A Business Power of Attorney (POA) is a legal document that designates an individual, known as the Agent, to handle business-related decisions on behalf of another, the Principal. This powerful tool comes in various forms, tailored for different business needs, such as operational authority or financial management. Crafting a Business POA involves careful consideration, ensuring it aligns with legal standards and the Principal’s objectives. Here, we’ll explore its meaning, types, and creation, offering practical tips and examples to guide you.

What is the Business Power of Attorney Form ? – Definition

A Business Power of Attorney (POA) form is a legal document that grants an individual, often referred to as the agent or attorney-in-fact, the authority to make business decisions and execute actions on behalf of another individual or entity, known as the principal. This form is pivotal for business continuity in instances where the principal is unable to manage their affairs due to absence, illness, or incapacitation.

What is the Meaning of the Business Power of Attorney Form?

A Business Power of Attorney Form is a legal document that designates an individual, known as the agent, to make decisions and act on behalf of a business entity, the principal, when the latter is unable to do so. This form delineates the agent’s scope of authority, whether it’s handling financial matters, making legal decisions, or managing operational tasks. It ensures business continuity during periods of the principal’s absence, incapacity, or other situations preventing direct involvement. It’s a critical component for any business’s contingency planning, making it essential for sustained operations and decision-making in unforeseen circumstances.

What is the best Sample Business Power of Attorney Form?

PRINCIPAL INFORMATION:

Full Legal Name: _________________ Title/Position: _________________ Business Name: _________________ Business Address: _________________ City: _________________ State: _________________ Zip: _________________

AGENT INFORMATION:

Full Legal Name: _________________ Address: _________________ City: _________________ State: _________________ Zip: _________________

SPECIAL INSTRUCTIONS:

(If any special instructions are to be included in this Power of Attorney, describe them here.)

POWERS GRANTED:

(Please initial next to each power granted to your Agent.)

_____ Conduct banking transactions. _____ Buy or sell real estate. _____ Enter into binding contracts. _____ Purchase or sell personal property. _____ Manage business operations. _____ Hire or terminate employees. _____ Represent the business in legal proceedings. _____ Handle tax and financial matters. _____ Other powers: ____________________________________________________________

LIMITATIONS ON POWERS:

(Describe any limitations on the powers granted to your Agent.)

EFFECTIVE DATE AND DURATION:

This Power of Attorney is effective as of _____________, 20, and shall continue until _____________, 20, unless revoked earlier.

THIRD PARTY RELIANCE:

Third parties may rely on this document as proof of the Agent’s powers to act on behalf of the Principal.

SIGNATURES:

The Principal and the Agent, by signing below, acknowledge and agree to all terms set forth in this Business Power of Attorney.

Principal’s Signature: ___________________________________ Date: _________________

Agent’s Signature: _____________________________________ Date: _________________

STATE OF _________________

COUNTY OF _______________

Subscribed and sworn to (or affirmed) before me on this _____ day of _______, 20, by [Principal’s Full Name] and [Agent’s Full Name], who are personally known to me or have produced _________________ as identification.

Notary Public’s Signature: ___________________________________

Notary Public’s Name (Printed): ______________________________

My Commission Expires: _________________

SEAL:

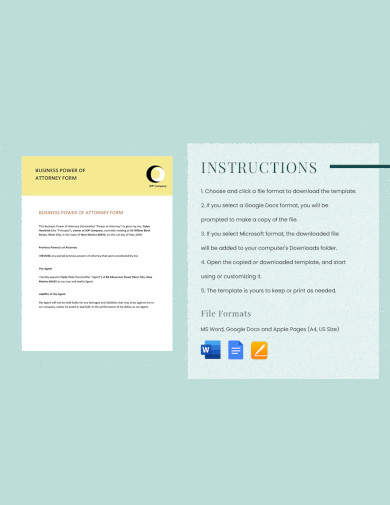

INSTRUCTIONS: Fill in the blanks with the appropriate information. Each section should be carefully reviewed and initialed or filled out to reflect the specific powers granted. It’s crucial that this form be notarized to ensure its legal efficacy. Consult with a legal professional to ensure that this document meets the requirements of your jurisdiction and the needs of the business.

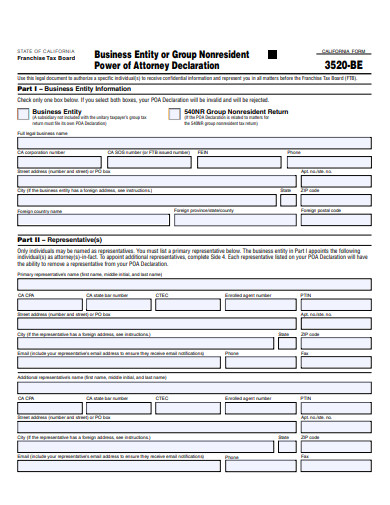

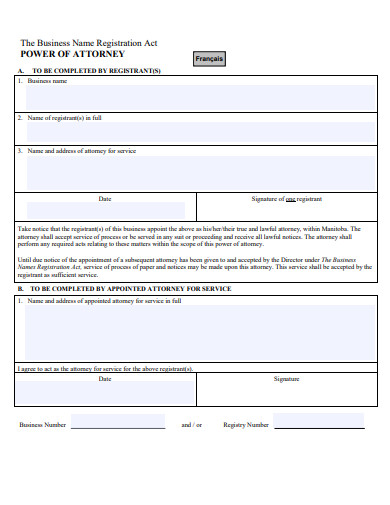

1. Business Power of Attorney Form Template

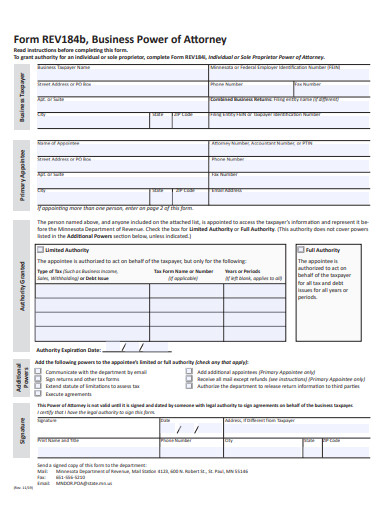

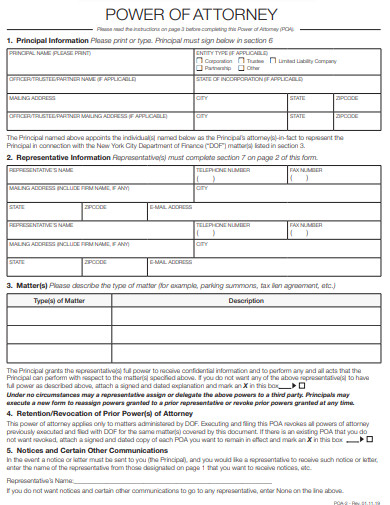

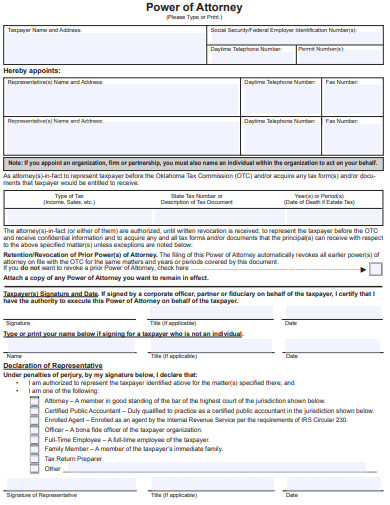

2. Business Power of Attorney Form

3. Simple Business Power of Attorney Form

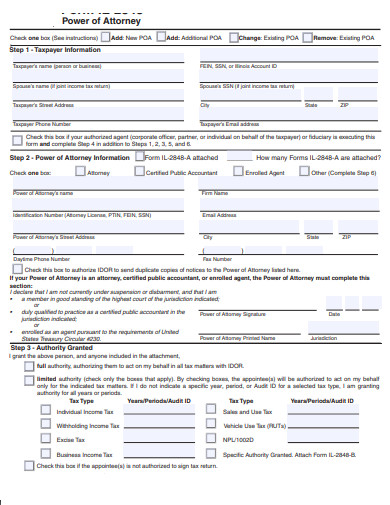

4. Kansas Business Power of Attorney Form

5. Special Business Power of Attorney Form

6. Printable Business Power of Attorney Form

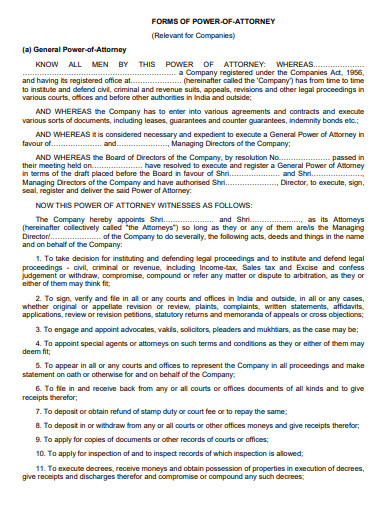

7. General Business Power of Attorney Form

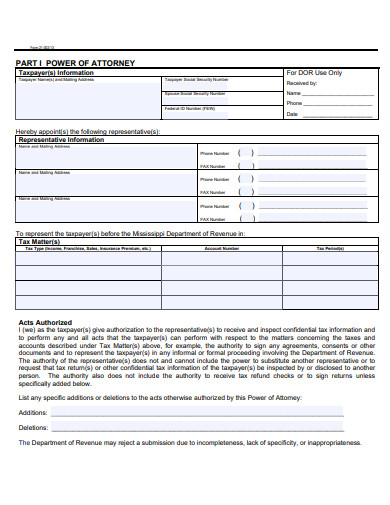

8. Mississippi Business Power of Attorney Form

9. Blank Business Power of Attorney Form

10. Specific Business Power of Attorney Form

11. Oklahoma Business Power of Attorney Form

What is power of attorney for running business?

Can power of attorney be given to a company by a company?

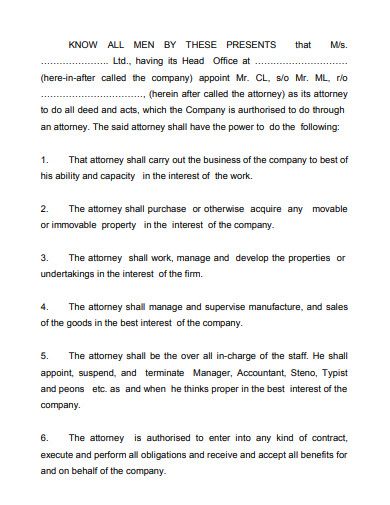

Yes, a company can grant a Power of Attorney to another company. This is a common practice in the business world, particularly when a company wants to delegate certain tasks or responsibilities to another company that specializes in those areas. The entity receiving the Power of Attorney is typically represented by an individual or individuals who are authorized to act on its behalf.

The process involves the company that is granting the Power of Attorney (the principal) to create a legal document specifying the extent of powers given to the other company (the agent). This document must be duly signed by authorized representatives of the principal company and may need to be notarized or even certified, depending on the jurisdiction and the type of powers being granted.

The appointed agent company then acts within the scope of authority granted by the Power of Attorney, which can range from specific tasks, like managing a particular project, to broader powers, like handling all operations in a certain geographic area. As with any Power of Attorney, it’s crucial for the document to be clear on the extent and limitations of the powers granted, and for both parties to adhere to any governing laws and regulations.

What are the different types of Business Power of Attorney forms?

There are several types of Business Power of Attorney (POA) forms that cater to different needs within the commercial realm. Here are some of the common variations:

- General Business Power of Attorney: This form provides broad powers to the agent to handle a wide range of business activities and decisions. It’s often used when the principal will be unavailable for an extended period.

- Special or Limited Business Power of Attorney: Unlike the general POA, this form restricts the agent’s authority to specific activities or transactions, such as managing a particular project, signing documents in the principal’s absence, or handling a specific set of financial transactions.

- Durable Business Power of Attorney: This type of POA is designed to remain in effect even if the principal becomes incapacitated. It ensures that the agent can continue to operate the business without interruption.

- Springing Business Power of Attorney: This POA comes into effect only under certain circumstances defined in the document, such as the illness or disability of the principal. It “springs” into action based on the occurrence of the specified event.

- Financial Power of Attorney for Business: This form is focused exclusively on financial matters, allowing the agent to handle banking, investment, and other monetary transactions for the business.

- Tax Power of Attorney: Often used to grant an agent the authority to handle tax filings and issues with tax authorities on behalf of the business.

Each type of Business Power of Attorney serves a specific purpose and should be chosen based on the needs and circumstances of the business. It’s essential to consult with a legal professional to determine the most appropriate type of POA for your business situation and to ensure that the form complies with state laws.

What is the purpose of a power of attorney for a business?

The purpose of a Power of Attorney (POA) for a business is to ensure that the business operations can continue without interruption in the event that the principal — typically the business owner or a key executive — is unavailable or unable to make decisions. Here are the primary objectives of having a POA in a business context:

- Continuity of Operations: A POA allows for the ongoing management of business affairs during the principal’s absence, whether due to travel, illness, or other reasons.

- Delegation of Decision-Making: It enables the principal to delegate decision-making authority to an agent, who can make critical business decisions without delay.

- Flexibility in Management: A POA can provide the flexibility to handle urgent business situations promptly, such as signing contracts or managing financial transactions.

- Legal Authority: The agent is legally empowered to act on behalf of the business, which can be necessary for executing legal documents or dealing with legal matters.

- Protection Against Incapacitation: If the principal becomes incapacitated, a durable POA ensures that the business can still be managed legally and effectively.

- Specific Task Execution: In cases where specialized knowledge or skills are required, a POA can authorize an agent with the requisite expertise to perform specific tasks.

- Financial Management: An agent can be given the authority to manage the business’s finances, including access to bank accounts, the ability to sign checks, manage investments, and handle other monetary transactions.

By creating a POA, a business can safeguard against uncertainties and maintain its operations smoothly, which is vital for its survival and success. It’s a critical part of business planning and risk management strategies.

How to get power of attorney for a business?

What is power of attorney in business communication?

In business communication, a Power of Attorney (POA) refers to a legal document that authorizes an individual, known as the agent or attorney-in-fact, to communicate decisions and execute transactions on behalf of the business owner or principal. The POA allows the agent to handle specific business tasks that can include signing documents, engaging in negotiations, entering into contracts, and managing day-to-day operational activities.

The use of a POA in business communication is crucial when the principal is unable to be present or wishes to delegate authority for efficiency or strategic purposes. This tool ensures that the business’s voice, in the form of decisions and actions, continues to be heard and respected in the commercial sphere, even in the absence of the principal. It provides continuity and can help streamline processes when direct action or communication by the principal is impractical.

How to Create the Business Power of Attorney Form? – a Step by Step Guide

Tips for creating an Effective Business Power of Attorney Form

Creating an effective Business Power of Attorney (POA) form requires careful planning and consideration of legal and practical matters. Here are some tips to guide you in crafting a document that serves your business needs:

- Be Specific with Powers: Clearly outline the specific powers granted to your agent. Vague language can lead to confusion and misuse of authority. Specify if the powers will include financial decisions, contract negotiations, operational changes, etc.

- Choose the Right Agent: Select an agent who is not only trustworthy but also has the knowledge and skills relevant to your business needs. Consider their understanding of your industry and ability to make sound decisions.

- Include Durability Clause: Decide whether the POA should be durable, which means it remains in effect if you become incapacitated. This ensures business continuity during unforeseen personal events.

- Limitations and Exclusions: Clearly state any limitations to the agent’s power, and consider including a termination clause that outlines how and when the POA will end or can be revoked.

- Legal Compliance: Ensure the form complies with the laws in your state. Legal requirements for POAs can vary significantly from one jurisdiction to another.

- Define the Term: Establish a clear start and end date for the POA. If it’s open-ended, specify under what conditions it will terminate, such as upon your return or upon a certain action being completed.

- Seek Legal Advice: Have a lawyer review or draft the document to ensure it’s legally sound and that you haven’t omitted any critical components.

- Notarize and Witness: Sign the POA in the presence of a notary and witnesses if required by law. This step is crucial for the document’s validity.

- Communicate with Your Agent: Make sure your agent understands their role and responsibilities. Provide guidance on how to make decisions that align with your business goals and values.

- Regular Reviews: Business circumstances and laws change. Regularly review and update your POA to ensure it remains relevant and effective.

- Secure Storage: Keep the original POA document in a safe and accessible place, and inform a trusted individual of its location.

- Inform Stakeholders: Notify your bank, company lawyer, and any other stakeholders that a POA has been created, providing copies if necessary.

- Avoid Co-Agents: Appointing co-agents can lead to confusion and conflicts. Instead, consider naming a successor agent if the primary agent is unable to serve.

- Provide a Revocation Process: Include instructions on how you or your successors can revoke the POA if needed.

By following these tips, you can create an effective Business POA that ensures your business operations can continue smoothly, even in your absence.

A Business Power of Attorney Form is a legal instrument empowering an individual to make business decisions on another’s behalf. It ensures operational continuity and can be tailored as general, special, or durable, among other types. Effective creation involves defining powers, selecting a competent agent, and legal compliance. Regular reviews and clear execution are paramount for maintaining its relevance and effectiveness in business continuity.

Related Posts

-

10+ Free New Hampshire (NH) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Nevada (NV) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Nebraska (NE) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Montana (MT) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Missouri (MO) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Minnesota (MN) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Mississippi (MS) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Massachusetts (MA) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Maryland (MD) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Maine (ME) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Louisiana (LA) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Kentucky (KY) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Kansas (KS) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Iowa (IA) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Indiana (IN) Power of Attorney Form Download – How to Create Guide, Tips