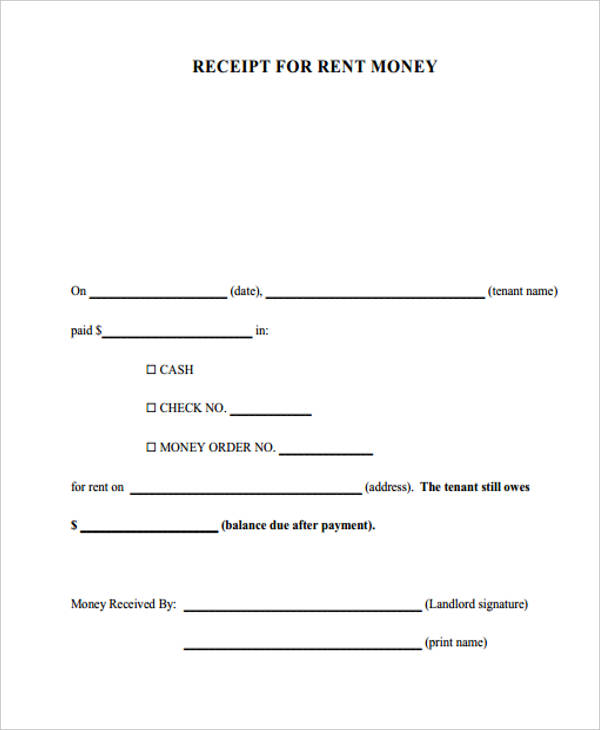

Rent Receipt Form

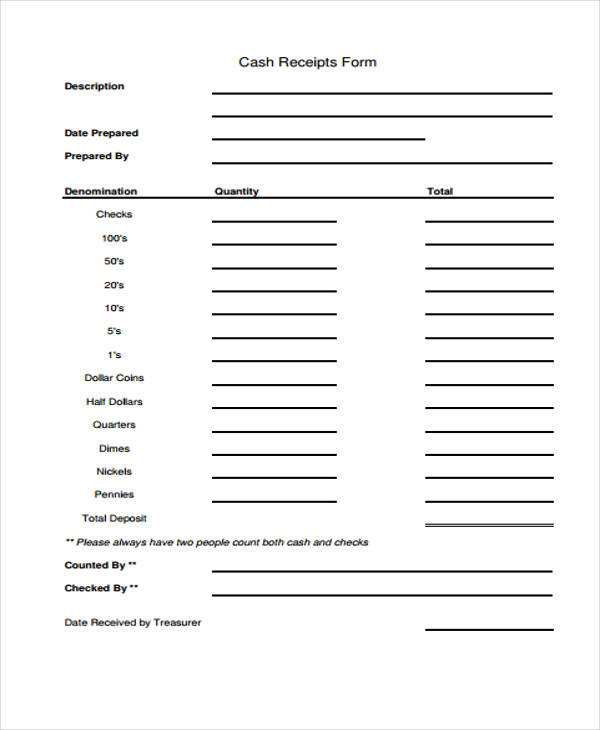

Cash Receipt Form

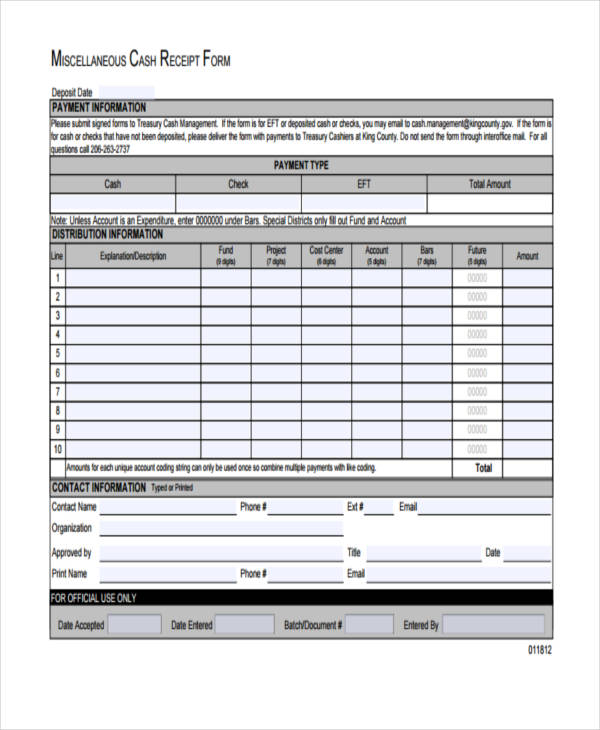

Miscellaneous Cash Receipt Form

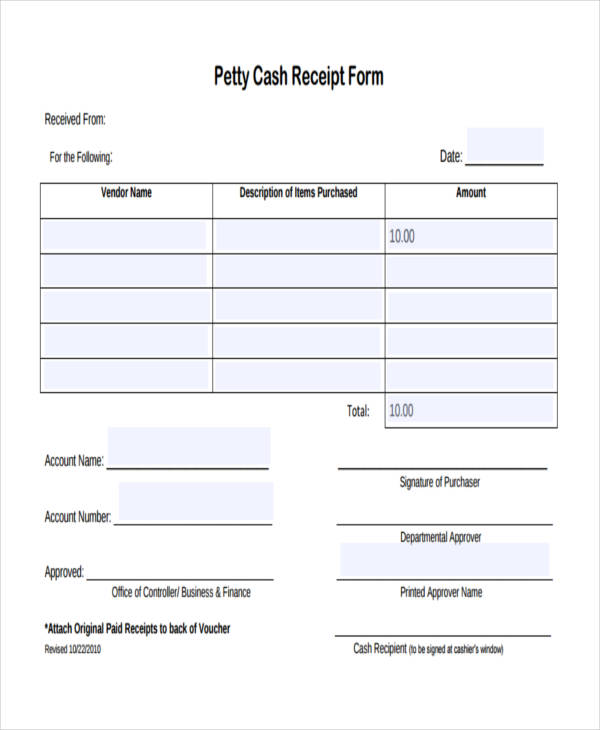

Petty Cash Receipt Form Example

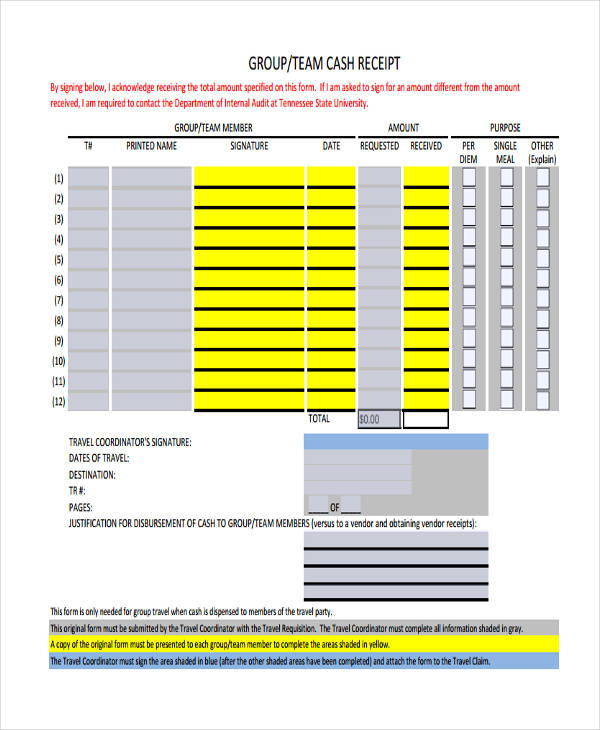

Group Cash Receipt Form

Free Managing Cash Receipt Form

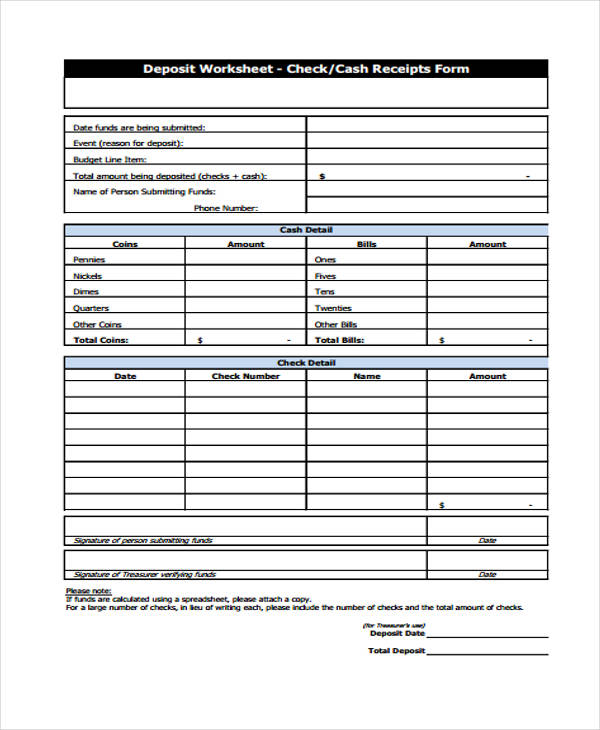

Check/Cash Receipt Form

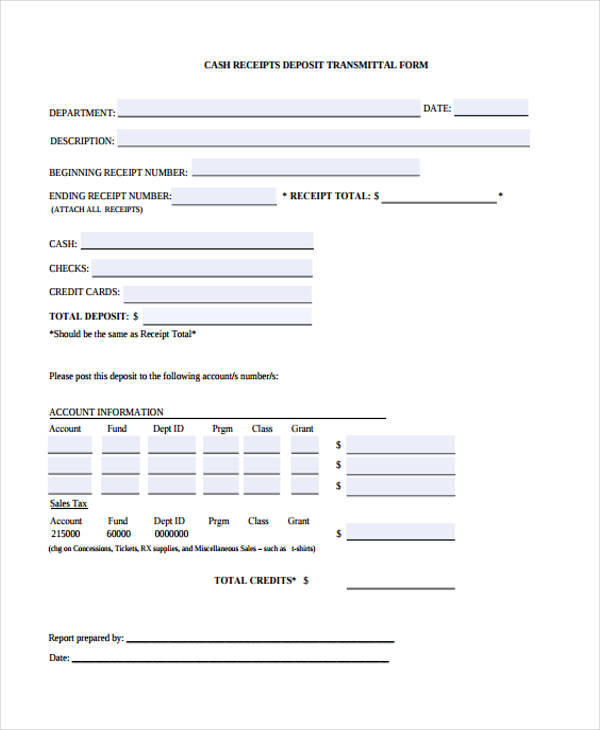

Cash Receipt Deposit Transmittal Form

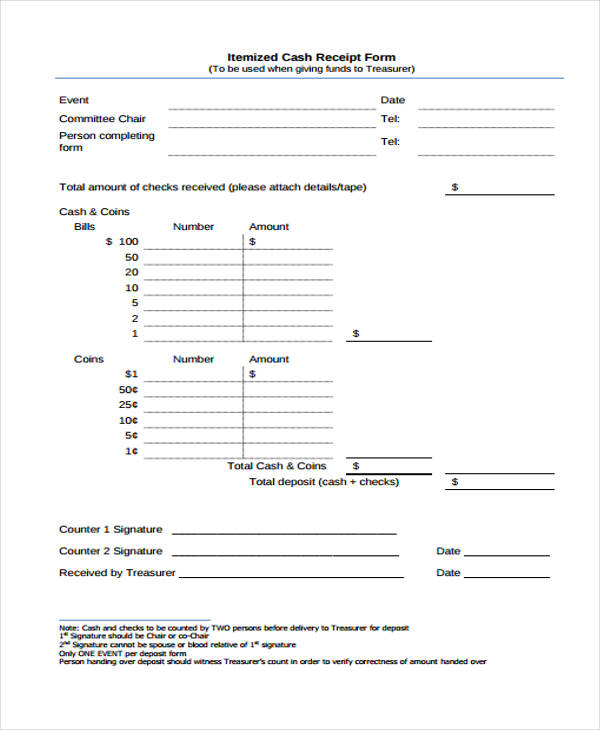

Itemized Cash Receipt Form

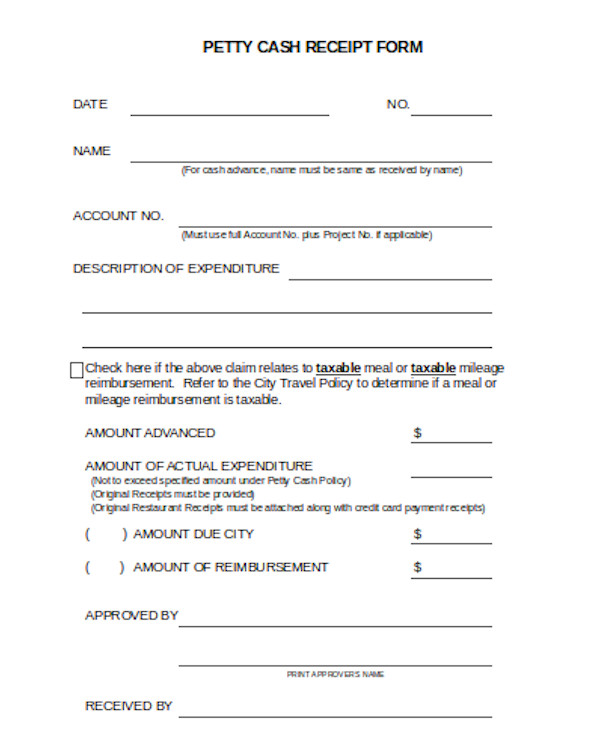

Blank Petty Cash Receipt Form

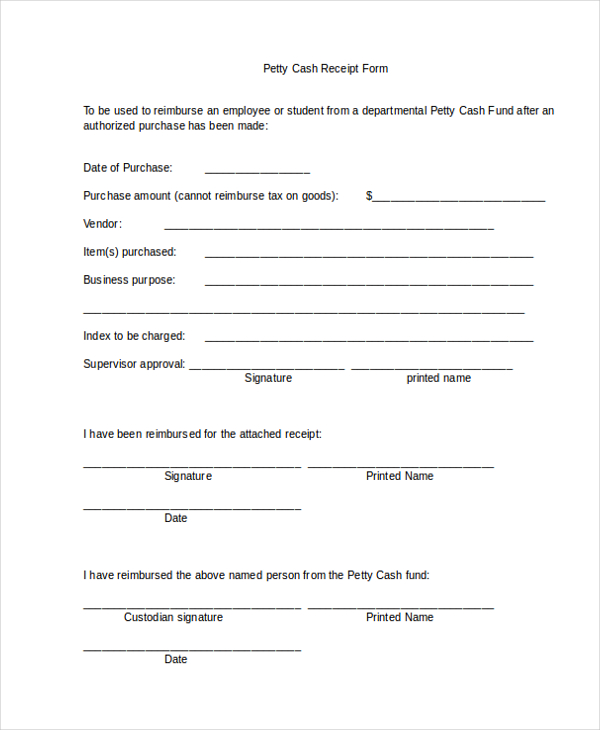

Petty Cash Receipt Form

How to make a receipt for cash?

Creating a cash receipt is straightforward and ensures transparency in cash transactions.

1. Choose a Template: Start with a standard Payment Receipt Form.

2. Fill in Details: Include the date, amount received, and payer’s name.

3. Specify Payment Reason: Clearly state the reason for the transaction.

4. Add Payment Method: Note it was a cash transaction.

5. Provide Confirmation: Sign the receipt to validate it. You also browse our Daily Cash Log

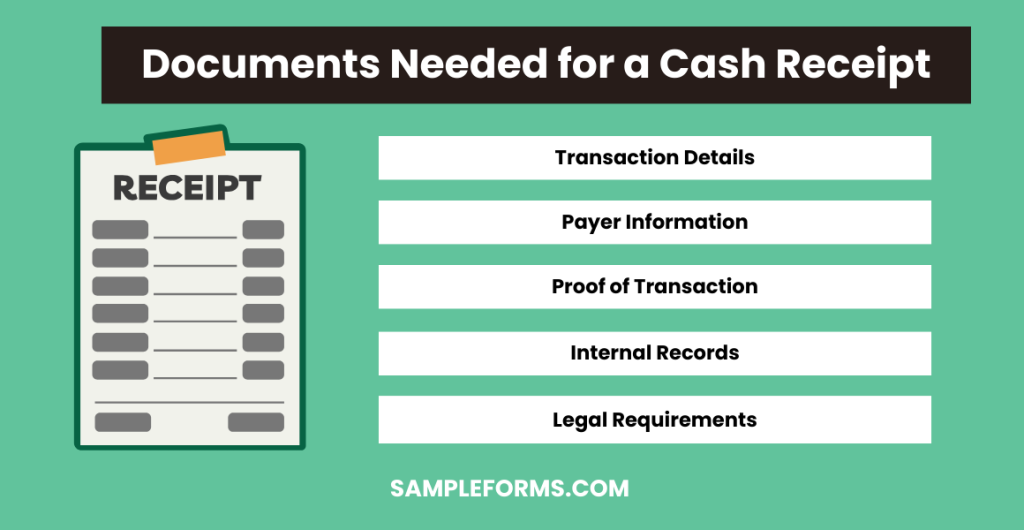

What documents do I need for a cash receipt?

Essential documents ensure the accuracy and legality of cash receipts.

1. Transaction Details: Necessary for cross-referencing with a Sales Receipt Form.

2. Payer Information: Include full name and contact details.

3. Proof of Transaction: Attach any relevant transaction documentation.

4. Internal Records: Link to your accounting records for auditing.

5. Legal Requirements: Ensure compliance with local financial regulations. You also browse our Petty Cash Requisition Form

What are the three main sources of cash receipts?

Cash receipts typically come from diverse and crucial sources.

1. Sales Revenue: From direct sales documented in a Restaurant Receipt Form.

2. Loan or Investment Inflows: Tracked via a Purchase Receipt Form when funding is received.

3. Asset Sales: Recorded using a Contractor Receipt Form when company assets are sold.

What is required on a cash receipt?

Certain key elements must be included on any cash receipt.

1. Date of Transaction: Essential for financial tracking.

2. Amount Received: Must be clearly stated.

3. Source of Payment: Identifies who made the payment.

4. Purpose of Payment: Clarifies what the payment was for, such as in a Rent Receipt Form.

5. Signature of Receiver: Provides authentication of receipt. You also browse our Lost Receipt Form

What should a cash receipt include?

A well-documented cash receipt should cover several critical aspects.

1. Complete Payer’s Details: Necessary for record-keeping.

2. Payment Description: Details the nature of the transaction.

3. Exact Amount: Should match the figure stated on a related Donation Receipt Form.

4. Form of Payment: Indicates cash was used.

5. Authorization: Signature of the person receiving the cash. You also browse our Car Receipt Form

What is the disadvantage of cash receipt?

While useful, cash receipts have certain drawbacks.

1. Risk of Theft: More vulnerable to physical theft.

2. Harder to Track: Can be challenging to monitor as with digital forms.

3. Prone to Errors: Manual entry increases error risk.

4. Lack of Backup: If lost, hard to reproduce accurately.

5. Time-Consuming: More administrative work compared to digital receipts. You also browse our School Receipt Form

What are the benefits of a cash receipt?

Cash receipts offer several advantages in financial management.

1. Proof of Payment: Acts as evidence of payment, useful for Hotel Receipt Form disputes.

2. Financial Record: Helps in maintaining accurate financial records.

3. Tax Documentation: Essential during tax filings and audits.

4. Transaction Verification: Provides instant verification of cash transactions.

5. Legal Protection: Offers protection in legal matters related to payments. You also browse our Daycare Receipt Form

What Is the Importance of a Cash Receipt Form?

A cash receipt form which has a general purpose or specific function can have a high level importance to a company that utilizes them and the customer that receive the receipt form. You also browse our Spa Receipt Form

A cash receipt form can be customized in order to be in line with the type of transaction being done. An example for a specific kind of cash receipt form is the petty cash receipt forms. A petty cash receipt form involves a transaction that requires the payment to come from a petty cash fund.

A company and its employees may use any kind of cash receipt form depending on the form that best suits the company’s needs and operations that it has. The company and its employees that the cash receipt form has an important purpose. If it did not have one, it would be useless to anyone who used it. You also browse our Security Deposit Receipt Form

Can a cash receipt be handwritten?

Yes, a cash receipt can be handwritten, especially in small transactions or when using a Petty Cash Receipt Form. Ensure legibility and include all necessary details.

How do you record a receipt of cash?

Recording a cash receipt involves documenting the transaction on a Acknowledgment of Receipt Form, entering details into your accounting system, and storing the receipt for record-keeping.

What is a proof of cash receipts?

Proof of cash receipts is documented evidence of cash transactions, typically through forms like a Deposit Receipt Form, showing all relevant transaction details.

What is the purpose of cash receipts?

The purpose of cash receipts is to provide a written acknowledgment of cash payments received, helping in financial tracking and accountability, often seen with an Event Receipt Form.

Who signs a cash receipt?

The recipient of the cash usually signs the cash receipt to confirm the accuracy of the transaction details documented in a Cleaning Receipt Form.

Can I write a receipt without a business?

Yes, individuals can write a receipt for personal transactions using a Missing Receipt Form to confirm payment was made and received without involving a business.

How do I prove I gave someone money?

To prove you gave someone money, provide a signed and dated Asset Receipt Form detailing the amount, recipient’s name, and purpose of the payment.

The Cash Receipt Form is a vital document for confirming transactions and maintaining robust financial records. It serves as proof that a payment has been made and received, ensuring transparency and accountability in business dealings. By using samples, forms, and letters effectively, organizations can manage their cash flows more efficiently and uphold a high standard of precision in financial documentation. The effective use of such forms supports a clear Receipt of Agreement between the involved parties, fostering trust and clarity in financial interactions.

Related Posts

-

FREE 5+ Sample Cleaning Receipt Forms in PDF

-

How to Write a Receipt Form? [ Types, Includes ]

-

FREE 6+ Asset Receipt Forms in MS Word | PDF

-

Lost Receipt Form

-

Donation Receipt Form

-

FREE 6+ Contractor Receipt Forms in PDF | MS Word

-

Delivery Receipt Form

-

FREE 7+ Service Receipt Forms in PDF | MS Word

-

What is Delivery Receipt Form? [ Definition, Policy and Procedures, Tips ]

-

What is Receipt Form? [ How to Fill, Uses ]

-

Deposit Receipt Form

-

Receipt Form

-

FREE 9+ Sample Receipt Forms in MS Word | PDF | Excel

-

FREE 8+ Sample Payment Receipt Forms in PDF | MS Word | MS Excel

-

Rental Receipt Form