An Audit Response Letter is crucial for addressing audit findings and maintaining compliance. This complete guide provides detailed examples and practical tips to help you craft an effective response. Whether you’re dealing with a financial, operational, or compliance audit, our guide covers all aspects of creating a Sample Letter that addresses each point thoroughly. Learn how to structure your letter, use appropriate language, and include all necessary details to respond effectively. By following our guide, you can ensure that your Audit Report is clear, professional, and comprehensive.

Download Audit Response Letter Bundle

What is Audit Response Letter?

An Audit Response Letter is a formal document written in response to an audit report. It addresses the findings and recommendations outlined in the audit, providing explanations, corrective actions, and timelines for resolving issues. This Sample Letter is essential for demonstrating accountability and compliance with audit requirements. By clearly addressing each finding, the letter helps maintain transparency and fosters trust between the audited entity and the auditing body.

Audit Response Letter Format

Letterhead

- Company Name:

- Address:

- City, State, ZIP Code:

- Date:

Recipient Information

- Auditor’s Name:

- Audit Firm:

- Address:

- City, State, ZIP Code:

Salutation

- Dear [Auditor’s Name],

Introduction

- Reference to Audit Report:

- Audit Period:

Response to Audit Findings

Finding 1

- Description:

- Response:

- Action Taken:

- Future Prevention:

Finding 2

- Description:

- Response:

- Action Taken:

- Future Prevention:

Additional Information

- Clarifications:

- Supporting Documents Attached:

Conclusion

- Summary of Actions:

- Commitment to Compliance:

Closing

- Sincerely,

- [Your Name]

- [Your Position]

- [Contact Information]

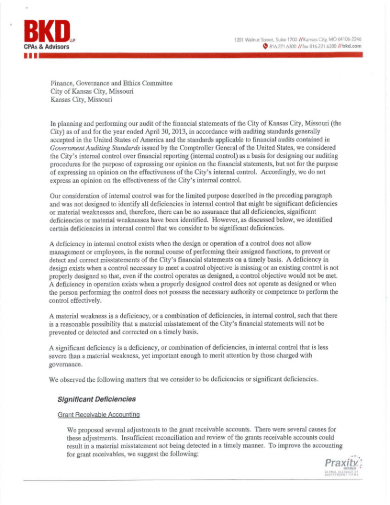

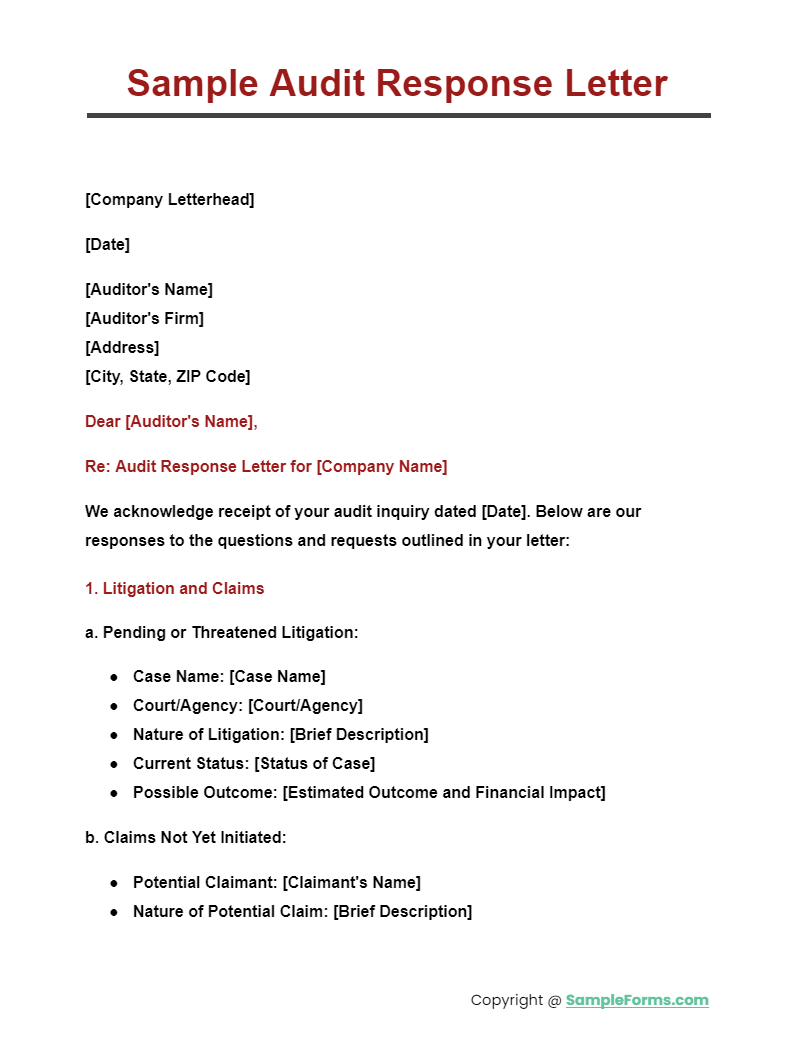

Sample Audit Response Letter

A Sample Audit Response Letter provides a structured template for addressing audit findings. This example ensures clarity and professionalism, guiding you in crafting a response similar to a Letter of Consent.

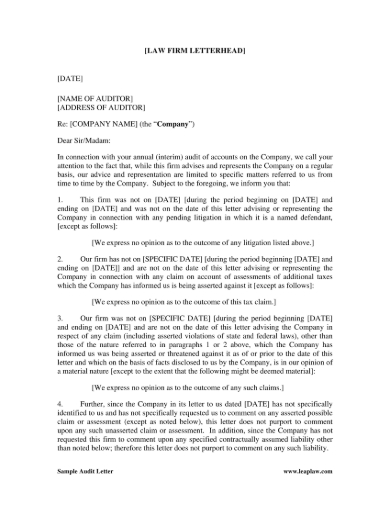

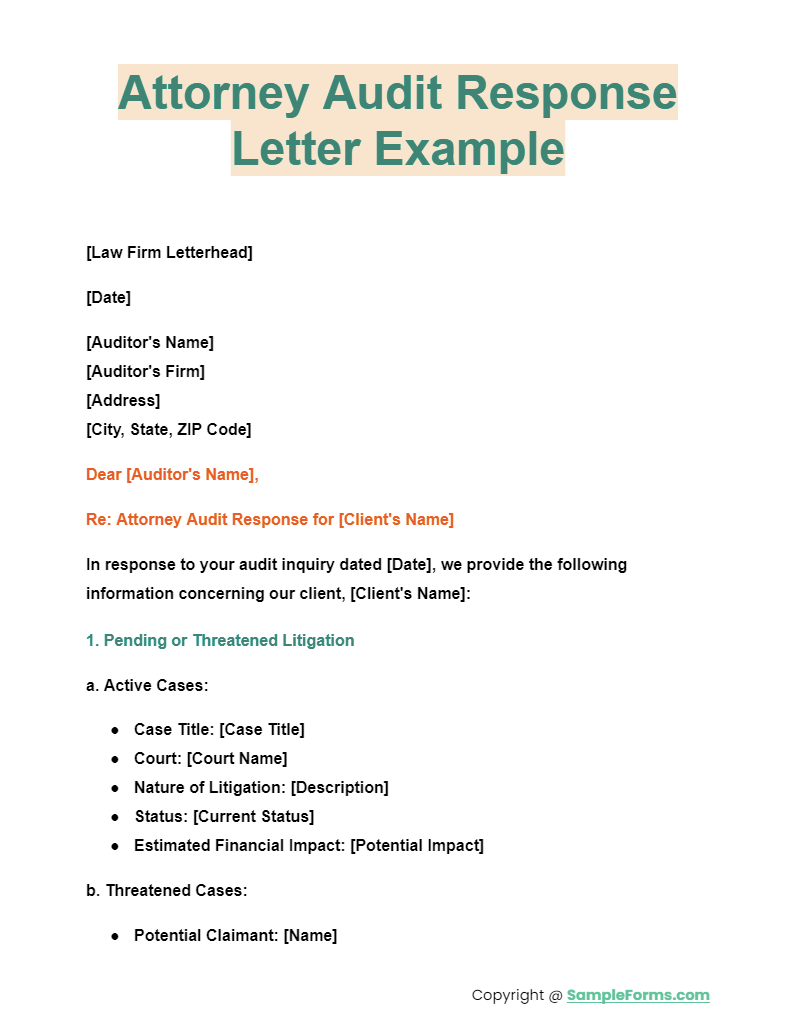

Attorney Audit Response Letter Example

An Attorney Audit Response Letter Example illustrates how legal counsel should address audit issues. This template helps attorneys respond accurately and effectively, much like writing a Character Reference Letter.

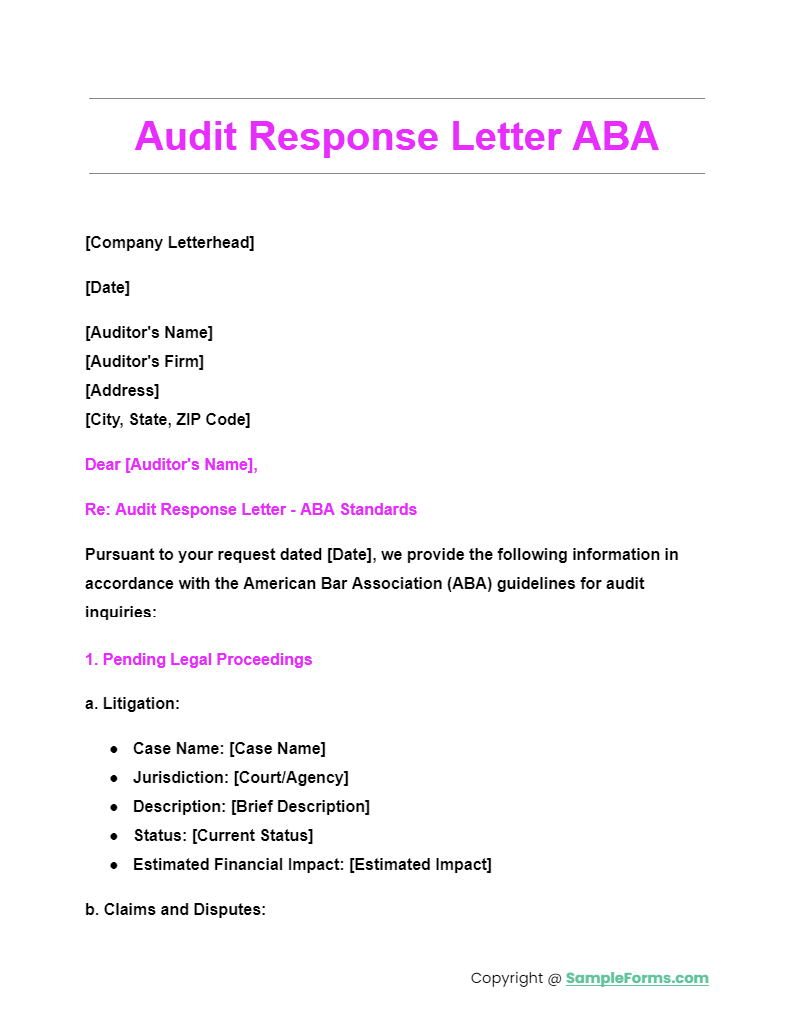

Audit Response Letter ABA

An Audit Response Letter ABA follows the American Bar Association guidelines, ensuring a standardized and compliant response. This structured approach is as critical as a well-crafted Reference Letter in maintaining legal and ethical standards.

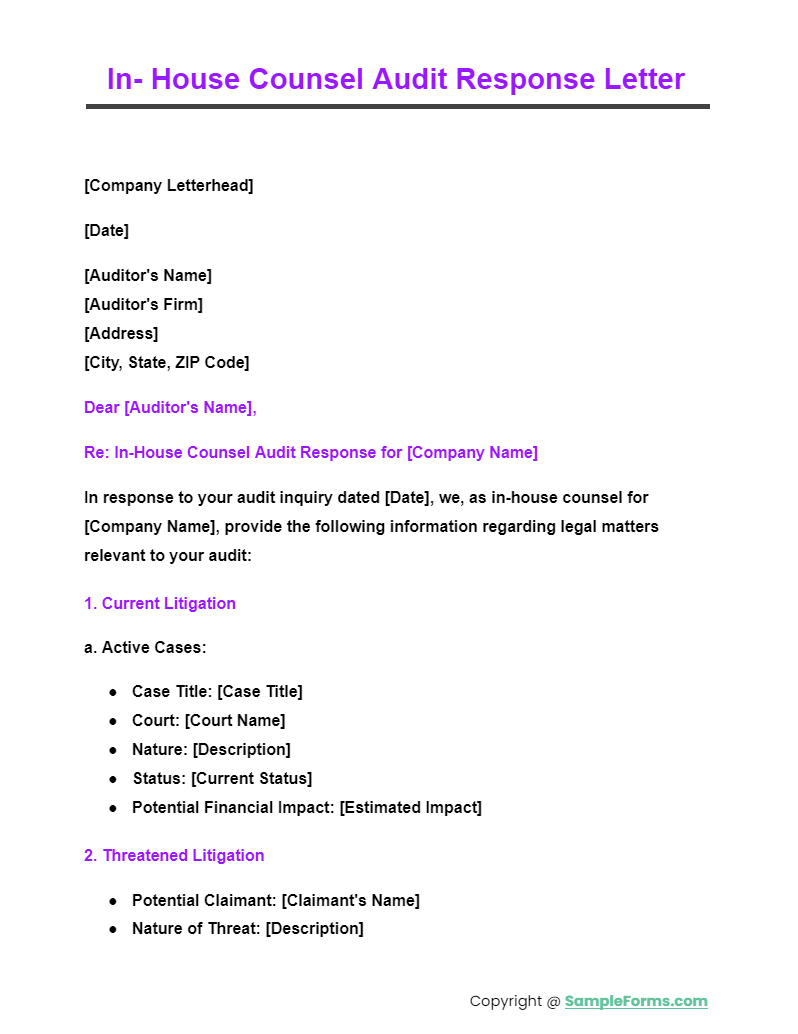

In-House Counsel Audit Response Letter

An In-House Counsel Audit Response Letter helps internal legal teams address audit findings comprehensively. This guide provides a clear format, akin to drafting a Letter of Intent, to ensure thorough and professional communication.

More Audit Response Letter Samples

1. Sample Audit Response Letters

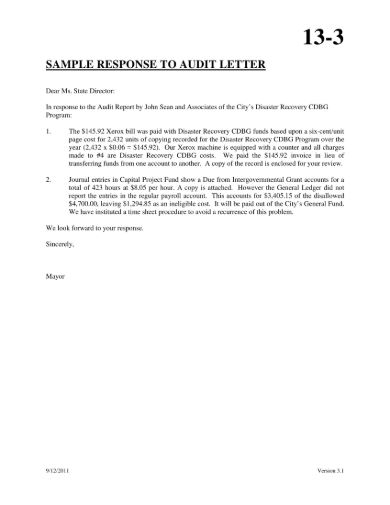

2. Sample Response to Audit Letters

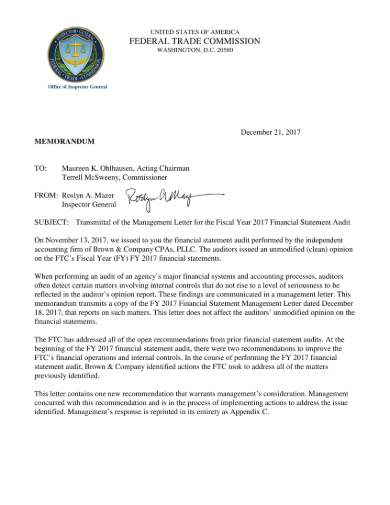

3. Sample Audit Response Letter

4. Sample Audit Response Letter

5. Sample Audit Letter

6. Sample Audit Letter of Response

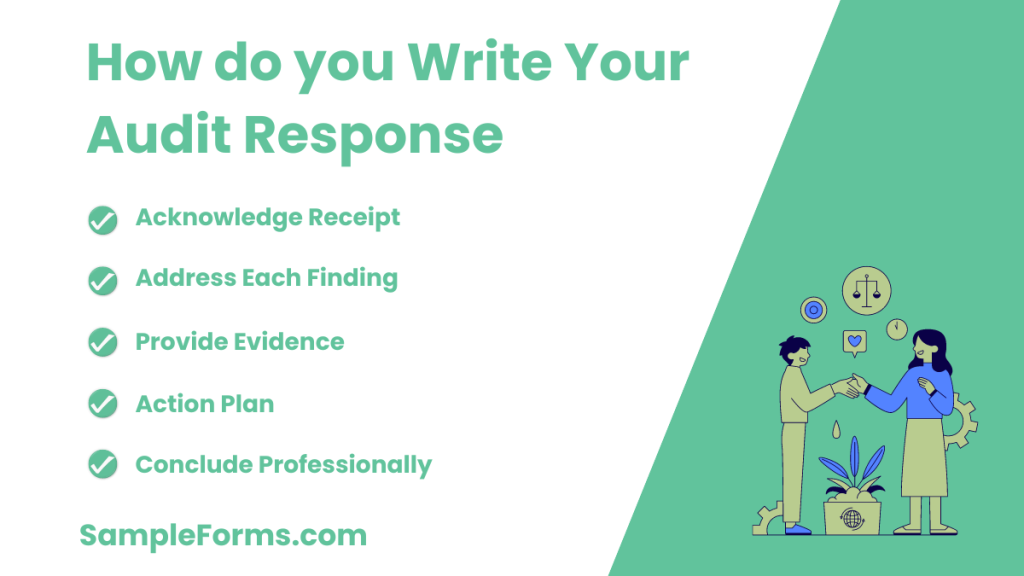

How do you write your audit response?

Writing an Audit Response Letter involves addressing findings comprehensively and professionally. Key steps include:

- Acknowledge Receipt: Confirm receipt of the audit report, similar to acknowledging a Letter of Interest.

- Address Each Finding: Provide detailed responses to each audit finding.

- Provide Evidence: Attach relevant documents that support your responses.

- Action Plan: Outline corrective actions and timelines.

- Conclude Professionally: Summarize your commitment to compliance and continuous improvement. You may also see Technical Audit Report

How to respond to an audit confirmation letter?

Responding to an audit confirmation letter requires accuracy and completeness. Key steps include:

- Verify Information: Ensure all details are correct.

- Provide Requested Data: Supply all required documents and data.

- Clarify Queries: Address any specific queries raised.

- Professional Tone: Maintain a professional tone, similar to writing a Complaint Letter.

- Timely Submission: Submit your response within the specified timeframe. You may also see Safety Audit Form

What happens if you don’t respond to audit letter?

Ignoring an audit letter can have serious consequences. Key issues include:

- Penalties: You may face financial penalties.

- Legal Actions: Possible legal actions against you.

- Compliance Issues: Increased scrutiny on your compliance practices.

- Reputation Damage: Harm to your organization’s reputation, akin to receiving a negative College Letter of Recommendation.

- Operational Disruptions: Potential operational disruptions. You may also see Nursing Audit Form

What should be included in an audit notification letter?

An Audit Notification Letter should clearly communicate the audit details. Key components include:

- Purpose: Explain the purpose of the audit.

- Scope: Define the scope and areas of focus.

- Schedule: Provide audit timelines and schedules.

- Requirements: List required documents and information, like a Donation Letter.

- Contact Information: Include auditor contact details for queries. You may also see Fundraising Letter

What should you not say in an audit?

Certain statements should be avoided in an audit response. Key points include:

- Admitting Fault: Do not admit fault without evidence.

- Blaming Others: Avoid shifting blame onto others. You may also see Chart Audit Form

- Speculation: Refrain from making speculative statements.

- Inconsistent Information: Ensure all information is consistent.

- Unprofessional Language: Maintain professionalism, similar to writing an Appeal Letter.

Types of Audit Findings

There have been many auditors who have trouble sorting the findings. Sorting the findings can help the auditors know whether the manner of management of the company needs correction and improvement or not. Here the four levels of importance when presenting and assessing an audit finding of a company.

1. Critical

The observation of the auditor has found that the quality of the management and the production direly needs correction since it might heavily affect the quality of the services and products of the company. This observation sees the company’s overall quality output to fail. You may also see Financial Audit Form

2. Major

The observation of the auditor has found that the production quality and the management needs an assessment, requiring the use of assessment forms. The issues might affect the quality of the services and the products of the company to some extent. This observation sees the company’s overall quality output to encounter obstacles.

3. Moderate

The observation of the auditor has found that the quality of the management and the production may need a company head’s observation, avoiding any problems that might occur that could affect the quality of the services and products. This observation may also use feedback forms, sees the company’s overall quality output to be okay for now but might somehow encounter small-scale problems.

4. Minor

The observation of the auditor has found that the quality of the management and the production may not need any form of further assessment, observation, or correction. The company might encounter very small-scale problems, but the management can easily solve that tiny problem. You may also see Audit Report Form

How to Create Audit Response Letter Forms

Here are a few tips and steps on how to create an audit response letter forms that are professionally effective in relaying the opinion of the owner of the company that was given audit. The steps are not arranged chronologically, but you can freely see it in that manner. Carefully read and follow the tips while also giving using a method that you find comfortable.

Step 1: Select and Customize a Template

To start the process of creating the document, you must go to template.net and browse their vast collection of professional premium high-quality audit response letter templates that you can easily customize. The templates are 100% compatible with any software from Adobe and Microsoft Office. You may also see Desk Audit Form

Step 2: Use Serif Default Font Styles

Most business files have letter font styles that appear formal. Businesses and companies utilize formal font styles and thus resort to using serif font styles, font styles that are formal by nature, rather than using sans-serif font styles. It has become a tradition to use the serifed typefaces, specifically the default fonts like Times New Roman and Georgia.

Step 3: Know How You Will Respond to the Letter

There various manners of how to respond in a letter. You can have an agreeing tone or a disagreeing tone. Both types of responses are legal and formal, as long as you present facts and reasons why you agree or disagree with the report and findings of the auditor about your company. You may also see Quality Audit Report Form

Step 4: Evaluate the Document

When you are unsure of your output, you have to evaluate the document. You can do it yourself or have a professional review the context and grammar in the content. You might have missed checking some errors because you were focused on writing the content than editing.

Step 5: Print the Business Document

The last thing you must do is to print the whole thing once you are finished with the evaluation of the document. Print multiples copies of the final document to be sure and save a copy of the file in your flash drive or desktop. You may also see Letter of Reference

Should I be worried about an audit?

No, audits are routine and ensure compliance. Address concerns by being prepared and maintaining accurate records, similar to organizing a Business Letter.

What does response mean in audit?

In an audit, a response involves addressing findings, providing explanations, and outlining corrective actions, similar to replying to a Audit Checklist Form.

What does an audit letter say?

An audit letter outlines the audit’s purpose, scope, and required documents. It’s a formal notification similar to a Teacher Recommendation Letter.

Where do audit letters come from?

Audit letters typically come from regulatory bodies, tax authorities, or internal auditors, akin to receiving a Recommendation Letter from Employer.

What are the 5 C’s of audit?

The 5 C’s of audit are: Criteria, Condition, Cause, Consequence, and Corrective action, ensuring thorough evaluation, like writing a Letter of Introduction.

How do you respond to an audit?

Respond to an audit by acknowledging receipt, addressing findings, providing evidence, outlining corrective actions, and maintaining professionalism, similar to a College Recommendation Letter.

What happens if you don’t respond to an audit?

Failure to respond to an audit can result in penalties, legal actions, and reputational damage, similar to ignoring an Employee Verification Letter.

What is overall response in audit?

The overall response in an audit addresses all findings and demonstrates commitment to compliance, similar to completing an Internal Audit Form.

The Audit Response Letter is an essential tool for addressing and resolving audit findings effectively. With our Sample, Forms, and Letters, you can craft a comprehensive and professional response that ensures compliance and accountability. By following the detailed guidance provided, you can address each audit point thoroughly and demonstrate your commitment to resolving any issues. Whether it’s a financial, operational, or compliance audit, using an Authorization Letter approach ensures that your response is clear, structured, and effective in maintaining good standing with

Related Posts

FREE 7+ Sample Business Report Forms in PDF WORD

13+ Hazard Report Forms in Word PDF

FREE 11+ Laboratory Report Forms in PDF DOC

FREE 18+ Work Order Forms in WORD DOC

FREE 15+ Service Report Forms in PDF Word | Apple Pages ...

Free Change Forms

FREE 14+ Referee Report Forms in PDF DOC

FREE 38+ Questionnaire Forms PDF

FREE 5+ Sponsorship Report Forms in PDF DOC

FREE 17 + Disciplinary Report Forms in Word PDF | Google Docs ...

FREE 9+ Sample Corrective Action Forms in PDF DOC

FREE 8+Sample Corrective Action Forms in Sample, Example, Format

FREE 14+ Joining Report Forms in PDF DOC

HR Forms in PDF

5+ Breakage Report Forms in PDF DOC