An Audit Checklist Form serves as an essential tool to ensure accuracy and compliance in financial auditing processes. It helps track, review, and verify records systematically, enhancing overall audit efficiency. This guide offers detailed examples and customizable fillable forms to streamline auditing tasks, whether for internal audits or external reviews. Key elements like record verification, risk assessment, and compliance checks are included in each checklist. Our templates are designed for easy use and can be adjusted for specific needs. Internal Audit Form and Fillable Form templates are available for various types of audits.

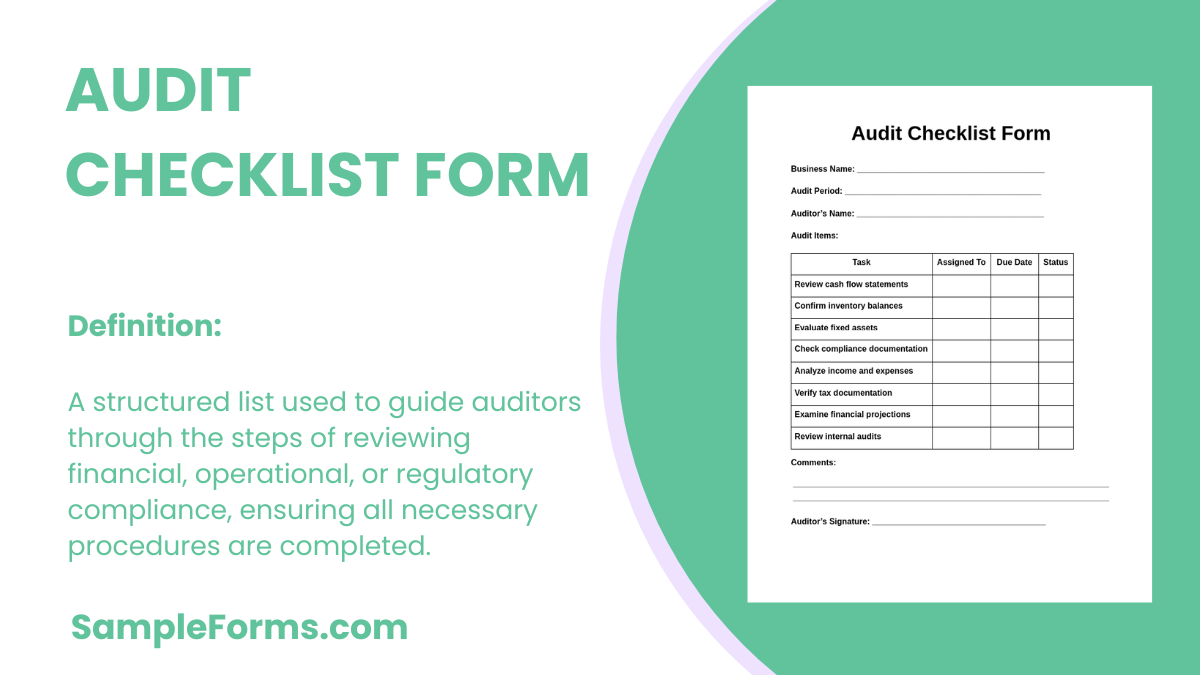

What is an Audit Checklist Form?

An Audit Checklist Form is a structured tool used to ensure that all necessary steps are followed during an audit. It lists tasks such as verifying financial statements, reviewing internal controls, and ensuring compliance with relevant regulations. The checklist helps auditors stay organized and ensures nothing is overlooked. Whether used for internal or external audits, the checklist ensures consistency and accuracy. Having a well-designed checklist also helps auditors save time and avoid missing crucial steps during the process.

Audit Checklist Form Format

Audit Details

- Audit Title: _____________________________

- Department: _____________________________

- Date of Audit: ___________________________

Audit Objectives

- Objective 1: ____________________________________

- Objective 2: ____________________________________

Audit Checklist

| Checklist Item | Status (Complete/Incomplete) | Notes | Deadline |

|---|---|---|---|

| Review financial statements | |||

| Confirm all tax filings are up to date | |||

| Verify internal control procedures | |||

| Assess compliance with regulations | |||

| Ensure records of all transactions |

Findings

- Brief description of audit findings:

-

Recommendations

- Based on the audit, the following recommendations are made:

Auditor’s Signature

- Signature: __________________________

- Name: ______________________________

- Date: _______________________________

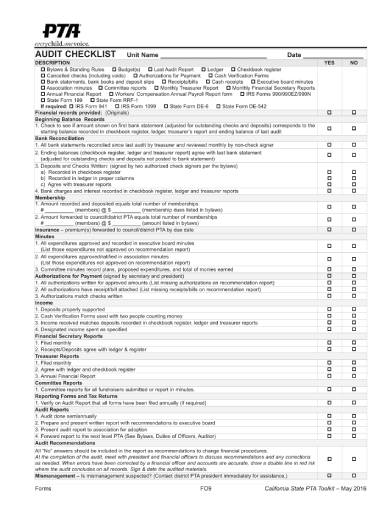

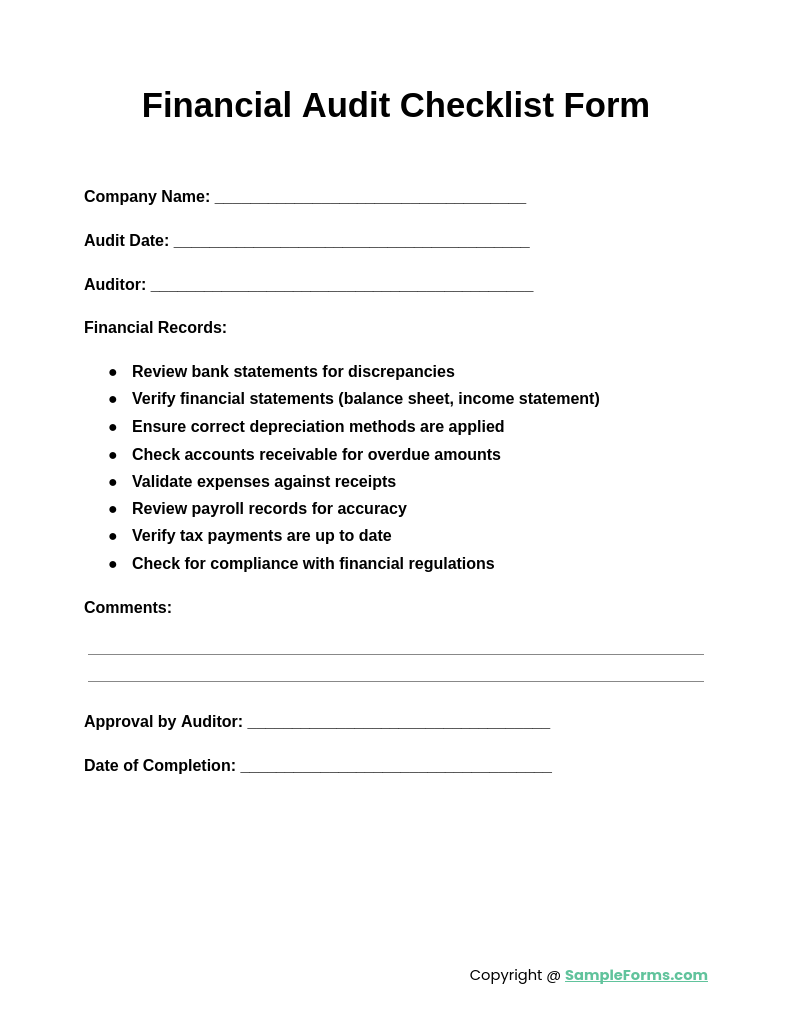

Financial Audit Checklist Form

The Financial Audit Checklist Form is a structured document designed to assess financial statements for accuracy and compliance. This form helps in evaluating internal controls, financial risks, and ensuring transparency in financial records. For restaurant owners, tasks from a Restaurant Opening Checklist Form can be included to track financial performance in the initial stages of business operations.

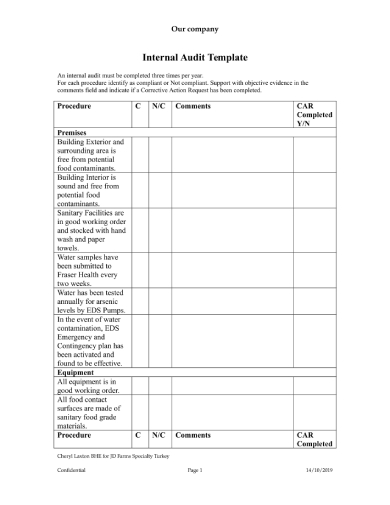

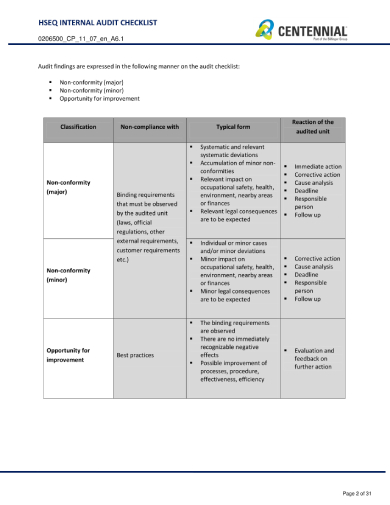

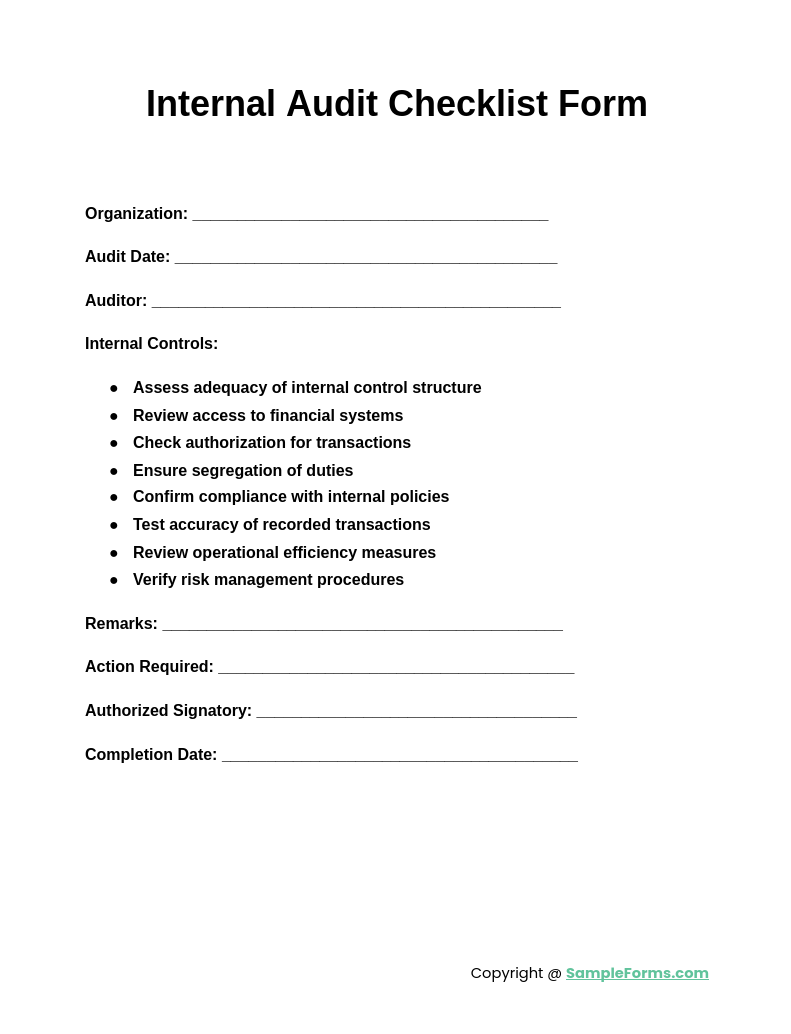

Internal Audit Checklist Form

The Internal Audit Checklist Form serves as a tool to evaluate an organization’s internal processes and ensure that they adhere to regulatory requirements. It covers areas like risk management, compliance, and operational effectiveness. A Move In Move Out Inspection Checklist could also be used alongside this to ensure asset tracking and property management are audited efficiently.

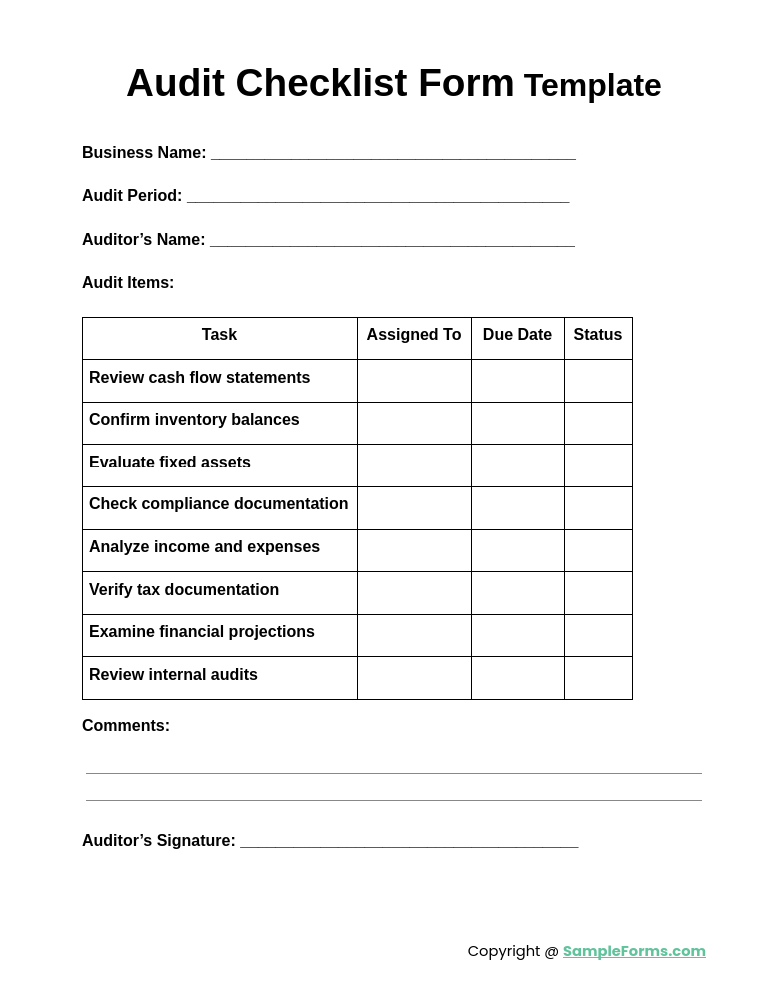

Audit Checklist Form Template

An Audit Checklist Form Template offers a customizable guide to auditors, enabling them to tailor audit processes to specific needs. This template simplifies reviewing financial reports, operational effectiveness, and regulatory adherence. You may also incorporate an Employee Onboarding Checklist Form to evaluate the audit of human resource processes.

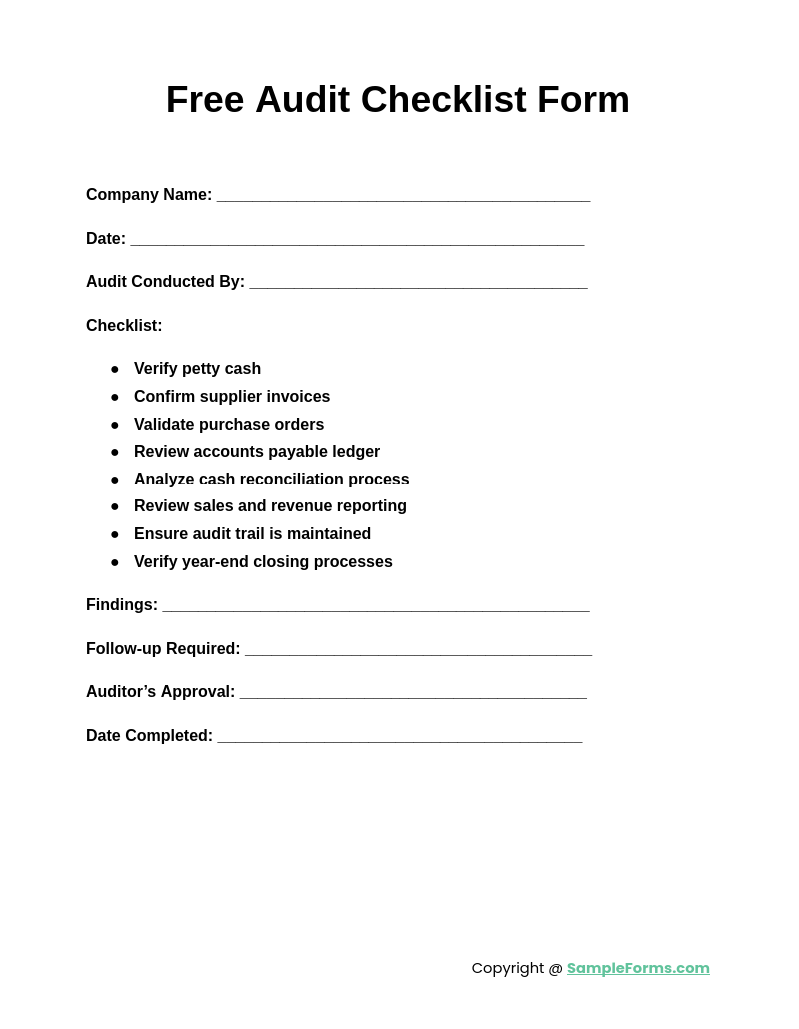

Free Audit Checklist Form

The Free Audit Checklist Form is a comprehensive, no-cost tool for businesses to conduct audits without missing essential steps. This form simplifies financial and internal audits, ensuring efficiency in reviewing policies, financial reports, and compliance. Including elements from a Recruitment Checklist can further expand the scope of the audit to hiring practices and employee evaluations.

Browse More Audit Checklist Form

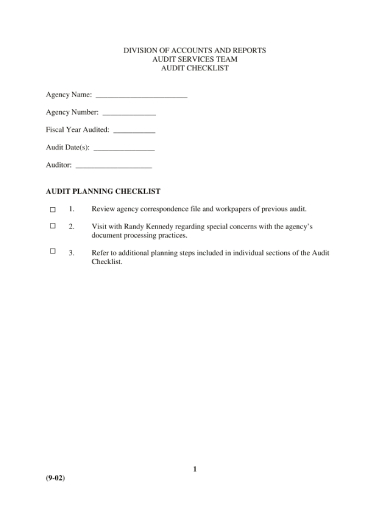

1. Internal Audit Checklist

2. Internal Audit Sample

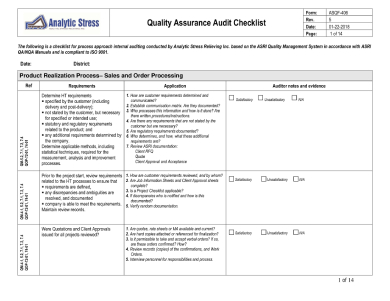

3. Quality Audit Checklist

4. Audit Checklist Sample

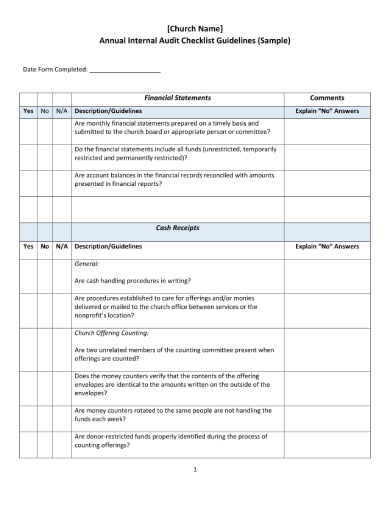

5. Sample Annual Audit Checklist Form

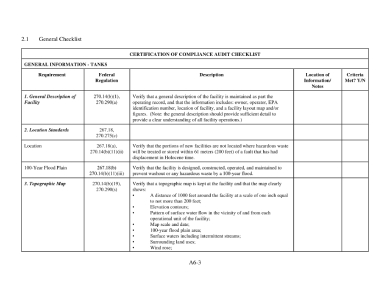

6. Checklist for Audit Example

7. Business Audit Checklist Form

8. Example Internal Audit Checklist

What is included in an audit checklist?

An audit checklist includes essential elements for evaluating financial records, internal controls, and regulatory compliance. It ensures that all key audit areas are thoroughly examined.

- Financial Records: Review income statements, balance sheets, and cash flow.

- Internal Controls: Evaluate the effectiveness of internal control systems.

- Compliance: Ensure adherence to relevant regulations.

- Assets & Liabilities: Verify the existence and valuation of assets.

- Employee Documentation: A Restaurant Checklist Form can be used to audit employee performance and daily operations.

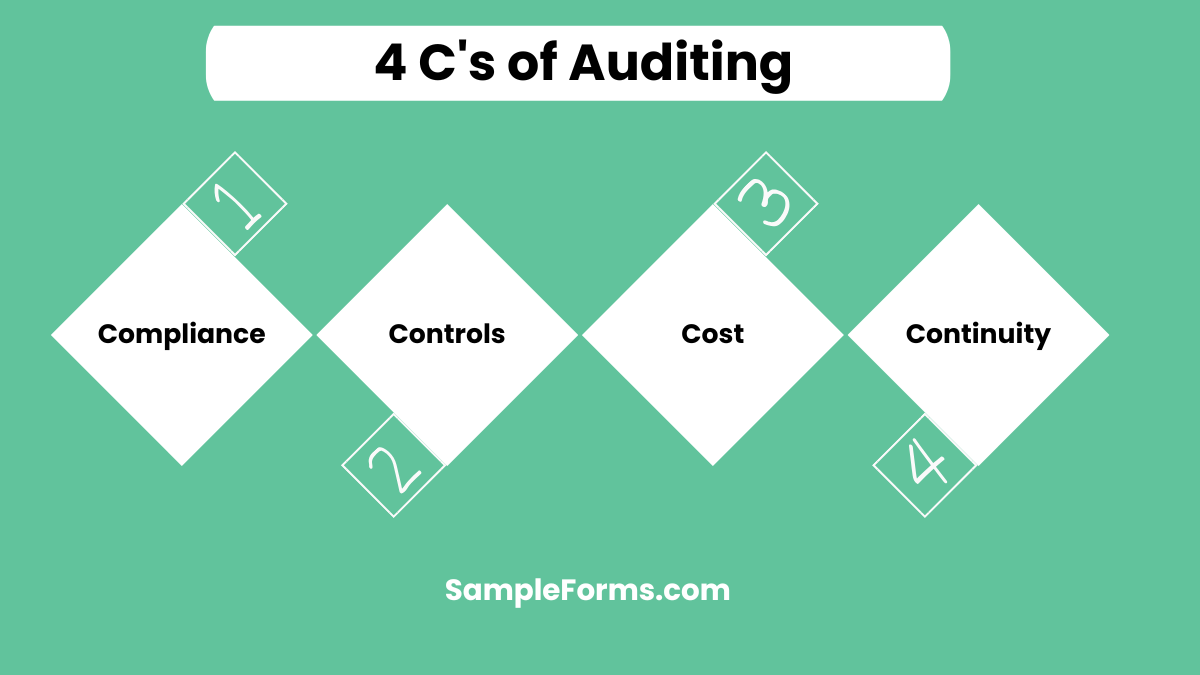

What are the 4 C’s of auditing?

The 4 C’s of auditing are crucial principles that guide the audit process, ensuring consistency and thoroughness.

- Compliance: Ensure adherence to laws and standards.

- Controls: Check the effectiveness of internal systems.

- Cost: Evaluate financial efficiency.

- Continuity: Ensure processes are sustainable and efficient, such as when completing a Bank Loan Application Form and Checklist Form.

How to design an audit checklist?

Designing an audit checklist involves identifying key audit areas, structuring the form to cover all necessary points, and making it user-friendly.

- Define Objectives: Clearly state the purpose of the audit.

- Identify Key Areas: Focus on financial, operational, and compliance elements.

- Structure Questions: Use both open and closed-ended questions.

- Create Sections: Organize the checklist by audit categories.

- Include Special Cases: For example, include sections for Order Fulfillment Checklist Form to review order processes.

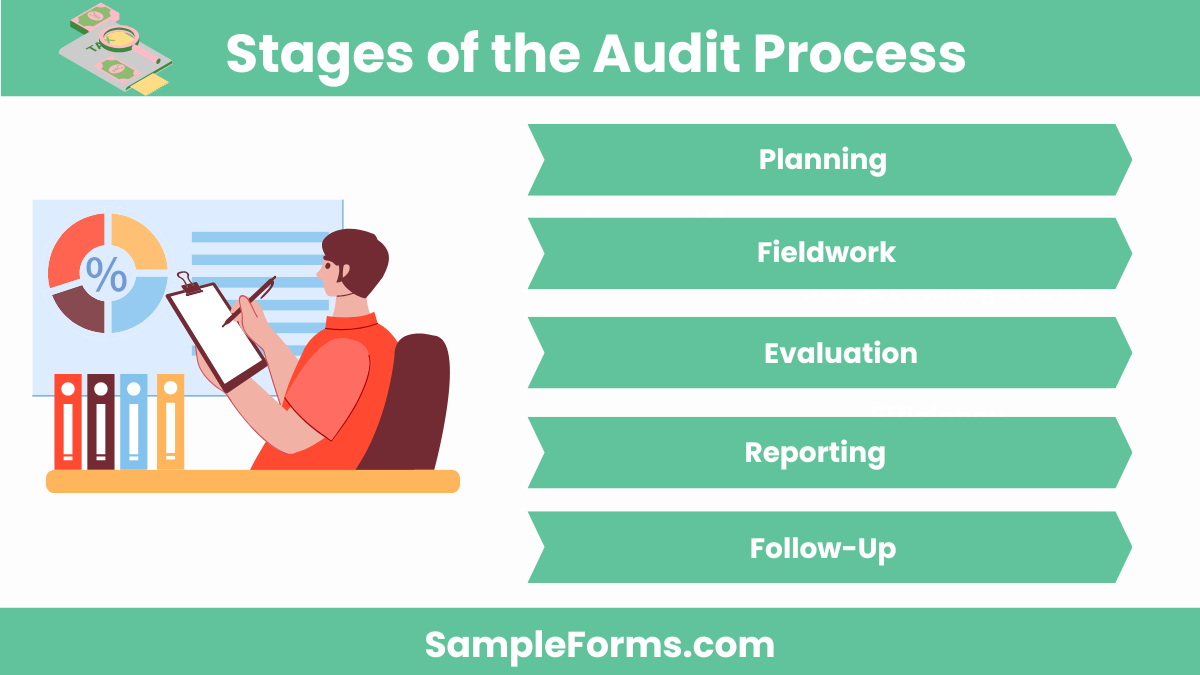

What are the Stages of the audit process?

The audit process consists of five essential stages that ensure a thorough review of the organization’s operations.

- Planning: Establish objectives and timelines.

- Fieldwork: Collect evidence through inspections and interviews.

- Evaluation: Analyze collected data for accuracy.

- Reporting: Create an audit report highlighting findings.

- Follow-Up: Address any issues found, such as those in the Employee Termination Checklist.

What is the rule 5 of auditor?

Rule 6 of auditing refers to the requirement for auditors to remain independent and objective during the audit process.

- Independence: Maintain neutrality during evaluations.

- Objectivity: Base conclusions on facts, not opinions.

- Transparency: Document every step in detail.

- Confidentiality: Ensure all data is secure.

- Responsibility: Apply standards like those used in a Business Credit Checklist Form to ensure thorough analysis.

Are audit checklists mandatory?

Audit checklists are not always mandatory but highly recommended. They help ensure consistency and thoroughness in audits, especially when filling out an Audit Report Form or conducting technical evaluations.

What does an audit checklist look like?

An audit checklist includes sections for compliance, internal controls, and risk assessments. A Technical Audit Report often has a structured list of key areas to ensure nothing is overlooked during an evaluation.

How to do a simple audit?

To perform a simple audit, review the necessary documents, verify records, check compliance, and summarize findings in a report. A Safety Audit Form is often used for such purposes in workplaces.

What does a good audit look like?

A good audit is thorough, objective, and well-documented. Auditors use structured forms like a Nursing Audit Form to assess operational and compliance aspects, ensuring all points are covered.

What documents do auditors usually look at?

Auditors typically review financial statements, internal control documents, and compliance records. A completed Audit Report contains findings based on these essential documents.

How to write an internal audit checklist?

To write an internal audit checklist, outline objectives, focus on compliance, and list required documentation. Use structured formats like a Chart Audit Form to ensure clarity and thoroughness.

How do you conduct an audit checklist?

Conducting an audit checklist involves gathering relevant documents, reviewing them, and ensuring compliance. A Financial Audit Form often guides the process to ensure all necessary aspects are audited.

Who prepares the audit checklist?

An audit checklist is usually prepared by an internal auditor or a compliance officer. For example, a Desk Audit Form is often used in HR and financial evaluations to check work environments and records.

What is a content audit checklist?

A content audit checklist helps assess the performance and relevance of content. It includes reviewing SEO, accuracy, and alignment with objectives, similar to preparing a Quality Audit Report Form.

What is a disclosure checklist audit?

A disclosure checklist audit ensures all required information is disclosed in financial statements or reports. Auditors use this to review documents like a Financial Form to ensure compliance with reporting standards.

An Audit Checklist Form plays a vital role in maintaining organizational transparency and accuracy in financial audits. From identifying discrepancies to ensuring compliance, these forms help guide auditors through every phase of the process. They can be customized for various audit types, making them highly versatile.

Related Posts

FREE 7+ Financial Assessment Form Samples in Sample, Example ...

FREE 7+ Sample Construction Short Forms in PDF WORD

What Is a Background Verification Form?

FREE 9+ Sample Delivery Confirmation Forms in WORD PDF

FREE 53+ Sample Self Assessment Forms PDF

FREE 11+ Supplier Questionnaire Form Samples in Sample ...

Risk Assessment Form Template

FREE 7+ Mental Status Exam Forms in PDF WORD

FREE 5+ Sponsorship Report Forms in PDF DOC

FREE 40+ Sample Incident Report Forms in PDF PAGES

FREE 9+ Sample Employee Promotion Forms in PDF WORD

8+ Internal Audit Forms - DOC, PDF, XLS

FREE 9+ Sample Construction Safety Forms in PDF WORD

FREE 10+ Supplier Evaluation Forms in DOC DOC