A Financial Statement Form is a depiction of the financial activities of a person or business. It consists of the entity’s assets and liabilities. Assets include real estate and balances in checking and savings accounts, while liabilities include credit card balances, mortgages, and loans.

For a business, a Financial Statement Form is very useful in that it provides a company an overview of their financial stability and growth, and helps them make various business decisions regarding operation, investments, and finance. As you may well know, getting one’s financial affairs in order is of utter importance for any entity, be it a person or a business, and Financial Forms are something we could not do without.

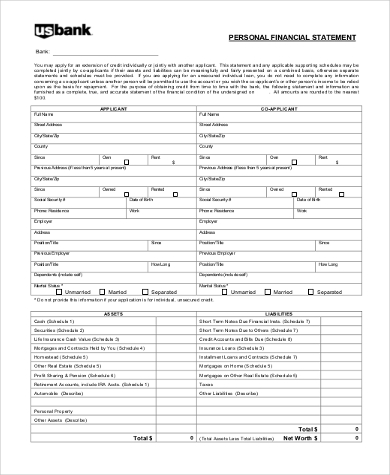

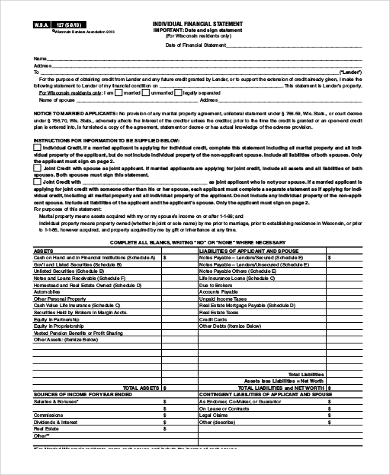

Personal Financial Statement

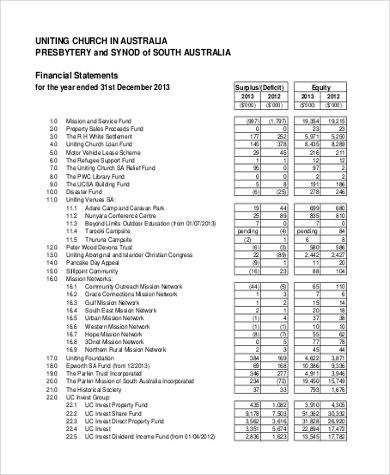

Sample Church Financial Statement

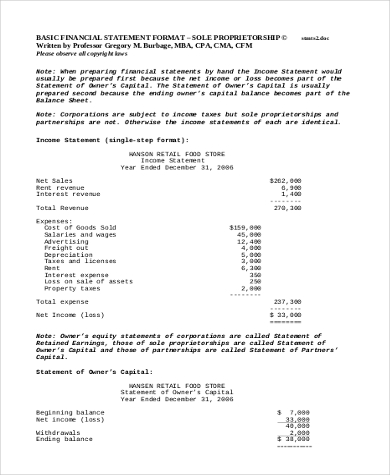

Financial Statement Format

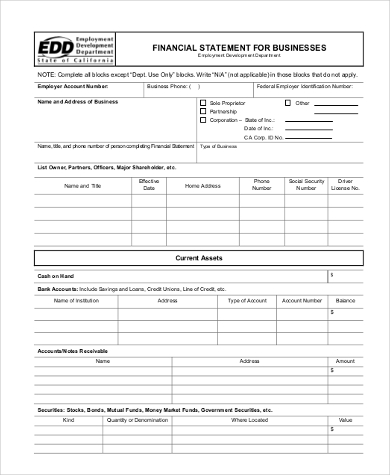

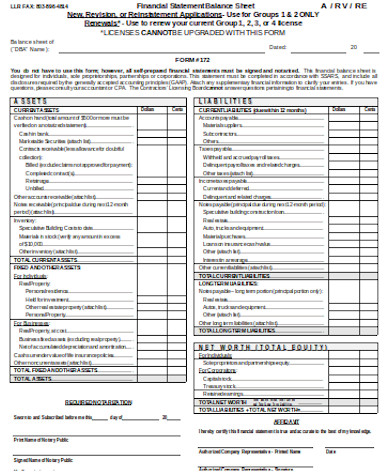

Business Financial Statement Form Sample

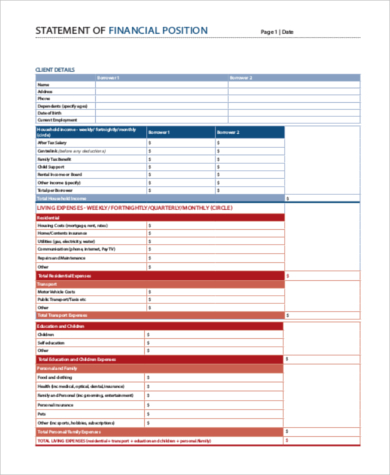

Financial Position Statement

Four Main Components of a Business Financial Statement Form

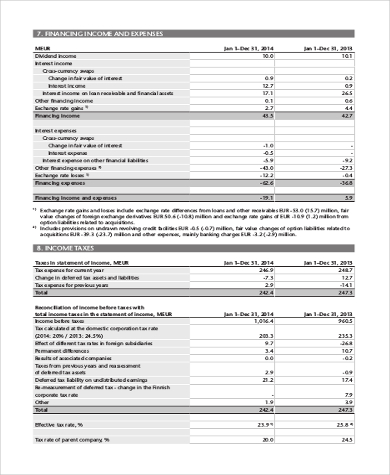

- Income Statement: This is the calculation of the net profit or loss of a company over a specific period of time. This is done by deducting the total expenses from the total income. If the income is greater than the expenses, then there is a net income; but if the expenses are greater than the income, then there is a net loss. You may use Income Statement Forms for this.

- Statement of Owner’s Equity: This component of Financial Statement Forms shows any changes in the capital of a business by comparing the capital at the start of a period and at the end of it. Income increases the capital and expenses decrease it. Therefore, if you calculate the total difference in expenses and income, you would see if the capital increased or decreased. It is also important to factor in the contributions and withdrawals made by owners, partners, or stockholders.

Financial Annual Statement

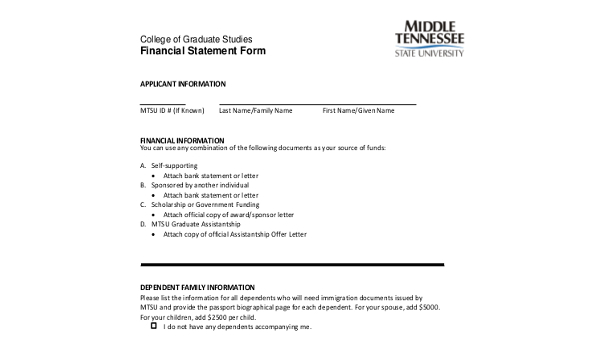

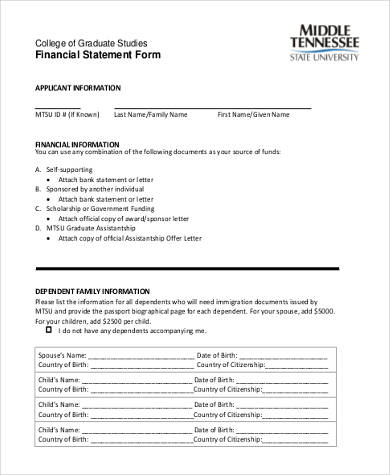

Financial Statement Form

Financial Statement Example

Financial Performance Statement

Printable Personal Financial Statement Form

Printable Financial Statement Form

- Balance Sheet: This provides a summary of the financial position of a company by presenting the company’s assets, liabilities, and capital at a certain date or point in time. A balance sheet shows that the assets should always equal to the liabilities plus the capital, because the former is being paid for by the latter.

- Statement of Cash Flows: This shows the cash flow in a company over a certain span of time in three main activities of a company: operation, investment, and finance. It shows the cash inflow, which is the receipt of cash, and the cash outflow, which are the payments. A cash balance is then drawn from the total income and expenses by the end of the period.

Aside from Business Financial Statements helping companies in assessing their financial capacity and growth to help them in their decision-making in different areas of their business, Personal Financial Statement Forms are also pretty important. This is one of the basis of lending companies or banks when you apply for a loan or mortgage. This helps credit officers gain perspective of your financial stability in order for them to make an informed decision.

Related Posts

-

FREE 8+ Sample Financial Aid Forms in PDF | MS Word

-

FREE 10+ Sample Financial Disclosure Forms in PDF | MS Word | Excel

-

FREE 8+ Sample Financial Information Release Forms in PDF | MS Word

-

FREE 9+ Sample Financial Assistance Forms in PDF | MS Word | Excel

-

FREE 9+ Sample Financial Planning Forms in PDF | MS Word

-

FREE 9+ Personal Financial Statement Form Samples in PDF | MS Word | Excel

-

FREE 9+ Sample Financial Hardship Forms in PDF | MS Word

-

FREE 8+ Sample Income Based Repayment Forms in PDF | MS Word

-

FREE 10+ Sample Profit and Loss Forms in PDF | Excel

-

FREE 18+ Sample Financial Forms in PDF | MS Word | Excel

-

FREE 5+ Financial Waiver Forms in MS Word | PDF

-

FREE 6+ Financial Consent Forms in MS Word | PDF

-

What are The Different Forms of Financial Aid? [ Types, Benefits, Purposes ]

-

How to Fill Out Financial Aid Forms? [ Include, Importance, How to, Steps ]

-

FREE 8+ Financial Responsibility Forms in PDF | Ms Word | Excel