People who have debts that are more than they can actually pay are the clients of bankruptcy attorneys and consultants. Along with the credit counseling certificate forms that clients must present to their chosen attorneys, they must also complete a bankruptcy intake document.

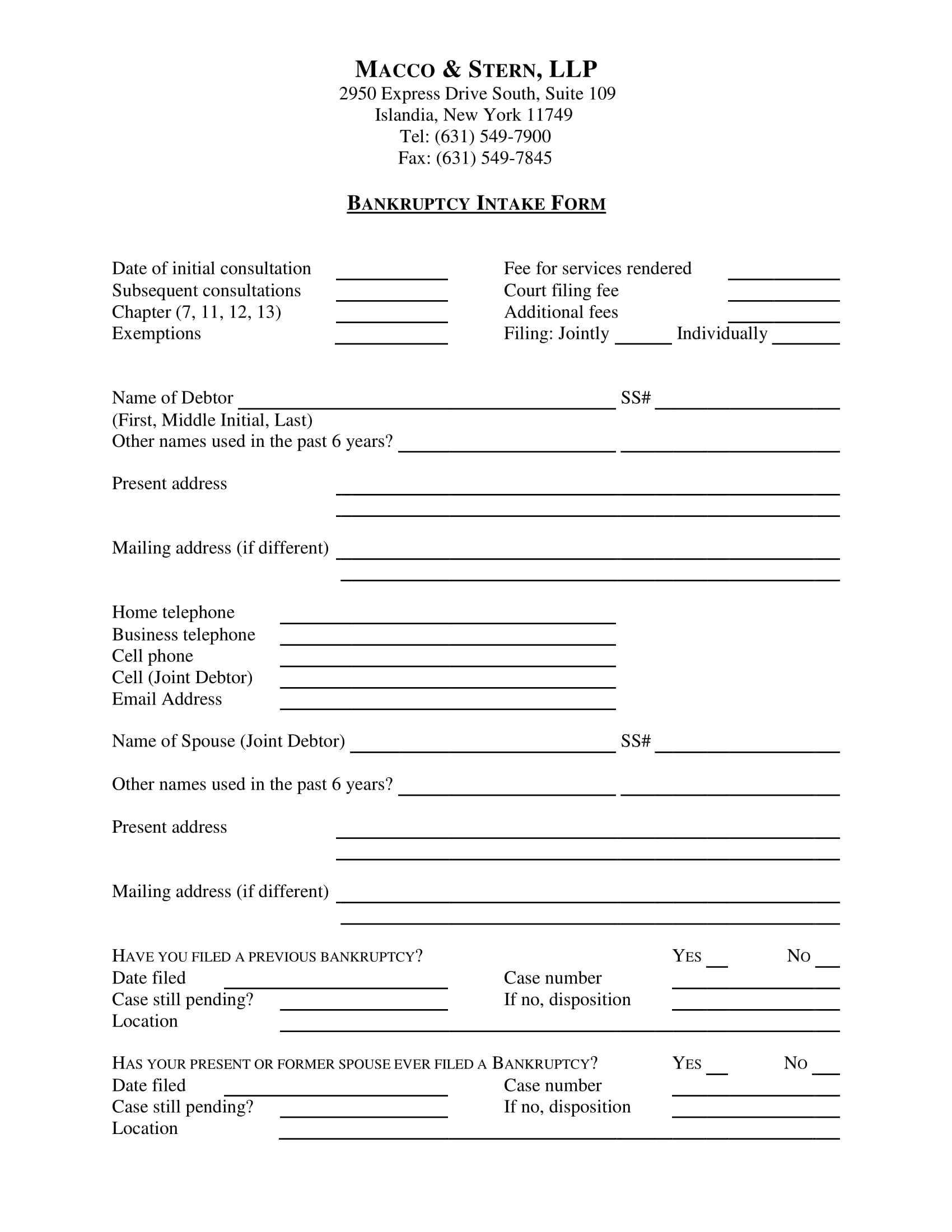

Bankruptcy Intake Form Sample

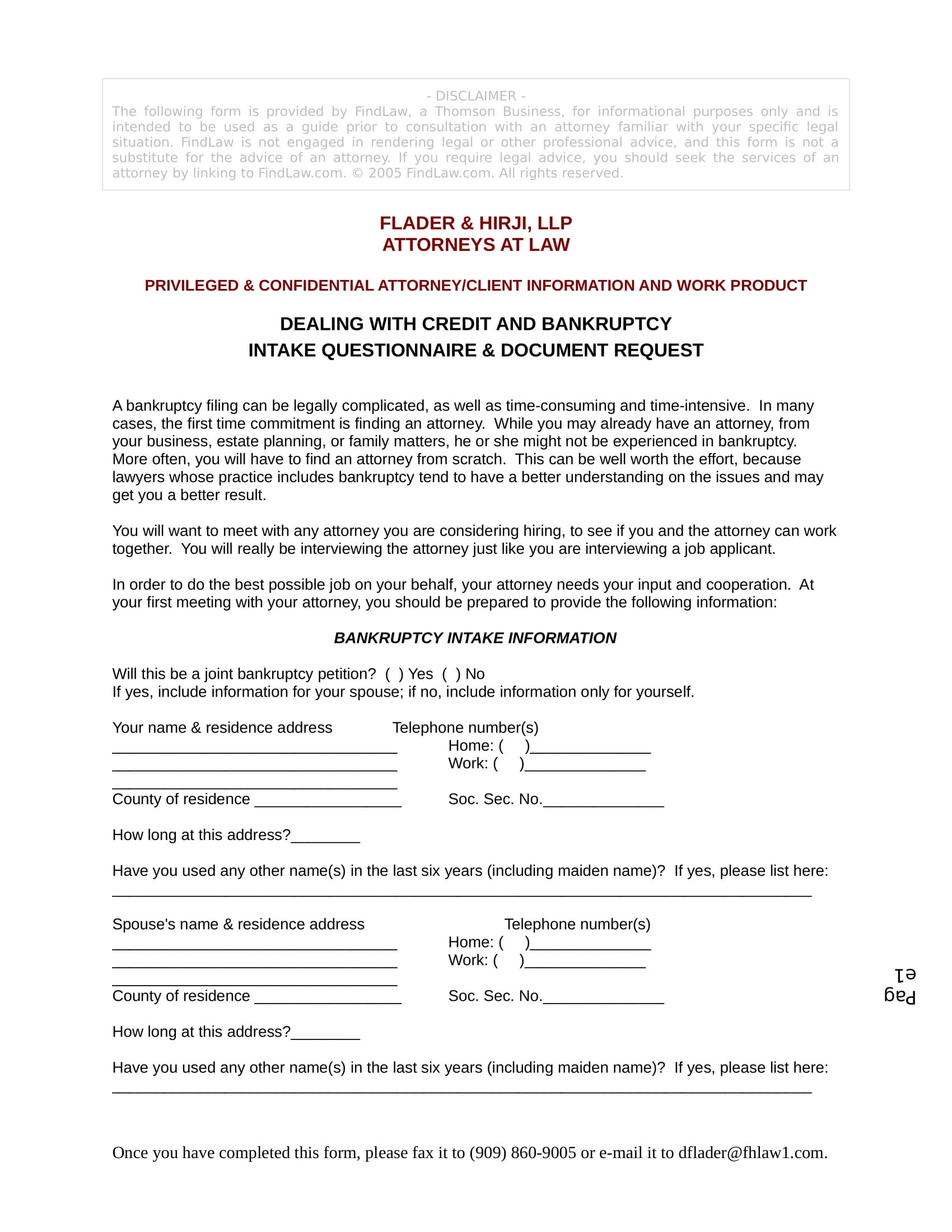

Bankruptcy Intake Form in DOC

What Is a Bankruptcy Intake Form?

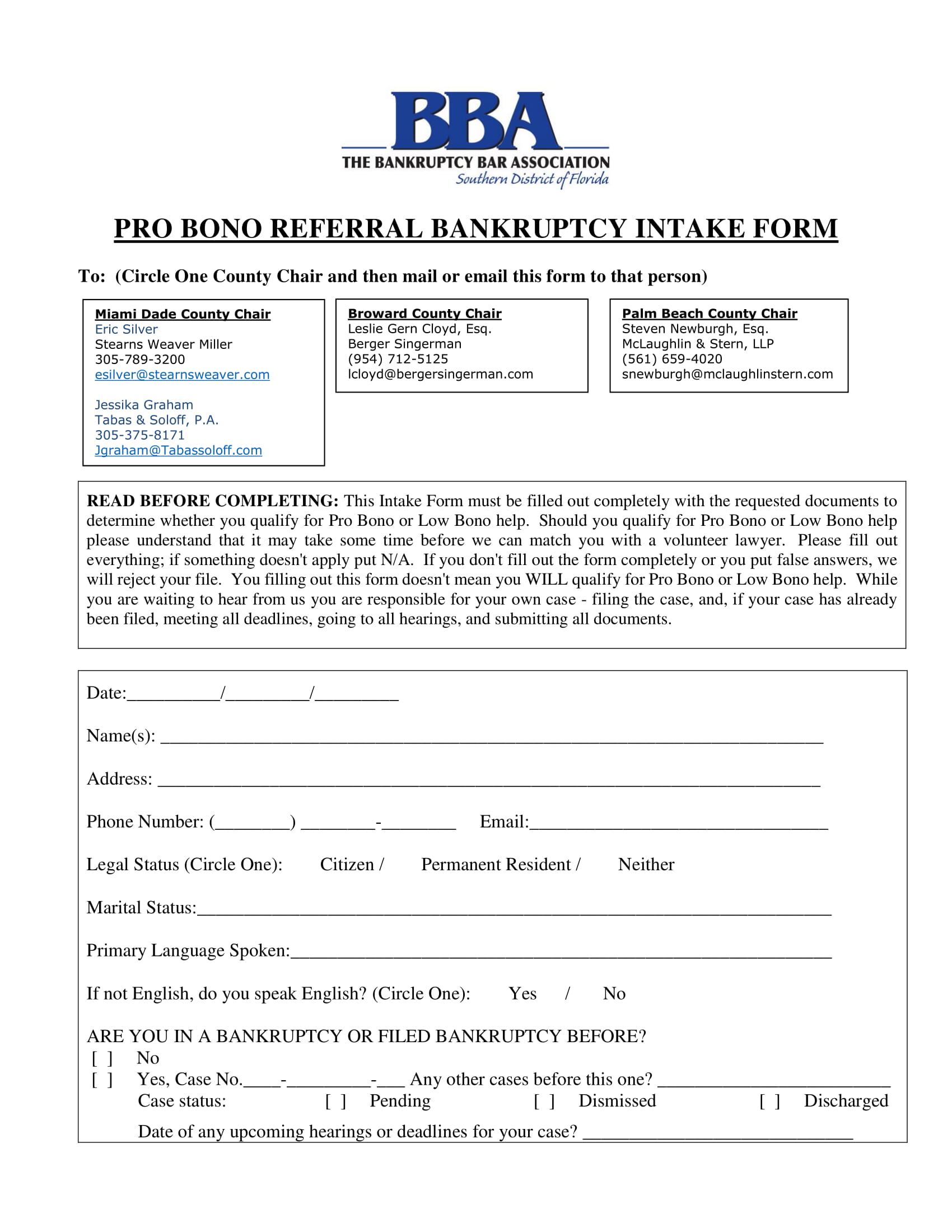

A bankruptcy intake form indicates the payments and fees that the client needs to provide to avail the consultation. The form also gathers the client’s general information and other details that are related to his bankruptcy. After the form is completed, the consultant or the attorney will hand a petition form to the client which will then be filed to the court electronically or personally by the attorney. The date when the petition is submitted will also be the date when the collection of the debt payment be halted.

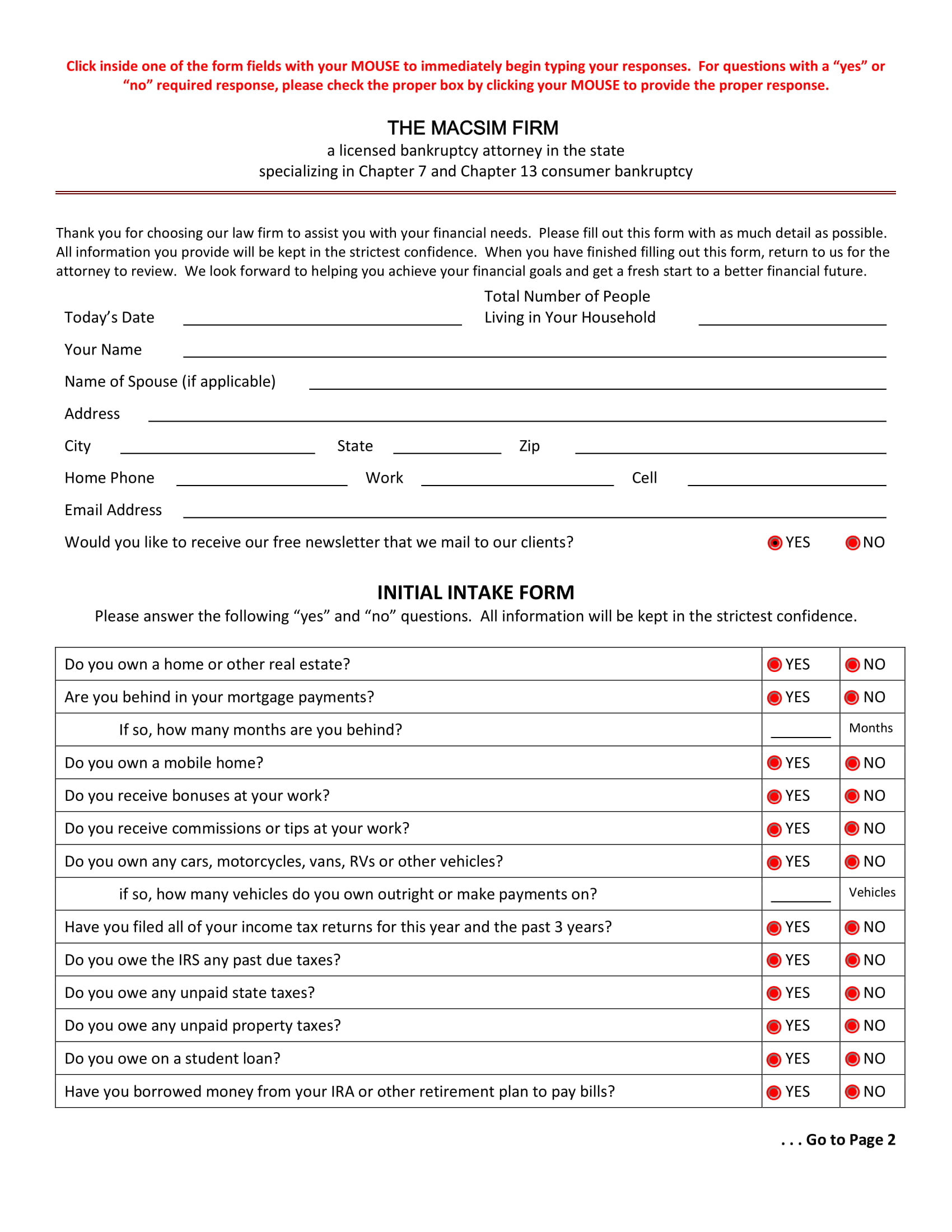

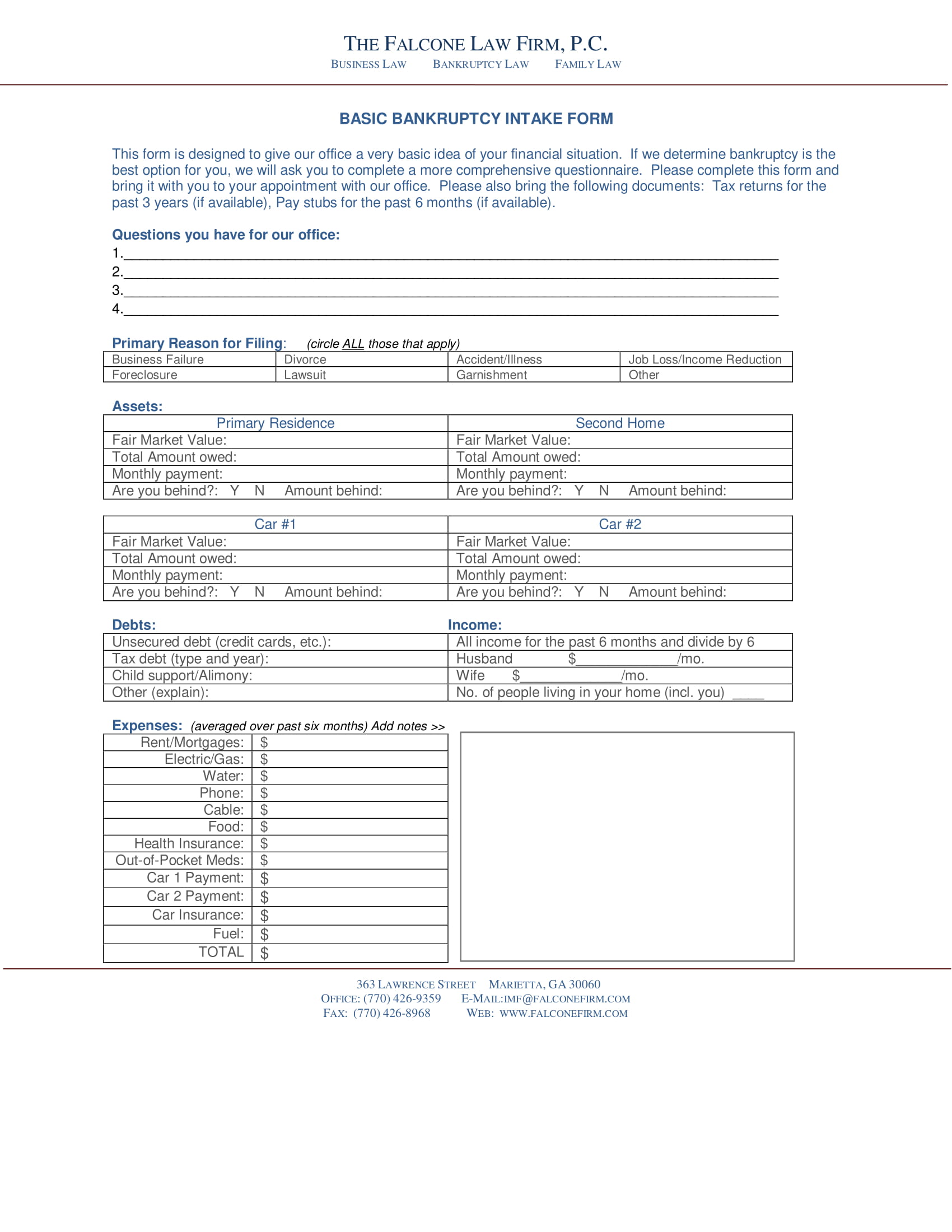

Bankruptcy Initial Intake Form

Basic Bankruptcy Intake Form

Significant Contents of a Bankruptcy Intake Form

Some bankruptcy consultants and attorneys prefer to have numerous pages for their intake form in order to collect enough details and enclose sufficient legal statements. On the other hand, there are also some who aim to minimize the time that their clients will be spending on completing an intake form, which is why the document is shortened and other details are only gathered during the interview or meeting with the attorney. Nonetheless, below are the significant contents and sections that should be included in any bankruptcy intake form:

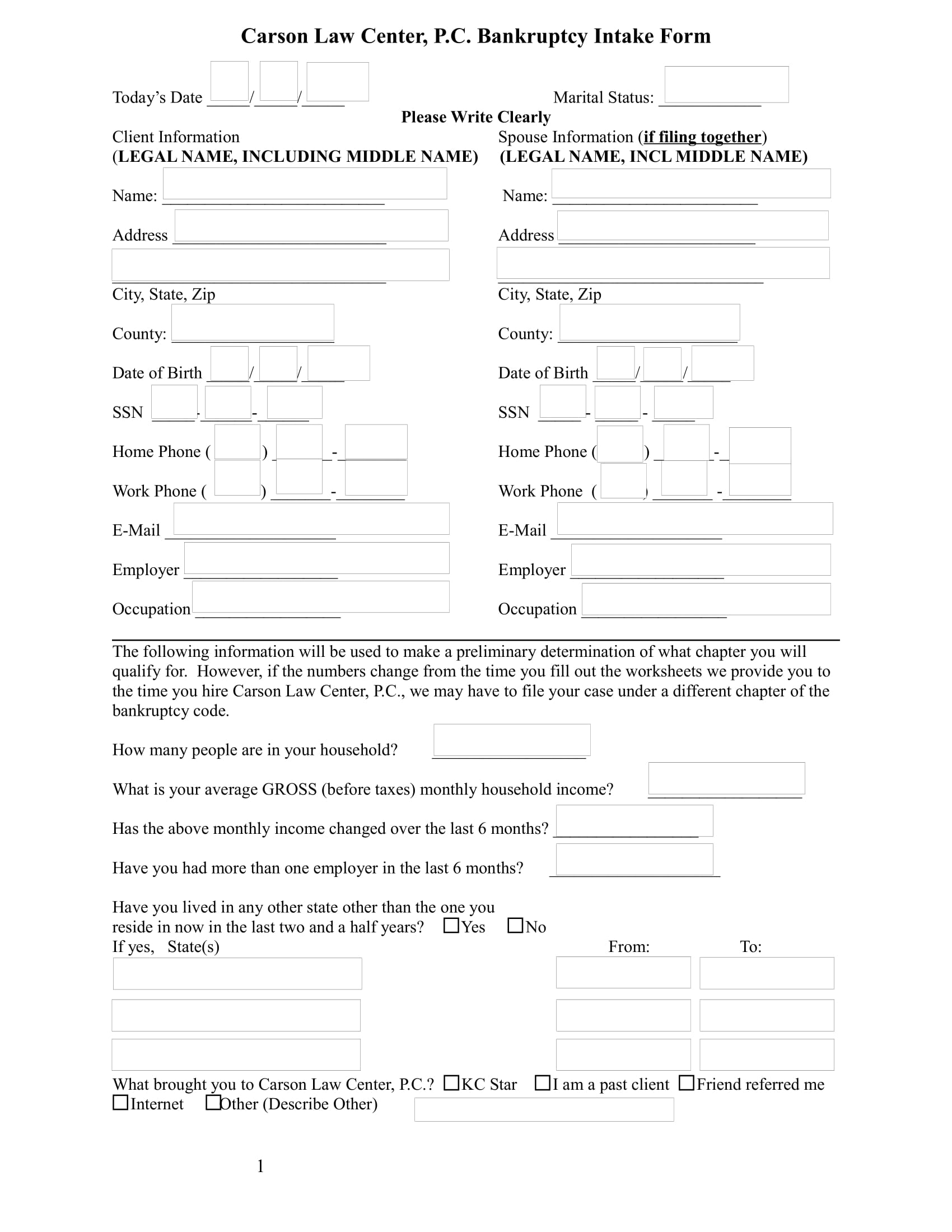

1. Consultation information

This is where the initial consultation dates and fees are stated which must be provided by the consultant or attorney. Additionally, this section also determines what chapter will be mandated for the bankruptcy of the client as well as whether the client is filing as part of a joint account or for his individual bankruptcy intentions. You may also see sample counseling intake forms.

2. Debtor information

The debtor is the borrower or the person who is filing the bankruptcy for owning money from a creditor or lender. This section will have the personal information of the debtor such as his full legal name, present and mailing address, and contact numbers.

3. Debtor’s spouse’s information

This will contain the identification of the debtor’s spouse along with the contact information to allow the attorney or consultant in informing the spouse if he or she is responsible for a joint account bankruptcy.

4. Bankruptcy questionnaire

The question that must be stated in this section should be to determine whether the debtor along with his spouse has filed a bankruptcy before. This includes obtaining the details of the debtor’s previous bankruptcy such as the date when it was filed, case number, location, and an indication if the bankruptcy case is still pending. You may also like career counseling forms.

5. Mortgage information

This is for the house and residential properties of the debtor that are under a mortgage loan. The debtor must disclose the location, type, and the current market value of the property. The principal balance of the mortgage along with the amount of the outstanding debts must also be indicated. This section must also have enough areas where a debtor who has numerous mortgage loans will be able to disclose all the necessary details. You may also check out blank counseling forms.

6. Personal property information

Personal properties are the collectibles, pieces of furniture, apparel, deposits, as well as the cash on hand owned by the debtor. This section has a list of property categories and will acquire the property description and market value disclosed by the debtor. Other properties included in this section are the annuities, education savings accounts, life insurance policies, stocks, interests, and patented inventions of the debtor. You may also see general counseling forms.

7. Car information

If a debtor has a car, it is significant that the description of the owned car will be stated on a separate sheet. The car information section will allow the debtor to indicate the model and make of his car as well as whether his car is under a type of lien or a lease agreement. Additionally, the monthly payments and the amount due should also be in this section along with the answers of the debtor if his wife or spouse is a joint owner of his owned automotive properties.

8. Taxes and domestic support

This is where the attorney or consultant will be informed about the unpaid taxes of the debtor and the debtor’s domestic support obligations. The debtor must name the government agency where he owes his taxes, the type of tax claims, and the exact or estimated amount owed. On the other hand, the debtor must also disclose details about his alimony and child support obligations if there are any. You might also be interested in project intake forms.

9. Lease agreement information

For debtors who are involved and associated into lease agreements for apartments and other properties, this section must be filled out with the identification of the other parties in the agreement and the type of property being leased unto the tenants. The dates of the contract or lease, account number, and the addendum for the terms and conditions of the contract must be indicated in this section as well. You may also check out coaching intake forms.

10. Creditor list

This is where the debtor enlists the identities of his creditors which includes their names, complete addresses, balance due, the name of the account holders, the co-debtors, and the collection agency.

11. Personal income

The debtor needs to indicate his marital status in this section as the primary data to be filled in along with the names of his dependents. Then, the name of the debtor’s employer will be stated with the other sources of income that the debtor has been involved into. The income of the debtor and his spouse will be disclosed with details in this section as well which includes their gross wages and net take-home pay amounts. You may also see initial counseling forms.

12. Monthly expense information

The expenses ranging from the debtor’s residential rent, taxes, mortgage payments, supplies, and even the monthly food amount allocation for the household are the factors that will complete this section.

13. Statement of financial affairs

This is another part of the form that mainly contains questions that focuses on the income, property transfers, and other significant information in relation to the debtor’s finances.

Law Center Bankruptcy Intake Form

Pro Bono Referral Bankruptcy Intake Form

Five Tips for Completing Bankruptcy Intake Forms

When dealing with bankruptcy, it is essential that the attorney will inform the client about what must be done as well as how the client must complete a bankruptcy intake form. Below are some tips that will help any client make the most of the bankruptcy intake form and assure that legal objectives are met properly:

1. Write clearly.

Some consultants prefer their debtors to complete the intake form with the use of a typewriter or through online completion since this assures that the general statements and inputted data are clear as well as concise. Nonetheless, if the debtor prefers to write by hand, he must make sure that his handwriting is clear and can be understood by the consultant.

2. Provide the full addresses.

Regardless if the address that is being required to be stated on the form is of the creditors or the associated partners in a business, the debtor must provide the complete and full address. This is to assure that notice forms and other related documents will be sent directly whenever needed for the bankruptcy process.

3. Avoid leaving blank sections.

The debtor must inform the consultant if there are sections that are not applicable for him to avoid confusion and to deal with a declined petition. Additionally, when it comes to indicating the amount of a debt from a lender, the debtor can disclose a high estimation if he is not knowledgeable about the exact amount he owes. You may also see counseling forms in PDF.

4. Indicate long answers on the next page of the form.

Since an intake form contains only a few blank spaces to cater answers and statements, the debtor must use the vacant areas at the back of each page. Nonetheless, the number of the question must also be included before the answers in order to determine where the answer will be associated when it will be reviewed by the consultant. You may also like event planning intake forms.

5. Enclose legal forms.

Bankrupt intake forms are also considered as financial forms which must be supplied with proof and evidence relating to the claims of the debtor. With this, the debtor must enclose or attach documents on the form such as deeds, mortgage loan agreements, tax return duplicates, and photocopies of identification cards with the debtor’s social security number.

With the aforementioned list of significant contents and tips, consultants will be able to create an efficient and functional intake form. On the other hand, debtors will be able to know how they can fully complete the form which will help in ensuring that they are meeting the standards and needs of the consultant as well as the court. You may also check out family assessment forms.

After the case session at the court, it is essential that the debtor will keep all the documents that relate to his filed bankruptcy within a period of ten years. This will assure that the debtor will be able to prove and show evidence about his bankrupt state to the creditors or lenders who will remain to ask for payments; in short, the form serves as a tool that protects the debtor from repaying debts after he issued bankruptcy. You may also see psychotherapy intake forms.

Related Posts

-

Client Intake Form

-

FREE 21+ Counseling Intake Forms in PDF | MS Word

-

FREE 4+ Therapy Intake Forms in PDF | MS Word

-

FREE 4+ Project Intake Forms in PDF | MS Word

-

New Patient Intake Form

-

Massage Intake Form

-

Coaching Intake Form

-

FREE 4+ Event Planning Intake Forms in PDF | MS Word

-

FREE 7+ Medical Intake Forms in PDF

-

FREE 10+ Sample Assessment Intake Forms in MS Word | PDF