Discover the essentials of the California Power of Attorney Form, a crucial legal document empowering individuals to make decisions on behalf of others. This guide offers an easy-to-follow approach for using the form effectively, complete with practical tips and legal insights. Whether you’re granting authority or assuming responsibility, our comprehensive overview simplifies the process, ensuring your decisions are legally sound and aligned with California’s legal requirements. Perfect for anyone needing clarity on power of attorney procedures in California.

What is the California Power of Attorney Form?

The California Power of Attorney Form is a legal document that allows one person, known as the principal, to appoint another person, called the agent or attorney-in-fact, to make decisions on their behalf. This can include decisions about finances, property, health care, or other personal matters. The form is used when the principal cannot make these decisions themselves, either temporarily or permanently, and needs someone they trust to act in their best interests. In California, this form must comply with state-specific laws to be valid.

What is the Best Sample California Power of Attorney Form?

Creating a sample California Power of Attorney Form involves crafting a document that is both legally sound and easily understandable. Here’s a simplified yet comprehensive example:

California Power of Attorney Form

Section 1: Principal Information

- Full Name of Principal: ____________________________

- Address: ____________________________

- City, State, Zip: ____________________________

- Phone Number: ____________________________

- Email Address: ____________________________

Section 2: Agent Information

- Full Name of Agent: ____________________________

- Address: ____________________________

- City, State, Zip: ____________________________

- Phone Number: ____________________________

- Email Address: ____________________________

Section 3: Alternate Agent (Optional)

- Full Name of Alternate Agent: ____________________________

- Address: ____________________________

- City, State, Zip: ____________________________

- Phone Number: ____________________________

- Email Address: ____________________________

Section 4: Powers Granted

- Financial Decisions: [ ] Yes [ ] No

- Real Estate Transactions: [ ] Yes [ ] No

- Personal Property Transactions: [ ] Yes [ ] No

- Healthcare Decisions: [ ] Yes [ ] No

- Other (Specify): ____________________________

Section 5: Special Instructions

- Instructions: _______________________________________________________

Section 6: Duration

- Effective Date: _______________________

- Termination Date (if applicable): _______________________

- This Power of Attorney is:

- Durable (remains in effect if I become incapacitated)

- Non-Durable

Section 7: Signatures

- Principal’s Signature: _______________________ Date: _______________________

- Agent’s Signature: _______________________ Date: _______________________

- Alternate Agent’s Signature (if applicable): _______________________ Date: _______________________

Section 8: Acknowledgment

- Notary Public’s Acknowledgment: State of California, County of ________________ On _______________________, before me, _______________________, Notary Public, personally appeared [Name of Principal], who proved to me on the basis of satisfactory evidence to be the person(s) whose name(s) is/are subscribed to the within instrument and acknowledged to me that he/she/they executed the same in his/her/their authorized capacity(ies), and that by his/her/their signature(s) on the instrument the person(s), or the entity upon behalf of which the person(s) acted, executed the instrument. I certify under PENALTY OF PERJURY under the laws of the State of California that the foregoing paragraph is true and correct. Witness my hand and official seal: Signature _______________________ (Seal)

This sample California Power of Attorney form is designed to be comprehensive and adaptable to various needs. It is crucial to ensure that all information is accurate and that the form is notarized to be legally binding. It is also advisable to consult with a legal professional before finalizing the document.

Note: This form is a sample and may need to be customized to fit specific circumstances. It is important to follow California state laws and requirements when drafting and executing a Power of Attorney.

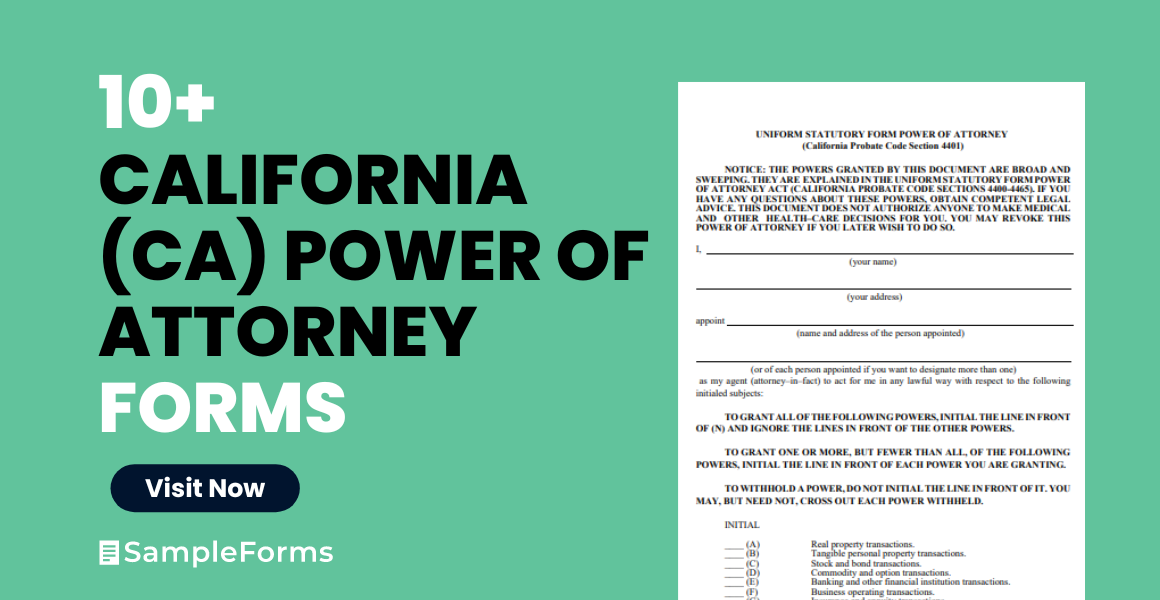

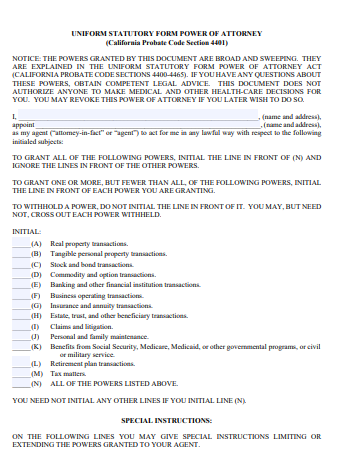

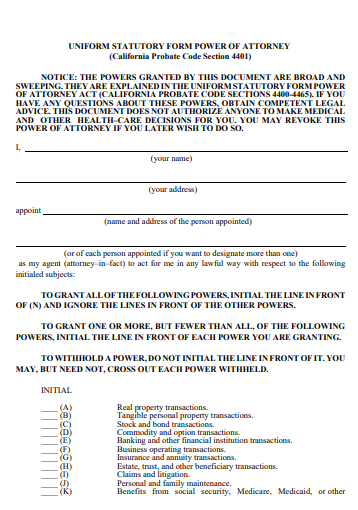

1. Free California Power of Attorney Form

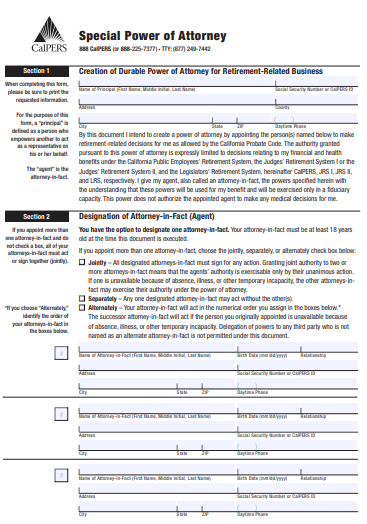

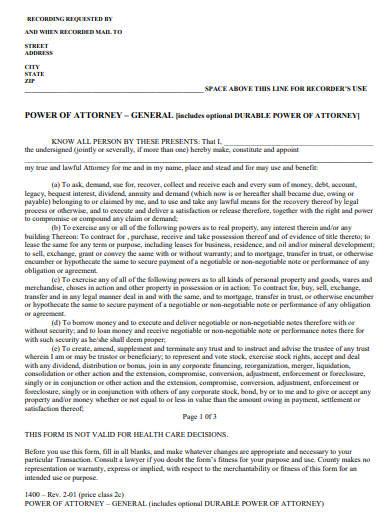

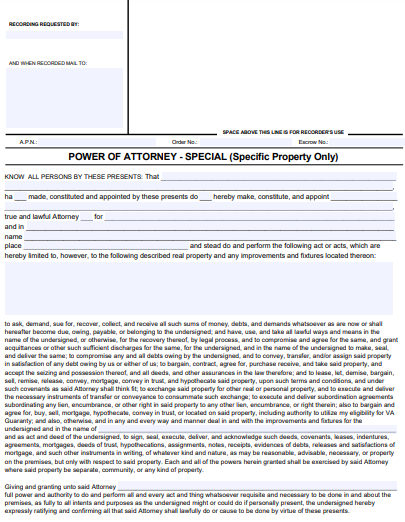

2. California Special Power of Attorney Form

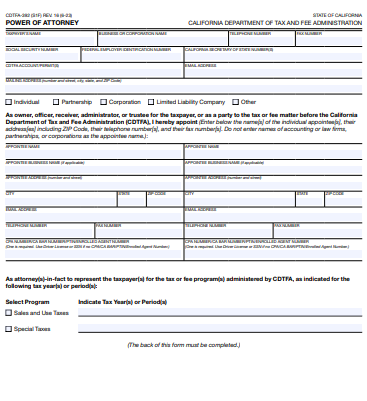

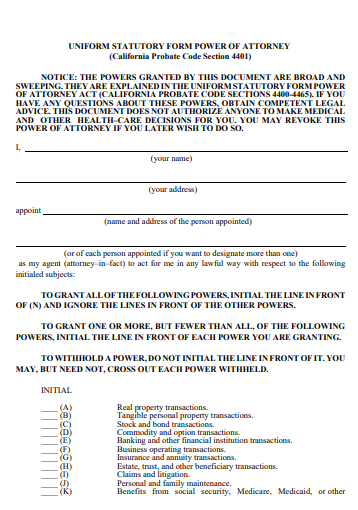

3. California Blank Power of Attorney Form

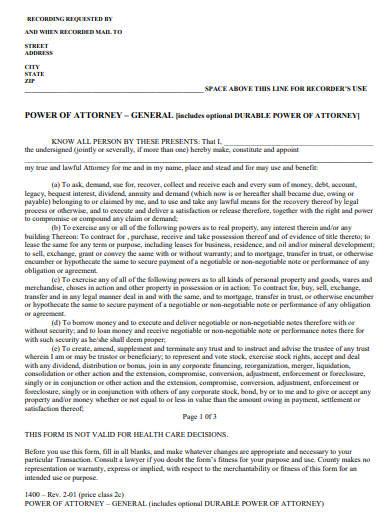

4. California General Power of Attorney Form

5. California Standard Power of Attorney Form

6. California General Power of Attorney Form

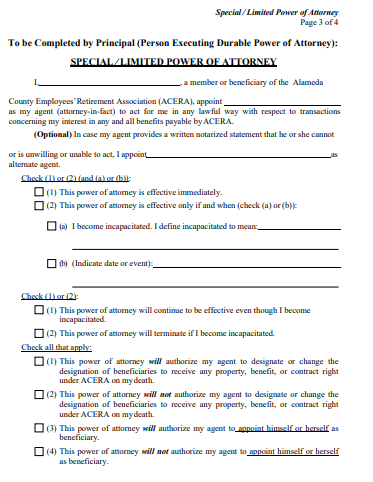

7. California Limited Power of Attorney Form

8. California Printable Power of Attorney Form

9. California Health care Power of Attorney Form

10. California Durable Power of Attorney Form

11. California Specific Power of Attorney Form

Where can I get a California power of attorney form?

To obtain a California Power of Attorney (POA) form, you have several options:

Online Legal Services:

- Websites like LegalZoom, Rocket Lawyer, and Nolo offer customizable POA forms tailored to California law. These platforms often provide guidance to help you choose the right type of POA for your needs.

California State Bar or Local Bar Associations:

- The State Bar of California or local bar associations may provide resources or references to where you can obtain POA forms.

Attorneys Specializing in Estate Planning or Elder Law:

- A lawyer specializing in estate planning or elder law can draft a POA that is specific to your situation. This option is particularly useful if your circumstances are complex.

Local Senior Centers or Legal Aid Societies:

- These organizations often have resources available for seniors, including standard POA forms and legal advice.

Office Supply Stores:

- Stores like Staples or Office Depot may carry legal form books that include POA forms.

Public Libraries:

- Many libraries have legal form books that you can photocopy or reference.

Online Government Resources:

- Some California government websites may provide POA forms or links to where such forms can be obtained.

Financial Institutions:

- If the POA is for financial matters, some banks and financial institutions provide their own POA forms that are specific to their requirements.

Remember, while obtaining a POA form is a crucial step, ensuring that it meets all legal requirements and is properly executed is equally important. It’s often advisable to consult with a legal professional, especially for more complex situations.

Can I do a power of attorney myself California?

Yes, you can create a Power of Attorney (POA) by yourself in California. However, it’s important to follow certain steps to ensure it’s legally valid and meets your specific needs. Here’s a general guide:

- Understand the Types of POA: Familiarize yourself with the different types of POA (e.g., General, Durable, Medical) to determine which one suits your needs.

- Choose Your Agent Wisely: Select a person you trust to act as your agent (also known as an Attorney-in-Fact). This person will make decisions on your behalf.

- Draft the POA Document: You can draft a POA document using online templates or forms from reputable legal websites. Ensure the form complies with California law.

- Be Specific About Powers Granted: Clearly outline the powers you are granting to your agent. Specify any limitations or conditions.

- Comply with California Legal Requirements:

- Capacity: You must be mentally competent when you sign the POA.

- Voluntariness: The POA must be signed voluntarily, without any coercion.

- Witnesses: California law requires that your POA be either notarized or signed by two adult witnesses. The witnesses must be adults and cannot be the agent, the notary, your healthcare provider, or an employee of your healthcare provider.

- Sign and Date the Document: Once the POA is drafted, sign and date it in front of the required witnesses or a notary public.

- Notarization (if applicable): For some types of POA, notarization may be required or recommended for additional legal validity.

- Distribute Copies: Provide a copy to your agent and any alternate agents. It’s also wise to inform relevant parties (like financial institutions or healthcare providers) about the POA.

- Regular Review and Update: Regularly review your POA and update it as necessary to reflect any changes in your situation or wishes.

While it’s possible to do a POA yourself, if your situation is complex or you have specific legal questions, it’s advisable to consult with an attorney specializing in estate planning or elder law. They can provide personalized advice and ensure that your POA meets all legal requirements and effectively represents your interests.

What are the 4 types of power of attorney in California?

In California, there are four primary types of Power of Attorney (POA), each serving different purposes and granting varying levels of authority:

-

General Power of Attorney:

- Scope: Grants broad powers to the agent (Attorney-in-Fact) to handle a wide range of financial and business transactions on behalf of the principal.

- Limitation: It becomes invalid if the principal becomes incapacitated, unless it is specified as durable.

-

Durable Power of Attorney:

- Key Feature: Remains in effect or becomes effective when the principal becomes incapacitated.

- Scope: Can be general, granting broad powers, or limited, granting specific powers.

- Purpose: Often used for estate planning and situations where the principal anticipates potential incapacity.

-

Limited (or Special) Power of Attorney:

- Scope: Grants specific, limited powers to the agent for particular tasks or for a limited time.

- Common Uses: Handling specific financial transactions, real estate management, or other defined duties.

- Expiration: Typically ends when the specific task is completed or at a time specified in the document.

-

Medical Power of Attorney (Advance Health Care Directive in California):

- Scope: Allows the agent to make healthcare decisions on behalf of the principal if they become unable to do so.

- Includes: Directions regarding end-of-life care, life-sustaining treatment preferences, and other healthcare choices.

- Note: In California, this is often combined with a living will in a document called an Advance Health Care Directive.

Each type of POA serves a distinct purpose and can be tailored to meet the specific needs and circumstances of the principal. It’s important to choose the right type of POA to ensure that your affairs are managed as you intend, especially in situations of incapacity or absence. Consulting with a legal professional can provide clarity and guidance in selecting and drafting the appropriate POA for your situation.

How do I appoint power of attorney in California?

Appointing a Power of Attorney (POA) in California involves several key steps to ensure that the document is legally valid and reflects your intentions. Here’s a step-by-step guide:

-

Determine the Type of POA Needed:

- Decide whether you need a General, Durable, Limited, or Medical POA based on your specific requirements.

-

Choose Your Agent:

- Select a person you trust to act on your behalf. This should be someone reliable and capable of handling the responsibilities.

-

Draft the POA Document:

- You can use a template from a reputable online source, get a form from an attorney, or draft one yourself. Ensure it complies with California laws.

- Clearly state the powers you are granting to your agent. Be specific about what they can and cannot do.

-

Meet Legal Requirements:

- You must be mentally competent when you sign the document.

- The POA must be signed voluntarily, without any undue influence or pressure.

-

Sign the Document:

- In California, your POA must be either notarized or signed by two adult witnesses. The witnesses must be adults and cannot be the agent, the notary, your healthcare provider, or an employee of your healthcare provider.

- If it’s a Medical POA (Advance Health Care Directive), it needs to be either notarized or signed by two witnesses.

-

Notarization (if applicable):

- While not always mandatory, notarization can add a layer of legal validity and is highly recommended, especially for financial POAs.

-

Inform Your Agent:

- Discuss your wishes and expectations with the person you’ve appointed as your agent. Make sure they understand their responsibilities and are willing to act on your behalf.

-

Distribute Copies:

- Provide a copy of the signed POA to your agent and any alternate agents. It’s also wise to inform relevant institutions (like banks or healthcare providers) about the POA.

-

Store the Document Safely:

- Keep the original document in a secure but accessible place. Inform your agent and a trusted family member or friend where it is stored.

-

Regular Review and Update:

- Regularly review your POA and update it as necessary to reflect any changes in your situation or preferences.

Remember, while you can draft and appoint a POA on your own, consulting with a legal professional is advisable, especially if your situation is complex. An attorney can help ensure that your POA is legally sound and effectively represents your interests.

How much does a power of attorney cost in California?

The cost of obtaining a Power of Attorney (POA) in California can vary widely based on several factors. Here’s a breakdown of potential costs:

DIY Forms:

- If you choose to use a do-it-yourself form from a reputable online source or a legal forms book, the cost can be relatively low, often ranging from free to around $100. This cost primarily covers the form itself and any guidance provided by the website or book.

Online Legal Services:

- Websites like LegalZoom, Rocket Lawyer, or Nolo offer POA forms with more structured guidance and support. These services can range from approximately $35 to $100.

Notary Fees:

- If your POA requires notarization, notaries in California typically charge up to $15 per signature. Some financial institutions offer free or discounted notary services for their customers.

Attorney Fees:

- If you decide to have an attorney draft your POA, the cost can vary significantly based on the complexity of your needs and the attorney’s rates. In California, attorney fees for drafting a POA can range from about $250 to $500 or more. For more complex estates or specialized situations, the cost could be higher.

Additional Costs:

- If your situation requires additional legal advice or if you need to create other estate planning documents in conjunction with your POA, there may be additional costs.

It’s important to choose the option that best suits your needs and budget. While DIY or online legal services can be cost-effective, consulting with an attorney can provide personalized advice and peace of mind, especially in complex situations. Remember, the cost of not having a POA, or having one that is poorly drafted, can be much higher in the long run, especially if it leads to legal challenges.

Do you need a lawyer to get a power of attorney in California?

In California, you are not legally required to have a lawyer to create a Power of Attorney (POA). Many people successfully complete a POA without legal assistance by using reliable templates or forms from reputable sources. However, there are several factors to consider when deciding whether to consult a lawyer:

Complexity of Your Situation:

- If your financial or personal affairs are complex, involving multiple assets, businesses, or specific wishes for healthcare decisions, a lawyer can help ensure that your POA accurately reflects your intentions and is legally sound.

Legal Expertise:

- A lawyer can provide expert advice on the type of POA that best suits your needs, whether it’s a General, Durable, Limited, or Medical POA. They can also ensure that your document complies with current California laws.

Customization:

- While standard forms can be sufficient for simple situations, a lawyer can help customize your POA to address specific concerns or scenarios, which might not be adequately covered by a generic form.

Peace of Mind:

- Consulting a lawyer can provide peace of mind, especially if you have concerns about the legal validity of your document or if you want to ensure that your wishes are clearly articulated and legally enforceable.

Avoiding Future Disputes:

- A lawyer can help draft a POA in a way that minimizes the likelihood of future disputes among family members or confusion about your intentions, particularly in situations where your decisions might be contentious.

Cost vs. Benefit:

- While hiring a lawyer involves a cost, it may be a worthwhile investment to ensure that your POA is effective and your interests are well-protected.

In summary, while a lawyer is not required for a POA in California, seeking legal advice can be beneficial, especially in complex situations or when you want to ensure that the document is comprehensive and legally robust.

How to Prepare a California Power of Attorney Form

Preparing a Power of Attorney (POA) form in California is a crucial process that allows you to appoint someone to make decisions on your behalf. This guide will walk you through each step to ensure your POA is valid and effective.

Step 1: Choose the Right Type of POA

- Determine the Type: Decide whether you need a General, Limited, Durable, or Medical POA based on your requirements.

- Understand the Differences: Each type serves a different purpose, so it’s important to understand which one aligns with your needs.

Step 2: Select Your Agent

- Choose Wisely: Your agent should be someone you trust implicitly, such as a family member or close friend.

- Consider Their Ability: Ensure they are capable of making decisions that align with your best interests.

Step 3: Fill Out the Form

- Principal Information: Enter your full name, address, and contact details.

- Agent Information: Provide the full name, address, and contact details of your chosen agent.

- Alternate Agent (Optional): If desired, appoint an alternate agent and provide their details.

- Powers Granted: Specify the powers you are granting, such as financial decisions, healthcare, or property management.

- Special Instructions: Add any specific instructions or limitations to the agent’s powers.

- Duration: State when the POA will become effective and if/when it will expire.

Step 4: Define the Scope

- Be Specific: Clearly outline the extent of powers granted to avoid any ambiguity.

- Consider Limitations: You may want to limit certain powers or set conditions under which the POA is operational.

Step 5: Sign and Date the Form

- Principal’s Signature: Sign the form in the presence of a notary public or required witnesses.

- Agent’s Acknowledgment: Have your agent sign the form, acknowledging their acceptance of the responsibilities.

Step 6: Notarization

- Find a Notary Public: In California, notarization is often required for a POA to be legally valid.

- Complete the Acknowledgment: The notary will fill out the acknowledgment section and affix their seal.

Step 7: Distribute Copies

- Provide Copies: Give a copy to your agent, any alternate agents, and keep one for your records.

- Inform Relevant Parties: Notify your bank, healthcare provider, or any other relevant parties about the POA.

Step 8: Review and Update Regularly

- Regular Reviews: Revisit your POA periodically to ensure it still reflects your wishes.

- Update as Needed: Make changes if your situation or preferences change.

Creating a Power of Attorney in California is a straightforward process when you follow these steps. Remember, this document grants significant authority to another person, so it’s important to approach this task with care and consideration.

Tips for Using an Effective California Power of Attorney Form

Creating an effective Power of Attorney (POA) form in California is essential for ensuring your affairs are handled according to your wishes. Here are some tips to help you make the most out of your California POA form.

1. Understand the Different Types of POA

- General vs. Specific: A General POA grants broad powers, while a Specific POA is limited to certain acts.

- Durable vs. Non-Durable: A Durable POA remains in effect if you become incapacitated, whereas a Non-Durable POA does not.

2. Choose the Right Agent

- Trust and Reliability: Select someone you trust implicitly and who is reliable.

- Understanding of Duties: Ensure they understand the responsibilities and are willing to act in your best interest.

3. Be Specific in Granting Powers

- Clear Terms: Clearly define what powers the agent has. Vague language can lead to confusion and misuse.

- Limitations: Consider setting limits on the agent’s powers to prevent abuse.

4. Include a Revocation Clause

- Flexibility: Ensure there is a clause that allows you to revoke the POA.

- Conditions for Revocation: Specify the conditions under which the POA can be revoked.

5. Regularly Update Your POA

- Changing Circumstances: Update your POA to reflect changes in your life, such as financial status or relationships.

- Review Periodically: Even if circumstances haven’t changed, review your POA regularly to ensure it still aligns with your wishes.

6. Ensure Legal Compliance

- State Laws: Make sure your POA complies with California state laws.

- Professional Advice: Consider consulting with a legal professional to ensure all legal requirements are met.

7. Notarize and Witness the Document

- Notarization: In California, notarization is often required for a POA to be legally valid.

- Witnesses: Having witnesses can add an extra layer of legal protection.

8. Communicate with Your Agent

- Discuss Responsibilities: Have a thorough discussion with your agent about what is expected.

- Provide Guidance: Offer guidance on how you would like certain situations to be handled.

9. Keep the Document Accessible

- Safe Storage: Keep the original document in a safe, accessible place.

- Copies: Provide copies to your agent and any relevant institutions, like your bank or healthcare provider.

10. Consider a Springing POA

- Conditional Activation: A “springing” POA becomes effective only under conditions you specify, such as incapacitation.

An effective California Power of Attorney form is a powerful tool for managing your affairs. By following these tips, you can ensure that your POA is clear, legally compliant, and truly reflective of your wishes.

What Are the Rules for Power of Attorney in California?

In California, POA rules require mental competence, voluntary signing, notarization or two adult witnesses, and compliance with state-specific legal provisions.

Is a California Power of Attorney Valid in All States?

A California POA is generally recognized in other states, but it’s advisable to check specific state laws, especially for real estate or healthcare decisions.

Can You Have More Than One Power of Attorney in California?

Yes, in California, you can appoint multiple agents in a POA, either to act jointly or separately in different matters.

What Is the Best Power of Attorney to Have in California?

The best POA in California depends on individual needs; commonly, a Durable POA is preferred for its effectiveness during incapacity.

Who Signs a Power of Attorney in California?

In California, the principal (person granting the power) and the agent must sign the POA, with notarization or two adult witnesses.

Understanding and creating a California Power of Attorney form requires careful consideration of state-specific rules and personal circumstances. Whether opting for a general, durable, or medical POA, it’s crucial to ensure legal compliance and clear communication with appointed agents. This guide and tips provide a foundational approach to effectively manage and safeguard your affairs through a POA in California.

Related Posts

-

10+ Free New Hampshire (NH) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Nevada (NV) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Nebraska (NE) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Montana (MT) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Missouri (MO) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Minnesota (MN) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Mississippi (MS) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Massachusetts (MA) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Maryland (MD) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Maine (ME) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Louisiana (LA) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Kentucky (KY) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Kansas (KS) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Iowa (IA) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Indiana (IN) Power of Attorney Form Download – How to Create Guide, Tips