An Agreement Form is a critical tool for securing terms in business transactions, and the Sales Agreement Form plays a pivotal role in defining rights and obligations. This guide provides examples, insights, and actionable tips for creating a robust Buy-Sell Agreement Form. Whether for partnerships or ownership transfers, having a well-drafted form ensures clarity, mitigates disputes, and streamlines processes. Dive into practical examples to safeguard your business interests effectively.

Download Buy-Sell Agreement Form Bundle

What is Buy-Sell Agreement Form?

A Buy-Sell Agreement Form is a legal document outlining the terms of transferring ownership between business partners. It safeguards interests, ensures continuity, and defines roles during buyouts or sales. Such agreements clarify rights, valuation processes, and sale terms.

Buy-Sell Agreement Format

Agreement Details

Agreement Title: ____________________________

Agreement Number: ____________________________

Effective Date: ____________________________

Parties Involved

Buyer Name: ____________________________

Buyer Address: ____________________________

Seller Name: ____________________________

Seller Address: ____________________________

Asset Details

Item/Asset Description: ____________________________

Quantity: ____________________________

Price: ____________________________

Terms and Conditions

Payment Terms: ____________________________

Transfer of Ownership Date: ____________________________

Signature Section

Buyer Signature: ____________________________ Date: ______________________

Seller Signature: ____________________________ Date: _____________________

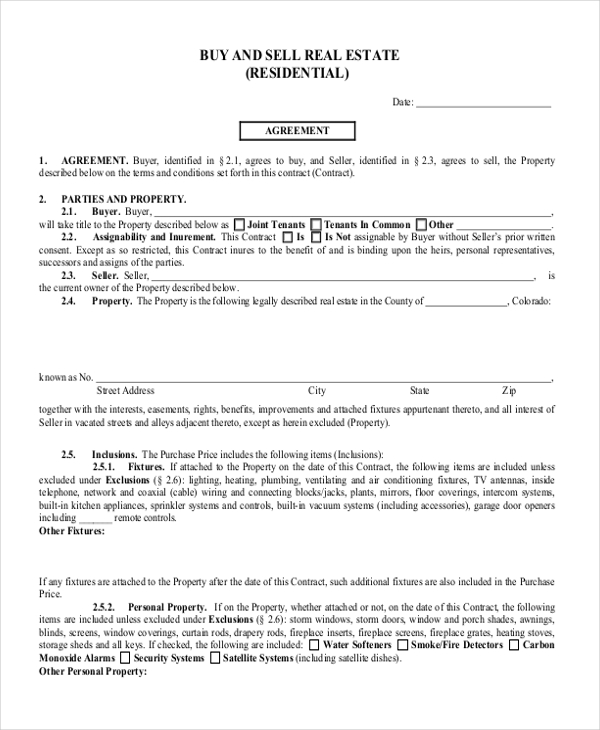

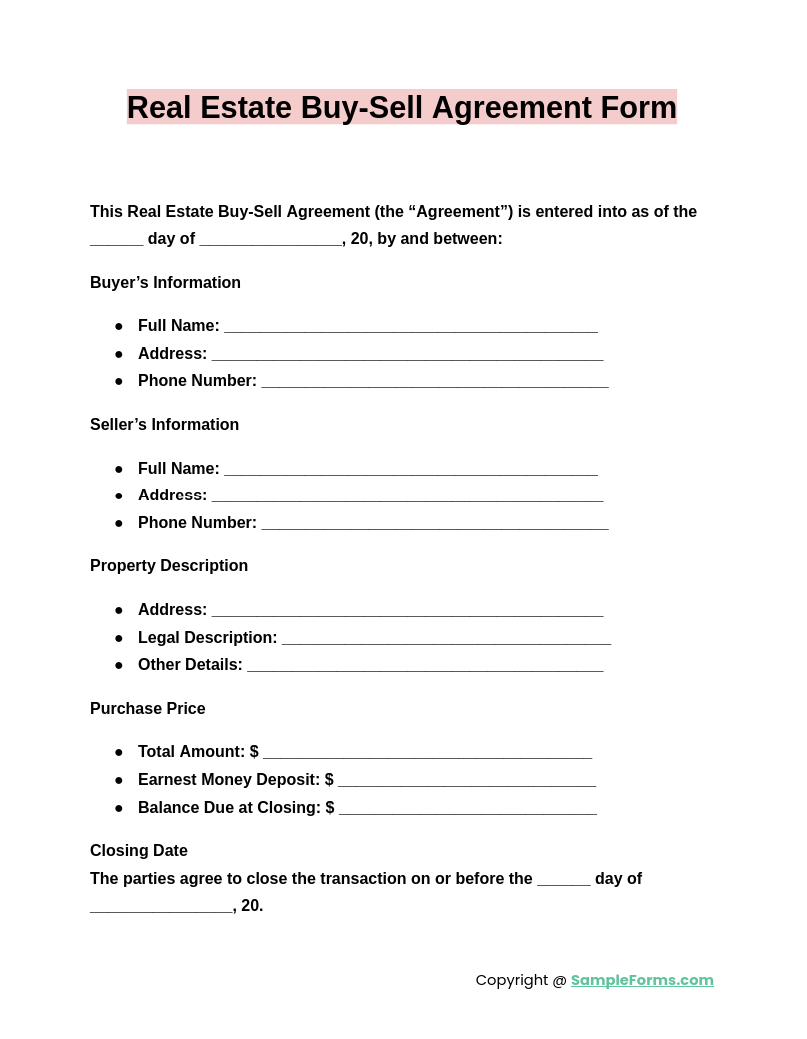

Real Estate Buy-Sell Agreement Form

A Real Estate Buy-Sell Agreement Form establishes legal terms for property transactions, ensuring transparency. It simplifies ownership transfer while protecting interests. Use alongside a Business Agreement Form for related business property dealings.

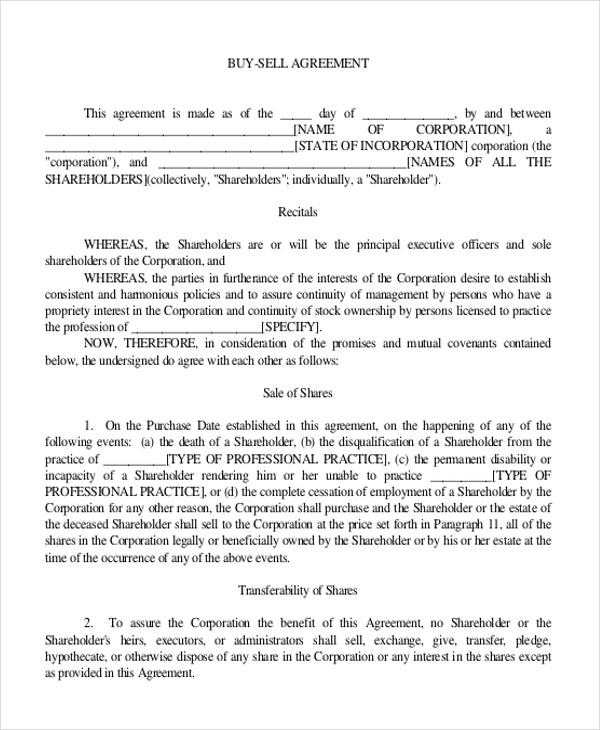

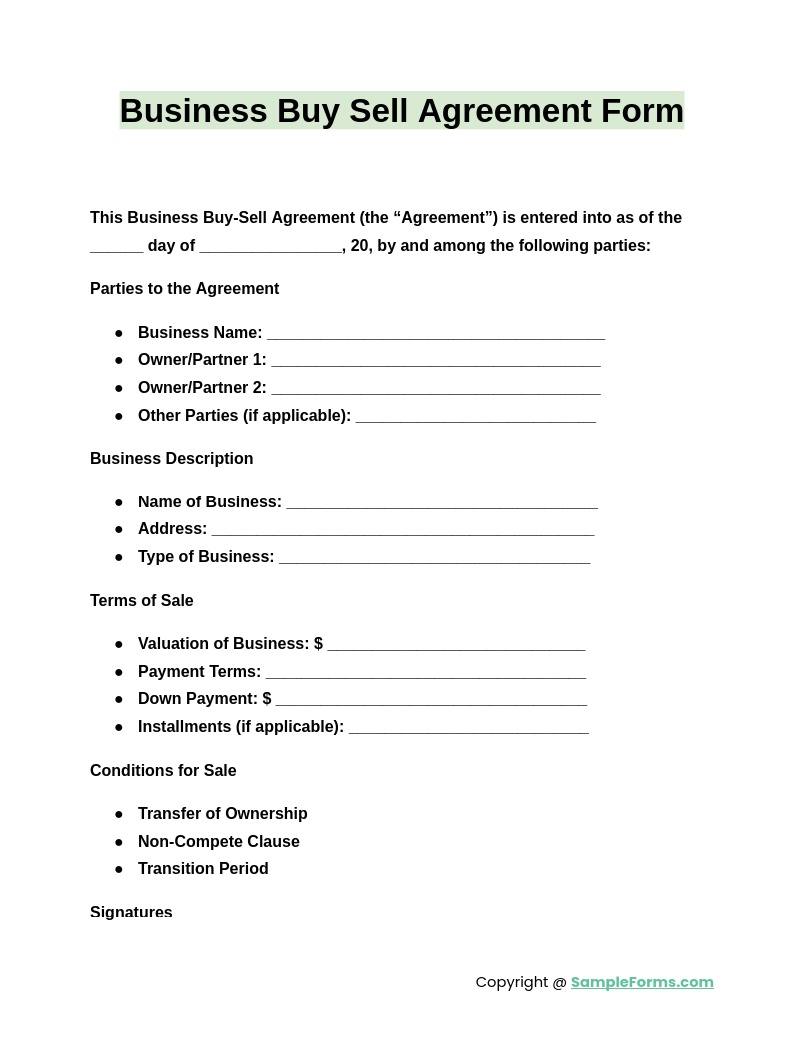

Business Buy-Sell Agreement Form

A Business Buy-Sell Agreement Form outlines ownership transfer terms in partnerships or corporations. It protects stakeholders and prevents disputes. Complement with a Personal Loan Agreement Form for financing arrangements.

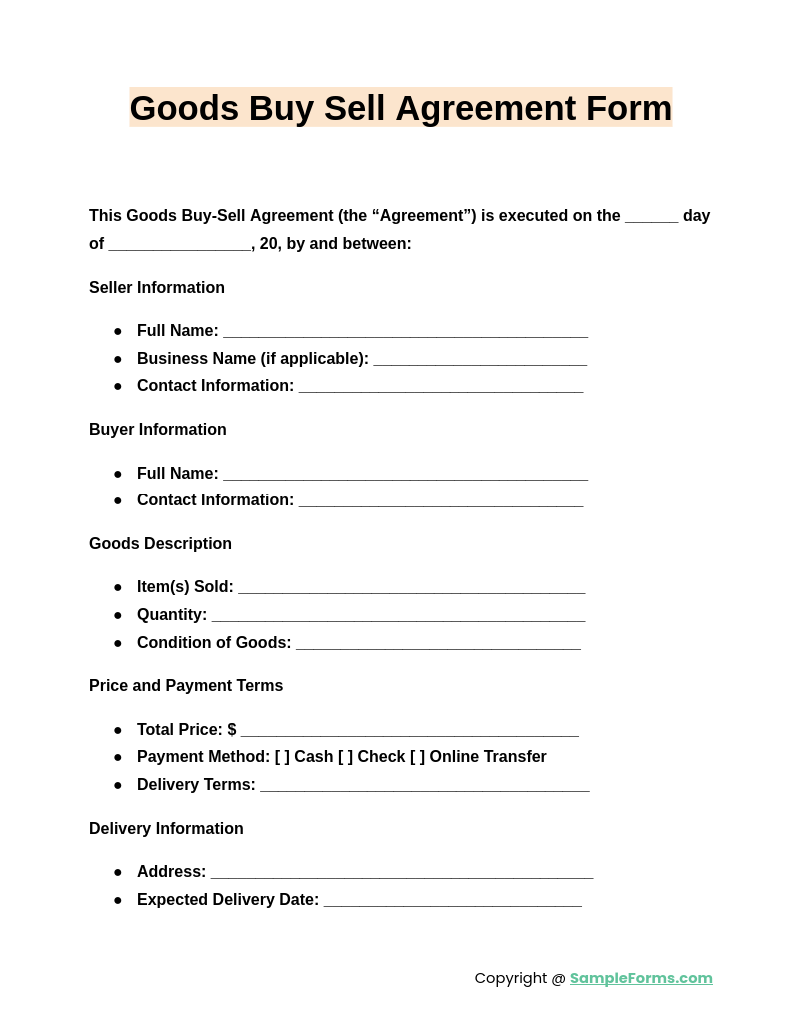

Goods Buy-Sell Agreement Form

A Goods Buy-Sell Agreement Form defines the terms of exchanging tangible items, safeguarding both buyer and seller rights. Pair it with a Hold Harmless Agreement Form to address liability issues.

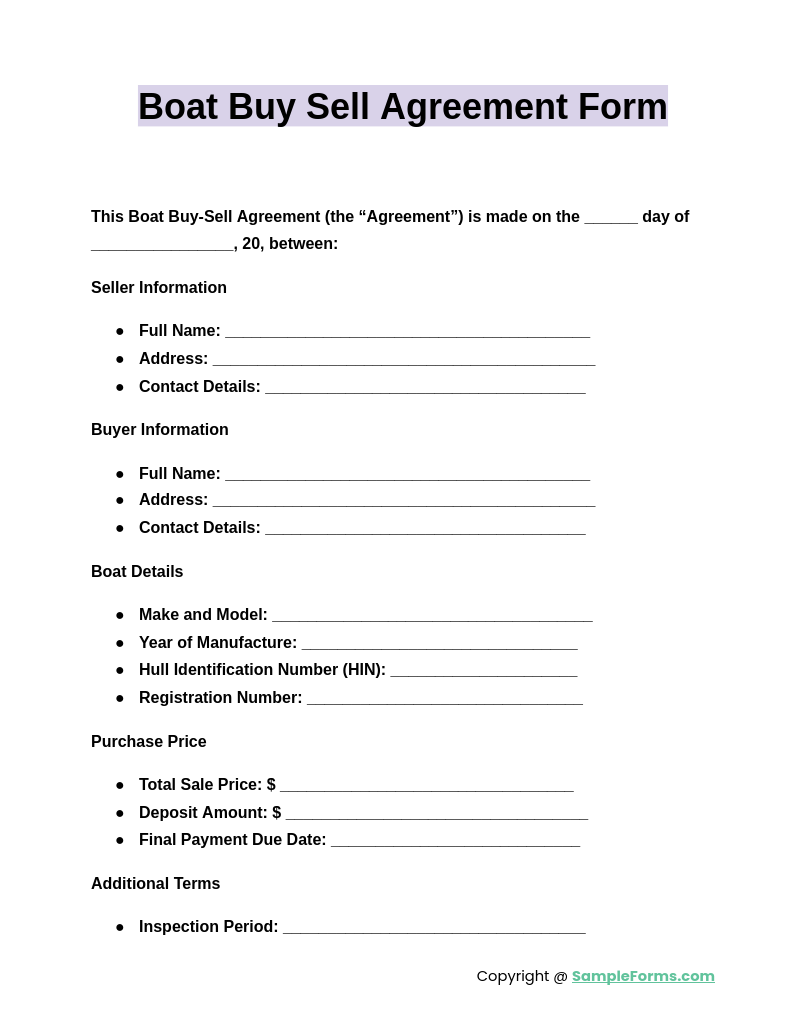

Boat Buy-Sell Agreement Form

A Boat Buy-Sell Agreement Form secures the purchase and sale terms of watercraft, ensuring compliance and transparency. Combine with a Consignment Agreement Form for additional selling arrangements if necessary.

Browse More Buy-Sell Agreement Forms

Buy Sell Agreement Template

Real Estate Buy And Sell Agreement

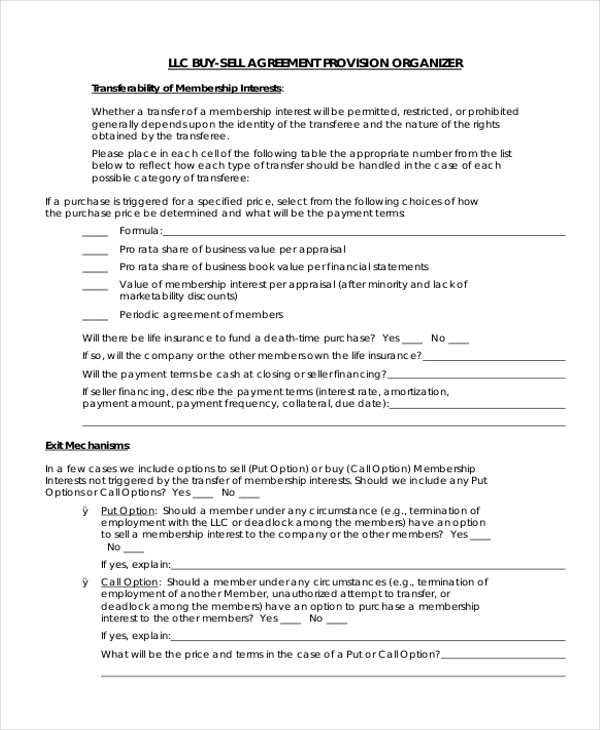

LLC Buy-Sell Agreement

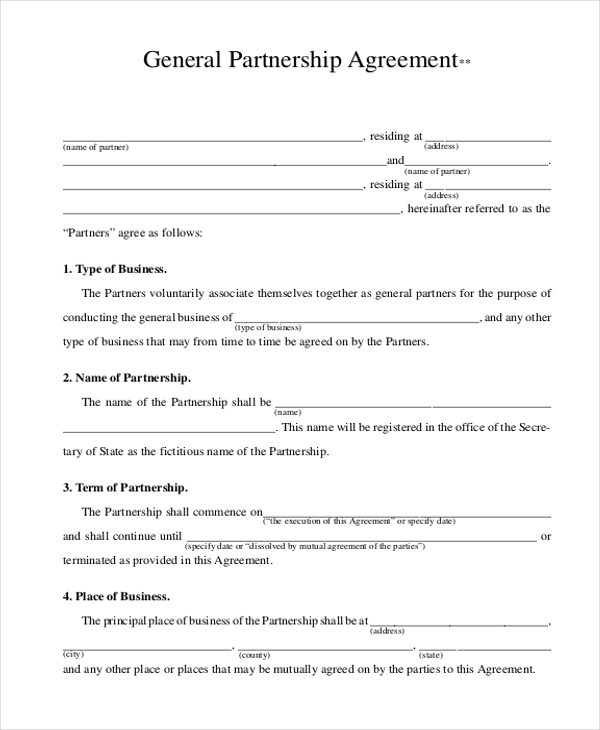

General Partnership Agreement

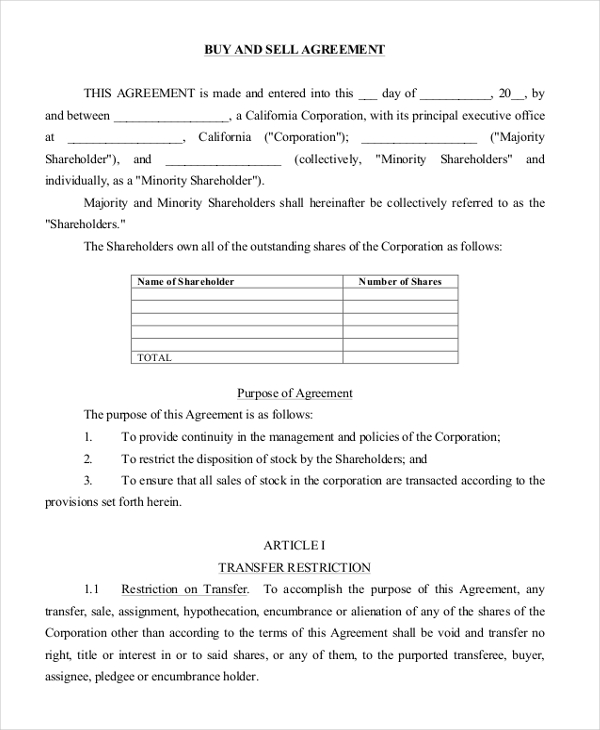

Buy-Sell Agreement

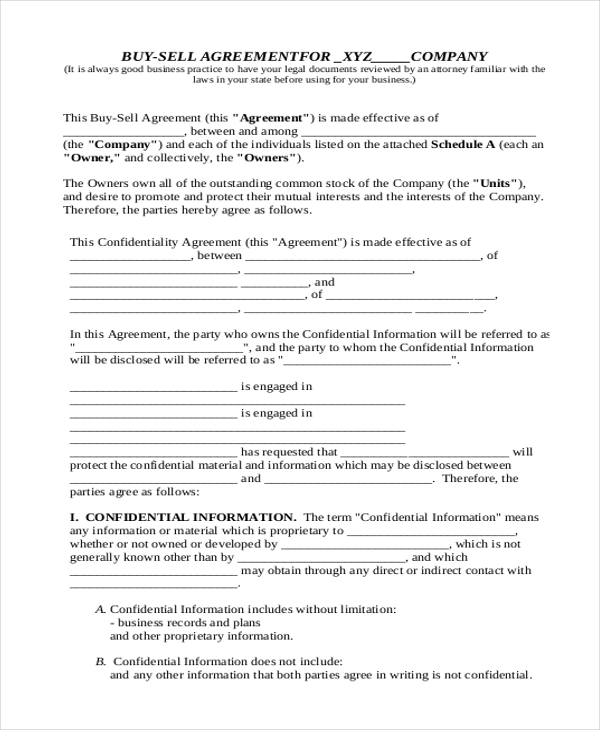

sell agreementhere which comes with sections on all important clauses of such an agreement like business type, the naBusiness

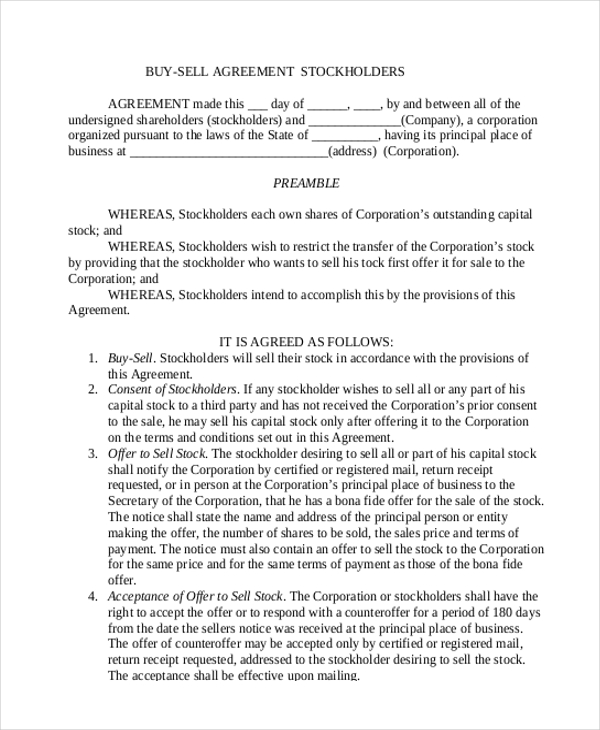

Stockholder Buy-Sell Agreement

Buy-Sell Agreement

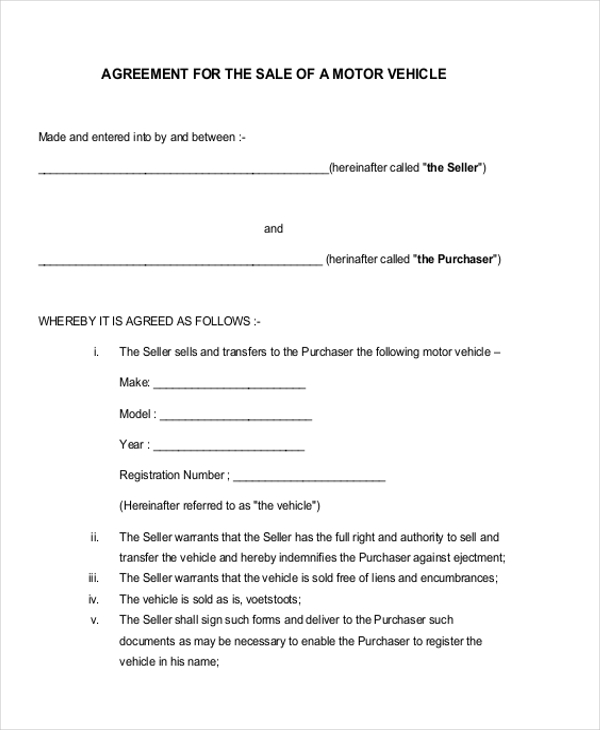

Vehicle Buy-Sell Agreement

This buy-sell agreement is regarding the sale of a motor vehicle. It contains basic information on the vehicle as well as a warranty from the seller regarding the right and authority to sell the car.

Buy-Sell Agreement Form

How do you write a buy-sell agreement?

Writing a buy-sell agreement ensures clarity and smooth ownership transfers. Follow these steps for a legally sound document:

- Define Ownership Terms: Outline details like shares, assets, or rights being transferred. Consider templates like an Apprenticeship Agreement Form for formatting.

- Include Triggering Events: Specify situations like death, retirement, or disputes that initiate the agreement.

- Valuation Methods: Decide on a method for determining the business’s value, such as market value or agreed-upon figures.

- Roles and Responsibilities: Clearly outline buyer and seller obligations to avoid conflicts.

- Legal Validation: Consult legal experts to ensure the agreement complies with laws and protects all parties.

What are the disadvantages of a buy-sell agreement?

Buy-sell agreements can have drawbacks if not carefully drafted. Consider these key points:

- Complexity of Terms: Overly detailed agreements may confuse parties. Tools like an Investment Agreement Form streamline terms.

- Potential for Disputes: Misunderstandings about valuation or terms can lead to conflicts.

- Limited Flexibility: Fixed terms may not adapt well to unforeseen situations.

- Cost of Drafting: Professional legal assistance adds to initial expenses.

- Execution Challenges: Implementing the agreement during critical times may be complex.

What happens if you don’t have a buy-sell agreement?

Lacking a buy-sell agreement exposes businesses to risks during ownership transitions. Key consequences include:

- Disputes Among Owners: Without clear terms, disagreements may arise, disrupting operations.

- Unclear Ownership Rights: Undefined roles create confusion, potentially requiring a Purchase Agreement Form to resolve.

- Delayed Transitions: Absence of predefined processes can stall ownership changes.

- Financial Instability: Unplanned changes may impact financial health and market confidence.

- Legal Vulnerability: Risk of lawsuits due to unclear or disputed terms.

How do you fill out a buy-sell agreement?

Filling out a buy-sell agreement ensures it is clear, valid, and enforceable. Follow these steps:

- Enter Party Details: Include full names and contact information for all involved. Reference a Guarantor Agreement Form for financial commitments.

- Specify Ownership Shares: Clearly define the ownership percentage or assets being transferred.

- Outline Trigger Events: Document specific conditions activating the agreement, such as retirement or sale.

- Add Payment Terms: Detail financial arrangements, timelines, and valuation methods.

- Obtain Signatures: Ensure all parties, including witnesses, sign for legal validity.

What needs to be in a buy-sell agreement?

A buy-sell agreement must include essential components to ensure its effectiveness. Key elements include:

- Ownership Terms: Define shares or assets involved in the transaction. Adapt layouts like a Custody Agreement Form if necessary.

- Trigger Events: Specify conditions activating the agreement, such as death or retirement.

- Valuation Clause: Include methods to calculate the value of the business or shares.

- Dispute Resolution: Outline processes for resolving conflicts, such as mediation or arbitration.

- Signatures and Dates: Ensure all parties and witnesses sign to validate the agreement legally.

Does a buy-sell agreement need to be notarized?

Notarizing a buy-sell agreement ensures legal validity, but it’s not always required. A Deposit Agreement Form may provide additional clarity for parties involved.

Who is the beneficiary of a buy-sell agreement?

The beneficiary is typically the remaining business owners or heirs. In specific cases, a Land Purchase Agreement Form may outline related beneficiaries.

Who drafts a buy-sell agreement?

Legal experts or business advisors usually draft buy-sell agreements. Templates like a Lease Agreement Form can be referenced for structuring terms.

Are buy-sell agreements taxable?

Buy-sell agreements may have tax implications depending on ownership transfer methods. Reference an Employment Agreement Form for related employment considerations.

How many policies are needed for a buy sell agreement?

The number of policies depends on the participants. For multi-party agreements, tools like a Sublease Agreement Form can provide structural guidance.

Can a purchase agreement be used as a bill of sale?

A purchase agreement can outline sale terms but doesn’t replace a bill of sale. A Loan Agreement Form provides financial clarity in similar contexts.

Do both parties need to be present for a bill of sale to be notarized?

Yes, both parties must be present for notarization. A Student Loan Agreement Form offers an example of mutual consent.

What is the best way to fund a buy sell agreement?

Funding methods include life insurance, savings, or loans. A Marketing Agreement Form outlines related strategies to support financial planning.

What are the triggering events for buy sell agreement?

Triggering events include death, retirement, or disability. A Cooperation Agreement Form can specify collaborative terms for addressing these events.

What is another name for a buy sell agreement?

A buy-sell agreement is also called a Shareholder Agreement Form, especially in corporate contexts, to define ownership rights and transitions.

In conclusion, the Buy-Sell Agreement Form serves as a foundation for successful business transactions. From defining terms to ownership transitions, it provides clarity and legal security. Tools like a Partnership Agreement Form further ensure mutual understanding and adherence to agreed terms, promoting a smooth operational environment.

Related Posts

-

FREE 50+ Mortgage Forms Download – How to Create Guide, Tips

-

FREE 4+ Real Estate Listing Information Forms in PDF | MS Word

-

FREE 7+ Garage (Parking) Rental Agreement Forms in PDF | MS Word

-

FREE 7+ Office Lease Agreement Forms in PDF | MS Word

-

FREE 4+ Salon Booth Rental Agreement Forms in PDF | MS Word

-

FREE 5+ Roommate Rental Agreement Forms in PDF | MS Word

-

Electrical Subcontractor Agreement Form

-

FREE 10+Non-Disclosure Forms in PDF | MS Word

-

FREE 5+ Construction Subcontractor Agreement Forms in PDF | MS Word

-

FREE 5+ Real Estate Lease Guarantee Co-Signer Agreement Forms in PDF | MS Word

-

FREE 5+ Lease with an Option to Purchase Agreement Forms in PDF | MS Word

-

FREE 7+ Realtors Lease Agreement Forms in PDF

-

FREE 10+ Subordination Agreement Forms in PDF | MS Word

-

FREE 10+ Condominium Lease Agreement Forms in PDF | MS Word

-

FREE 5+ Lottery Agreement Forms in PDF | MS Word