Navigating the Arkansas (AR) Power of Attorney Form can be a pivotal step in managing your legal affairs. This guide provides essential insights on how to effectively use and understand the Power of Attorney (POA) in Arkansas. Whether you’re assigning someone to make decisions on your behalf or taking on this responsibility for another, our tips ensure a smooth, legally sound process. Dive into the nuances of Arkansas POA with confidence, backed by our expert, easy-to-follow advice.

What is the Arkansas (AR) Power of Attorney Form?

The Arkansas Power of Attorney (POA) Form is a legal document that allows you to choose someone else to make important decisions on your behalf. This person, known as your ‘agent’, can handle things like your finances, property, or health care decisions if you’re unable to do so yourself. It’s a way to ensure that someone you trust is in charge of your affairs if you can’t manage them due to illness, absence, or other reasons. This form is specific to the state of Arkansas, meaning it follows Arkansas state laws and regulations.

What is the best Sample Arkansas (AR) Power of Attorney Form?

Creating a sample Arkansas Power of Attorney (POA) form as a fillable document involves several key components to ensure it’s legally sound and comprehensive. However, it’s important to note that I can provide a text-based example here, which you would need to convert into a fillable form using appropriate software or online tools. Here’s a simplified version of what such a form might look like:

Arkansas Power of Attorney Form

Principal Information:

- Name: [__________]

- Address: [__________]

- Phone Number: [__________]

Agent Information:

- Name: [__________]

- Address: [__________]

- Phone Number: [__________]

Powers Granted:

- Financial Decisions

- Real Estate Management

- Health Care Decisions

- Business Operations

- Other: [__________]

Special Instructions: [__________________________________]

Duration:

- Durable (Remains in effect even if I become incapacitated)

- Non-Durable (Ends if I become incapacitated)

- Effective Date: [__________]

- Termination Date (if applicable): [__________]

Third Party Reliance: I authorize any third party who receives a copy of this document to act under it. Third parties may rely upon the representations of my Agent as to all matters relating to any power granted to them.

Signatures:

- Principal’s Signature: [__________]

- Date: [__________]

- Agent’s Signature: [__________]

- Date: [__________]

Witnesses (if required by state law):

- Witness 1 Signature: [__________]

- Date: [__________]

- Address: [__________]

- Witness 2 Signature: [__________]

- Date: [__________]

- Address: [__________]

Notarization

(if required by state law): State of Arkansas ) ) ss. County of [__________] )

On this, the [] day of [____], [__], before me, a notary public, personally appeared [Name of Principal], known to me (or satisfactorily proven) to be the person whose name is subscribed to the within instrument, and acknowledged that they executed the same for the purposes therein contained.

In witness whereof, I hereunto set my hand and official seal.

Notary Public: [____] My Commission Expires: [____]

To create a fillable form, you can use this template as a basis and add form fields using a PDF editor or a form builder tool. Remember, the requirements for a valid POA can vary, so it’s crucial to ensure that the form complies with Arkansas state laws.

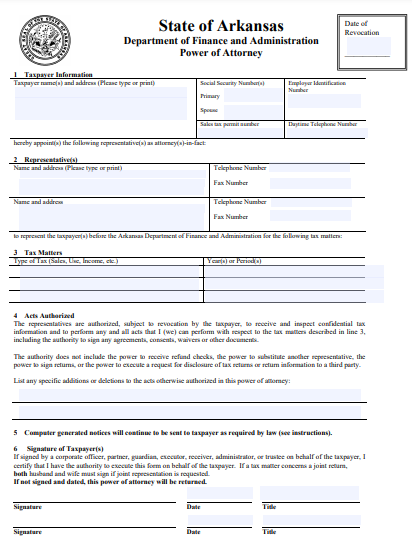

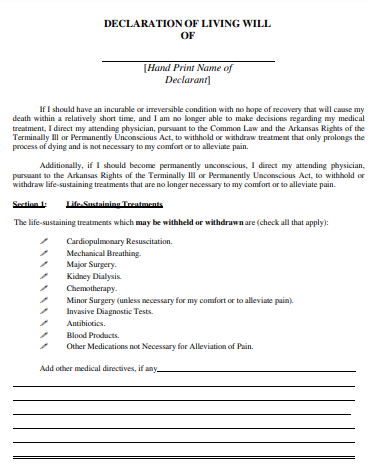

1. State of Arkansas Power of Attorney Form

2. Arkansas Limited Power of Attorney Form

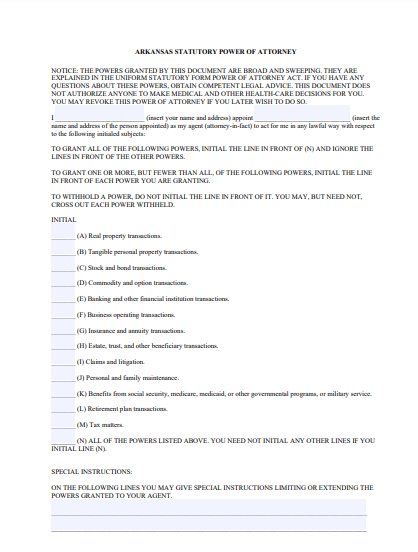

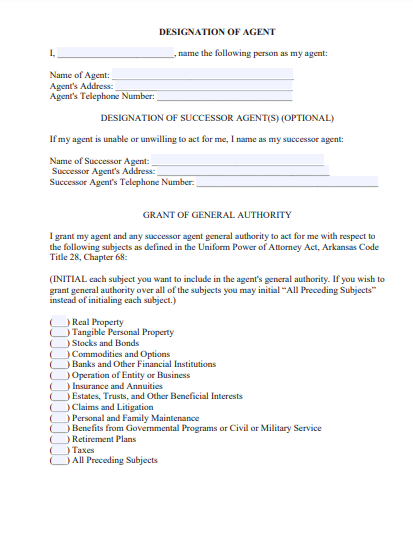

3. Arkansas Statutory Power of Attorney Form

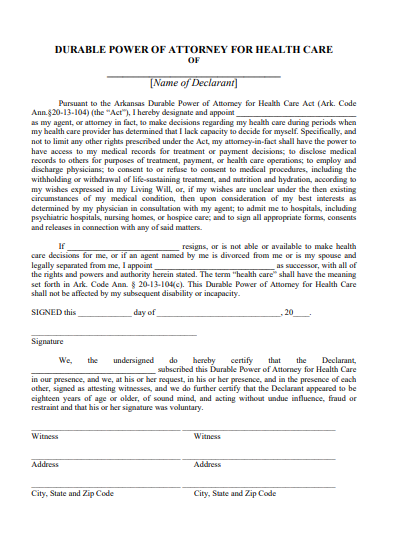

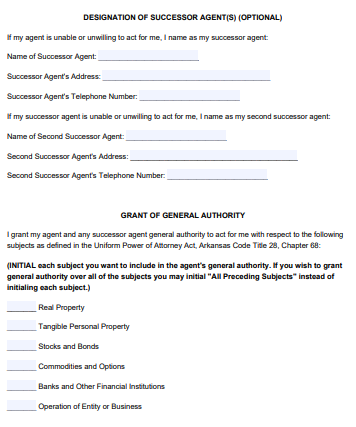

4. Arkansas Durable Power of Attorney Form

5. Arkansas Sample Power of Attorney Form

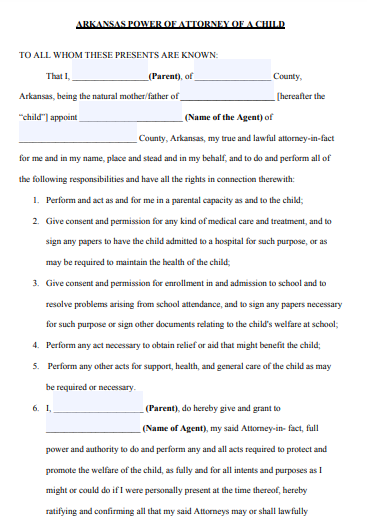

6. Arkansas Power of Attorney of a Child Form

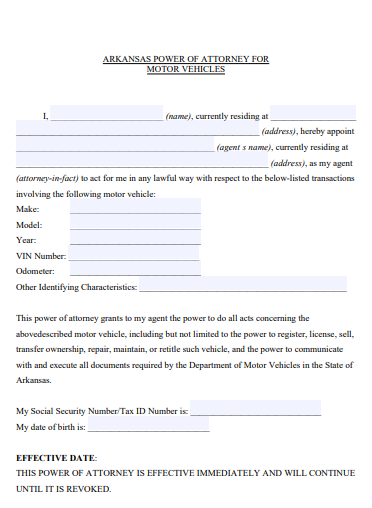

7. Arkansas Power of Attorney Form for Motor Vehicles

8. Printable Arkansas Power of Attorney Form

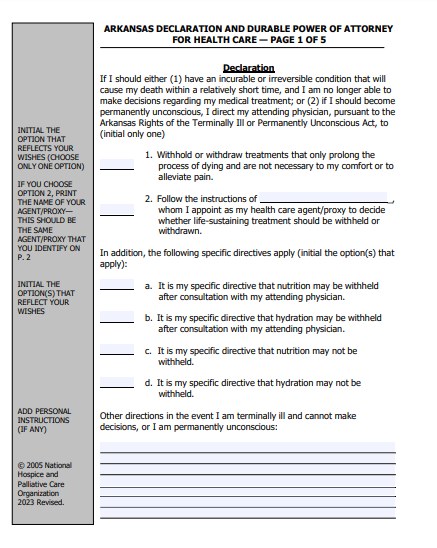

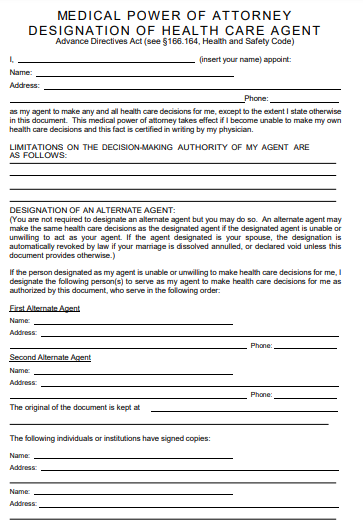

9. Arkansas Health Care Power of Attorney Form

10. Standard Arkansas Power of Attorney Form

11. Arkansas Medical Power of Attorney Form

What Types of Power of Attorneys Are Available in Arkansas?

| Type of Power of Attorney | Description |

|---|---|

| General Power of Attorney | Grants broad powers over financial and business transactions. It becomes invalid if the principal becomes incapacitated. |

| Durable Power of Attorney | Remains effective even if the principal becomes incapacitated, covering decisions related to finance, health, or other areas. |

| Healthcare Power of Attorney | Allows an agent to make healthcare decisions on behalf of the principal, including treatment and end-of-life care. |

| Limited Power of Attorney | Grants specific, limited powers to an agent for a set duration or task, like selling a property or managing a single transaction. |

| Springing Power of Attorney | Becomes effective upon the occurrence of a specified event, often the incapacitation of the principal. |

| Financial Power of Attorney | Specifically grants an agent authority to handle the principal’s financial matters, like banking, taxes, and investments. |

What Are the Legal Requirements of a Financial POA in Arkansas?

In Arkansas, a Financial Power of Attorney (POA) is a legal document that allows an individual (the principal) to designate another person (the agent) to manage their financial affairs. To ensure that a Financial POA is legally valid and enforceable in Arkansas, it must meet specific requirements:

- Capacity of the Principal: The principal must be a competent adult, meaning they understand the implications of signing the POA and are doing so voluntarily.

- Writing and Language: The POA must be in writing and should be clear in its language, specifying the powers granted to the agent.

- Identification of Parties: The document must clearly identify the principal and the agent, typically including their full legal names and addresses.

- Scope of Authority: The POA should explicitly state the powers granted to the agent. This can include handling bank transactions, paying bills, managing investments, and other financial matters.

- Signature of the Principal: The principal must sign the POA. This signature should ideally be made in the presence of a notary public to add a layer of legal validation.

- Notarization: While not always mandatory, it’s highly recommended that the POA be notarized. A notarized POA is more likely to be accepted by financial institutions and other organizations.

- Witnesses: In some cases, it may be advisable or required to have the POA witnessed by one or more adults who can attest to the principal’s capacity and voluntary action.

- Durable Provision: If the POA is intended to be durable (remaining in effect if the principal becomes incapacitated), it must include specific language stating this intention.

- Compliance with State Laws: The POA must comply with Arkansas laws, particularly the Arkansas Code, which outlines the legal framework for POAs in the state.

- Revocation Clause: It’s often recommended to include a clause that specifies how and when the POA can be revoked by the principal.

It’s important to note that while a Financial POA can be a powerful tool for managing one’s affairs, it should be created with care and precision. Consulting with a legal professional experienced in Arkansas law is advisable to ensure that the POA meets all legal requirements and accurately reflects the principal’s wishes

Who Can Be Named an Attorney-in-Fact (Agent) in Arkansas?

When Does My Durable Financial POA Take Effect?

When Does My Financial Power of Attorney End?

Your Financial Power of Attorney (POA) typically ends under the following circumstances:

- Revocation: If you, as the principal, revoke the POA while mentally competent.

- Death: Automatically terminates upon the principal’s death.

- Expiration Date: If the document specifies an end date.

- Incapacity of the Agent: If no alternate agent is named and the original agent is unable to serve.

- Completion of Purpose: For a Limited POA, when the specific task or time period outlined is completed.

- Invalidation by Court: If a court finds the POA invalid for reasons like improper execution or fraud.

- Divorce: In some cases, if the agent is the principal’s spouse and the couple divorces (depending on state laws and POA terms).

It’s important to regularly review and update your POA to ensure it reflects your current wishes and circumstances.

How to Prepare a Arkansas Power of Attorney Form

Step 1: Understanding the Types of POA

- Determine the Type: Choose between General, Durable, Healthcare, Limited, Springing, or Financial Power of Attorney based on your needs.

Step 2: Selecting Your Agent

- Choose Wisely: Select someone trustworthy, preferably over 18, and mentally competent.

- Discuss Responsibilities: Ensure the chosen agent understands and agrees to their duties.

Step 3: Define the Powers

- Be Specific: Clearly outline the powers and responsibilities you are granting to your agent.

Step 4: Drafting the Document

- Use a Form or Attorney: Utilize a standard form or consult an attorney for a custom POA.

- Include Essential Information: Your name, agent’s name, powers granted, and conditions for the powers.

Step 5: Legal Requirements

- Follow Arkansas Law: Ensure the POA meets all legal requirements of Arkansas, including being in writing, signed, and notarized.

Step 6: Signatures

- Sign the Document: Sign in front of a notary public. Witnesses may also be required.

Step 7: Distribute Copies

- Provide Copies: Give copies to your agent, financial institutions, doctors, and anyone else who may need it.

Step 8: Storing the Original

- Safe Storage: Keep the original document in a secure yet accessible place.

Step 9: Regular Review

- Periodic Updates: Regularly review and update the POA as needed.

Step 10: Revocation Process

- Understand Revocation: Know how to revoke the POA if necessary, including providing written notice to your agent and relevant parties.

Note: This guide is a general outline. For specific legal advice and customizing your POA to your unique situation, consider consulting with an attorney.

Tips for Using Effective Arkansas Power of Attorney Form

Related Posts

-

10+ Free New Hampshire (NH) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Nevada (NV) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Nebraska (NE) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Montana (MT) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Missouri (MO) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Minnesota (MN) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Mississippi (MS) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Massachusetts (MA) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Maryland (MD) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Maine (ME) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Louisiana (LA) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Kentucky (KY) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Kansas (KS) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Iowa (IA) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Indiana (IN) Power of Attorney Form Download – How to Create Guide, Tips