An Audit Report is essential for businesses to assess financial accuracy, operational efficiency, and compliance with regulations. A well-structured Audit Report Form provides transparency, identifies discrepancies, and strengthens decision-making. Whether for financial audits, operational assessments, or regulatory reviews, a properly formatted Report Form ensures accountability. This guide covers the importance of audit reports, essential components, and step-by-step instructions to create an effective document. Understanding different types of audits, key reporting elements, and legal considerations will help you draft a comprehensive audit report tailored to your specific business needs.

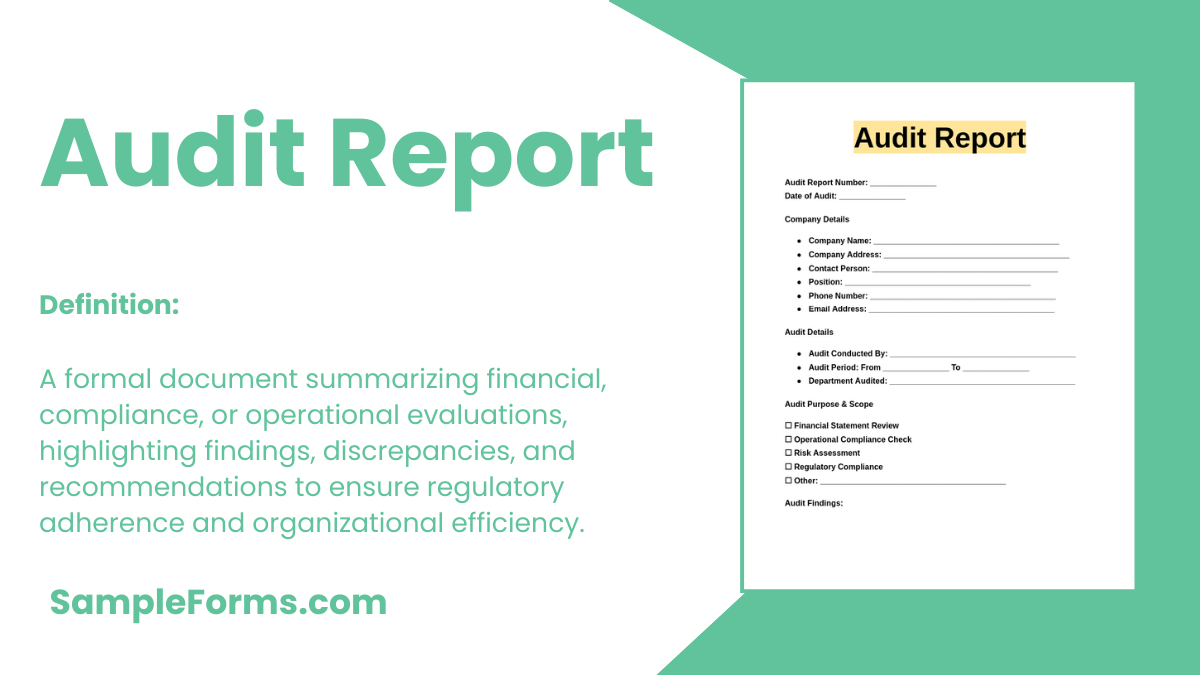

What is Audit Report?

An Audit Report is an official document summarizing the findings of an audit, evaluating financial records, compliance, and internal processes. It provides an objective assessment of an organization’s financial health, ensuring transparency and accountability. Typically prepared by auditors, it includes key findings, risk evaluations, and recommendations for improvement. A well-drafted audit report helps businesses meet regulatory requirements, enhance operational efficiency, and mitigate financial risks. By presenting a structured review of records and procedures, it serves as a critical tool for decision-makers and stakeholders.

Audit Report Format

Audit Title:

[Insert Title]

Prepared By:

- Auditor Name: [Full Name]

- Audit Firm/Department: [Specify]

- Date of Report: [Insert Date]

Scope of Audit:

- Audit Period: [Start Date] to [End Date]

- Areas Covered: [Financial/Operational/Compliance]

- Key Audit Criteria: [Regulatory Standards, Internal Policies]

Audit Methodology:

- Data Collection: [Interviews, Document Review, Field Observations]

- Analytical Techniques: [Risk Assessment, Financial Analysis]

Key Findings & Observations:

- Finding 1: [Summarize Major Issue]

- Finding 2: [Summarize Another Issue]

- Finding 3: [Summarize Additional Issue]

Recommendations for Improvement:

- Recommendation 1: [Suggested Action]

- Recommendation 2: [Suggested Action]

Conclusion & Compliance Status:

- Overall assessment of organization’s compliance.

- Areas requiring urgent attention and corrective action.

Approval & Submission:

Auditor Signature: ___________ Date: ___________

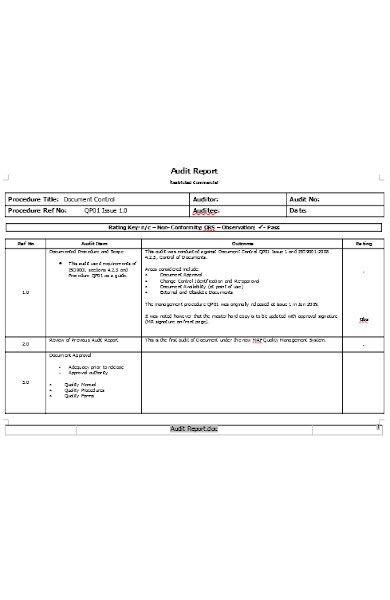

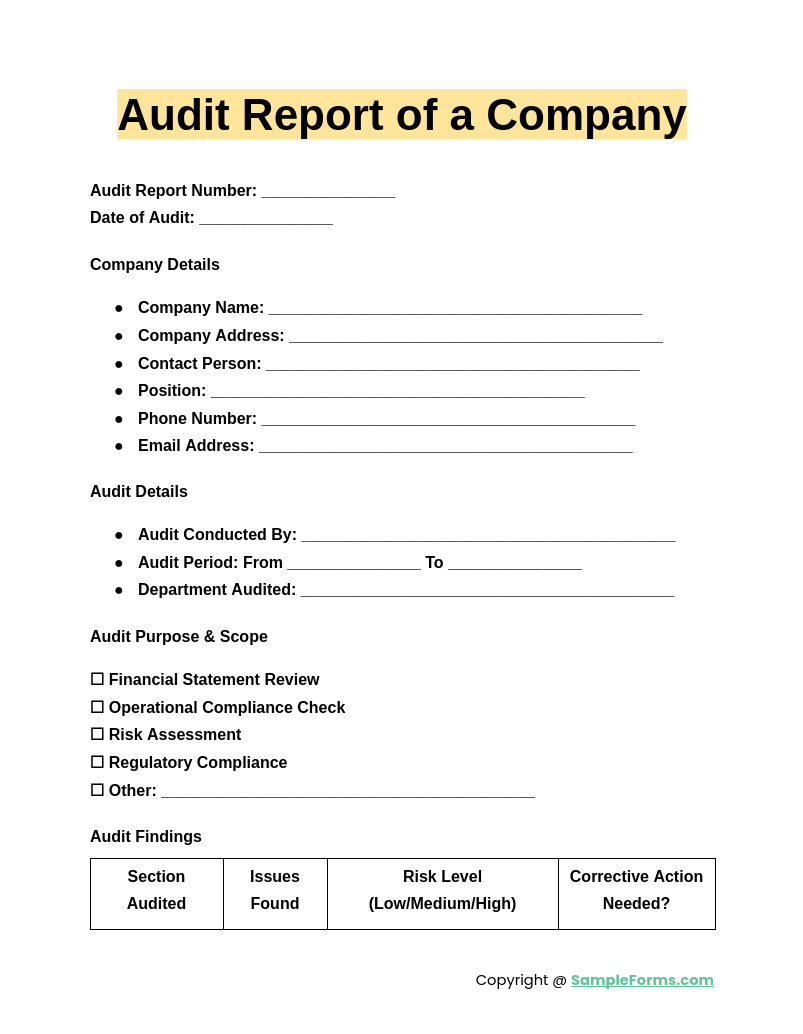

Audit Report of a Company

An Audit Report of a Company provides a detailed evaluation of financial records, ensuring compliance and accuracy. Similar to an Internal Audit Form, it reviews business operations, identifies discrepancies, and suggests corrective actions for improved efficiency and regulatory adherence.

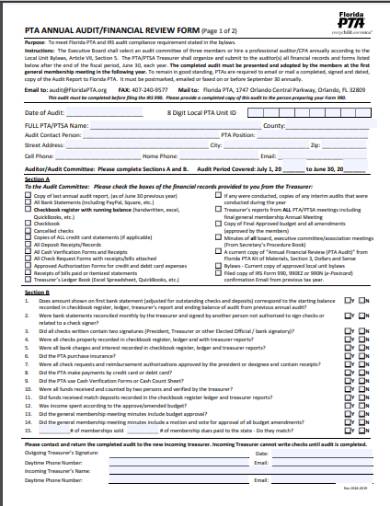

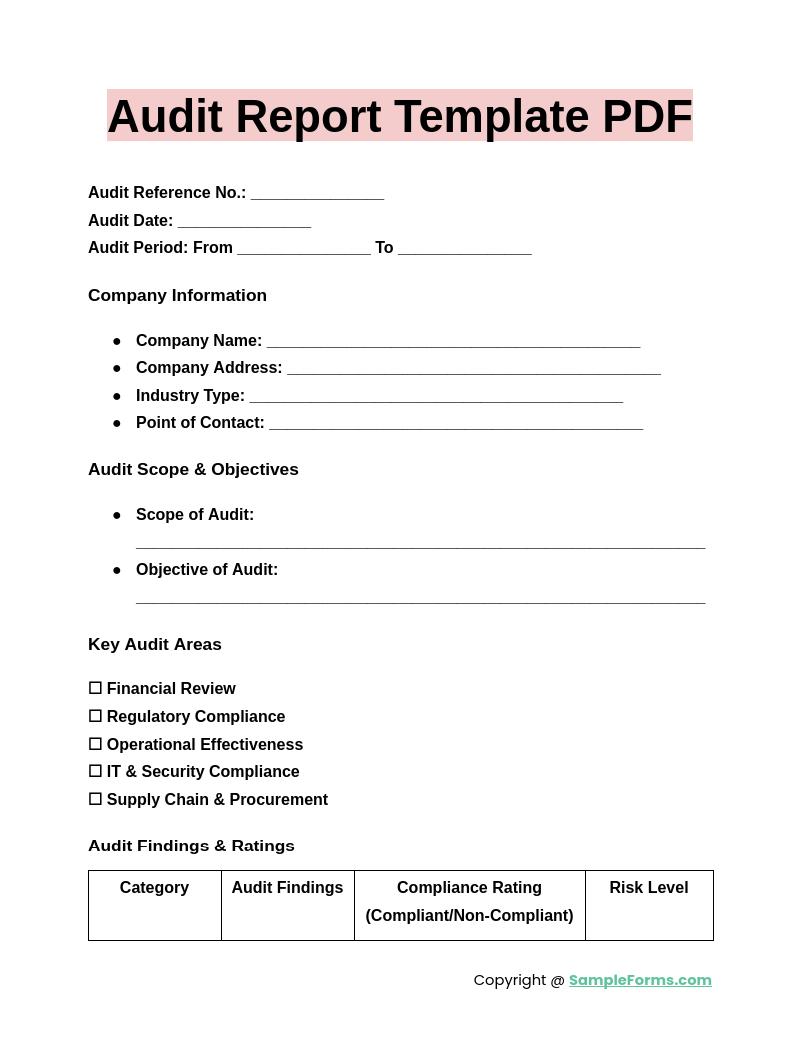

Audit Report Template PDF

An Audit Report Template PDF offers a structured format for documenting audit findings. Like an Audit Checklist Form, it includes financial assessments, compliance reviews, and risk evaluations, streamlining the reporting process for auditors and organizations seeking transparency and accuracy.

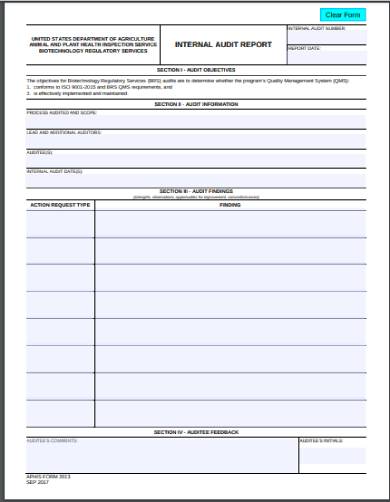

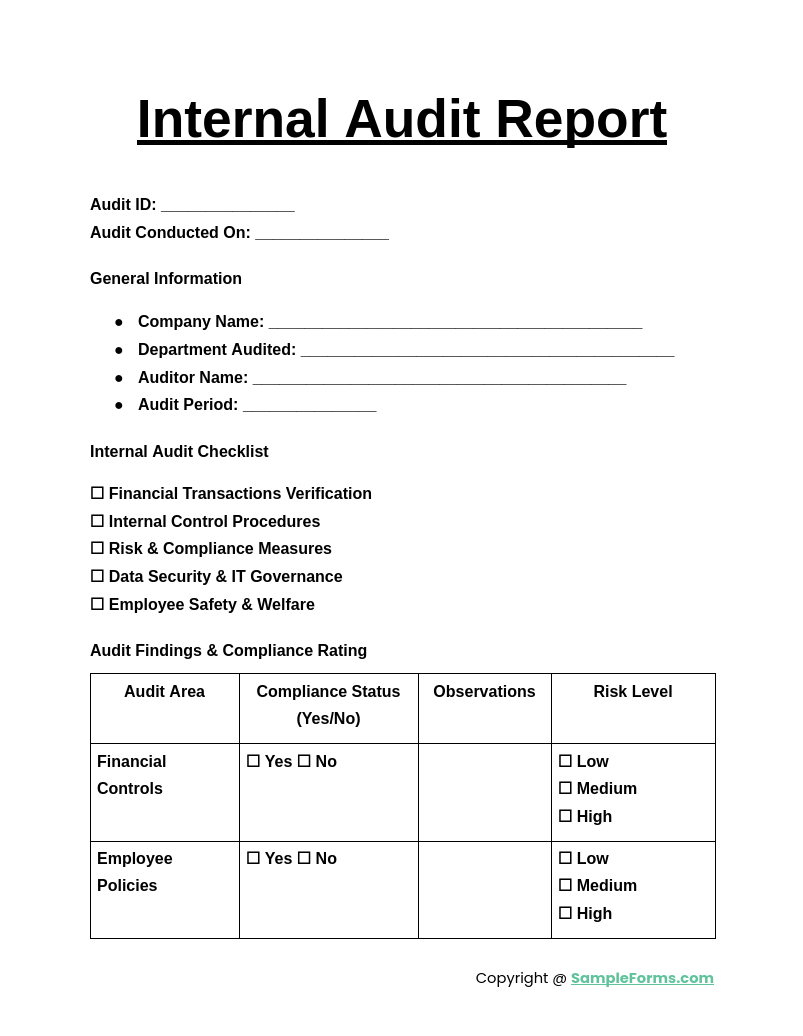

Internal Audit Report

An Internal Audit Report assesses an organization’s internal processes, identifying inefficiencies and compliance gaps. Similar to a Technical Audit Report, it ensures operational integrity, strengthens internal controls, and enhances decision-making through systematic evaluations of business practices.

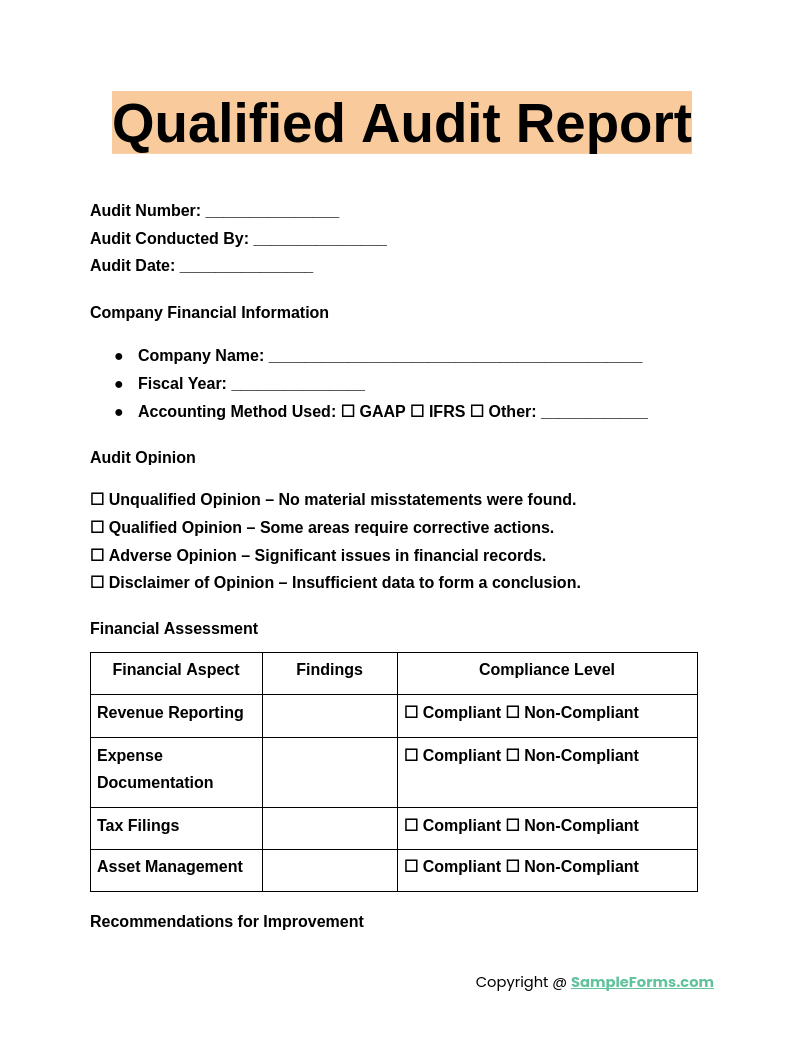

Qualified Audit Report

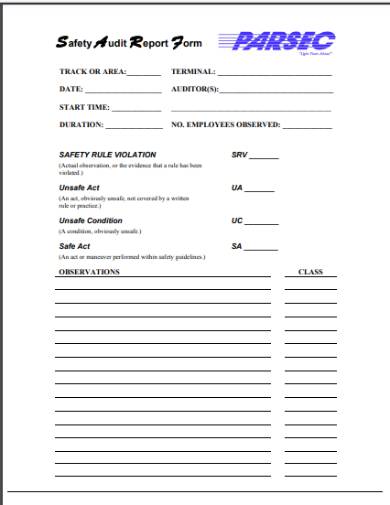

A Qualified Audit Report highlights discrepancies in financial statements while maintaining partial compliance. Like a Safety Audit Form, it documents concerns, suggests improvements, and provides insights into risk management, ensuring organizations adhere to financial and safety regulations effectively.

Browse More Audit Report Forms

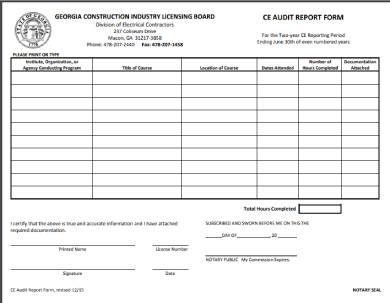

1. Technical Audit Report Form

2. Generic Audit Report Form

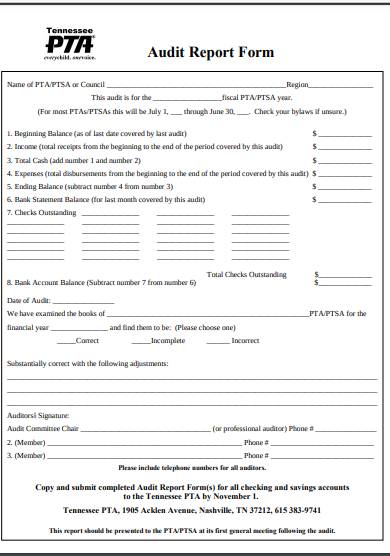

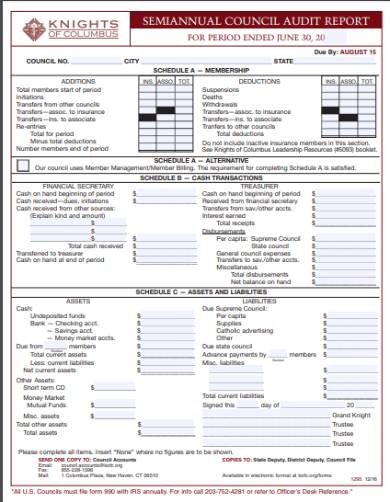

3. Semi-Annual Audit Report Form

4. Education Audit Report Form

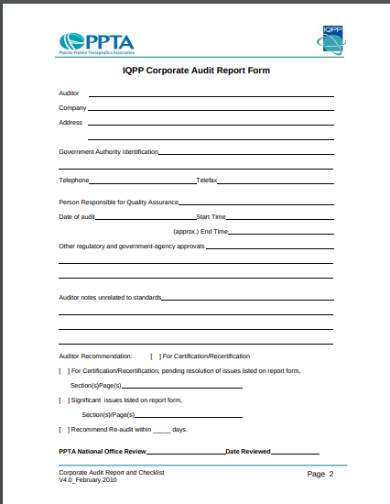

5. Corporate Audit Report Form

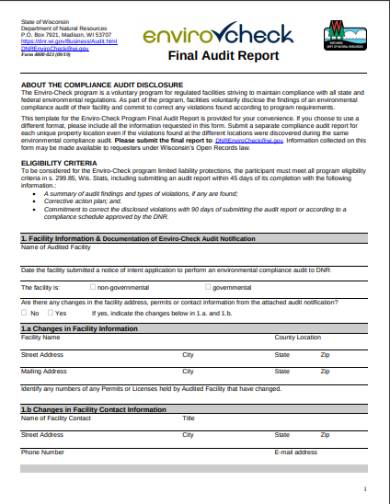

6. Final Audit Report Form

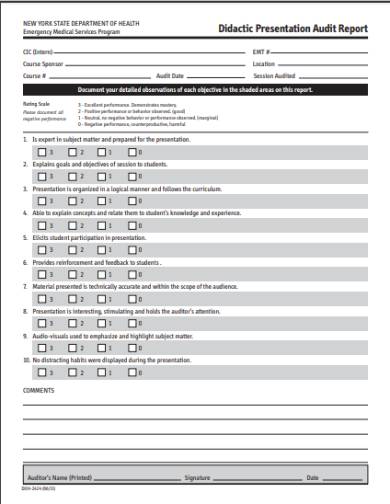

7. Presentation Audit Report

8. Financial Audit Report Form

9. Safety Audit Report Form

10. Internal Audit Report Form

11. Simple Audit Report Form

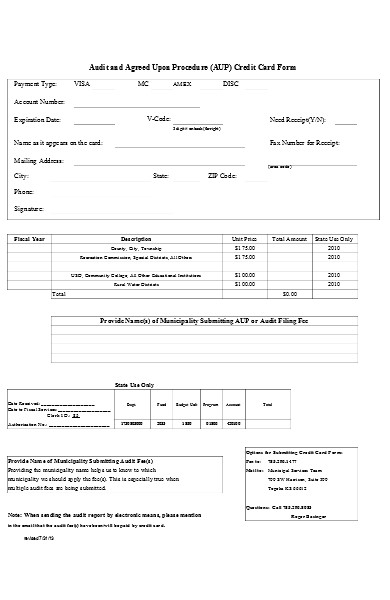

12. Audit Credit Report Form

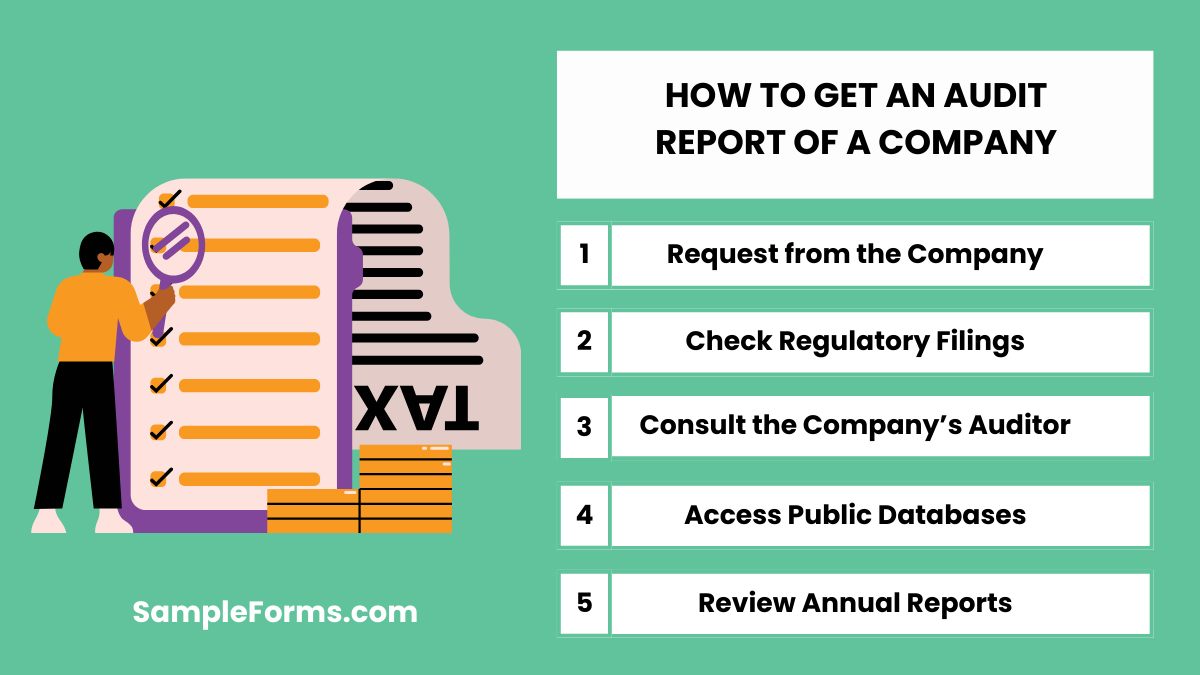

How to get an audit report of a company?

Obtaining an Audit Report of a company involves a systematic process to ensure compliance and financial transparency. The steps to access the report include:

- Request from the Company: Public companies often publish audit reports, while private firms may provide them upon request, similar to a Nursing Audit Form for healthcare assessments.

- Check Regulatory Filings: Many businesses file audit reports with regulatory authorities, making them accessible for verification and financial review.

- Consult the Company’s Auditor: If authorized, external auditors can provide insights into the audit findings and financial compliance.

- Access Public Databases: Government and financial institutions maintain audit reports for transparency and legal purposes.

- Review Annual Reports: Audit findings are often included in a company’s annual report, giving stakeholders detailed financial insights.

Who benefits from an audit report?

An Audit Report provides essential financial and compliance insights that benefit multiple stakeholders. The key beneficiaries include:

- Business Owners & Management: Helps improve financial strategies and internal operations, similar to a Chart Audit Form used to assess medical records.

- Investors & Shareholders: Provides transparency into a company’s financial health, enabling informed investment decisions.

- Regulatory Bodies: Ensures businesses comply with financial and legal regulations, preventing fraud and misrepresentation.

- Lenders & Creditors: Verifies financial stability before approving loans or extending credit.

- Employees & Stakeholders: Builds trust by demonstrating the company’s commitment to transparency and ethical business practices.

What are the 4 types of audit reports?

Auditors issue four types of Audit Reports, each indicating different financial and compliance statuses. These include:

- Unqualified Report: A clean audit with no major discrepancies, similar to a Financial Audit Form, ensuring accuracy in financial statements.

- Qualified Report: Identifies minor issues that do not significantly impact the financial records’ reliability.

- Adverse Report: Indicates major financial misstatements or violations that need urgent correction.

- Disclaimer of Opinion: Issued when auditors cannot determine the financial health due to missing or unreliable data.

What is the purpose of an audit report?

An Audit Report plays a crucial role in verifying financial integrity, ensuring compliance, and improving decision-making. The primary purposes include:

- Ensuring Accuracy: Confirms financial statements are correct and free from significant errors, similar to a Desk Audit Form for reviewing job classifications.

- Compliance Verification: Ensures adherence to legal and financial regulations, preventing fraud and mismanagement.

- Risk Identification: Highlights potential financial risks, allowing businesses to address issues proactively.

- Investor Confidence: Builds trust among stakeholders by providing transparent financial insights.

- Operational Improvement: Identifies inefficiencies, helping organizations enhance internal processes and financial controls.

What happens after an audit report?

Once an Audit Report is issued, businesses must take necessary steps based on the findings. The post-audit process includes:

- Management Review: The company evaluates audit findings and recommendations, similar to a Quality Audit Report Form for assessing compliance standards.

- Corrective Actions: If issues are identified, corrective measures are implemented to address financial discrepancies.

- Regulatory Compliance: Companies submit reports to regulatory bodies to ensure adherence to financial laws.

- Stakeholder Communication: Audit findings are shared with investors, lenders, and other relevant parties for transparency.

- Follow-Up Audits: Additional audits may be conducted to verify the effectiveness of corrective actions and ensure continued compliance.

Who prepares the audit report?

An Audit Report is prepared by an independent auditor or an internal audit team. Similar to a Daily Report Form, it documents financial assessments, compliance checks, and risk evaluations for businesses, organizations, or government entities.

Who issues the audit report?

A certified public accountant (CPA) or an audit firm issues the Audit Report after evaluating financial records. Like a Missing Report Form, it officially confirms financial accuracy and compliance with regulations, ensuring transparency for stakeholders and regulatory bodies.

What will trigger an IRS audit?

An IRS audit is triggered by inconsistent tax filings, excessive deductions, or unreported income. Similar to a Car Accident Report Form, discrepancies, red flags, or unusual financial activities may lead to further investigation by tax authorities.

Do my accounts need to be audited?

Audits are required for certain businesses based on revenue, industry, or regulatory requirements. Like a Patient Report Form, an audit helps ensure financial health, detect errors, and confirm compliance with applicable tax laws and regulations.

How long does it take to get an audit report?

The audit process can take a few weeks to months, depending on complexity. Similar to an Evaluation Report Form, it requires thorough analysis, verification, and review before finalizing findings and issuing a formal report.

Is auditors report mandatory?

Yes, an Audit Report is mandatory for publicly traded companies and regulated industries. Like a Construction Report Form, it ensures financial stability, compliance, and operational integrity, helping businesses maintain transparency and legal accountability.

Do small companies need to be audited?

Small companies may not require audits unless mandated by stakeholders or lenders. Similar to a Marketing Report Form, financial records should still be reviewed to maintain accuracy, credibility, and potential business growth opportunities.

What do auditors look for?

Auditors examine financial statements, internal controls, and regulatory compliance. Like a Referee Report Form, they assess fairness, accuracy, and adherence to rules, ensuring that businesses meet financial and operational standards.

What is the limit for audit?

Audit thresholds vary by jurisdiction, industry, and business size. Similar to a Daily Cash Report, companies exceeding specific revenue or transaction limits must undergo financial audits for regulatory compliance and financial transparency.

Who signs an audit report?

A certified auditor or an authorized audit firm representative signs the Audit Report after verification. Like a Safety Report Form, the signature validates the report’s accuracy, ensuring legal accountability and compliance with industry standards.

A Weekly Report Form is essential for maintaining consistency in audits, tracking progress, and documenting findings over time. An Audit Report provides a comprehensive analysis of financial and operational data, helping businesses ensure compliance and efficiency. Whether used for internal assessments, external regulatory requirements, or financial reporting, an accurate audit report minimizes risks and strengthens corporate governance. By utilizing structured templates, businesses can streamline reporting processes and enhance accuracy. With well-organized samples and forms, creating a professional audit report becomes effortless and highly effective.

Related Posts

FREE 8+ Sample Audit Report Forms in PDF WORD

5+ Sample Audit Checklist Form - PDF

FREE 9+ Sample Corrective Action Forms in PDF DOC

FREE 9+ Sample Construction Safety Forms in PDF WORD

4+ Real Estate Lead Forms - PDF, DOC

FREE 8+ Vendor Questionnaire Forms in Samples, Examples, Formats

5+ Free Contractor Warranty Forms - PDF, DOC

FREE 7+ Sample Construction Short Forms in PDF WORD

7 Client Satisfaction Questionnaire Forms

8+ Sample Tax Verification Forms in Samples, Examples, Formats

5+ Audit Response Letter Form - PDF

6+ Technical Audit Reports - PDF, DOC

How to Write a Receipt Form?

7+ Legal Confirmation Letter - PDF

4+ Accounts Receivable Ledger Form - XLS, XLXS, XLTX