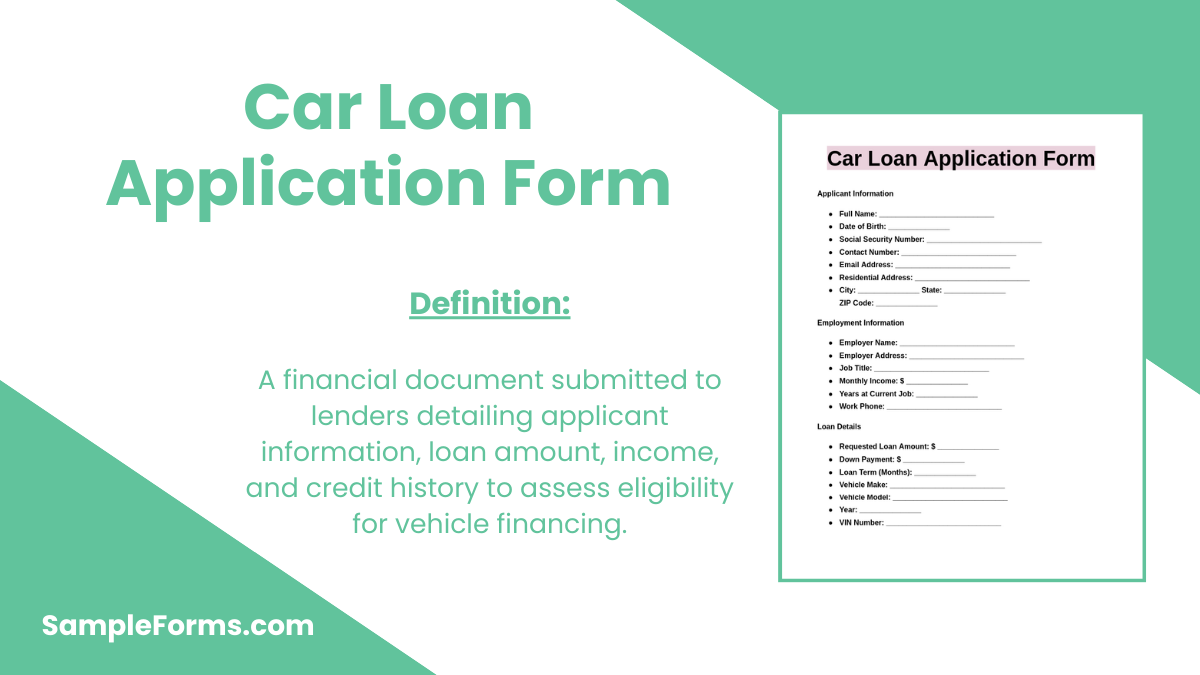

A Car Loan Application Form is a crucial document required to apply for financing when purchasing a vehicle. This Application Form helps financial institutions assess an applicant’s eligibility based on credit history, income, and repayment capability. It includes essential details such as personal information, employment history, loan amount requested, and financial statements. Understanding the requirements and submitting supporting documents, such as proof of income and identification, can speed up the approval process.

Download Car Loan Application Form Bundle

What is Car Loan Application Form?

A car loan application form is a document which is used by loan providers and financial aid companies for their clients whose aim is to borrow a specific value of money for purchasing a car. The common document preparers of this type of application form are not only car loan agencies but also banks and financial institutions as well as car sellers themselves who offer benefits and opportunities to anyone planning to have a car yet does not have sufficient finances to allocate for a car payment.

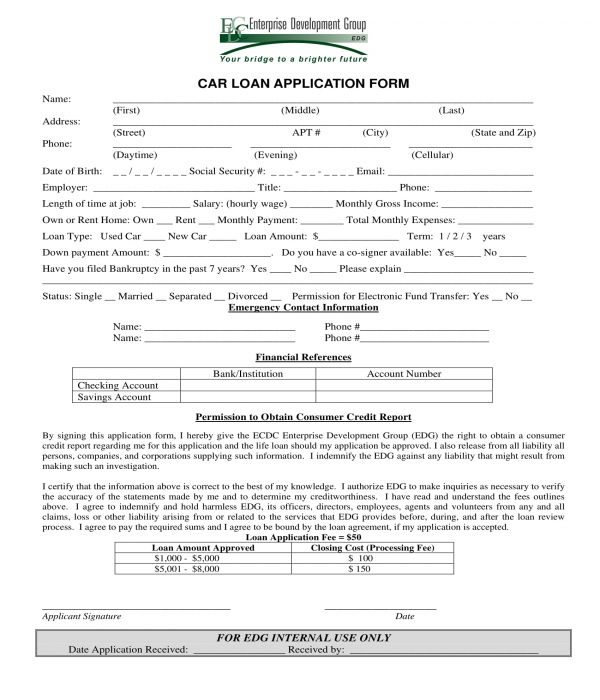

Car Loan Application Format

Applicant Information

- Full name and date of birth.

- Contact details, including address and phone number.

- Employment details, including employer name and income.

Loan Details

- Requested loan amount.

- Preferred repayment duration and interest rate.

- Purpose of the loan and vehicle details.

Financial Information

- Monthly income and expenses.

- Existing loans and liabilities.

- Credit history and banking details.

Terms and Conditions

- Repayment schedule and late payment penalties.

- Consequences of defaulting on the loan.

- Agreement to credit check and verification procedures.

Authorization and Signatures

- Applicant’s declaration of accuracy.

- Lender’s approval and conditions.

- Signatures of both parties with date.

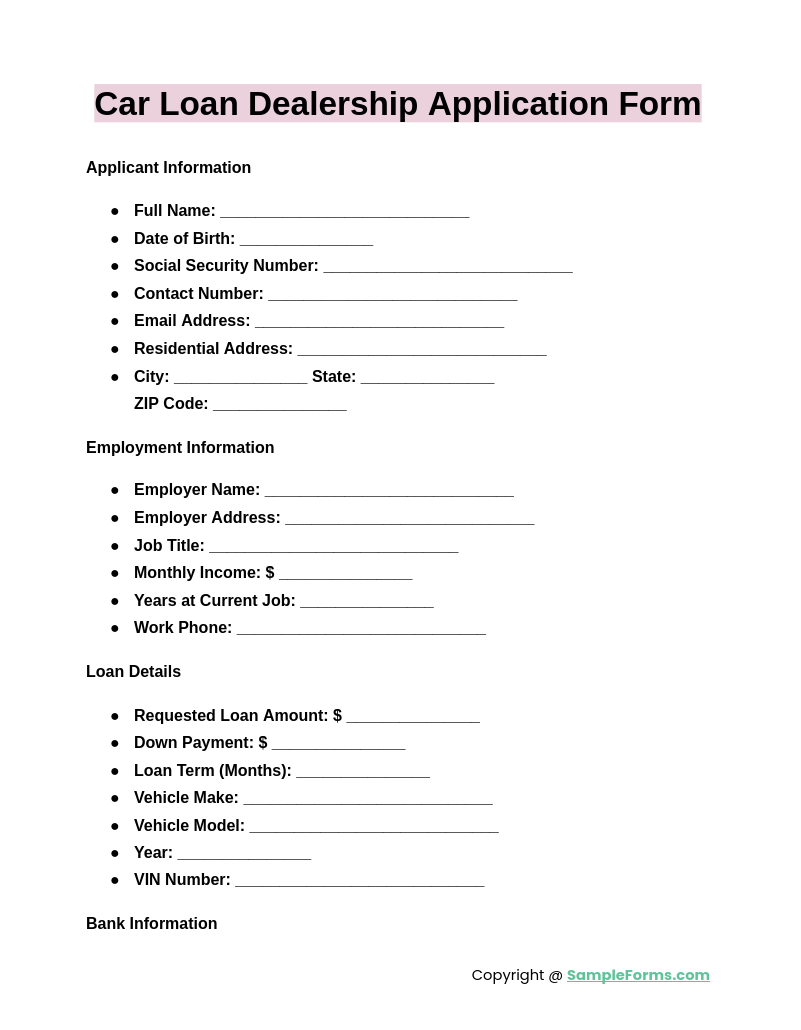

Car Loan Dealership Application Form

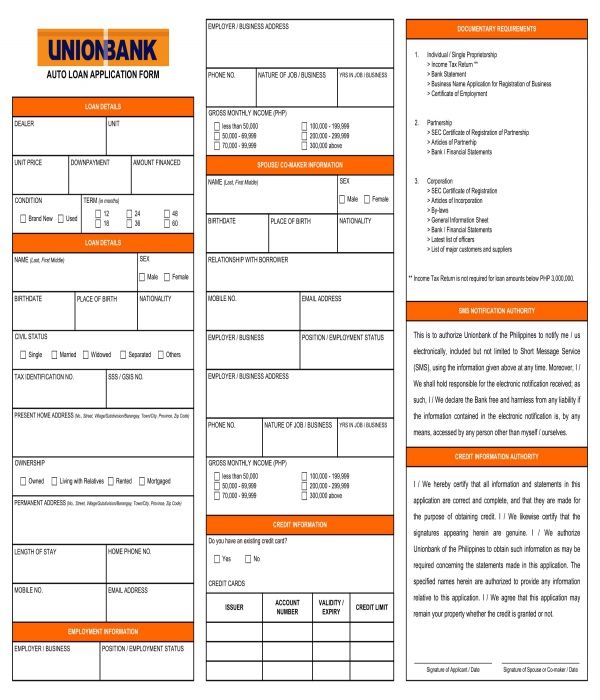

A Car Loan Dealership Application Form is used by dealerships to facilitate vehicle financing for customers. It collects borrower information, loan amount, and repayment terms to secure approval. Similar to a Business Credit Application Form, it streamlines financial transactions between buyers and lenders.

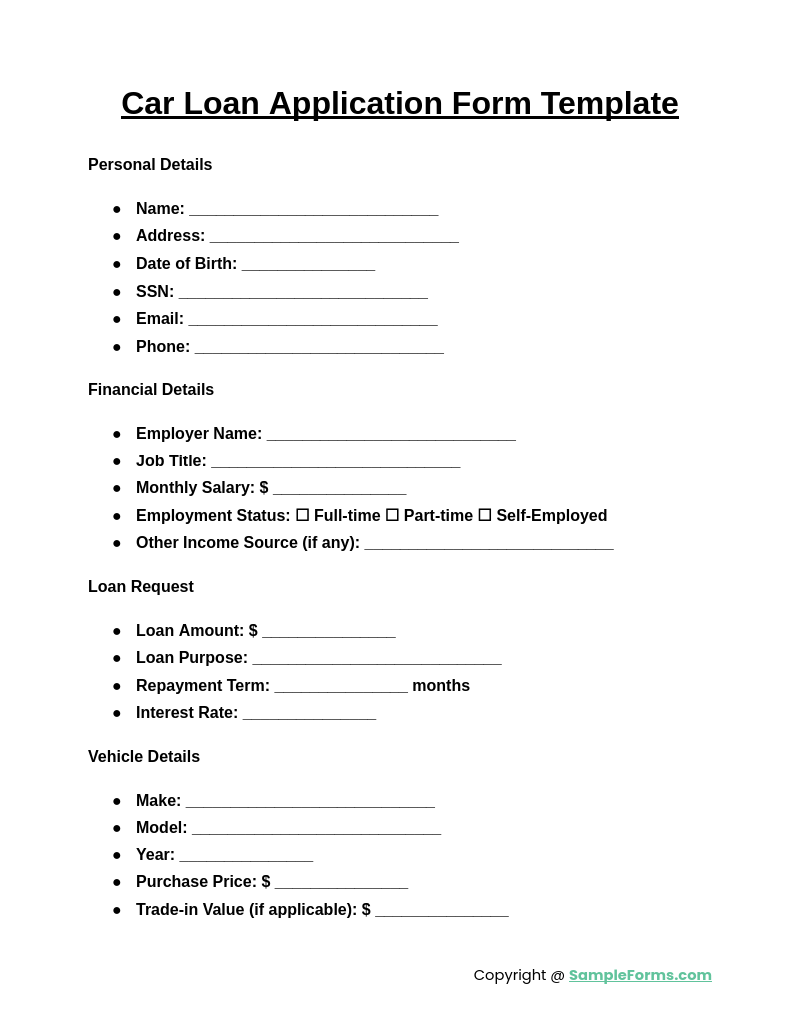

Car Loan Application Form Template

A Car Loan Application Form Template provides a standardized format for loan requests, ensuring all necessary details like credit score, employment history, and vehicle price are included. Like a Child Care Application Form, it requires accurate personal and financial details for approval.

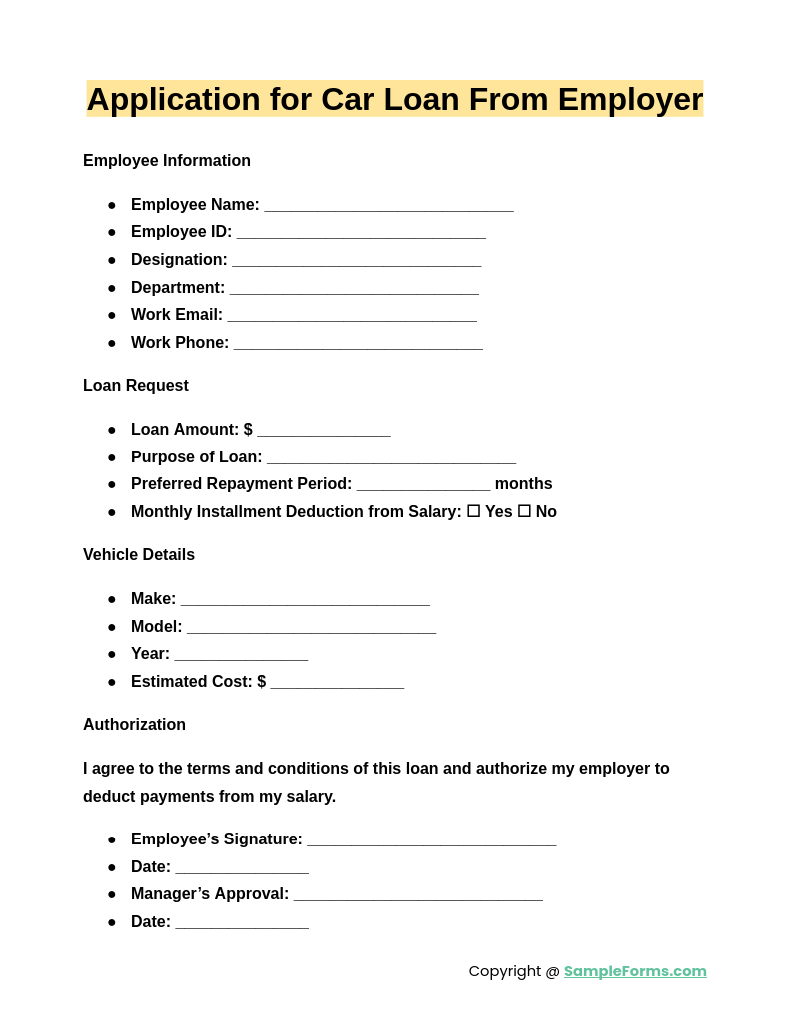

Application for Car Loan From Employer

An Application for Car Loan From Employer enables employees to request financial assistance for vehicle purchases through workplace loan programs. Just like a Security Guard Application Form, it ensures eligibility criteria, repayment terms, and employment verification for approval.

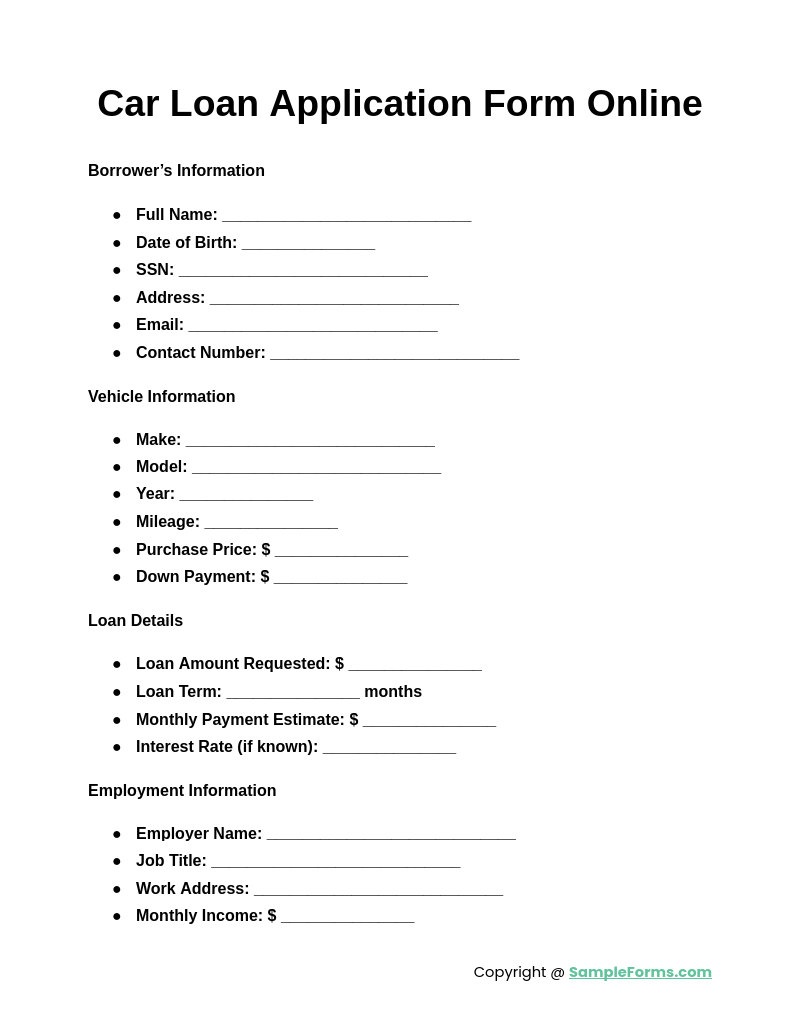

Car Loan Application Form Online

A Car Loan Application Form Online simplifies the loan application process, allowing users to submit digital forms with instant verification. Much like an Examination Application Form, it ensures fast processing, reducing paperwork and expediting loan approvals efficiently.

Browse More Car Loan Application Forms

Car Loan Application Form Sample

Car Auto Loan Application Form

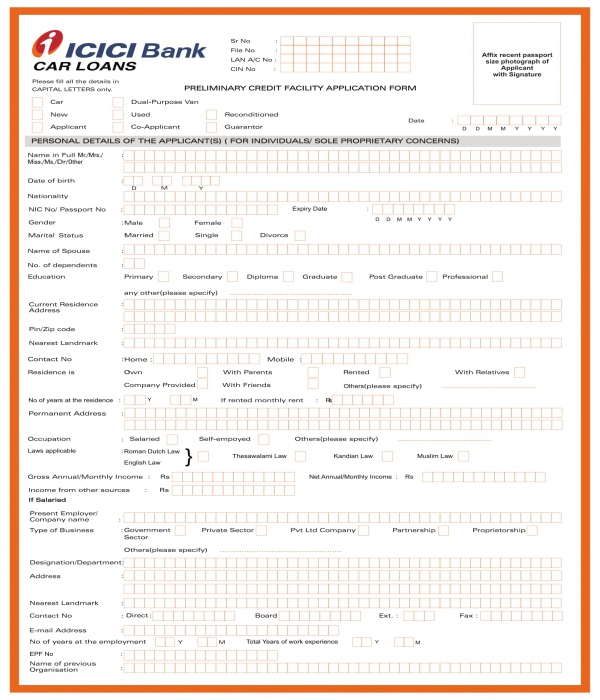

Car Loan Credit Facility Application Form

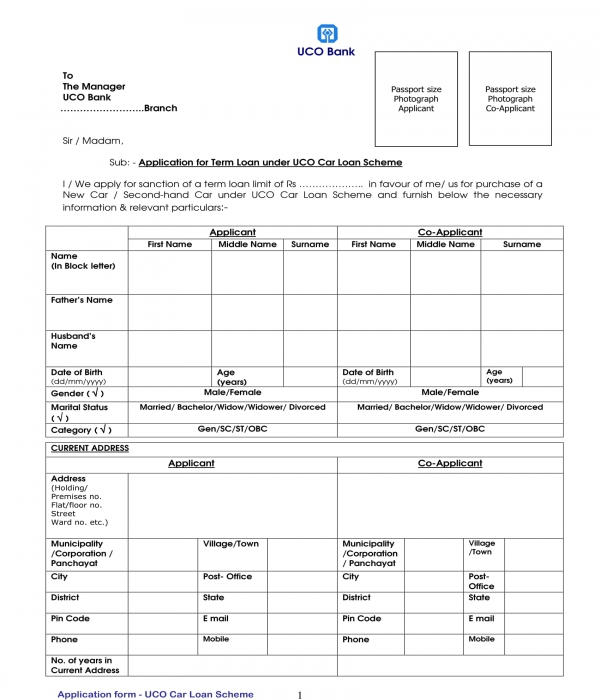

Car Loan Scheme Application Form

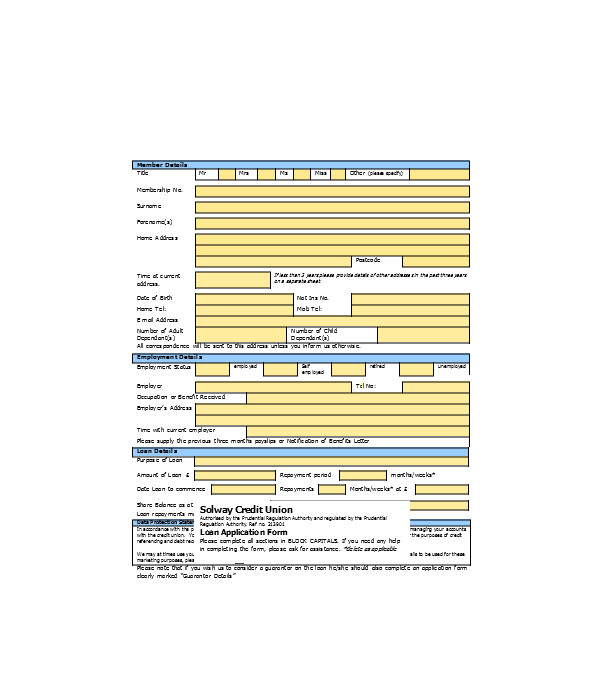

Basic Car Loan Application Form

How do I apply for a car loan?

Applying for a car loan involves meeting eligibility criteria, providing necessary documentation, and securing lender approval. Like a Scholarship Application Form, it requires financial details and background verification.

- Check Eligibility: Ensure you meet the lender’s credit and income requirements before applying.

- Gather Documents: Provide proof of income, employment history, and identification.

- Compare Lenders: Research banks, credit unions, and online lenders for the best rates.

- Submit Application: Fill out the form accurately and submit it with required documentation.

- Receive Approval: Await lender evaluation and finalize the loan agreement.

What is a good interest rate for a car?

A good interest rate varies based on credit score and market conditions. Similar to a Student Application Form, it requires proper financial assessment before approval.

- Credit Score Impact: Higher scores qualify for lower interest rates.

- Loan Term Length: Shorter terms often have lower interest rates.

- Down Payment: A higher down payment reduces the total interest.

- Market Rates: Compare lenders for the most competitive offers.

- Loan Type: Fixed-rate loans provide stable payments, while variable rates fluctuate.

What credit score is needed for a car loan?

Lenders use credit scores to assess eligibility and determine interest rates. Like a Membership Application Form, financial history plays a key role in approval.

- Excellent Credit (750+): Qualifies for the best interest rates and loan terms.

- Good Credit (700-749): Offers competitive rates and flexible terms.

- Fair Credit (600-699): Approval possible but with higher interest rates.

- Poor Credit (Below 600): Limited options, often requiring a co-signer or higher down payment.

- Credit Building Tips: Pay bills on time, reduce debts, and check reports for errors.

How much income do I need for a car loan?

Lenders assess income to ensure affordability. Like an Internship Application Form, financial stability verification is necessary before approval.

- Debt-to-Income Ratio: Lenders prefer a DTI below 40%.

- Monthly Earnings: Steady income improves approval chances.

- Employment History: Stable jobs with consistent earnings strengthen applications.

- Loan Amount: Higher income supports larger loan approvals.

- Proof of Income: Pay stubs, tax returns, or employer verification required.

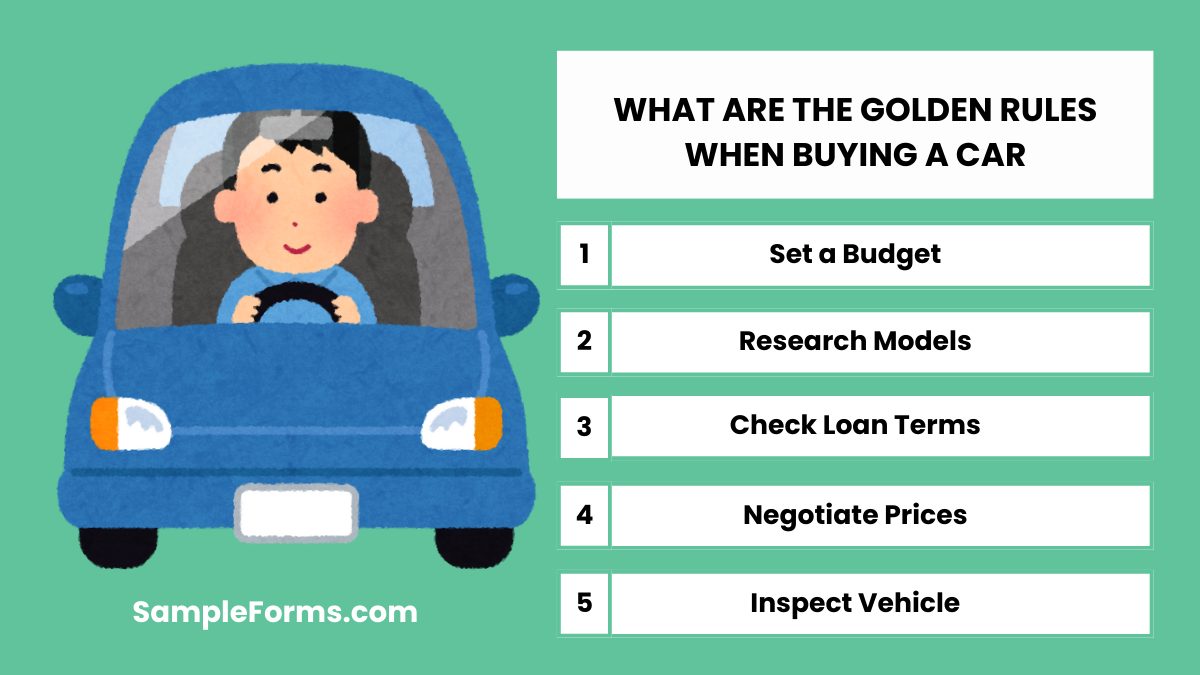

What are the golden rules when buying a car?

Following essential rules ensures a smart purchase decision. Much like a Business Application Form, careful planning and evaluation are key.

- Set a Budget: Avoid exceeding financial limits.

- Research Models: Compare features, reliability, and resale value.

- Check Loan Terms: Understand interest rates, fees, and penalties.

- Negotiate Prices: Get the best deal before finalizing the purchase.

- Inspect Vehicle: Ensure quality through professional evaluation.

What credit score do you need for a $25000 car loan?

A credit score of 650 or higher improves approval chances for a $25,000 car loan. Like a Volunteer Application Form, financial history and stability determine eligibility, interest rates, and loan terms for borrowers.

Do car dealerships look at your bank account?

Dealerships usually check income and financial stability but do not access bank account details directly. Similar to a Contractor Application Form, they require proof of income, employment verification, and credit reports before finalizing loan approval.

What is a good monthly car payment based on income?

A car payment should not exceed 15% of monthly income. Like a Counseling Application Form, it requires careful financial assessment to maintain affordability and avoid budget strain while ensuring loan repayment stability.

What is the minimum salary to buy a car?

Lenders prefer an annual income of at least $25,000 for car loan approval. Much like a Nurse Application Form, steady earnings and a low debt-to-income ratio improve the chances of qualifying for a car loan.

Is it better to go through a lender or bank for a car loan?

Banks offer competitive rates, while dealerships provide convenience. Similar to a Permit Application Form, evaluating terms, interest rates, and approval conditions is essential for making the best financial decision.

What bank gives the most auto loans?

Banks like Capital One, Chase, and Wells Fargo issue the most auto loans. Like a Certificate Application Form, choosing the right financial institution requires reviewing interest rates, loan terms, and customer service.

Do dealerships take cash for down payment?

Most dealerships accept cash down payments, but large amounts may require verification. Similar to a Grant Application Form, proof of funds is essential to comply with financial regulations and dealership policies.

Which bank offers the lowest car loan?

Banks like PenFed, Bank of America, and LightStream provide low-interest car loans. Like a Recruitment Application Form, comparing multiple options ensures the best rates, saving money over the loan term.

What is the minimum FICO score for a car loan?

A minimum FICO score of 600 is usually required for approval. Similar to a Work Application Form, creditworthiness, income, and employment history play vital roles in securing favorable loan terms and interest rates.

Is it better to finance a car through a bank or dealership?

Banks typically offer better rates, while dealerships provide financing flexibility. Like a Training Application Form, evaluating terms and conditions before making a decision ensures financial stability and minimizes long-term costs.

A Car Loan Application Form simplifies the financing process, ensuring accurate borrower details and transparent loan terms. Whether buying a new or used car, this form streamlines approvals. Similar to an Employment Application Form, it requires complete and verified information for processing.

Related Posts

-

Job Application Form

-

Internship Application Form

-

Recruitment Application Form

-

FREE 8+ Commercial Property Application Forms in PDF

-

FREE 18+ Leave Cancellation Forms Download – How to Create Guide, Tips

-

FREE 6+ Business Credit Checklist Forms in PDF

-

FREE 6+ Background Check Application Forms in PDF | MS Word

-

FREE 6+ Leasing Application Forms in PDF | MS Word

-

FREE 10+ New Job Application Forms in PDF | MS Word | Excel

-

FREE 9+ Articles Of Organization Forms in PDF

-

FREE 10+ Commercial Rental Application Sample Forms in PDF | MS Word

-

FREE 5+ HR Reclassification Application Forms in PDF | MS Word

-

FREE 8+ Clearance Application Forms in PDF | MS Word

-

FREE 6+ Talent Application Forms in PDF | MS Word

-

FREE 6+ House Rental Application Forms in PDF | MS Word | Excel