Managing a business requires an individual to handle the finances, manpower, equipment, and all other sectors which requires decision-making strategies. Regardless of how smooth a business is being managed, there will always be glitches and pitfalls which will hold the business enterprise liable. This is where a Release of Liability Form will serve a great use.

A Liability Waiver Form is highly similar to the aforementioned Release Form. These two documents are used to protect the business enterprise from further lawsuits of employees who faced accidents due to human and machine errors.

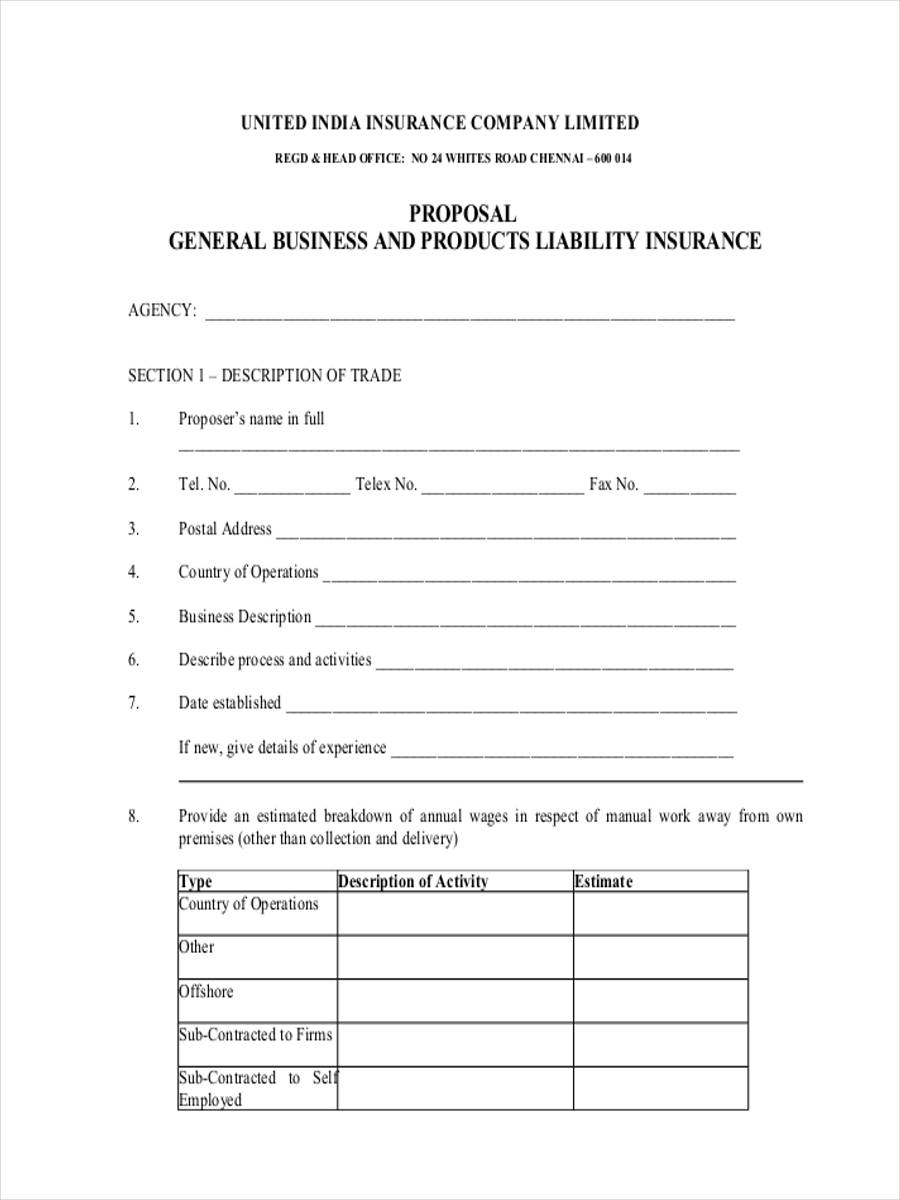

Business Liability Coverage Form

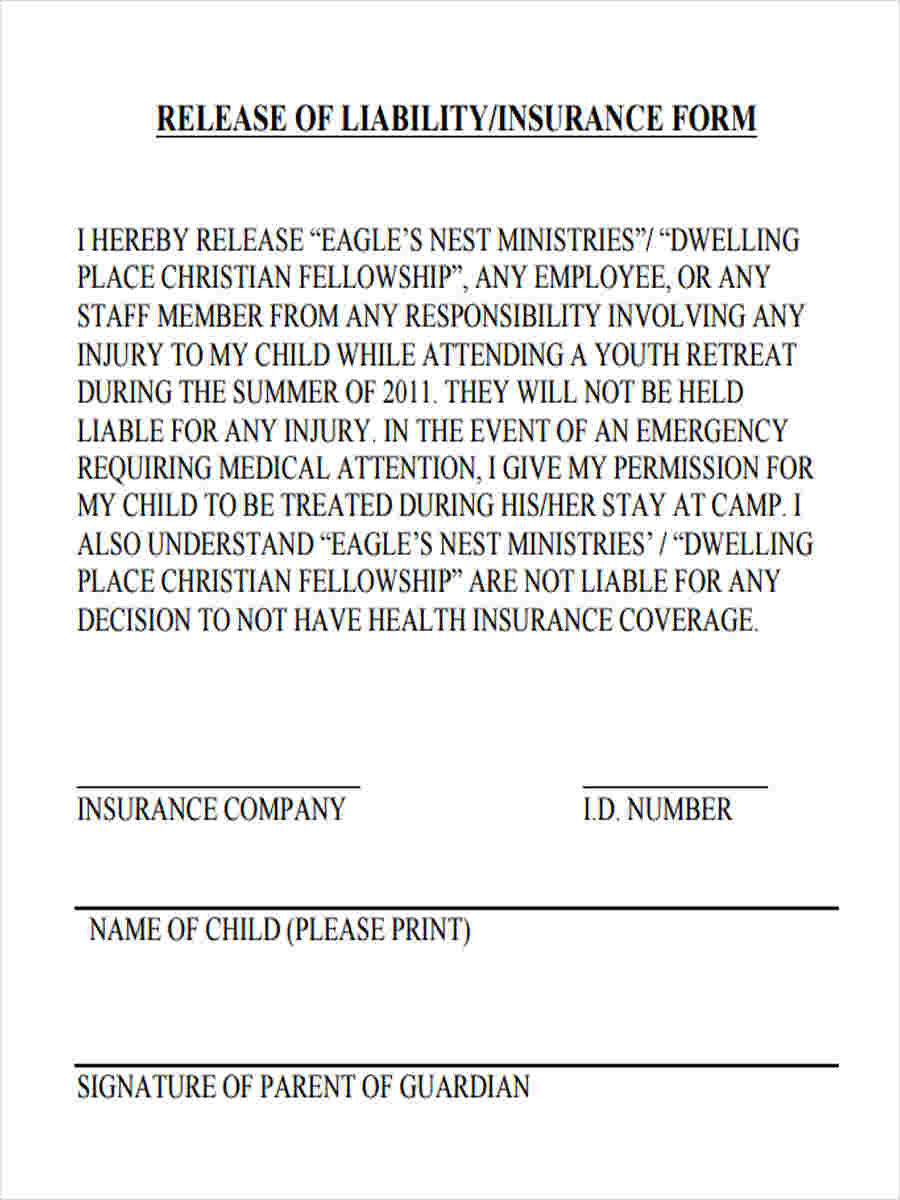

Business Release of Liability

Business Wavier of Liability

Client Liability Waiver

What Is a Business Liability?

Business Liabilities have two different definitions: first, it refers to the obligations of a business enterprise to account and pay for the penalties of an incident which happened due to the faulty actions of the people involved in the business premises. Secondly, it is the accounts payable which are stated on a business’s accounting balance sheet.

However, the first definition is what requires the use of forms and insurance documents. To assure that an employee or a client will not point the business enterprise as the liable party for an incident, the company should have a Certificate of Liability Insurance. The insurance will help in protecting the company and shouldering further payments agreed as a resolution of the incident.

What Is a Liability Waiver Form?

A Liability Waiver Form or a Release of Liability Form is a document that contains an agreement between two parties wherein one of the parties, or the person who signs the form, will be accountable for his own action that up brings a possible accident. The form will also have a list of words and their general meanings in assuring that both parties will fully understand the statements on the document.

Generlal Business Liability Insurance

Liability Insurance Release

Tips for Selecting Small Business Liability Insurance

Choosing the best insurance plan for your business is not an easy job to do, especially if you know that the services you offer in your business is risky and requires a high quality security precaution for your employees and workers. But if your business is still in the beginning of its term, consider using a General Liability Form as a preventive measure and always keep these tips in mind before signing with an insurance company:

- Research some options. The internet is a way to look for insurance plans. This also allows you to easily compare two insurance providers and reach out to them effectively.

- Speak and negotiate with an insurance representative. The representative knows what type of insurance will be good for your business. However, only you have the ability to decide in choosing which among the presented plans will suit you.

- Assess the risks of your business. The higher the risks of your business, the greater the coverage that you should have. Therefore, do a risk assessment and determine the level of risks in your business.

Insurance providers only provide options, but the final words will still be from their clients. As you run through your business, assure that when doing a particular activity such as a company outing or party, you will have the attendees sign a Liability Release Forms or a Waiver of Liability Forms.

Related Posts Here

-

Contract Addendum Form

-

FREE 37+ Sample Claim Forms in PDF | Excel | MS Word

-

Report Form

-

FREE 49+ Budget Forms in PDF | MS Word | Excel

-

Profile Form

-

Menu Form

-

Event Planner Form

-

FREE 16+ Ticket Order Forms in PDF | MS Word | Excel

-

Employee Dress Code Policy Form

-

Rental History Form

-

Advertising Contract Form

-

Service Agreement Form

-

Income Statement Form

-

Accident Statement Form

-

Performance Review Form