A Business Financial Statement Form is a crucial document for tracking a company’s financial health. It provides insights into income, expenses, assets, and liabilities, helping Businesses Form assess performance and secure funding. Whether you’re a startup, small business, or large corporation, maintaining a Financial Form ensures transparency and informed decision-making. This Statement Form is often required for loan applications, tax reporting, and investor relations. In this guide, we’ll cover everything from structure to best practices, ensuring your financial reporting meets professional standards. Let’s dive into the essentials and explore how to create an accurate and comprehensive statement.

Download Business Financial Statement Form Bundle

What is Business Financial Statement Form?

A Business Financial Statement Form is a formal document that presents a company’s financial position over a specific period. It includes details of revenue, expenses, assets, and liabilities. Businesses use this form to evaluate performance, secure loans, and attract investors. It typically consists of three main reports: the balance sheet, income statement, and cash flow statement. This financial snapshot helps businesses stay accountable, make informed decisions, and comply with regulations. Whether for internal review or external reporting, a well-prepared statement ensures financial clarity and stability.

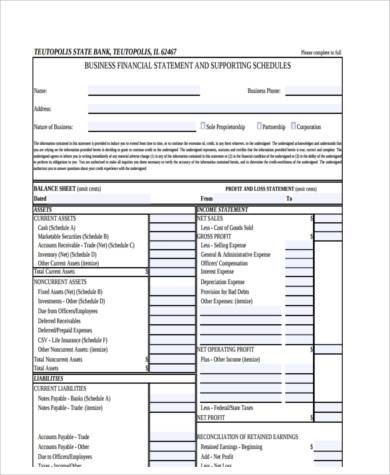

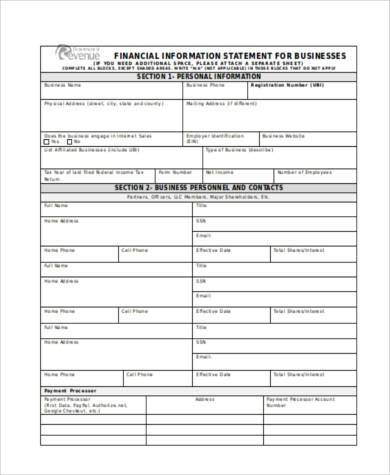

Business Financial Statement Format

Company Information

- Business Name – Official name of the company.

- Business Address – Location where the company operates.

- Tax Identification Number – Unique tax ID assigned to the business.

- Reporting Period – Duration covered by the financial statement.

Assets

- Current Assets – Cash, accounts receivable, inventory, and other short-term resources.

- Fixed Assets – Long-term assets including property, equipment, and land.

- Intangible Assets – Intellectual property, trademarks, and goodwill.

Liabilities

- Short-term Liabilities – Accounts payable, short-term loans, and other obligations due within a year.

- Long-term Liabilities – Loans, mortgages, and debts payable beyond one year.

Equity

- Owner’s Equity – Initial investments and retained earnings.

- Shareholder’s Equity – Capital contributed by investors and stockholders.

Income Statement

- Revenue – Total income from sales and services.

- Expenses – Operational costs, salaries, utilities, and other expenditures.

- Net Profit/Loss – Revenue minus expenses for the given period.

Signatures and Certification

- Prepared By – Name and designation of the preparer.

- Reviewed By – Auditor or financial officer verifying accuracy.

- Date of Submission – Official date of the report.

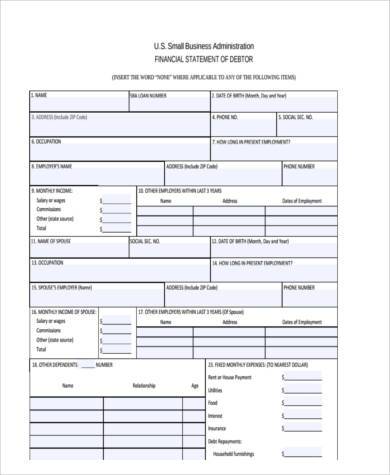

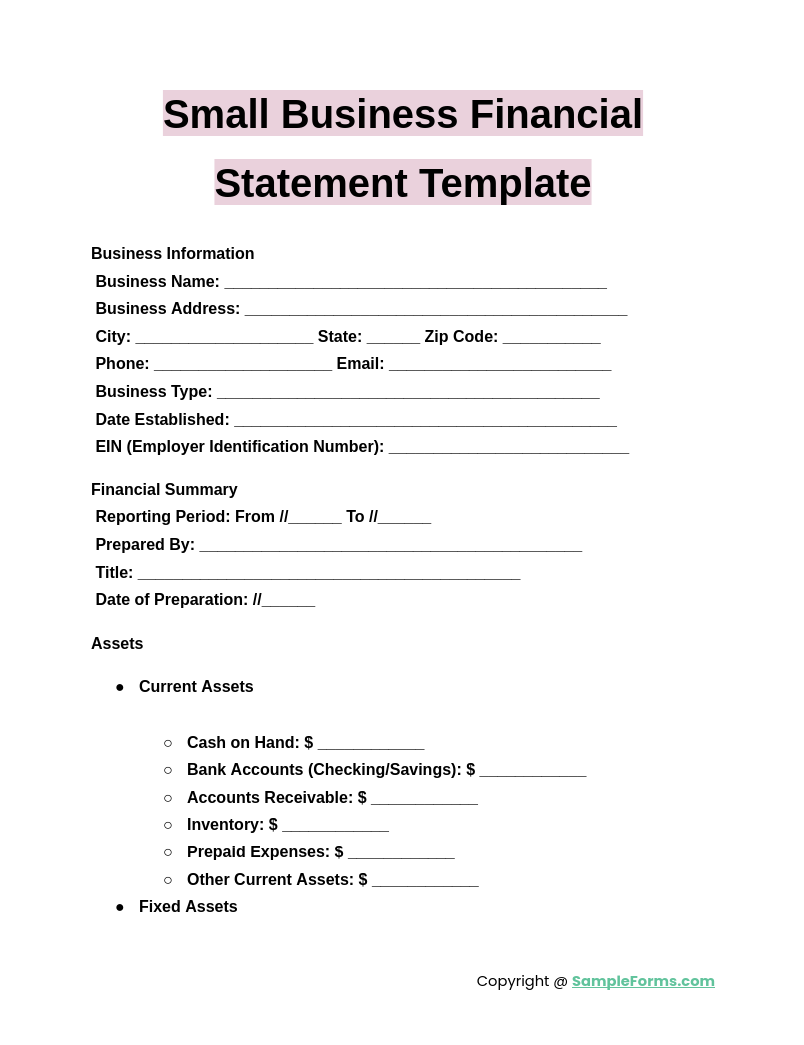

Small Business Financial Statement Template

A Small Business Financial Statement Template helps entrepreneurs track their financial performance. Unlike an Employee Witness Statement Form, it details revenue, expenses, and liabilities, ensuring transparency in financial reporting for growth, tax compliance, and securing business loans.

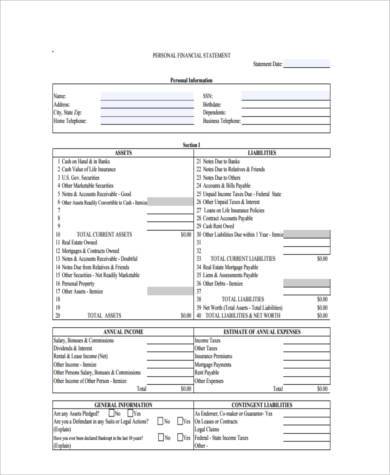

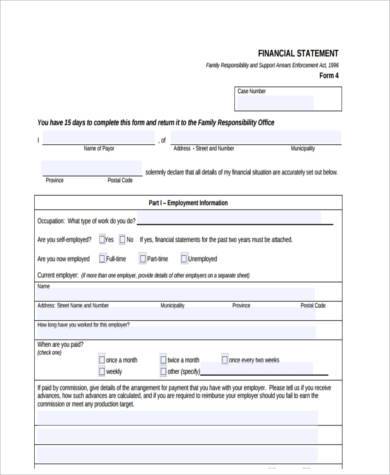

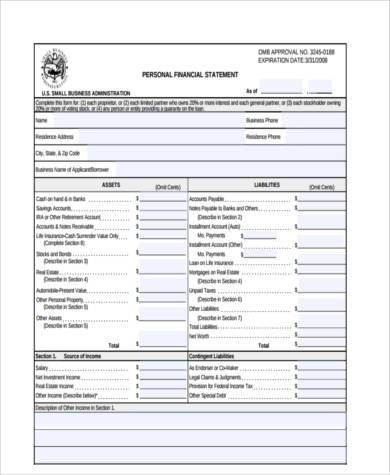

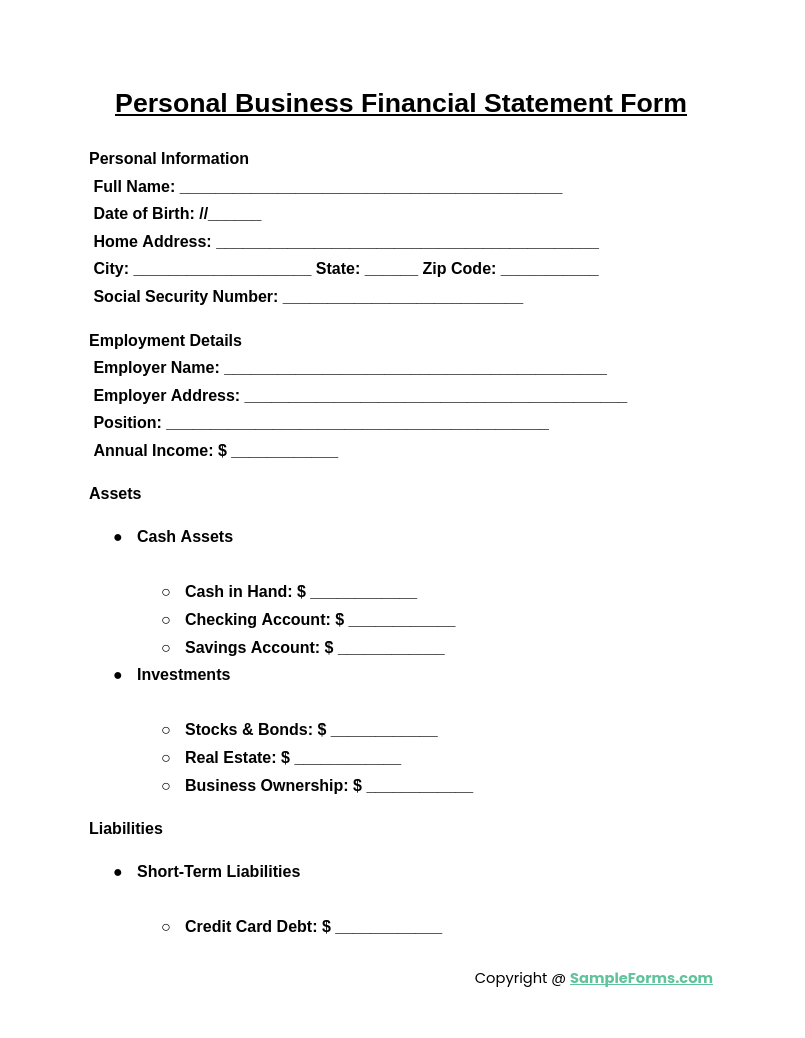

Personal Business Financial Statement Form

A Personal Business Financial Statement Form provides a clear view of an individual’s financial standing. Similar to a Closing Statement Form, it includes income, assets, liabilities, and expenses, helping business owners manage finances, secure funding, and make informed investment decisions.

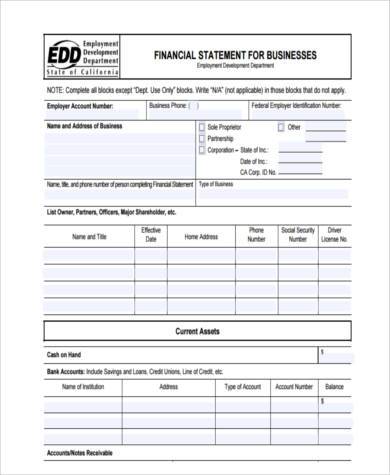

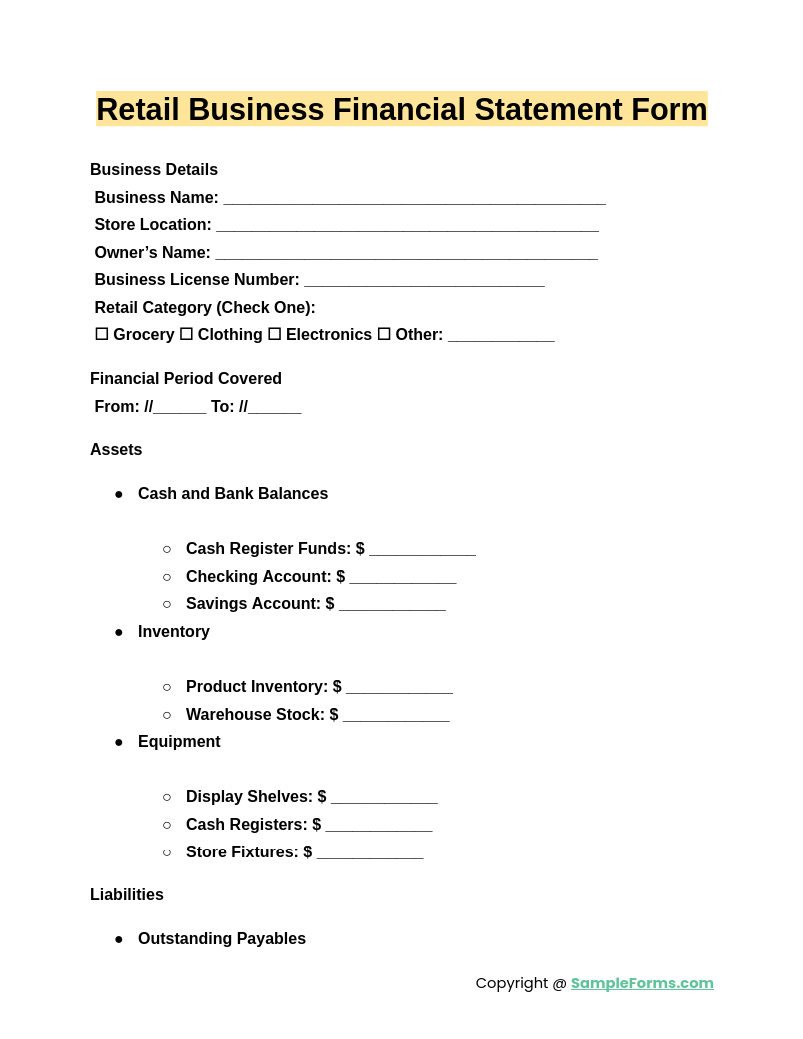

Retail Business Financial Statement Form

A Retail Business Financial Statement Form is designed for stores to track sales, expenses, and inventory. Like a Billing Statement Form, it ensures accurate financial records, enabling better decision-making, inventory control, and improved profitability for retail businesses.

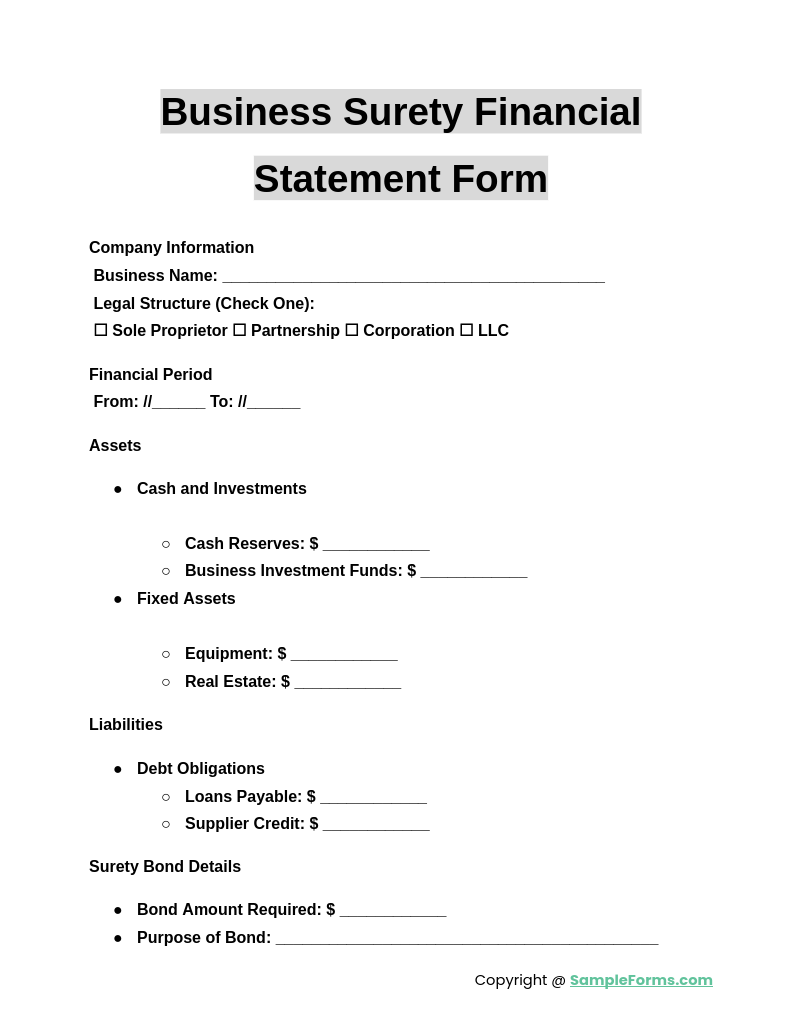

Business Surety Financial Statement Form

A Business Surety Financial Statement Form is vital for securing surety bonds and financial backing. Similar to a Financial Statement Form, it showcases business assets, liabilities, and revenue, proving financial stability for contractual obligations and business growth.

Browse More Business Financial Statement Forms

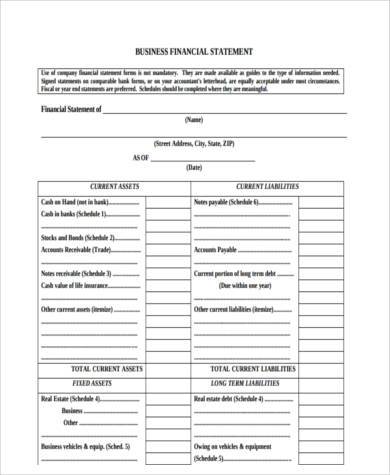

Business Financial Statement Blank Form

Business Financial Statement Form in PDF

Small Business Financial Statement Form

Printable Business Financial Statement Form

Free Business Financial Statement Form

Business Financial Statement Form Example

Generic Business Financial Statement Form

Business Financial Statement Form in Word Formt

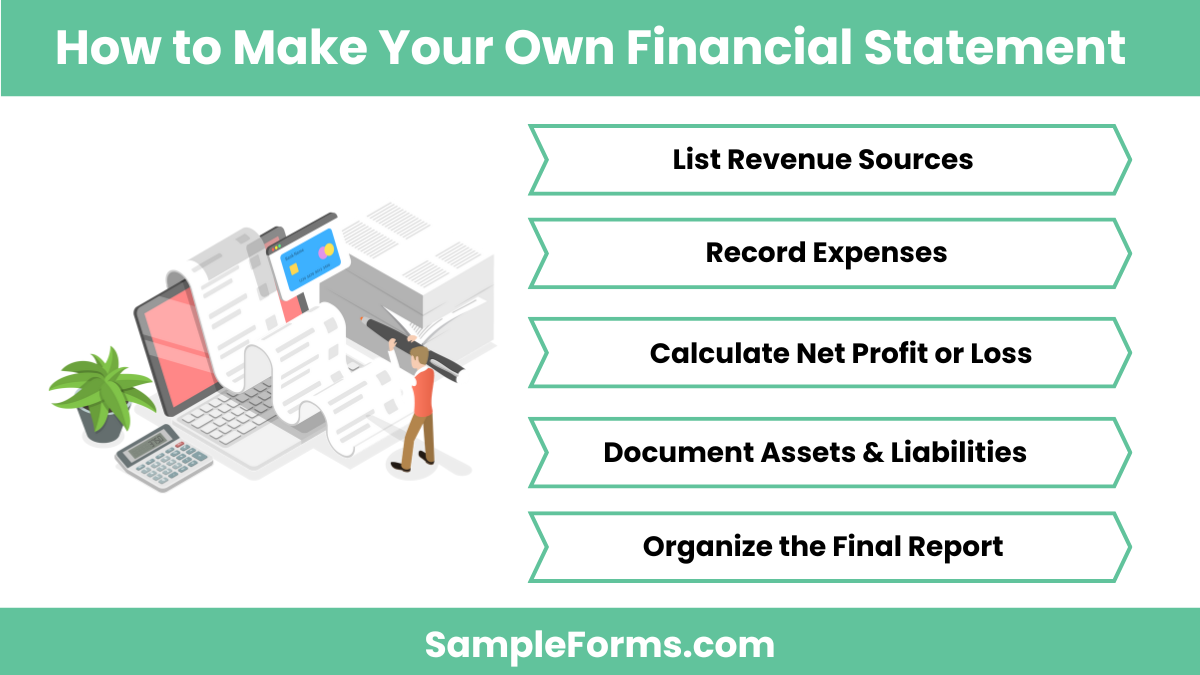

How to make your own financial statement?

A self-prepared Legal Statement Form provides insights into business finances. Follow these steps to create an accurate and detailed financial statement:

- List Revenue Sources: Include income from sales, investments, and other business earnings.

- Record Expenses: Track operating costs, payroll, rent, and other business expenditures.

- Calculate Net Profit or Loss: Deduct expenses from total revenue to determine profitability.

- Document Assets & Liabilities: Include cash, inventory, property, and outstanding debts.

- Organize the Final Report: Format the statement professionally for easy reference and compliance with accounting standards.

How do I write a financial statement for my business?

Creating a Personal Financial Statement Form requires accurate financial data and structured reporting. Follow these steps to ensure a complete and professional document:

- Gather Financial Records: Collect details of revenue, expenses, assets, and liabilities to provide an accurate financial picture.

- Prepare an Income Statement: Outline your business’s revenues, expenses, and net profit over a specific period.

- Draft a Balance Sheet: List assets, liabilities, and equity to assess the company’s financial standing at a given time.

- Create a Cash Flow Statement: Track cash inflows and outflows to manage liquidity and business sustainability.

- Review & Finalize: Ensure accuracy by cross-verifying figures and following standard accounting practices.

How to get company financial statements?

Accessing a Financial Statement Form of a company depends on whether it is publicly traded or privately held. Here’s how you can obtain it:

- Check Public Filings: Public companies must disclose their financials in annual reports available on official government websites.

- Visit the Company Website: Many businesses publish financial statements in investor relations sections.

- Request from the Company: Privately held firms may provide reports upon request, subject to confidentiality agreements.

- Use Financial Databases: Subscription-based services provide access to various companies’ financial reports.

- Consult Regulatory Bodies: Government agencies often store business records, making them accessible for legal or financial review.

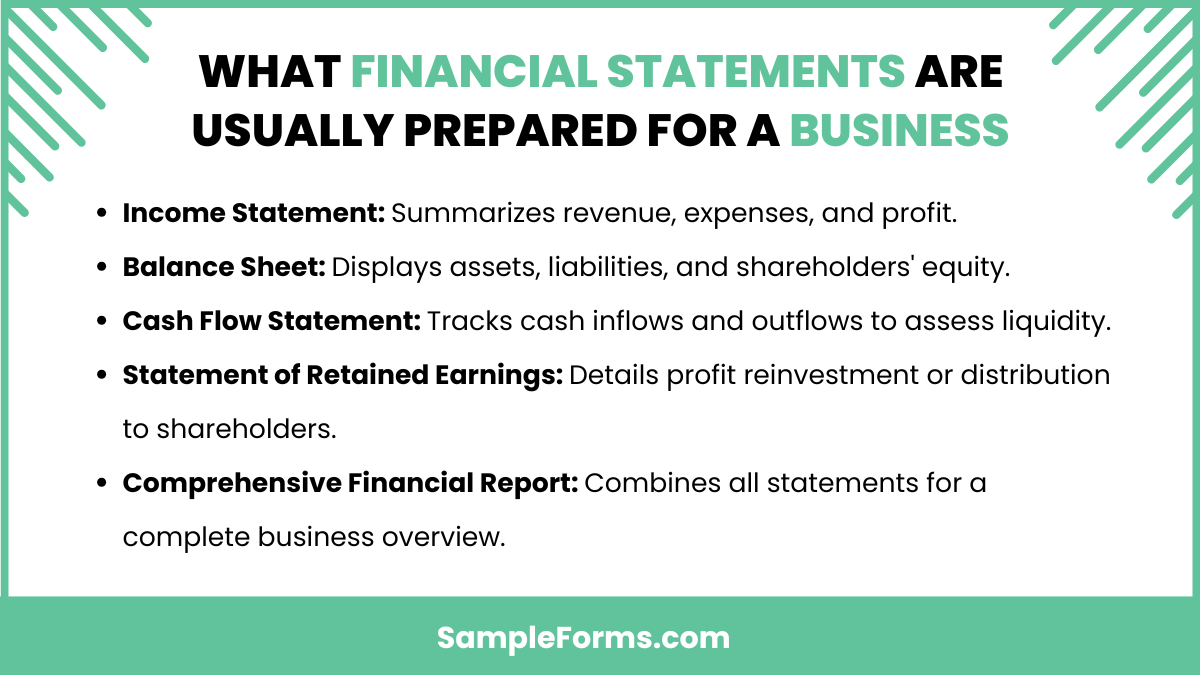

What financial statements are usually prepared for a business?

Businesses typically prepare four main financial documents, including the Income Statement Form, to analyze financial health. These include:

- Income Statement: Summarizes revenue, expenses, and profit over a specific period.

- Balance Sheet: Displays assets, liabilities, and shareholders’ equity at a given point.

- Cash Flow Statement: Tracks cash inflows and outflows to assess liquidity.

- Statement of Retained Earnings: Details profit reinvestment or distribution to shareholders.

- Comprehensive Financial Report: Combines all statements for a complete business overview.

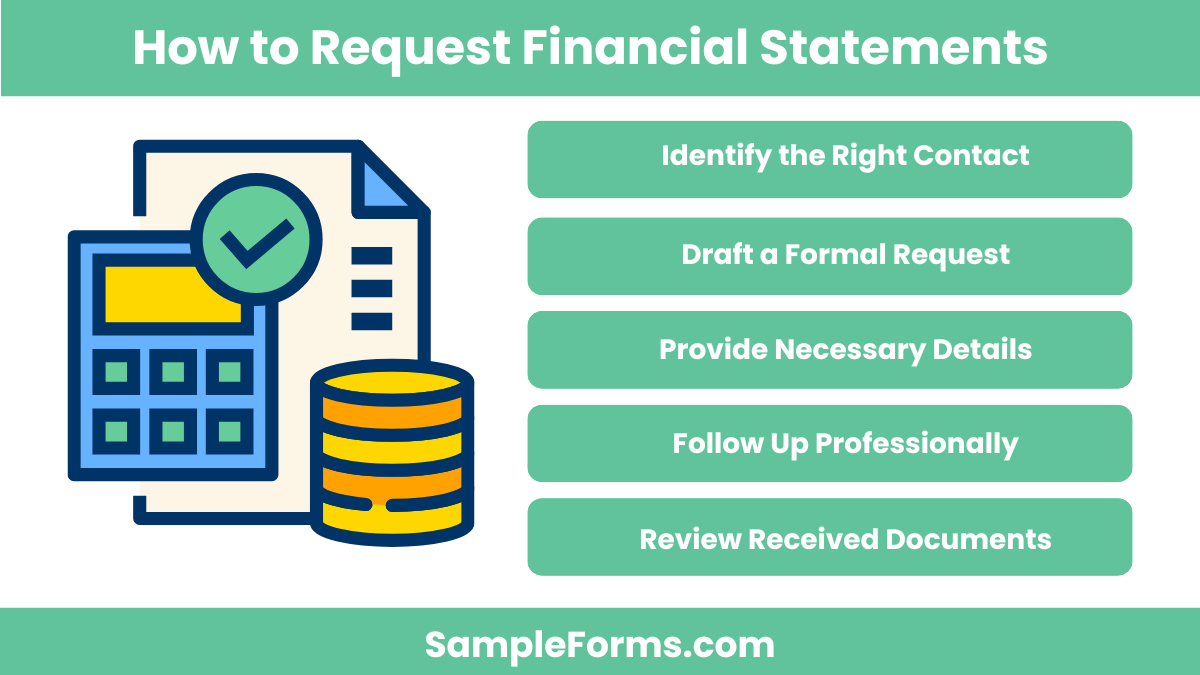

How do I request financial statements?

If you need financial records, submitting an Employee Statement Form or official request is essential. Follow these steps:

- Identify the Right Contact: Determine whether to contact accounting, finance, or investor relations departments.

- Draft a Formal Request: Clearly state why you need the financial documents and specify the period covered.

- Provide Necessary Details: Include your name, organization, and any required authorization for processing.

- Follow Up Professionally: If no response is received within a reasonable timeframe, send a polite follow-up email.

- Review Received Documents: Verify accuracy and completeness before using them for business decisions.

What are the golden rules of accounting?

The three golden rules are:

- Debit the receiver, credit the giver.

- Debit what comes in, credit what goes out.

- Debit expenses and losses, credit incomes and gains. A Disclosure Statement Form ensures financial transparency.

Who prepares a company’s financial statements?

A company’s financial statements are typically prepared by accountants or financial professionals. In some cases, a Voluntary Statement Form may be used for internal financial disclosures before finalizing reports.

How much does it cost to prepare financial statements?

The cost varies based on business size and complexity. A basic Property Statement Form for financial reporting may cost $500–$5,000, while large corporations may pay significantly more for audited reports.

Can you prepare financial statements without a CPA?

Yes, businesses can prepare financial statements without a CPA, but accuracy is crucial. A Student Statement Form may help in learning financial preparation, but expert review ensures compliance and reliability.

Do financial statements need to be notarized?

Financial statements typically don’t require notarization unless mandated by law. However, in legal or regulatory cases, a Confirmation Statement Form may be necessary to validate financial disclosures.

Who can prepare financial statements?

Business owners, accountants, or finance teams can prepare financial statements. In legal transactions, a Real Estate Statement Form may be used for property-related financial reporting and disclosures.

How do I see the balance sheet of a company?

Public companies publish balance sheets in annual reports. Private firms may require authorization. A Sworn Statement Form may be needed to request financial details from specific businesses.

What is the amount owed by a business?

The amount owed is recorded as liabilities in financial statements. A Counseling Statement Form can help businesses plan debt management and repayment strategies effectively.

Can a bookkeeper do financial statements?

Yes, bookkeepers can draft financial statements, but an accountant ensures compliance. Some businesses use an Operating Statement Form for internal financial tracking before external review.

Do all financial statements need to be audited?

No, only publicly traded or regulated entities require audits. Private businesses can prepare unaudited reports, but a Witness Statement Form may be necessary for financial disputes or legal matters.

A well-structured Business Financial Statement Form is essential for every business, from startups to large enterprises. It ensures accurate financial tracking, aids in tax preparation, and supports funding applications. Whether you’re drafting a Bakery Business Form or a corporate statement, maintaining proper records is key to long-term success. With the right format, your financial statements will provide transparency and credibility. Use our samples and templates to simplify your reporting process. Stay compliant, make informed decisions, and keep your business financially sound with the right statement forms.

Related Posts

-

FREE 5+ Income Statement Spreadsheet Forms in PDF

-

FREE 9+ Personal Financial Statement Form Samples in PDF | MS Word | Excel

-

FREE 9+ Sample Financial Statement Forms in PDF | MS Word | Excel

-

Check Register Form

-

Investment Trading Journal Form

-

FREE 6+ Accounts Payable Forms in PDF

-

FREE 4+ Campaign Finance Forms in PDF

-

FREE 7+ Change in Custodian Forms in MS Word | PDF | Excel

-

FREE 4+ Payroll Reallocation Forms in PDF | Excel

-

Credit Debit Form

-

FREE 6+ Income Tax Forms in PDF | Excel

-

FREE 6+ Checkbook Register Forms in PDF | Excel

-

FREE 8+ Budget Transfer Forms in PDF | Excel

-

FREE 3+ Youth Allowance Forms in PDF

-

FREE 4+ Family Allowance Forms in PDF