A Verification Form is essential for confirming banking details for financial transactions. Whether for loans, payroll, or direct deposits, it helps institutions validate account ownership and ensure secure payments. A Banking Form typically includes account holder details, bank name, account number, and financial institution authorization. Completing this form correctly minimizes errors and prevents fraud. This guide covers essential steps, examples, and best practices for filling out a Bank Verification Form accurately. Understanding its purpose ensures seamless banking operations and compliance with financial regulations.

Download Bank Verification Form Bundle

What is Bank Verification Form?

A Bank Verification Form is a document used to confirm a person’s banking details, ensuring accuracy in financial transactions. It is commonly required by banks, employers, and lenders to verify account ownership before processing payments, loans, or direct deposits. This form typically includes personal details, bank name, routing number, and account number. It helps prevent fraud, reduce errors, and streamline banking processes. Financial institutions use it to validate information provided by individuals or businesses, ensuring secure and efficient transactions.

Bank Verification Format

Account Holder Information

Full Name: [Insert Name]

Account Number: [XXXXXXXX]

Bank Name: [Insert Bank Name]

Branch Address: [Insert Address]

Verification Request

- Purpose of Verification: [Loan/Employment/Transaction]

- Authorized Entity: [Company or Institution Name]

Bank Confirmation

- Account Holder Name Match: [Yes/No]

- Account Status: [Active/Dormant]

Authorized Signatures

Bank Representative Signature: [Signature]

Account Holder Signature: [Signature]

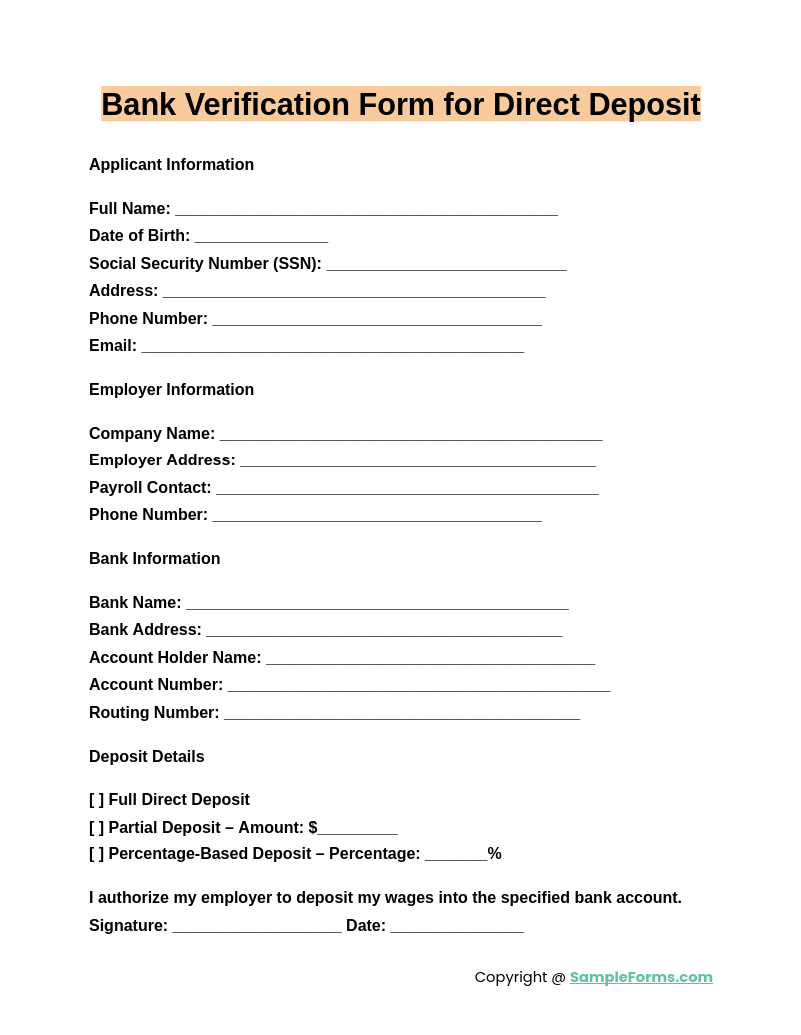

Bank Verification Form for Direct Deposit

A Bank Verification Form for Direct Deposit ensures accurate and secure payroll or benefit transfers. Similar to a Verification Certificate Form, it confirms account details to prevent errors and ensure seamless electronic fund transfers.

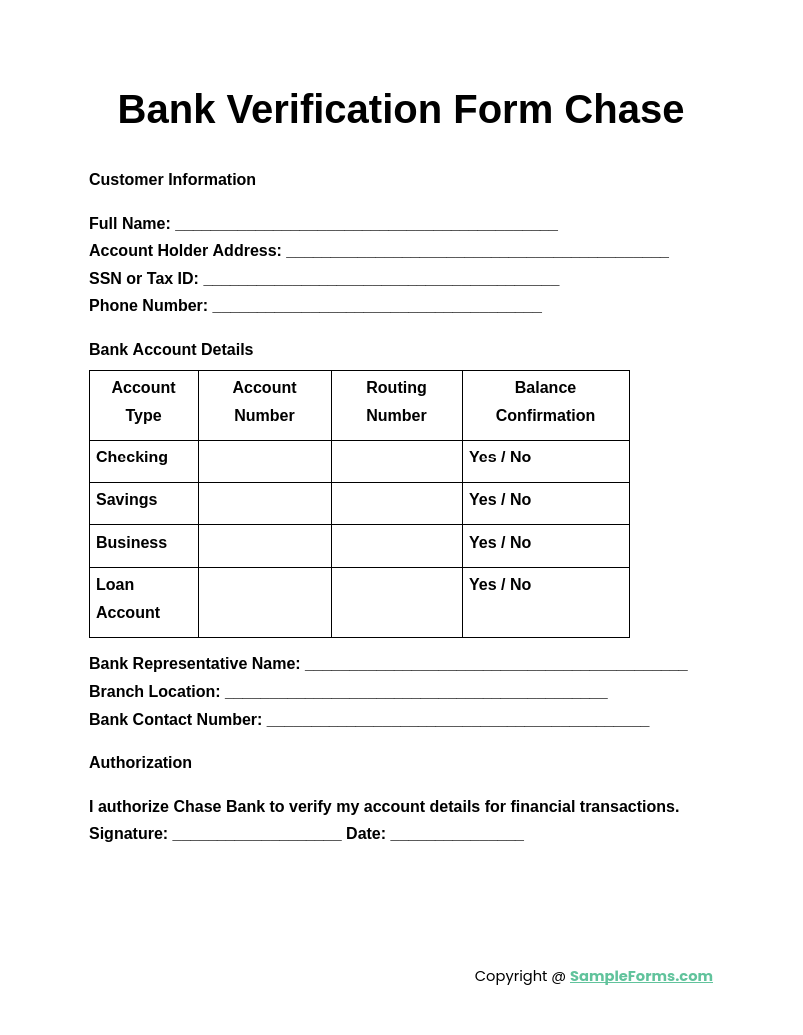

Bank Verification Form Chase

A Bank Verification Form Chase is used to verify account details for Chase Bank transactions. Similar to a Birth Verification Form, it authenticates personal and financial information to facilitate secure banking operations.

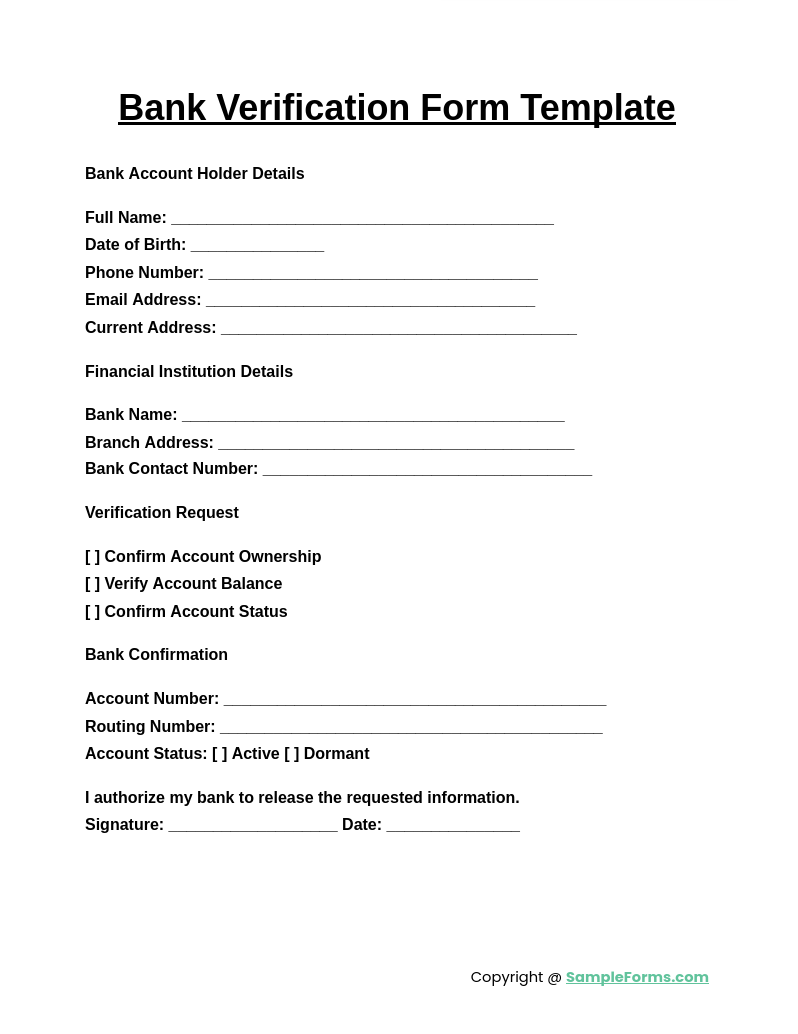

Bank Verification Form Template

A Bank Verification Form Template provides a standardized format for financial verification. Similar to a Dental Insurance Verification Form, it collects essential banking details, ensuring accuracy and fraud prevention in financial transactions.

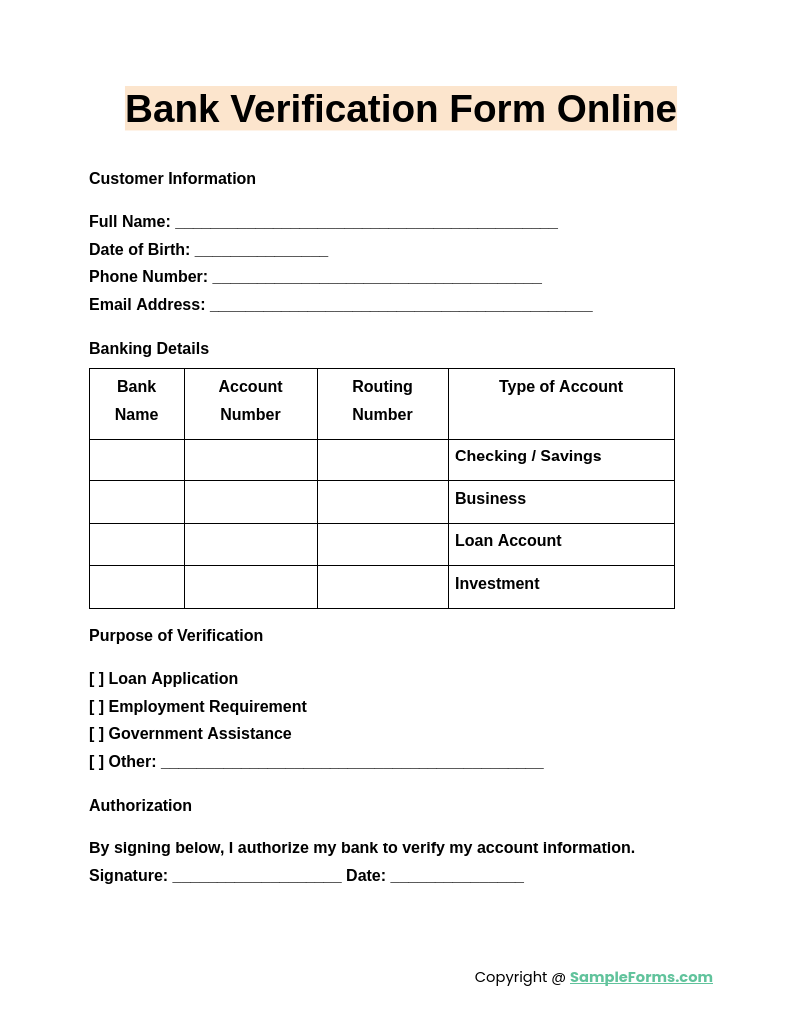

Bank Verification Form Online

A Bank Verification Form Online simplifies remote account verification. Similar to an Enrollment Verification Form, it allows digital submission, making financial validation faster, more accessible, and secure for banking and transactional needs.

Browse More Bank Verification Forms

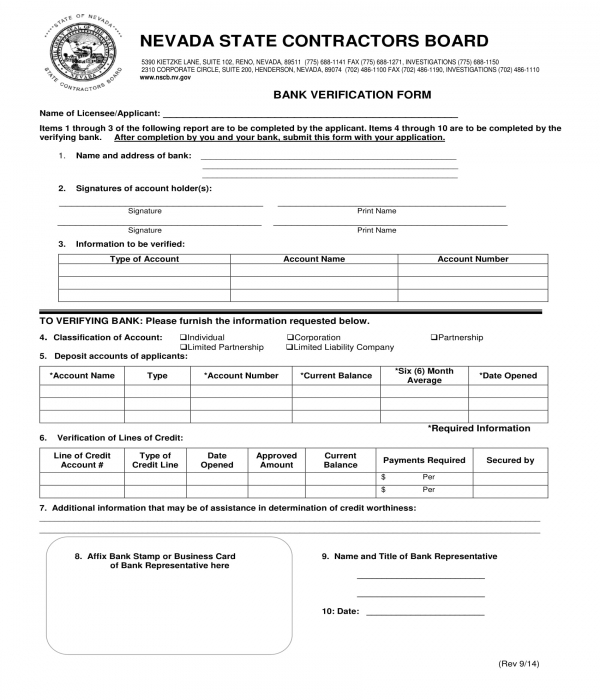

Bank Verification Form Sample

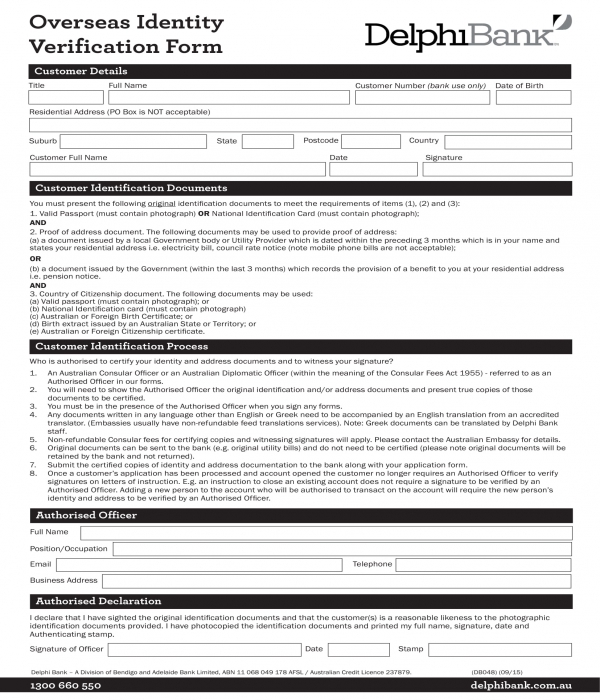

Bank Overseas Identity Verification Form

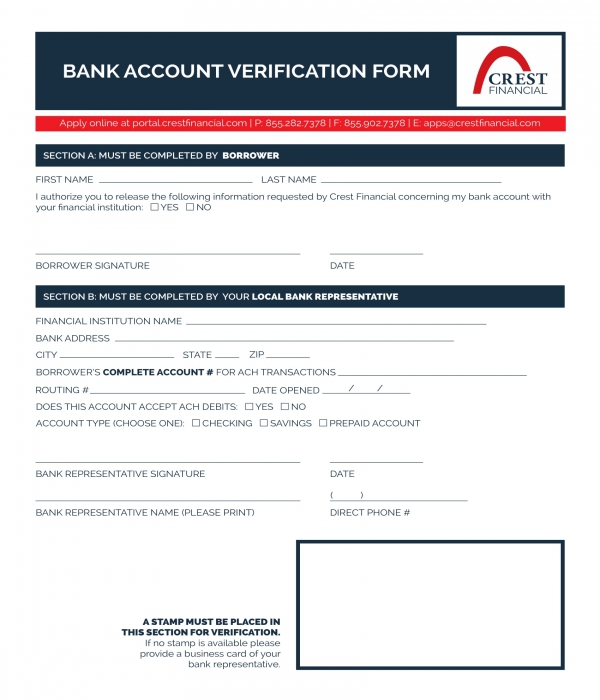

Bank Account Verification Form

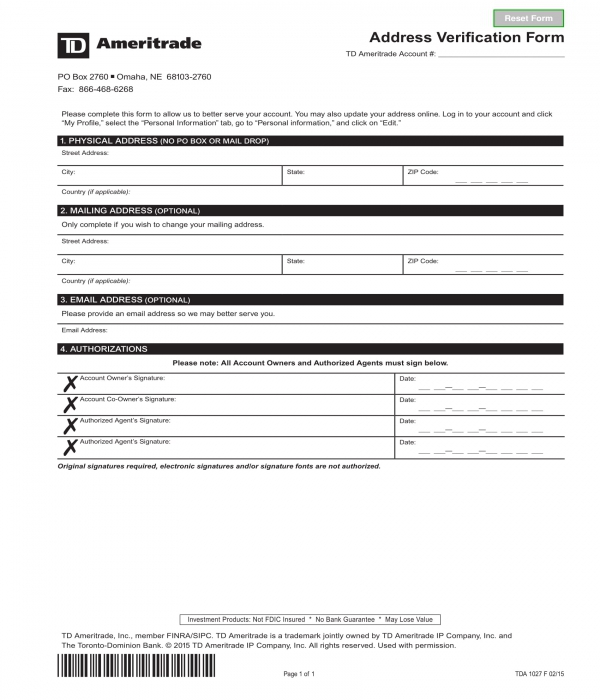

Bank Address Verification Form

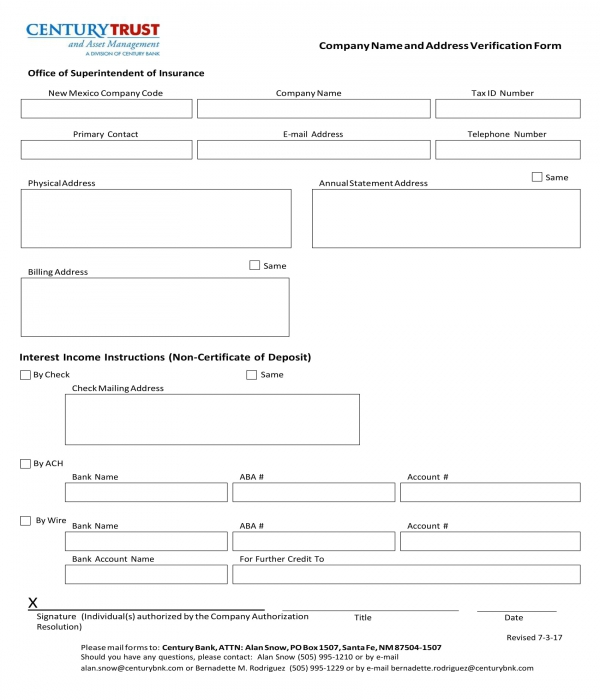

Bank Company Verification Form

Banker’s Verification Form

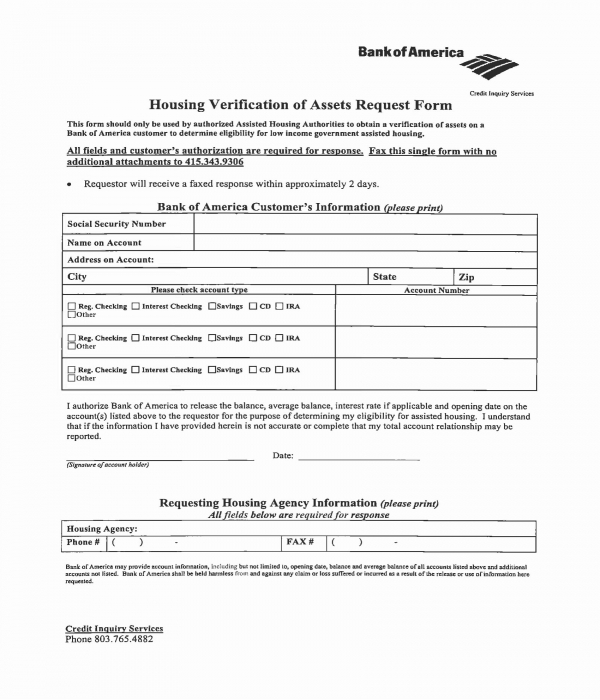

Bank Housing Verification of Assets Request Form

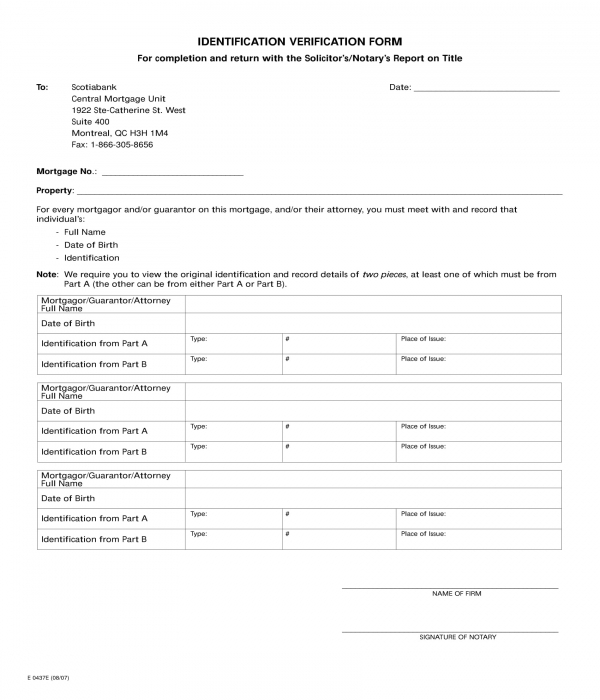

Bank Identification Verification Form

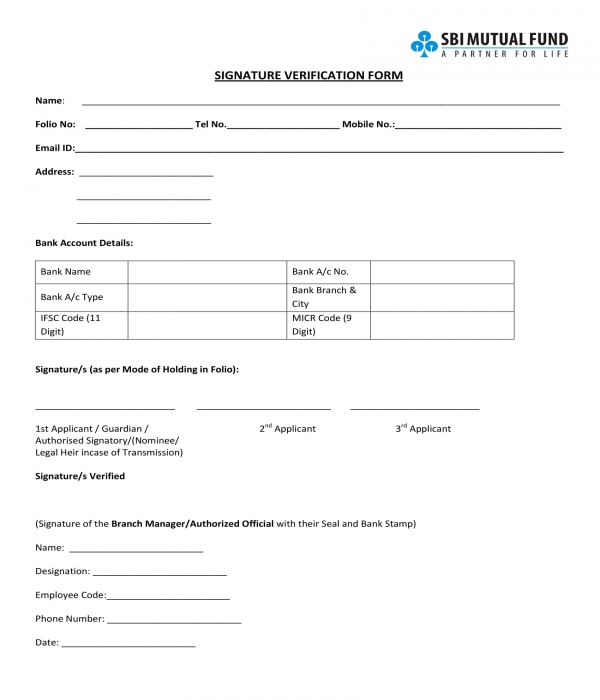

Bank Signature Verification Form

How Do I Get a Bank Verification Form?

A Bank Verification Form is obtained from your bank to confirm account ownership and details for financial transactions. Similar to a Notary Verification Form, it serves as an official authentication document.

- Visit Your Bank: Request the form in person at your branch.

- Download Online: Many banks provide downloadable forms on their websites.

- Contact Customer Support: Request the form via phone or email.

- Provide Identification: Submit valid ID and account details for verification.

- Complete & Submit: Fill out and return the form to the bank for processing.

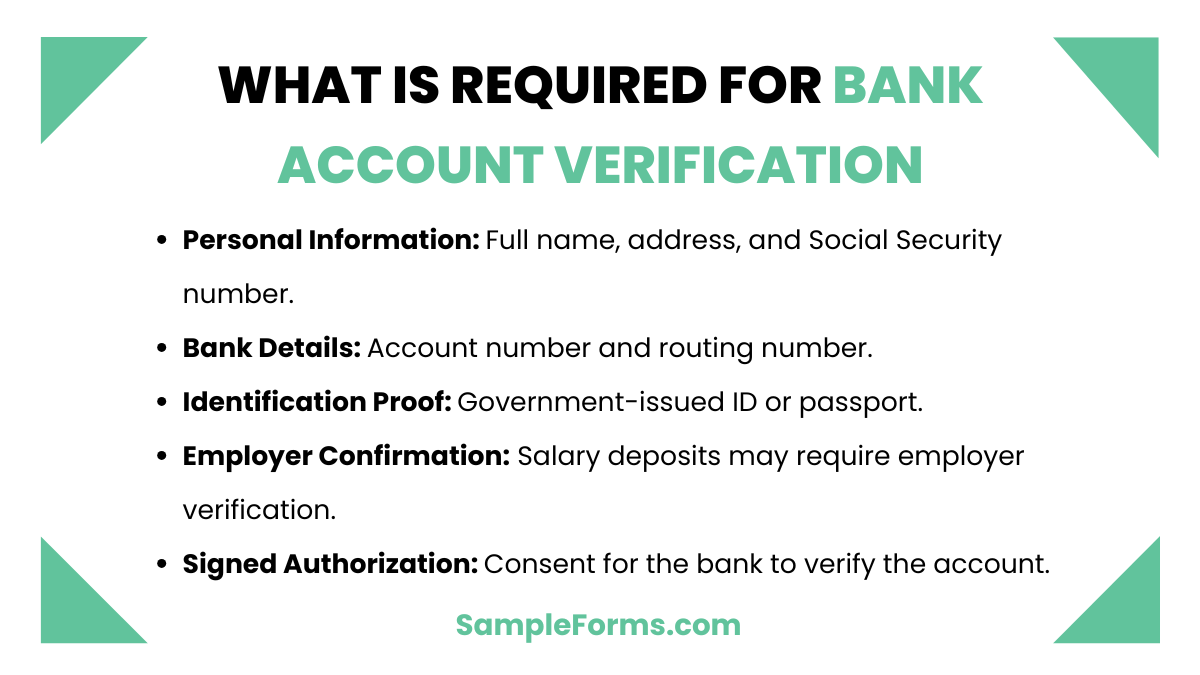

What Is Required for Bank Account Verification?

Banks require specific details to verify account ownership and transaction legitimacy. Similar to a Insurance Verification Form, it ensures accurate financial identification.

- Personal Information: Full name, address, and Social Security number.

- Bank Details: Account number and routing number.

- Identification Proof: Government-issued ID or passport.

- Employer Confirmation: Salary deposits may require employer verification.

- Signed Authorization: Consent for the bank to verify the account.

Why Is Bank Account Verification Important?

Bank account verification prevents fraud and ensures secure transactions. Similar to an Background Verification Form, it confirms identity and financial credibility.

- Fraud Prevention: Protects against identity theft and unauthorized access.

- Regulatory Compliance: Meets financial and legal requirements.

- Transaction Security: Ensures safe deposits and withdrawals.

- Loan & Credit Approval: Banks verify accounts before granting credit.

- Employer Payments: Employers require verification for salary processing.

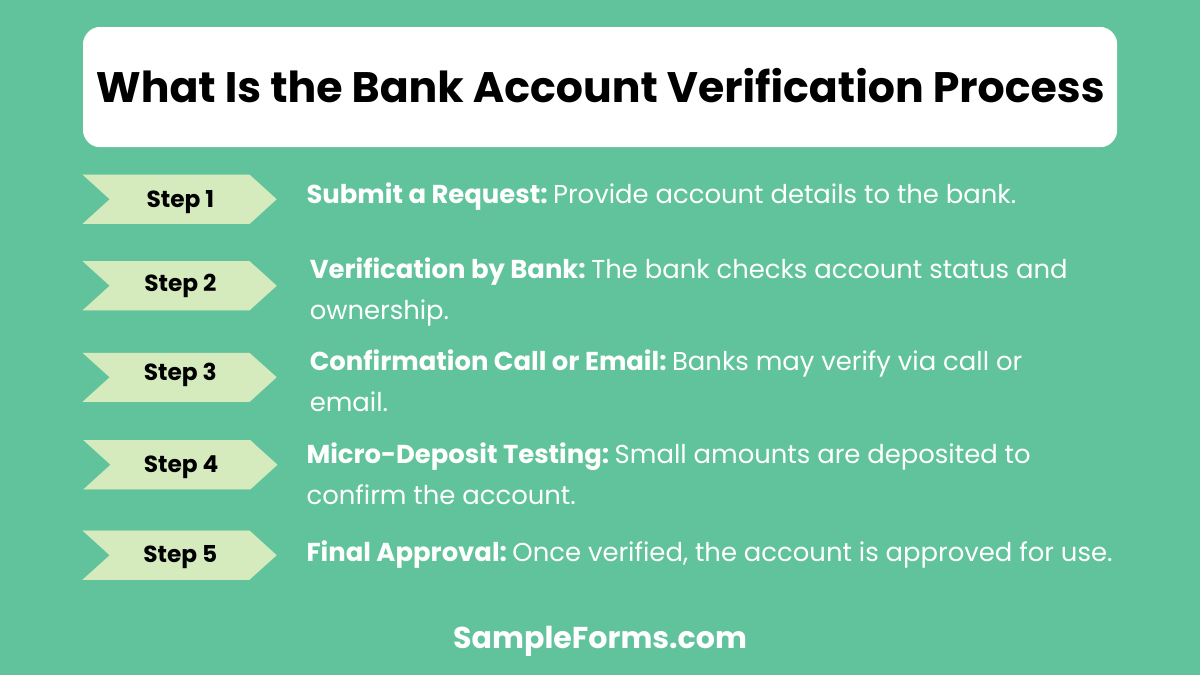

What Is the Bank Account Verification Process?

The verification process confirms account legitimacy and ownership. Similar to an Employee Verification Form, it ensures accurate banking information.

- Submit a Request: Provide account details to the bank.

- Verification by Bank: The bank checks account status and ownership.

- Confirmation Call or Email: Banks may verify via call or email.

- Micro-Deposit Testing: Small amounts are deposited to confirm the account.

- Final Approval: Once verified, the account is approved for use.

What Information Is Obtained in the Verification of a Bank Account?

Banks collect key financial details during verification. Similar to an Employment Verification Form, it confirms identity and account validity.

- Account Holder Name: Confirms ownership.

- Account Status: Active, dormant, or closed.

- Bank Routing & Account Numbers: Used for transactions.

- Deposit & Withdrawal History: Reviews financial activity.

- Linked Services: Identifies direct deposits, loans, and bill payments.

What can I use for bank verification?

You can use official bank statements, checks, or a Residential Verification Form to confirm account ownership, ensuring secure financial transactions and compliance with banking regulations.

What is instant banking verification?

Instant banking verification allows real-time confirmation of account details. Similar to a Medical Verification Form, it ensures accuracy by securely verifying financial information instantly through digital banking platforms.

How do I verify my bank online?

Online bank verification requires logging into your account, providing credentials, and using Identification Verification methods such as OTP or security questions to confirm identity.

What can be used as proof of bank account?

Documents like bank statements, canceled checks, or a Payroll Verification Form serve as proof of an active bank account for financial and official purposes.

What is positive verification in banking?

Positive verification ensures account ownership and activity. Similar to Disability Verification, it confirms accurate financial details before transactions are processed securely.

Can I verify someone’s bank account?

No, you cannot verify someone’s bank account without consent. Similar to a Service Verification Form, proper authorization and legal procedures are required for third-party account validation.

Why does my bank keep asking for verification?

Banks request verification to prevent fraud, comply with regulations, and secure transactions. Similar to a Training Verification Form, it ensures identity accuracy and account security.

How do I complete bank verification?

Bank verification requires submitting documents, linking accounts, and confirming transactions. Similar to a Reference Verification Form, it ensures accurate identity and financial validation.

Is online bank verification safe?

Yes, online bank verification is safe with encrypted security measures. Similar to Social Security Verification Form, it uses multi-factor authentication to protect personal and financial data.

Can I get bank proof online?

Yes, most banks provide digital proof like e-statements or a Auto Insurance Verification Form to verify bank account details securely through online banking.

A Bank Verification Form: Sample, Forms, Letters, Use is crucial for secure financial operations. It ensures that account details are correctly validated before processing transactions like loans, payroll, or deposits. This form safeguards against fraud and enhances financial accuracy. Whether used by banks, businesses, or government agencies, a properly filled verification form simplifies approval processes. Additionally, a Signature Verification Form is often required alongside it for further authentication. Understanding its importance helps individuals and businesses maintain seamless and secure banking interactions.

Related Posts

-

Proof of AA Attendance Form

-

Tenant Employment Verification Form

-

What Is a Volunteer Verification Form? [ Definition, Types, Importance ]

-

Verification Certificate Form

-

What Is a Training Verification Form? [ Definition, Uses, Significance ]

-

What Is a Shelter Verification Form? [ Types, Tips, Samples ]

-

What Is a Service Verification Form? [ Uses, Samples ]

-

What Is an Insurance Verification Form? [ Uses, Impotance, Samples ]

-

Birth Verification Form

-

Background Verification Form

-

FREE 10+ Asset Verification Forms in PDF | MS Word

-

Address Verification Form

-

What Is a Residential Verification? [ Types, Importance, Samples ]

-

What Is an Identification Verification? [ Definition, Uses, Importance, Inclusions ]

-

What Is a Disability Verification? [ Definition, Importance, Uses, Contents ]