The Balance Sheet Form is a crucial tool in accounting, offering a snapshot of a company’s financial position. This complete guide provides clear examples and templates to help you understand and create effective balance sheets. Learn how to utilize these forms to accurately track assets, liabilities, and equity. From basic Accounting Form to advanced financial management, our guide ensures you have the knowledge to maintain precise financial records. With Fillable Form included, you’ll have everything you need to streamline your accounting process. Discover how communication examples play a vital role in understanding and implementing balance sheets efficiently.

Download Balance Sheet Form Bundle

What is Balance Sheet Form?

A Balance Sheet Form is a financial statement that outlines a company’s assets, liabilities, and equity at a specific point in time. This form is essential for evaluating a company’s financial health and stability. By listing all assets on one side and liabilities and equity on the other, it provides a clear picture of what the company owns versus what it owes. Simple yet comprehensive, a balance sheet is a fundamental component of financial analysis and decision-making.

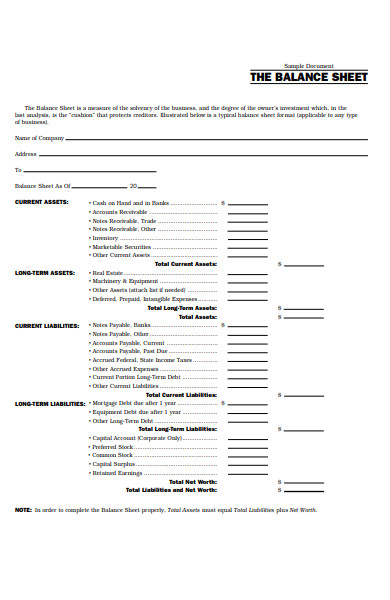

Balance Sheet Format

1. Assets

- Current Assets:

- Cash and Cash Equivalents

- Accounts Receivable

- Inventory

- Non-Current Assets:

- Property, Plant, and Equipment

- Investments

- Intangible Assets

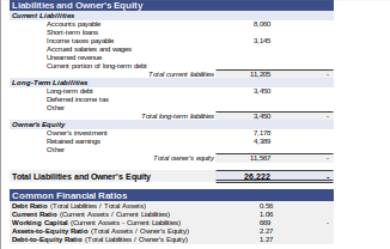

2. Liabilities

- Current Liabilities:

- Accounts Payable

- Short-Term Debt

- Accrued Liabilities

- Non-Current Liabilities:

- Long-Term Debt

- Deferred Tax Liabilities

3. Equity

- Owner’s Equity:

- Capital Stock

- Retained Earnings

4. Total Liabilities and Equity

- Total:

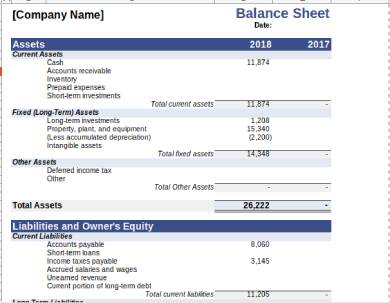

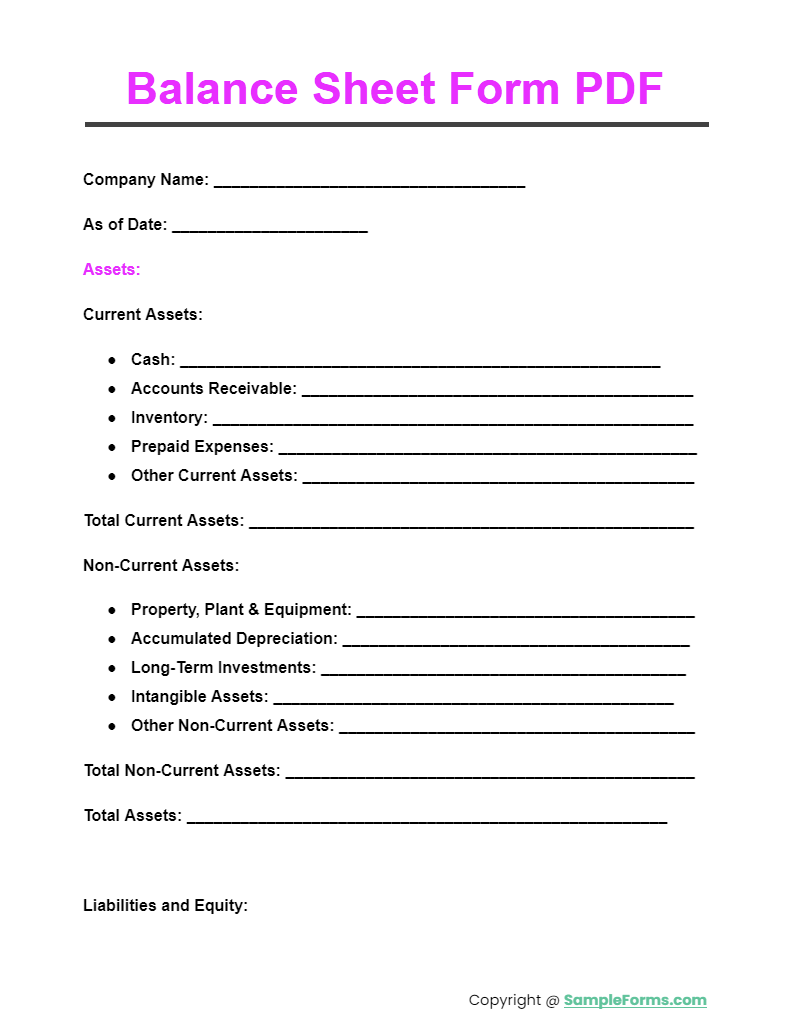

Balance Sheet Form PDF

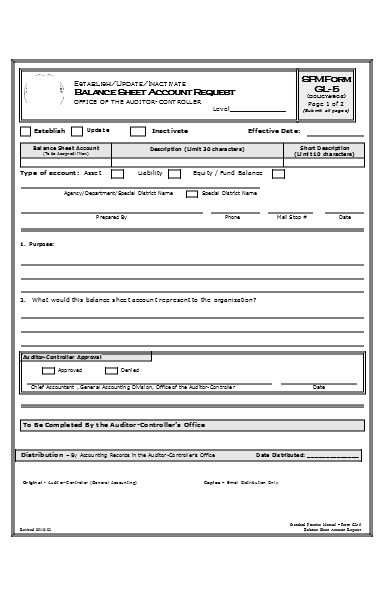

A Balance Sheet Form PDF offers a standardized format for documenting your company’s financial position. This digital form is ideal for secure, easy sharing and printing. Integrating this with an Employee Sign-in Sheet ensures comprehensive financial and attendance tracking in one convenient package.

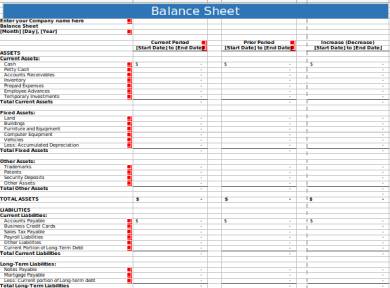

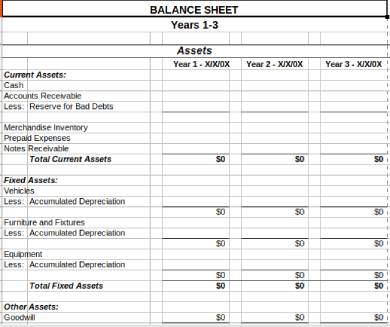

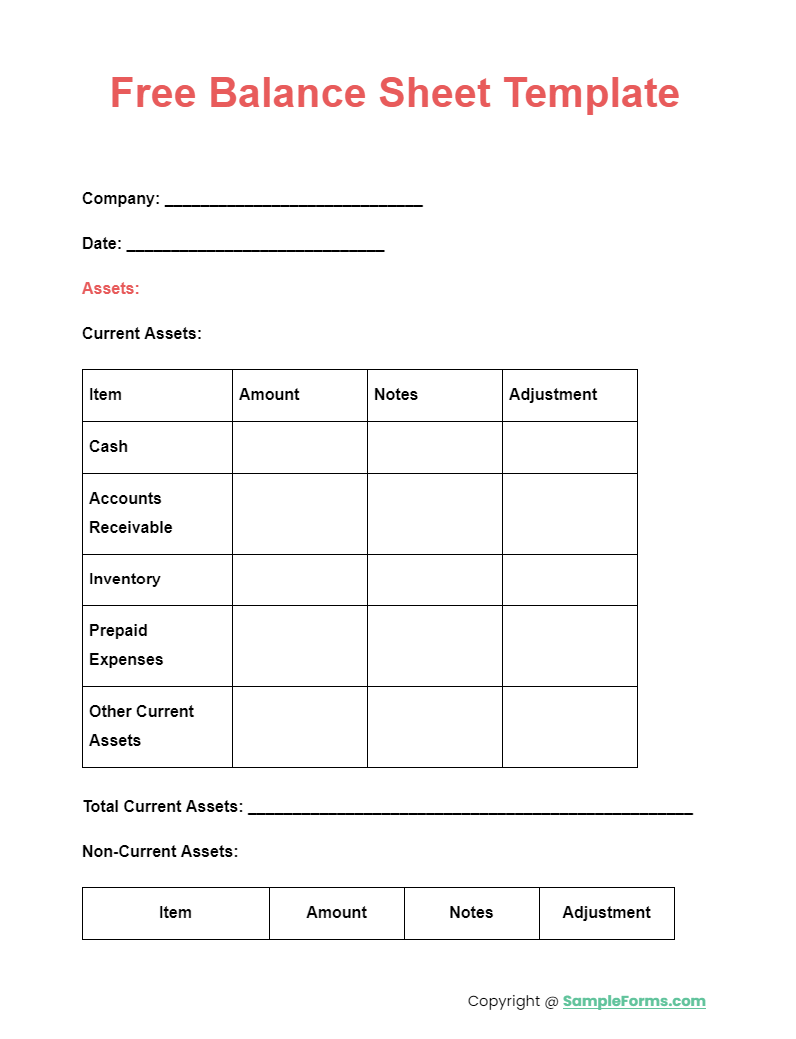

Free Balance Sheet Template

A Free Balance Sheet Template provides an accessible way for businesses to manage finances without extra costs. This template simplifies the process of listing assets, liabilities, and equity. Pairing it with a Sign-in/Sign-up Sheet enhances your organizational efficiency by maintaining clear financial and attendance records.

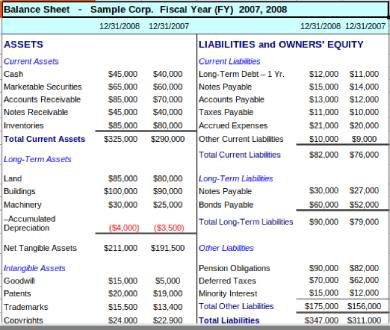

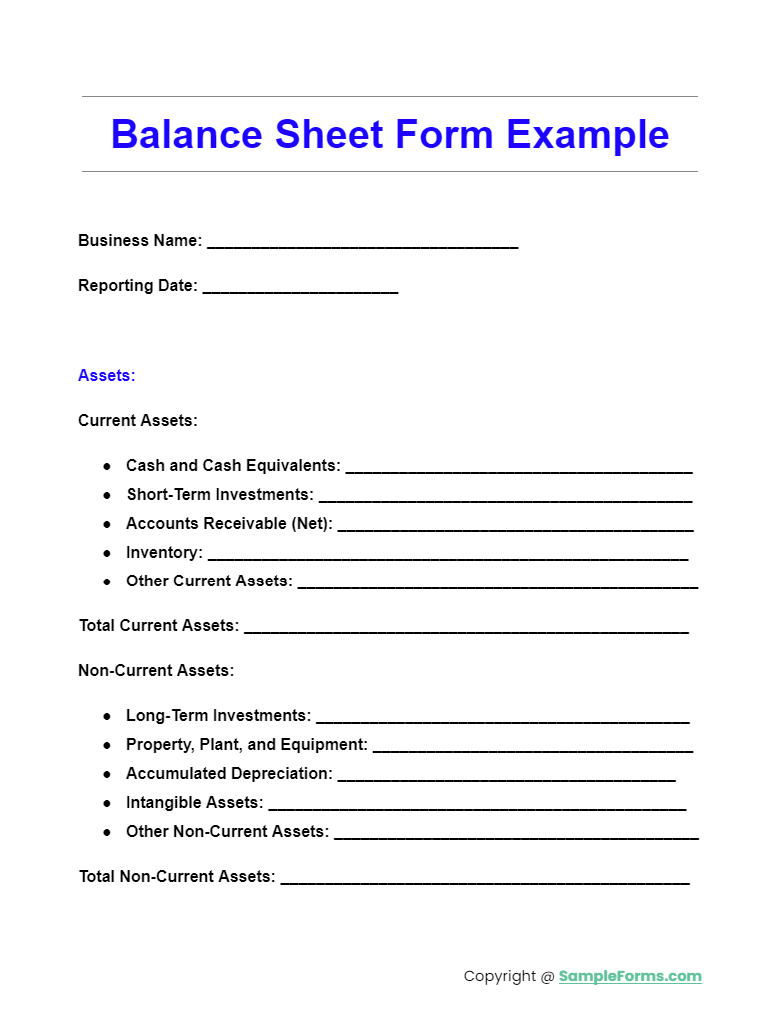

Balance Sheet Form Example

A Balance Sheet Form Example serves as a practical guide to understanding the layout and essential elements of a balance sheet. Using an example helps in accurate financial reporting. Combine this with a Daycare Sign-In Sheet for a comprehensive approach to managing financial and attendance records in childcare settings.

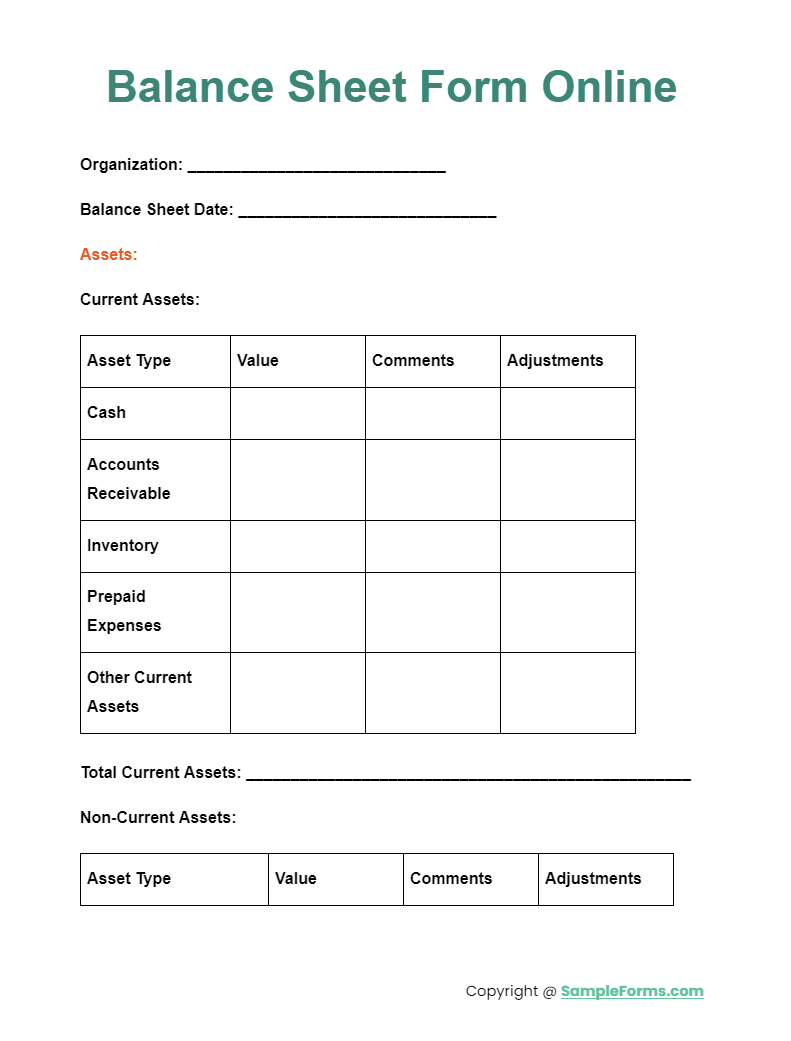

Balance Sheet Form Online

A Balance Sheet Form Online offers convenience and accessibility, allowing you to manage your financial statements from anywhere. This digital solution is perfect for modern businesses. Integrating it with a Safety Meeting Sign-In Sheet ensures a holistic approach to safety and financial documentation in your organization.

More Balance Sheet Form Samples

1. Balance Sheet Form Template

2. Business Balance Sheet Form

3. Balance Sheet Form Sample

4. Sample Balance Sheet Form Template

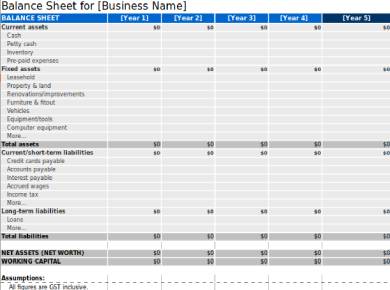

5. Multi-Year Balance Sheet Form

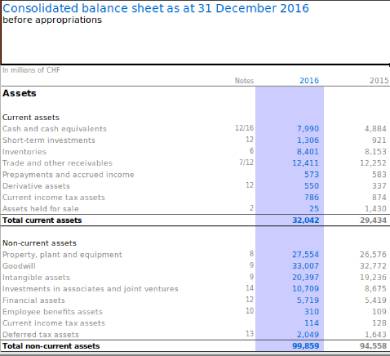

6. Consolidated Balance Sheet Form

7. Sample Balance Sheet Form

8. Balance Sheet Short Form

9. Balance Account Sheet Form

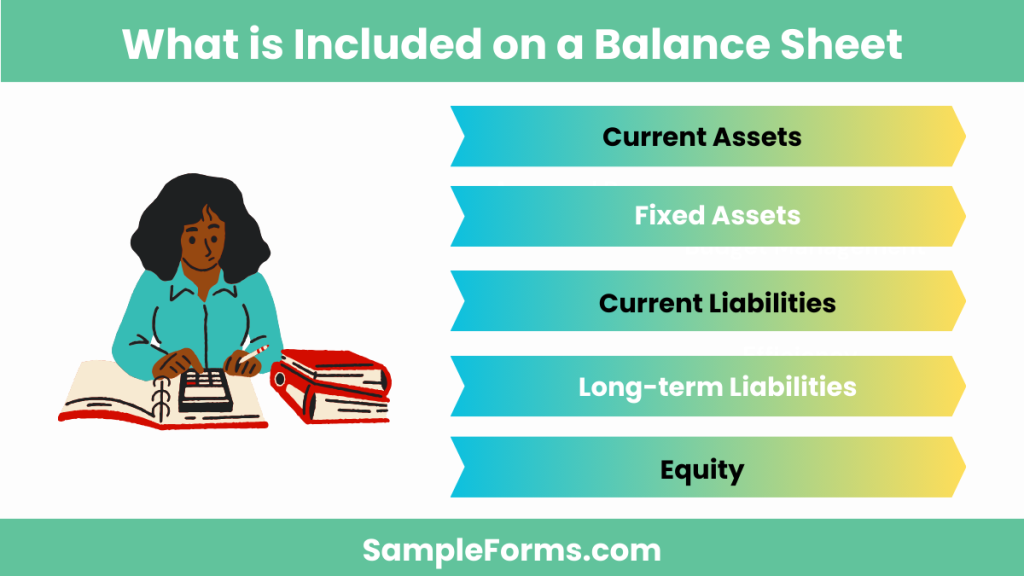

What is included on a balance sheet?

A balance sheet includes detailed information about a company’s assets, liabilities, and equity. This document provides a snapshot of the company’s financial condition. A Student Sign-In Sheet is used to monitor student attendance daily.

Adhering to specific rules and regulations ensures that study leave is managed effectively. Key rules include:

- Current Assets: Cash, receivables, inventory.

- Fixed Assets: Property, equipment, vehicles.

- Current Liabilities: Accounts payable, short-term debts.

- Long-term Liabilities: Mortgages, bonds payable.

- Equity: Common stock, retained earnings. You may also see Missing Report Form

How to Prepare a Balance Sheet Form

Being the newly hired accountant tasked to prepare a balance sheet for this accounting period puts a tremendous amount of pressure on you. That is due to your inexperience in the field, thus doubting your capabilities as an accountant. To help you ease the uneasiness the task has brought upon you, here are the steps to help you prepare a Balance Sheet Form. You may also see Real Estate Open House Sign-In Sheet

Step 1. Gather all Financial Records and Documents

Firstly, gather all the financial records and documents. The financial records and documents needed in the preparation of a balance sheet are receipts, invoices, ledger accounts, and inventory of capital goods owned by the company. These documents contain all the information, such as amounts, facts, and figures, needed in preparing a balance sheet.

Step 2. Download a Balance Sheet Template

Then, download a Balance Sheet Form template so that you can begin preparing a balance sheet. To download a template, choose from an assortment of Balance Sheet templates listed in the samples section. You can find the samples section in the middle portion of this article. Using a ready-made template makes accomplishing the task efficiently and quickly by having a ready-made platform to work from. You may also see Sign-in/Sign-up Sheet

Step 3. Edit the Balance Sheet Template

After downloading the template of your choosing, you can now proceed in editing your Balance Sheet Form. In editing your Balance Sheet Form, start by listing the items and value included in your assets and liabilities. Your assets should be listed on the lefthand side of the form and the liabilities listed on the righthand side. After recording, balance both sides to find out the owner’s equity by using this equation: Equity = Assets – Liabilities. Then, list down the owner’s equity, including its components, their corresponding values, and the equity’s total amount below the liability. Lastly, add the total amount of liabilities to the total amount of equity. The sum derived from that should correspond to the total amount of the asset to balance the amount reflected on the sheet.

Step 4. Save and Store an Electronic Copy of the Balance Sheet

After you’re done editing the template and balancing the amount reflected on the sheet, save and store it as an electronic copy in your company’s financial database. Saving and storing an electronic copy of the recent balance sheet allows your superiors and the senior management to access it using their computers. Plus, it also allows you to access previous balance sheets and income statements and compare them to the recent ones for financial analysis purposes.

Step 5. Print the Balance Sheet Form

Aside from storing an electronic copy of the balance sheet, you should also print a hard copy of the balance sheet. A printed balance sheet is the one that you submit to your senior accountants to help them prepare a financial statement. You may also see Employee Time Sheet

What are assets on a balance sheet?

Assets on a balance sheet represent everything a company owns that has value. Managing assets effectively ensures financial stability. A Parent Sign-In Sheet is essential for tracking daily attendance accurately.

Adhering to specific rules and regulations ensures that study leave is managed effectively. Key rules include:

- Current Assets: Include cash, accounts receivable, and inventory.

- Fixed Assets: Include property, plant, and equipment.

- Intangible Assets: Include patents, trademarks, and goodwill.

- Investments: Include stocks, bonds, and other securities.

- Other Assets: Include miscellaneous items not categorized above.

Components of a Balance Sheet

The history of balance sheets goes a way back, as far as the 15th century. An italian, franciscan monk named Luca Pacioli is credited in publishing a textbook on accounting that features a balance sheet. The textbook listed resources separately from the claim against the former. The resources and claim aforementioned are what we know today as the debit and credit. Debit and credit are the basic forms of what composes a balance sheet. Both are subracted from one another which becomes the owner’s equity. To give you a glimpse of what makes a balance sheet, listed below this paragraph are its components and its respective definitions. You may also see

1. Assets

Assets are resources that provides future benefit to the owner, whether it’s an organization or an institution. There are two kinds of assets in accounting, the current asset and the fixed asset. Current assets are assets that are currently owned by the owner. Current assets include cash on hand, cash in the bank, accounts receivables, revenue, inventory and prepaid expenses. On the other hand, fixed assets are assets that generate revenue. Fixed assets include furnitures and fixtures, vehicles, buildings, equipment and other capital goods. You may also see Ledger Account Form

2. Liability

Liabilities as defined, are necessary sacrifices that a business makes to another business as a result of past transactions. Liabilities include debts, accounts payables, notes payables, acrued expenses, and tax expenses. Liabilities listed in the balance sheet are subracted from assets which results in the owner’s equity. You may also see Accounts Receivable Ledger Form

3. Owner’s Equity

Owner’s or shareholder’s Equity, as per definition, is the difference between the value of the owner’s asset and the value of the owner’s liability. Owner’s equity are divided in two, namely, the capital and retained earnings. Capital, also known as, the shareholder’s capital, is the amount that the owner or shareholders invested. While retained earnings are the amount that the owner or shareholders wish to keep or retain. You may also see Account Report Form

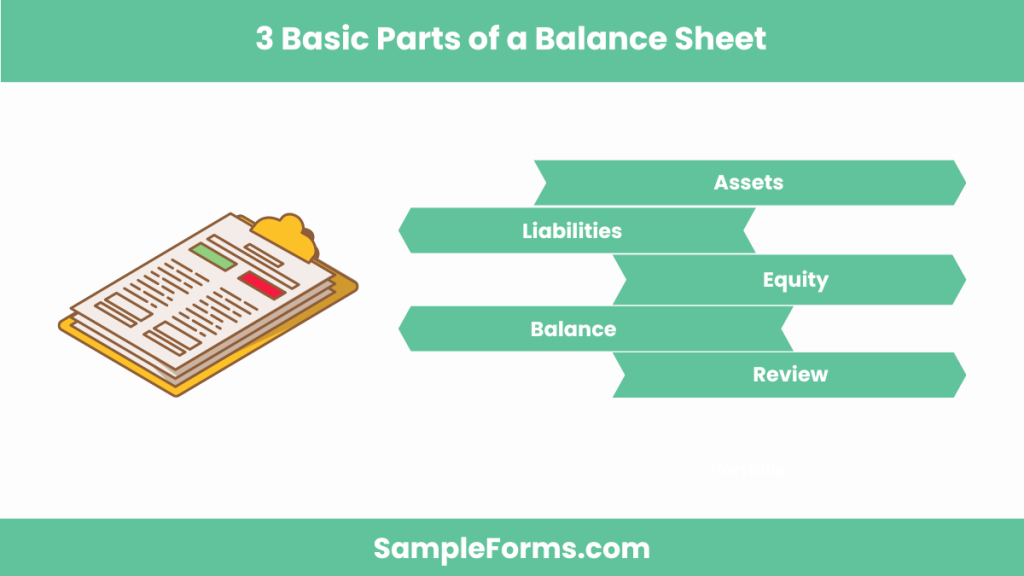

What are the 3 basic parts of a balance sheet?

The three basic parts of a balance sheet are assets, liabilities, and equity. Understanding these parts is crucial for financial health. A Visitor Sign-In/Out Sheet helps manage and track visitors effectively.

Adhering to specific rules and regulations ensures that study leave is managed effectively. Key rules include:

- Assets: All the resources owned by the company.

- Liabilities: All the debts and obligations the company owes.

- Equity: The owners’ interest in the company, including retained earnings and stockholder equity.

- Balance: Ensuring assets equal the sum of liabilities and equity.

- Review: Regularly review to ensure accuracy and compliance. You may also see Account Code Request Form

Tips on Using the Balance Sheet Template

Using a balance sheet template can simplify financial tracking and ensure consistency. A Volunteer Sign-in Sheet Form helps track volunteer participation effectively.

Adhering to specific rules and regulations ensures that study leave is managed effectively. Key rules include:

- Update Regularly: Keep your balance sheet current to reflect the latest financial data.

- Detail Everything: Include all assets, liabilities, and equity details.

- Review Periodically: Regularly review and adjust as necessary.

- Use Formulas: Utilize built-in formulas for accuracy.

- Customize: Adapt the template to fit specific business needs. You may also see Disciplinary Report Form

How to prepare a balance sheet pdf?

Preparing a balance sheet PDF involves gathering financial data, organizing it into a standard format, and converting it into a PDF document. This ensures the balance sheet is easily shareable and professional. A Patient Sign-in Sheet is essential for managing patient appointments and records accurately.

Adhering to specific rules and regulations ensures that study leave is managed effectively. Key rules include:

- Gather Data: Collect all relevant financial information.

- Organize: Arrange the data into assets, liabilities, and equity sections.

- Use Software: Utilize accounting software for accuracy.

- Review: Double-check all entries for correctness.

- Convert: Save the document as a PDF for easy distribution.

By incorporating these elements, you can create a comprehensive and effective balance sheet form that meets all necessary requirements and standards. You may also see Inspection Report Form

Can you make a balance sheet for yourself?

Yes, you can create a personal balance sheet by listing your assets, liabilities, and equity. Using an Application Accounting Form can help organize and track your personal finances effectively.

Who prepares balance sheets?

Balance sheets are typically prepared by accountants or financial professionals. An Account Code Request Form is often used to ensure the correct categorization of financial transactions.

What are liabilities on a balance sheet?

Liabilities on a balance sheet are the company’s debts and obligations. Examples include loans, accounts payable, and mortgages. Properly documenting these with an Accounts Payable Form is crucial.

What is equity on a balance sheet?

Equity on a balance sheet represents the owner’s interest in the company after liabilities are subtracted from assets. This is often documented using an Accounting Request Form.

What should my balance sheet look like?

A balance sheet should clearly list assets, liabilities, and equity, ensuring that the total assets equal the total of liabilities and equity. Using an Accounting Registration Form can help maintain accuracy.

What are the 2 basic forms of the balance sheet?

The two basic forms of a balance sheet are the account form and the report form. The Request Accounting Form can be used to switch between these formats if needed.

Is there a balance sheet template in Excel?

Yes, Excel offers balance sheet templates that can be customized to fit your needs. A Report Form template can be adapted for this purpose.

What is a perfect balance sheet?

A perfect balance sheet accurately represents a company’s financial position, with all assets, liabilities, and equity correctly documented. Regularly updating a Daily Report Form helps maintain this accuracy.

Related Posts

-

FREE 5+ Gross Profit Margin Forms in Excel

-

FREE 5+ Petty Cash Register Samples in Excel | PDF

-

FREE 6+ Vendor Ledger Samples in PDF

-

Cash Receipt Journal Form

-

Accounts Receivable Ledger Form

-

Credit Debit Form

-

FREE 4+ Financial Audit Forms in PDF

-

FREE 7+ Contemporary Sales Statement Samples in PDF

-

FREE 6+ Checkbook Register Forms in PDF | Excel

-

Daily Cash Log

-

FREE 8+ Budget Transfer Forms in PDF | Excel

-

FREE 5+ Debenture Short Forms in PDF

-

FREE 5+ Credit Card Billing Authorization Forms in PDF | MS Word